Global Investors: Deutsche Bank's Saudi Arabia Investment Opportunity

Table of Contents

Saudi Arabia's Vision 2030 and its Impact on Investment

Saudi Arabia's Vision 2030 is a transformative national plan aimed at diversifying the economy away from oil dependence and creating a vibrant, modern society. This ambitious strategy has unlocked a wealth of investment opportunities across numerous sectors, attracting significant interest from global investors seeking lucrative returns and long-term growth.

Infrastructure Development and Investment Potential

Vision 2030 is driving massive infrastructure development, creating a wealth of opportunities for infrastructure investment in Saudi Arabia. Gigantic projects are reshaping the nation's landscape, promising substantial returns for investors willing to participate.

- Neom: This futuristic megacity project encompasses smart technologies, renewable energy, and advanced infrastructure, offering diverse investment opportunities.

- Red Sea Project: This luxury tourism development will transform the Red Sea coastline, creating high-value investment opportunities in hospitality, tourism infrastructure, and related sectors.

- Public-Private Partnerships (PPPs): The Saudi Arabian government actively encourages PPPs, providing a framework for private sector participation in large-scale infrastructure projects, reducing risk and ensuring a transparent investment process.

The Booming Renewable Energy Sector

Saudi Arabia is making significant strides in renewable energy, aiming for substantial increases in renewable energy capacity. This commitment translates into considerable investment opportunities in solar, wind, and other clean energy technologies.

- Several large-scale solar and wind power projects are currently underway, presenting attractive returns for investors. These projects offer the potential for significant long-term returns, coupled with the satisfaction of contributing to a sustainable future.

- The Saudi Arabian government offers substantial incentives, including tax breaks and streamlined regulatory processes, to encourage investment in renewable energy. This supportive environment significantly lowers the barriers to entry for foreign investors.

Deutsche Bank's Expertise in Facilitating Saudi Arabia Investments

Deutsche Bank possesses unparalleled expertise and extensive market knowledge in Saudi Arabia. With a long-standing presence and a dedicated team of professionals, they offer a comprehensive suite of services tailored to the needs of global investors.

Access to Exclusive Investment Opportunities

Deutsche Bank's deep network and established relationships within Saudi Arabia provide access to exclusive investment opportunities not readily available to the general public. Their connections open doors to private equity deals, early-stage ventures, and other high-potential investments.

- Deutsche Bank actively facilitates connections between global investors and key Saudi Arabian businesses and government entities.

- Their extensive network extends to private equity firms and venture capital funds operating within the Kingdom, providing access to a diverse range of investment opportunities.

Risk Management and Due Diligence Support

Navigating the intricacies of any investment environment requires careful planning and risk mitigation. Deutsche Bank provides comprehensive risk management and due diligence services to ensure informed decision-making.

- Their team conducts thorough due diligence assessments, evaluating investment risks and opportunities to ensure alignment with investor goals.

- Deutsche Bank offers tailored risk management strategies, including hedging and diversification options, to help protect investments from potential market fluctuations and geopolitical factors.

Regulatory Environment and Investment Incentives

Saudi Arabia boasts a progressively transparent and investor-friendly regulatory framework for foreign investment. The government has implemented various initiatives to streamline the investment process and incentivize foreign participation.

Government Support and Incentives for Foreign Investors

The Saudi Arabian government actively encourages foreign investment, providing a range of incentives to attract global capital.

- Tax breaks and subsidies are available for investments in key sectors, making Saudi Arabia a highly competitive investment destination.

- Streamlined regulatory processes and a simplified licensing framework expedite investment approvals and reduce bureaucratic hurdles.

Conclusion

Saudi Arabia offers a unique and compelling investment landscape driven by Vision 2030's ambitious diversification plans and significant infrastructure development. The booming renewable energy sector and a supportive regulatory environment further enhance its attractiveness to global investors. Deutsche Bank, with its deep expertise and network within Saudi Arabia, is ideally positioned to help you navigate this exciting opportunity. Invest in Saudi Arabia's future with Deutsche Bank today! Contact Deutsche Bank to learn more about Saudi Arabia investment opportunities and unlock the potential of this dynamic market.

Featured Posts

-

Aurelien Veron Et Laurent Jacobelli Sur Europe 1 Week End

May 30, 2025

Aurelien Veron Et Laurent Jacobelli Sur Europe 1 Week End

May 30, 2025 -

Mastering The Bargain Hunt Tips And Tricks For Smart Shopping

May 30, 2025

Mastering The Bargain Hunt Tips And Tricks For Smart Shopping

May 30, 2025 -

Thlyl Adae Awstabynkw Ela Almlaeb Altrabyt Tqryr Shaml Mn Shyft Alshrq Alawst

May 30, 2025

Thlyl Adae Awstabynkw Ela Almlaeb Altrabyt Tqryr Shaml Mn Shyft Alshrq Alawst

May 30, 2025 -

Entradas Bad Bunny Conciertos Madrid Y Barcelona Preventa Live Nation Y Ticketmaster

May 30, 2025

Entradas Bad Bunny Conciertos Madrid Y Barcelona Preventa Live Nation Y Ticketmaster

May 30, 2025 -

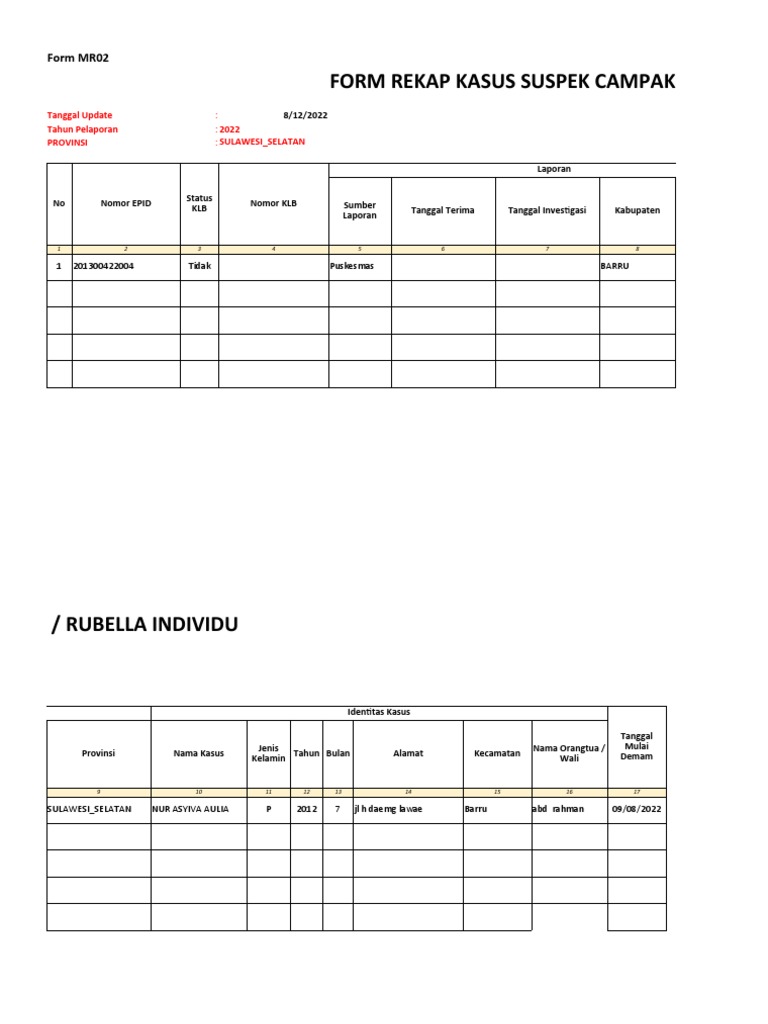

Meningkatnya Kasus Suspek Campak Di Pohuwato Ancaman Bagi Kesehatan Anak

May 30, 2025

Meningkatnya Kasus Suspek Campak Di Pohuwato Ancaman Bagi Kesehatan Anak

May 30, 2025