Gold Price Surge: Trump's EU Threats Fuel Trade War Fears

Table of Contents

Trump's Trade Policies and their Impact on Gold Prices

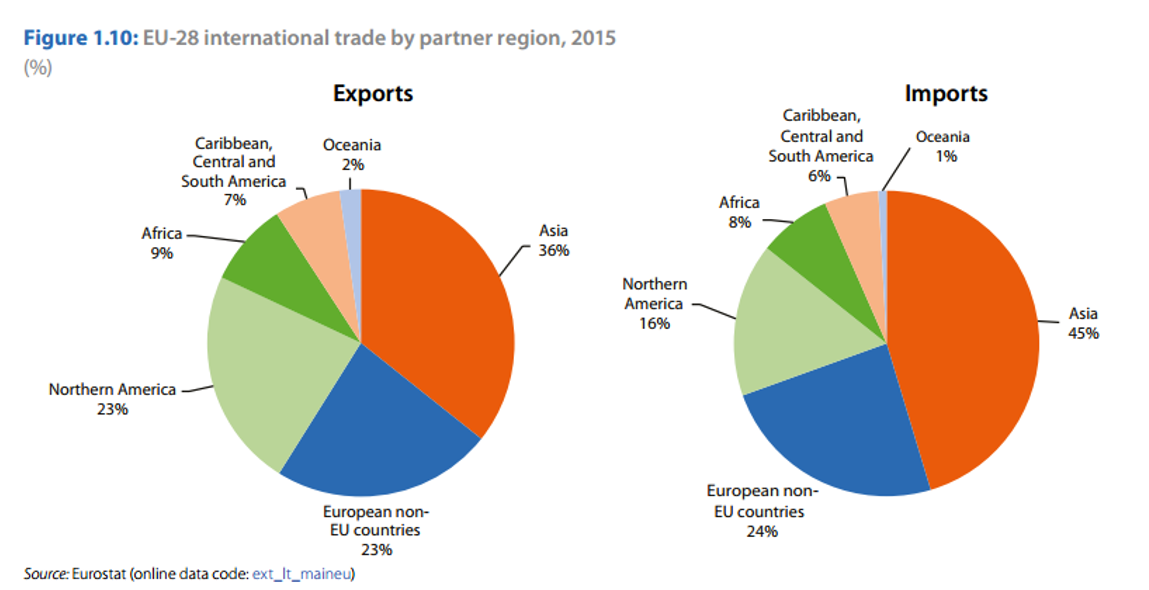

President Trump's administration has implemented a series of protectionist trade policies, significantly impacting global markets. The imposition of tariffs on steel and aluminum imports from the EU, along with threats of further tariffs on a wide range of goods, has created considerable uncertainty. This uncertainty is a key driver of the current gold price surge.

The market's reaction to these policies has been largely negative. The increased uncertainty surrounding global trade and economic growth has led investors to seek safer investment options. This flight to safety has significantly boosted the demand for gold.

- Increased uncertainty in the global economy: The unpredictability of Trump's trade actions creates a volatile environment, making investors nervous about traditional investments.

- Weakening of the US dollar: The US dollar's inverse relationship with gold prices means that a weakening dollar (often a consequence of trade war fears) typically leads to a rise in gold prices.

- Safe-haven demand for gold rising due to economic instability: Investors view gold as a reliable store of value during times of economic and political turmoil.

- Potential for decreased global trade and economic slowdown: A full-blown trade war could significantly hinder global economic growth, further fueling the demand for gold as a safe haven asset.

The Safe Haven Appeal of Gold During Economic Uncertainty

Gold has historically served as a safe haven asset during times of economic and political crisis. Its appeal stems from its inherent properties and its perceived stability in turbulent markets. When uncertainty rises, investors often move away from riskier assets and into gold.

Investors turn to gold during periods of high uncertainty for several reasons:

- Gold's inherent value and lack of counterparty risk: Unlike stocks or bonds, gold's value is not tied to any specific entity or government, offering a degree of insulation from market fluctuations.

- Gold's use as a hedge against inflation: During periods of high inflation, the purchasing power of fiat currencies erodes, making gold a valuable store of value that maintains its purchasing power.

- Diversification benefits of adding gold to an investment portfolio: Gold often has a low or negative correlation with other asset classes, meaning it can help reduce overall portfolio volatility.

- Psychological impact of global uncertainty on investor sentiment: Fear and uncertainty often drive investors towards perceived safe haven assets like gold, creating a self-fulfilling prophecy.

Analyzing the Current Gold Market Trends and Predictions

Current gold prices reflect the ongoing uncertainty stemming from the trade war. Recent market volatility highlights the sensitivity of gold prices to geopolitical events and economic news. Experts have varying opinions on future gold price movements, with some predicting continued growth while others foresee a potential correction.

- Short-term vs. long-term price predictions: Short-term predictions are often highly speculative, while long-term forecasts tend to be more conservative.

- Factors influencing future gold prices: Interest rates, inflation levels, and future geopolitical events all influence the price of gold.

- Potential risks and opportunities in the gold market: While gold offers protection during uncertain times, it's not without risk. Price volatility is a major factor to consider.

- Current investor sentiment towards gold: Current investor sentiment is generally positive towards gold, reflecting the ongoing trade war uncertainty and a desire for safe haven assets.

Impact on Different Investment Strategies

The gold price surge significantly impacts various investment strategies. Conservative investors might increase their gold holdings to mitigate risks, while aggressive investors might see opportunities for higher returns, although with increased risk.

- Rebalancing portfolios to include or increase gold holdings: Many investors are re-evaluating their portfolio allocations to include a larger proportion of gold.

- Strategies for managing risk in a volatile market: Diversification and careful risk management are crucial during periods of market uncertainty.

- Exploring different gold investment options: Investors have several options, including physical gold, gold ETFs, and gold mining stocks, each with its own risk-reward profile.

Conclusion

The recent gold price surge is a direct consequence of the escalating trade war between the US and the EU, fueled by President Trump's aggressive trade policies. This uncertainty has increased the demand for gold as a safe haven asset, highlighting its importance in a diversified investment portfolio. Understanding the dynamics of the gold market and how global events impact gold prices is crucial for informed investment decisions. Stay informed about the evolving situation with the gold price surge and consider how to incorporate gold into your investment strategy to mitigate risks associated with a potential trade war. Learn more about diversifying your portfolio with gold investment options today!

Featured Posts

-

Week End Europe Soir Avec Karim Bouamrane Et Regis Le Sommier

May 27, 2025

Week End Europe Soir Avec Karim Bouamrane Et Regis Le Sommier

May 27, 2025 -

Wonder Park Frequently Asked Questions Faqs

May 27, 2025

Wonder Park Frequently Asked Questions Faqs

May 27, 2025 -

Bouamrane Vs Faure Le Congres Du Ps Et L Enjeu De L Unite

May 27, 2025

Bouamrane Vs Faure Le Congres Du Ps Et L Enjeu De L Unite

May 27, 2025 -

Did Tai Do That A Yellowjackets 3x05 Preview Shauna And Walters Collaboration

May 27, 2025

Did Tai Do That A Yellowjackets 3x05 Preview Shauna And Walters Collaboration

May 27, 2025 -

Mila Kunis And Ashton Kutcher Beverly Hills Outing After Venice Film Project

May 27, 2025

Mila Kunis And Ashton Kutcher Beverly Hills Outing After Venice Film Project

May 27, 2025

Latest Posts

-

Double Trouble In Hollywood Actors Strike Amplifies Writers Walkout

May 31, 2025

Double Trouble In Hollywood Actors Strike Amplifies Writers Walkout

May 31, 2025 -

Brexit Damage Control Boe Governor Urges Closer Eu Trade Relations

May 31, 2025

Brexit Damage Control Boe Governor Urges Closer Eu Trade Relations

May 31, 2025 -

Foreign Student Ban At Harvard Judge Grants Extension

May 31, 2025

Foreign Student Ban At Harvard Judge Grants Extension

May 31, 2025 -

White House Meeting Powell And Trump Discuss The State Of The Us Economy

May 31, 2025

White House Meeting Powell And Trump Discuss The State Of The Us Economy

May 31, 2025 -

Economic Impact Of Tulsas Remote Worker Program A Comprehensive Review

May 31, 2025

Economic Impact Of Tulsas Remote Worker Program A Comprehensive Review

May 31, 2025