Goldman Sachs Pay Dispute: CEO's Title At The Heart Of The Matter

Table of Contents

The Nature of the Goldman Sachs Pay Dispute

The Goldman Sachs pay dispute centers on alleged discrepancies in compensation awarded to various employee groups. While the exact figures remain undisclosed due to ongoing legal proceedings, sources suggest substantial differences exist between the compensation received by certain executives and that of employees performing similar functions. The arguments presented by both sides highlight a fundamental disagreement over fairness and the transparency of the firm's compensation structure.

- Employee Claims: Employees claim their compensation is significantly lower than what is warranted by their contributions and responsibilities, especially when compared to executive compensation. They argue that the current system is inequitable and lacks transparency.

- Management's Justification: Goldman Sachs' management defends its compensation structure, arguing that it is performance-based and aligned with market standards. They emphasize the different roles and responsibilities of various employee groups and justify the disparity in compensation accordingly.

- Potential Breaches: Allegations include potential breaches of internal compensation policies and possibly contractual obligations, further complicating the matter. These alleged breaches form a significant part of the ongoing legal arguments.

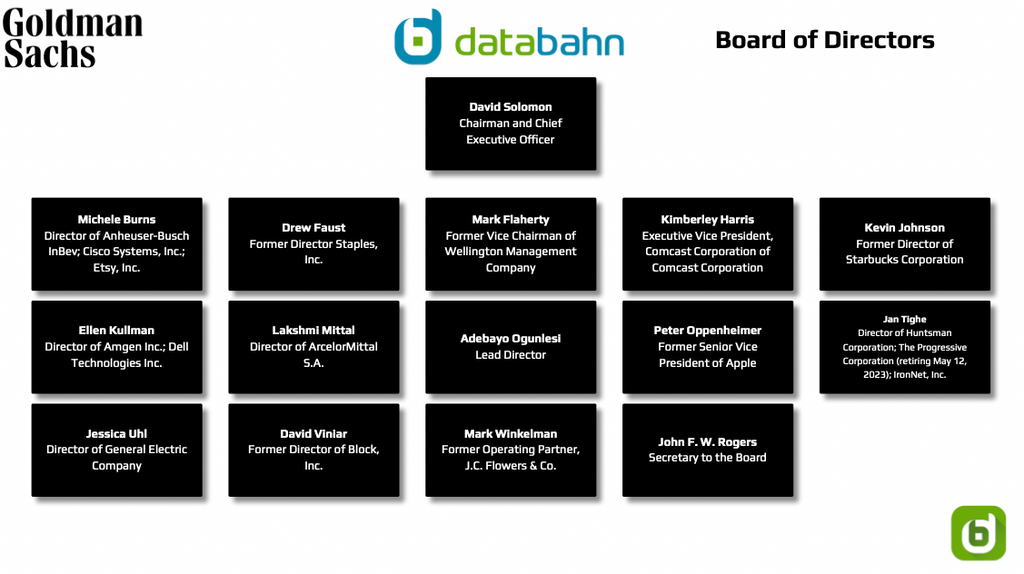

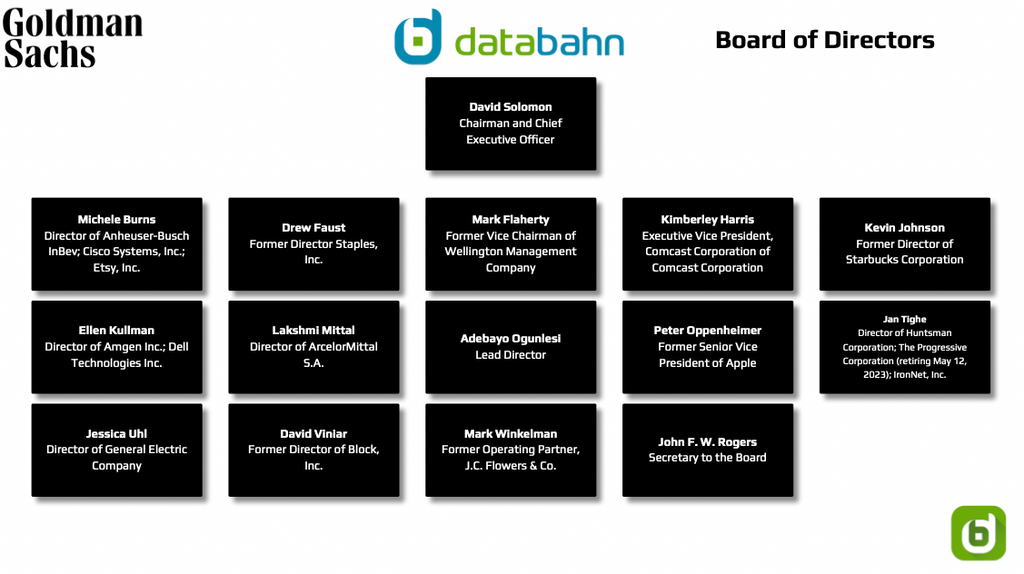

- CEO's Title's Role: Crucially, the CEO's official title plays a pivotal role in determining compensation eligibility for certain groups of employees. The dispute hinges on the interpretation of clauses linking compensation to the CEO’s specific responsibilities and the cascading effect on other employee levels.

The CEO's Title and its Legal Implications

The CEO's official title, along with its associated responsibilities as defined in Goldman Sachs’ internal documents and employment contracts, is at the heart of the legal battle. The specific wording of employment contracts and internal policies regarding compensation structures based on the CEO's role is crucial. Legal experts are analyzing these contracts for clauses that may have been misinterpreted or violated.

- Contractual Clauses: Specific clauses within employment contracts are being examined, focusing on the linkage between the CEO's title, responsibilities, and the resulting compensation structure for other employees. This dissection of the fine print is vital to understanding the legal arguments.

- Potential Legal Actions: Both sides are considering various legal actions, including potential lawsuits and arbitration. This includes potential class-action lawsuits representing affected employees.

- Precedent-Setting Potential: The outcome of this dispute holds significant precedent-setting potential for future executive compensation disputes and the interpretation of employment contracts within the financial industry.

- Expert Legal Opinions: Leading employment lawyers are closely monitoring the case, offering opinions on the potential outcomes and their implications for corporate governance and compensation practices.

Impact on Goldman Sachs' Reputation and Stock Price

The public nature of the Goldman Sachs pay dispute is causing significant reputational damage. Negative media coverage and public scrutiny are impacting investor confidence and consequently, the company's stock price.

- Negative Media Coverage: The widespread negative media coverage paints a picture of internal conflict and potential mismanagement, damaging Goldman Sachs' image as a responsible and ethical employer.

- Impact on Employee Morale: The dispute has negatively impacted employee morale and could lead to increased attrition, as employees question the fairness and transparency of the compensation system.

- Regulatory Scrutiny: This high-profile dispute is likely to invite increased regulatory scrutiny regarding Goldman Sachs' compensation practices and corporate governance.

- Stock Performance: Short-term and long-term impacts on Goldman Sachs' stock performance are anticipated, with the potential for sustained negative effects if the dispute remains unresolved.

Wider Implications for the Financial Industry

The Goldman Sachs pay dispute has wider implications for compensation practices and corporate governance across the financial sector. The case highlights the need for greater transparency and fairness in executive compensation and underscores the importance of clearly defined roles and responsibilities in employment contracts.

- Similar Disputes: The dispute could trigger similar lawsuits in other financial institutions, as employees become more aware of their rights and demand greater transparency in compensation structures.

- Transparency Calls: The dispute is likely to strengthen calls for increased transparency in executive compensation and the implementation of more robust corporate governance measures.

- Regulatory Oversight: Regulators may introduce stricter oversight of executive pay and compensation practices, seeking to prevent similar disputes and protect employee rights.

- Public Perception: The Goldman Sachs case is shaping public perception of executive compensation in the financial industry, fostering a growing demand for fairer and more equitable practices.

Conclusion: Resolving the Goldman Sachs Pay Dispute

The Goldman Sachs pay dispute underscores the critical role of the CEO's title and its connection to the broader compensation structure within the firm. The potential ramifications are significant, impacting not only Goldman Sachs' reputation and financial stability but also shaping the future of executive compensation and corporate governance in the financial industry. The ongoing legal battles and the potential for wider regulatory changes will continue to impact the financial landscape for years to come. Stay informed about the ongoing developments in this landmark Goldman Sachs pay dispute and its implications for CEO compensation structures and related employment issues across the financial industry. For further updates and analysis, refer to reputable financial news sources and legal publications.

Featured Posts

-

Doblete De Burky Rayadas Se Llevan La Victoria

Apr 23, 2025

Doblete De Burky Rayadas Se Llevan La Victoria

Apr 23, 2025 -

The Destruction Of Pope Franciss Ring A Papal Tradition

Apr 23, 2025

The Destruction Of Pope Franciss Ring A Papal Tradition

Apr 23, 2025 -

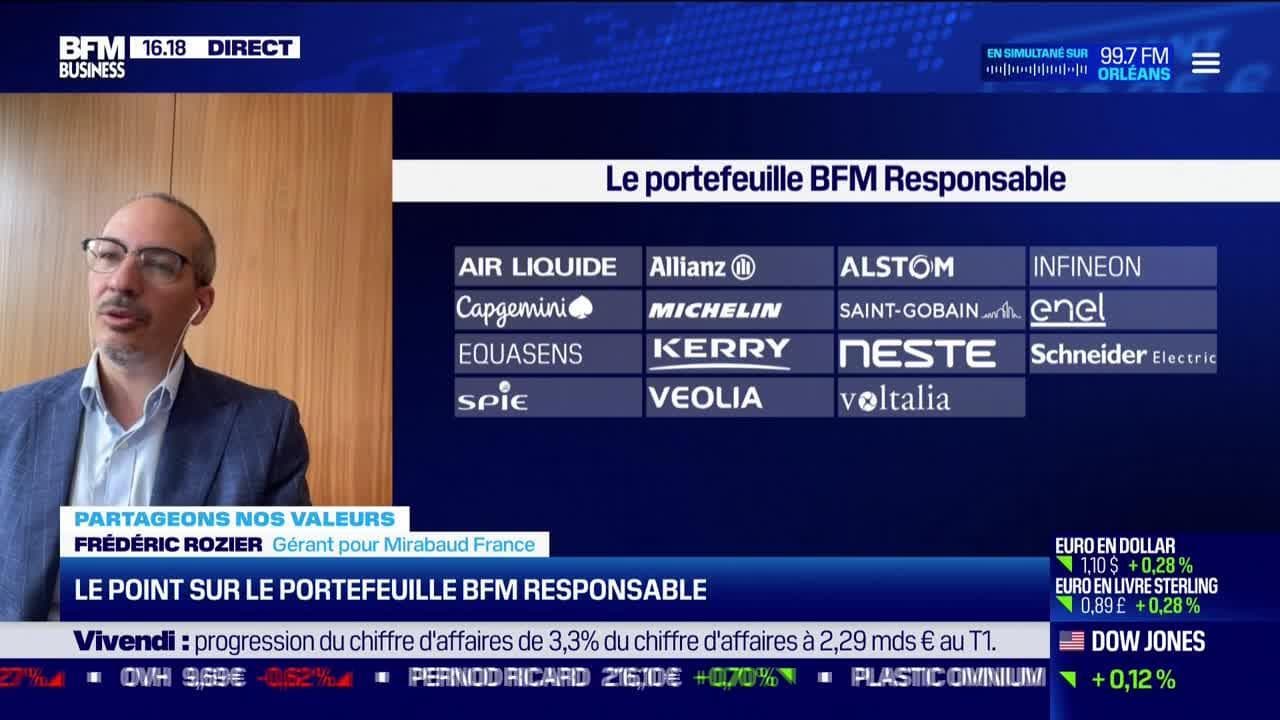

Le Portefeuille Bfm Decryptage De L Arbitrage De La Semaine 17 02

Apr 23, 2025

Le Portefeuille Bfm Decryptage De L Arbitrage De La Semaine 17 02

Apr 23, 2025 -

La Carte Blanche Decryptage Du Travail De Dominique Carlach

Apr 23, 2025

La Carte Blanche Decryptage Du Travail De Dominique Carlach

Apr 23, 2025 -

Office365 Data Breach Nets Millions For Hacker Fbi Reveals

Apr 23, 2025

Office365 Data Breach Nets Millions For Hacker Fbi Reveals

Apr 23, 2025

Latest Posts

-

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025

Nyt Strands Puzzle Solutions Saturday February 15th Game 349

May 10, 2025 -

February 15th Nyt Strands Answers Game 349

May 10, 2025

February 15th Nyt Strands Answers Game 349

May 10, 2025 -

Nyt Strands Game 349 Hints And Solutions For February 15th

May 10, 2025

Nyt Strands Game 349 Hints And Solutions For February 15th

May 10, 2025 -

Solve Nyt Strands Game 354 Hints For Thursday February 20

May 10, 2025

Solve Nyt Strands Game 354 Hints For Thursday February 20

May 10, 2025 -

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025