Goldman Sachs's Pay Controversy: The CEO's Title Defines Compensation

Table of Contents

The CEO's Disproportionate Compensation Package

The Goldman Sachs CEO's compensation isn't simply a high salary; it's a multifaceted package heavily reliant on bonuses and stock options, creating a substantial pay gap and contributing to the Goldman Sachs pay controversy.

Salary vs. Bonuses

While the base salary is significant, a substantial portion of the CEO's total compensation comes from performance-based bonuses and stock options. This structure incentivizes short-term gains, potentially at the expense of long-term strategic planning and sustainable growth.

- Quantifying the Gap: The CEO's total compensation often exceeds the average employee salary by several hundred times, highlighting the extreme disparity. Precise figures vary year to year and are often subject to debate, but the scale of the difference remains consistently substantial.

- Performance Metrics: Bonuses are typically tied to specific financial targets and performance indicators, such as revenue growth, profitability, and stock price performance. However, these metrics can be easily manipulated, and short-term successes might overshadow long-term consequences.

- Inflated Bonuses and Short-Term Gains: The focus on short-term performance metrics can incentivize strategies that prioritize immediate profits over sustainable growth, potentially risking the company's long-term health for the sake of boosting executive bonuses.

Comparing CEO Compensation to Other Executives

The Goldman Sachs pay controversy extends beyond the CEO; it encompasses the entire compensation hierarchy within the firm.

Compensation Hierarchy within Goldman Sachs

A clear hierarchy exists within Goldman Sachs's compensation structure, with pay decreasing significantly as one moves down the organizational ladder from the CEO to other executive levels.

- Pay Ratios: The pay ratio between the CEO and other high-ranking executives, such as managing directors and other C-suite members, is significant but generally less extreme than the gap between the CEO and the average employee.

- Justification of Ratios: The justification for these pay ratios often centers on the argument that the CEO carries greater responsibility and exerts a more significant influence on the firm's overall performance. However, critics often question whether this justifies the magnitude of the discrepancies.

- Internal and External Criticisms: Both internal and external stakeholders frequently raise concerns about the fairness and transparency of this compensation structure, fueling the ongoing Goldman Sachs pay controversy.

Public Perception and the Impact on Employee Morale

The significant pay gap at Goldman Sachs has drawn considerable public attention, significantly impacting the firm's brand reputation and employee morale.

The Controversy and Public Reaction

News articles and social media discussions frequently criticize Goldman Sachs's executive compensation practices, highlighting the perceived unfairness of the system and contributing to the ongoing Goldman Sachs pay controversy.

- Negative Public Opinion: Public opinion often views the high compensation packages as excessive and out of sync with the compensation received by the average employee, particularly during times of economic hardship or uncertainty.

- Brand Reputation Damage: The controversy surrounding executive pay can negatively impact Goldman Sachs's brand reputation, potentially affecting its ability to attract and retain top talent.

- Employee Morale and Retention: The significant pay disparity can lead to decreased employee morale, reduced job satisfaction, and increased employee turnover, creating significant challenges for the firm.

Regulatory Scrutiny and Future Implications

The Goldman Sachs pay controversy has brought increased regulatory scrutiny and raises questions about potential changes in corporate governance related to executive compensation.

Potential for Regulatory Changes

Increasing public and political pressure is driving discussions regarding stricter regulations on executive pay, which could significantly impact Goldman Sachs and similar financial institutions.

- Existing and Proposed Regulations: Various regulations and proposed legislation aim to increase transparency and limit excessive executive compensation, addressing concerns about corporate governance.

- Long-Term Effects: These regulatory changes could significantly alter Goldman Sachs's compensation practices, potentially leading to a more equitable distribution of compensation and reducing the scale of the pay gap.

- Corporate Responsibility Debate: The ongoing debate surrounding corporate responsibility and fair compensation emphasizes the need for companies to balance profitability with ethical considerations.

Conclusion

The Goldman Sachs pay controversy underscores the significant role the CEO's title plays in shaping compensation structures within the financial industry. The substantial disparity between the CEO's compensation and that of average employees, coupled with public criticism and potential regulatory changes, highlights the complexities and ethical considerations inherent in executive pay. Key takeaways include the immense pay gap, negative public perception, its impact on employee morale, and the potential for future regulatory interventions. What are your thoughts on the impact of CEO compensation on Goldman Sachs’s overall success and employee morale? Share your opinions in the comments below!

Featured Posts

-

Trumps Trade War Imfs Warning On Financial System Instability

Apr 23, 2025

Trumps Trade War Imfs Warning On Financial System Instability

Apr 23, 2025 -

Equifax Efx Q Quarter Earnings Beat Estimates Macroeconomic Concerns Remain

Apr 23, 2025

Equifax Efx Q Quarter Earnings Beat Estimates Macroeconomic Concerns Remain

Apr 23, 2025 -

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 23, 2025

Hollywood Strike Actors Join Writers Bringing Industry To A Standstill

Apr 23, 2025 -

Analyse De John Plassard Usa Today La Course Aux Armements Entre Les Usa Et La Russie

Apr 23, 2025

Analyse De John Plassard Usa Today La Course Aux Armements Entre Les Usa Et La Russie

Apr 23, 2025 -

Tina Knowles And Breast Cancer A Missed Mammograms Impact

Apr 23, 2025

Tina Knowles And Breast Cancer A Missed Mammograms Impact

Apr 23, 2025

Latest Posts

-

Dakota Johnson With Family At Materialist Premiere Photos

May 10, 2025

Dakota Johnson With Family At Materialist Premiere Photos

May 10, 2025 -

Dakota Johnson With Family At Los Angeles Materialist Screening

May 10, 2025

Dakota Johnson With Family At Los Angeles Materialist Screening

May 10, 2025 -

Melanie Griffith And Dakota Johnsons Siblings At Materialist Premiere

May 10, 2025

Melanie Griffith And Dakota Johnsons Siblings At Materialist Premiere

May 10, 2025 -

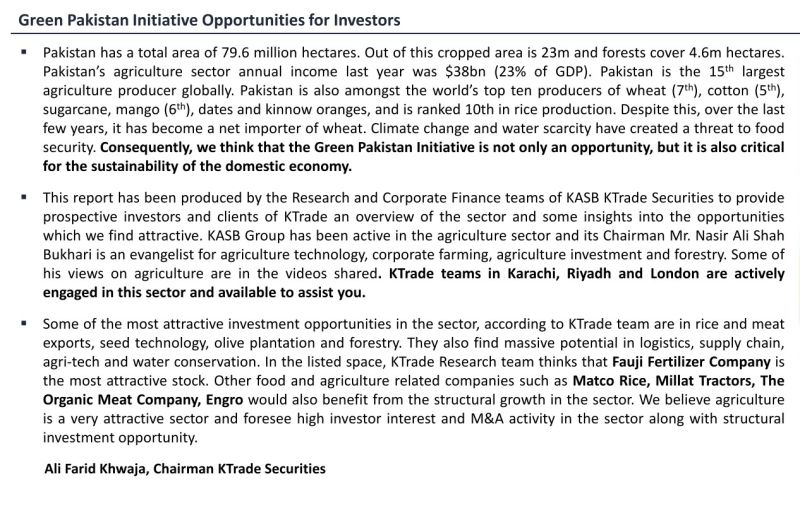

Democratizing Stock Investment The Jazz Cash K Trade Partnership

May 10, 2025

Democratizing Stock Investment The Jazz Cash K Trade Partnership

May 10, 2025 -

Jazz Cash And K Trade Partner To Democratize Stock Investing And Trading

May 10, 2025

Jazz Cash And K Trade Partner To Democratize Stock Investing And Trading

May 10, 2025