GOP Tax Plan: Does It Really Cut The Deficit? A Mathematical Look

Table of Contents

The GOP Tax Plan's Core Provisions and Their Projected Impact

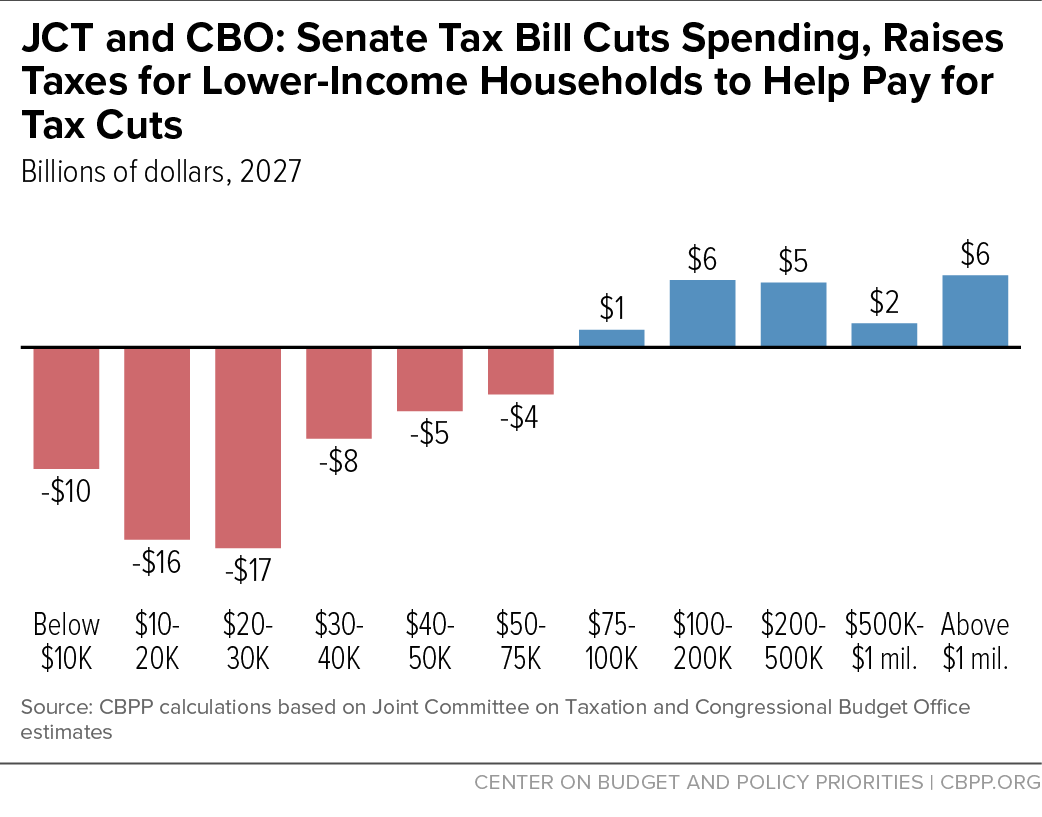

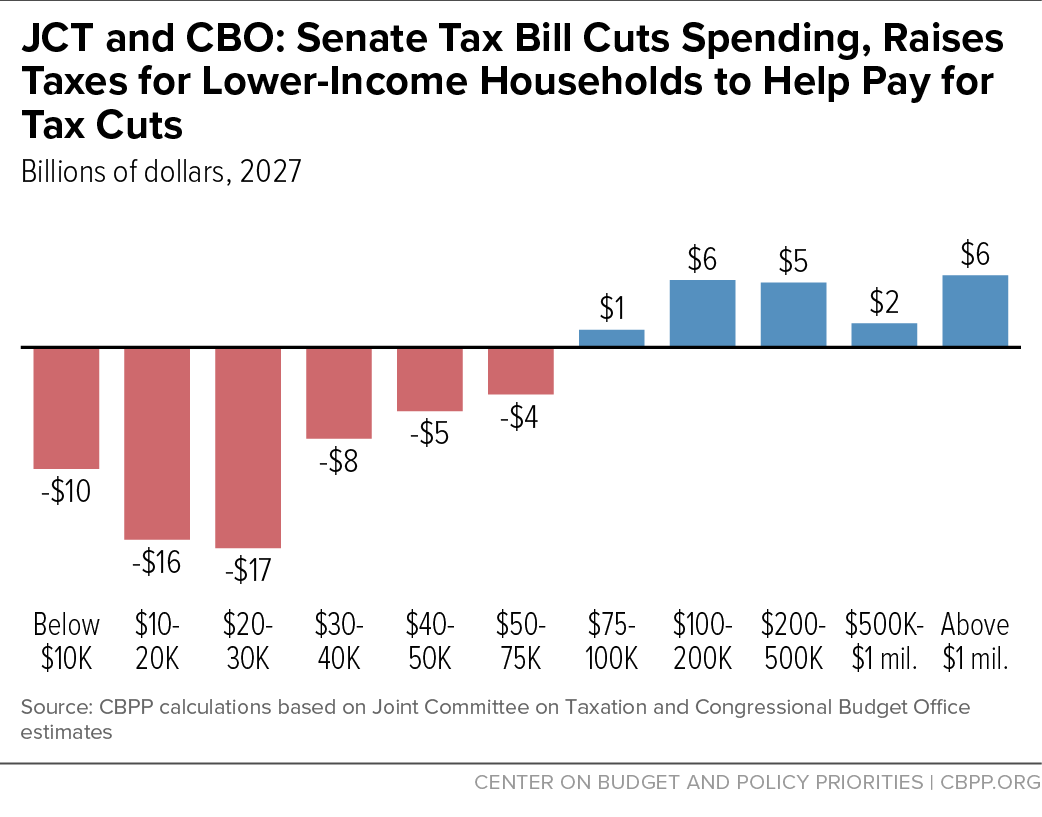

The GOP Tax Plan enacted sweeping changes to both individual and corporate tax rates. The centerpiece was a significant reduction in the corporate tax rate, from 35% to 21%. Simultaneously, individual income tax rates were also lowered, although the changes were more complex and varied depending on income brackets.

- Corporate Tax Cuts: Reduced the top corporate tax rate from 35% to 21%, projected to significantly impact corporate profits and investment decisions.

- Individual Tax Cuts: Lowered individual income tax rates across several brackets, with varying impacts based on income level and family structure. Standard deductions were also increased.

- Projected Revenue Impact: Proponents of the plan, using dynamic scoring, argued that the tax cuts would stimulate economic growth, leading to increased tax revenues that would offset the initial revenue loss from lower tax rates. Opponents, using static scoring, countered that the revenue loss would outweigh any potential growth-induced increases.

The difference between dynamic and static scoring is crucial. Dynamic scoring attempts to model the impact of tax changes on economic behavior and growth, while static scoring assumes no behavioral change. The Congressional Budget Office (CBO) and the Tax Policy Center (TPC) offered differing projections, highlighting the complexities and uncertainties inherent in forecasting the long-term economic effects of the GOP Tax Plan. These differing projections, based on varying assumptions, underscore the difficulty in making definitive statements about the plan's impact on the deficit.

Analyzing the Revenue Projections: A Critical Examination

The revenue projections offered by proponents of the GOP Tax Plan relied on several key assumptions, some of which have been heavily criticized.

- Economic Growth Estimations: The projected economic growth spurred by the tax cuts was a central argument for the plan's deficit-reducing potential. However, critics questioned the magnitude of this growth, suggesting that the projected increase was overly optimistic.

- Behavioral Responses to Tax Cuts: The assumption of significant behavioral changes – such as increased investment and employment – in response to lower taxes was a key component of dynamic scoring. The extent to which these behavioral responses would actually occur is debatable.

- Alternative Economic Models: Alternative economic models, incorporating different assumptions about economic behavior and growth, yielded substantially different projections for the plan's impact on the deficit. These models often pointed to a much larger increase in the national debt than predicted by proponents.

Understanding concepts like the Laffer curve (the relationship between tax rates and tax revenue) and the multiplier effect (the amplification of initial changes in spending or investment) is crucial for interpreting the conflicting economic models and their various projections.

The Role of Debt and Deficit in the Long Term

It’s essential to distinguish between the federal deficit (the annual difference between government spending and revenue) and the national debt (the accumulation of past deficits). Sustained deficits lead to a growing national debt, which in turn increases interest payments, crowding out other government spending, and potentially impacting long-term economic growth.

Data from the CBO shows a significant increase in the national debt following the implementation of the GOP Tax Plan. Analyzing potential future scenarios, considering varying economic growth rates, paints a complex picture. Higher growth could potentially mitigate the debt increase, while lower growth could exacerbate it, leading to unsustainable debt levels.

Comparing the GOP Tax Plan to Alternative Fiscal Policies

Alternative approaches to fiscal policy could have achieved deficit reduction through different means.

- Spending Cuts: Reducing government spending in various areas could have reduced the deficit without significant tax cuts.

- Tax Increases on Higher Earners: Increasing taxes on higher-income individuals could have generated additional revenue to offset some of the deficit.

Comparing these alternatives to the GOP Tax Plan reveals important trade-offs. While spending cuts might reduce the deficit, they could also harm social programs and economic growth. Similarly, increasing taxes on higher earners could discourage investment and economic activity. Visual aids like charts and graphs would effectively compare the projected deficit impacts of these various policies.

Conclusion: The Verdict on the GOP Tax Plan and Deficit Reduction

Our mathematical analysis reveals that the GOP Tax Plan's impact on the deficit is far from straightforward. While proponents argued for significant economic growth offsetting the revenue losses from tax cuts, the actual impact has been a considerable increase in the national debt. The analysis highlighted the limitations of relying solely on dynamic scoring and the uncertainties inherent in economic forecasting.

Therefore, the initial claim that the GOP Tax Plan would significantly reduce the deficit is not supported by the data. Further research is needed to fully understand the long-term economic consequences of the plan and to explore alternative fiscal policies that could achieve more sustainable deficit reduction. We encourage readers to engage with the topic further, critically analyzing the data and information surrounding the GOP Tax Plan, forming their own informed opinions, and exploring resources like the CBO and TPC websites for in-depth analysis. Understanding the complexities of the GOP Tax Plan and its impact is crucial for informed civic engagement.

Featured Posts

-

Suki Waterhouse Stars In Michael Kors New Amazon Luxury Collection Campaign

May 20, 2025

Suki Waterhouse Stars In Michael Kors New Amazon Luxury Collection Campaign

May 20, 2025 -

Americans Escaping Trump The Rise Of European Citizenship Applications

May 20, 2025

Americans Escaping Trump The Rise Of European Citizenship Applications

May 20, 2025 -

Gmas Ginger Zee Addresses Critics Remarks On Aging

May 20, 2025

Gmas Ginger Zee Addresses Critics Remarks On Aging

May 20, 2025 -

Nyt Mini Crossword April 20 2025 Complete Solution Guide

May 20, 2025

Nyt Mini Crossword April 20 2025 Complete Solution Guide

May 20, 2025 -

Jennifer Lawrence Deytero Paidi Gia Tin Agapimeni Ithopoio

May 20, 2025

Jennifer Lawrence Deytero Paidi Gia Tin Agapimeni Ithopoio

May 20, 2025

Latest Posts

-

Cassis Blackcurrant The Ultimate Guide To This Exquisite Liqueur

May 21, 2025

Cassis Blackcurrant The Ultimate Guide To This Exquisite Liqueur

May 21, 2025 -

Switzerland Condemns Chinas Military Drills Near Taiwan

May 21, 2025

Switzerland Condemns Chinas Military Drills Near Taiwan

May 21, 2025 -

Switzerland Condemns Pahalgam Terrorist Attack Minister Cassis Official Statement

May 21, 2025

Switzerland Condemns Pahalgam Terrorist Attack Minister Cassis Official Statement

May 21, 2025 -

Pahalgam Terror Attack Switzerlands Condemnation And Call For Peace

May 21, 2025

Pahalgam Terror Attack Switzerlands Condemnation And Call For Peace

May 21, 2025 -

Adios A Las Enfermedades Cronicas El Poder Del Superalimento Para Un Envejecimiento Activo

May 21, 2025

Adios A Las Enfermedades Cronicas El Poder Del Superalimento Para Un Envejecimiento Activo

May 21, 2025