Government's Increased Enforcement Of Student Loan Repayment: A Borrower's Guide

Table of Contents

Understanding the Increased Enforcement Actions

The government employs several methods to collect on defaulted federal student loans. These enforcement actions can significantly impact your finances and creditworthiness. Understanding these tactics is the first step towards proactive debt management and avoiding further complications. Keywords related to this section include wage garnishment, tax refund offset, credit bureau reporting, legal action, default, and student loan collections.

-

Wage Garnishment: The government can garnish up to 15% of your disposable income after a default on your student loan. This means a portion of your paycheck will be automatically deducted to repay your debt. This can severely impact your ability to meet other financial obligations.

-

Tax Refund Offset: If you're expecting a federal tax refund, be aware that the government can seize it to pay down your defaulted student loans. This means you might not receive any refund at all.

-

Credit Bureau Reporting: Defaulting on your student loans has severe consequences for your credit score. A negative mark on your credit report can make it difficult to secure loans, rent an apartment, or even get a job in the future. This negative impact can last for many years.

-

Legal Action: In some cases, the government may take legal action against you, leading to lawsuits and court judgments. These judgments can result in additional financial penalties, such as higher interest rates and increased collection fees.

-

Increased Collection Agency Activity: Expect more aggressive collection practices from both government agencies and private collection agencies assigned to recover defaulted loans. These agencies may contact you frequently via phone, mail, and even in person.

Identifying Your Repayment Options & Avoiding Default

Avoiding student loan default is paramount. Several repayment options can help you manage your debt effectively and prevent the serious consequences outlined above. Keywords relevant to this section include repayment plan, income-driven repayment (IDR), forbearance, deferment, student loan consolidation, and loan rehabilitation.

-

Standard Repayment: This involves fixed monthly payments over a 10-year period. While straightforward, it may not be feasible for everyone.

-

Graduated Repayment: Payments start low and gradually increase over time. This option can help manage early financial constraints, but payments will become significantly higher later in the repayment period.

-

Extended Repayment: This plan stretches payments over a longer period (up to 25 years), lowering monthly payments but increasing the total interest paid over the life of the loan.

-

Income-Driven Repayment (IDR): IDR plans base your monthly payment on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has different eligibility requirements and payment calculation methods. Carefully compare them to find the best fit.

-

Deferment: This allows you to temporarily postpone your student loan payments under specific circumstances, such as unemployment or enrollment in graduate school. Interest may or may not accrue during deferment, depending on the loan type.

-

Forbearance: Forbearance temporarily reduces or suspends your monthly payments. Similar to deferment, interest may accrue during this period, increasing your overall debt.

-

Student Loan Consolidation: Combining multiple federal student loans into a single loan can simplify repayment and potentially lower your monthly payment, though this depends on the interest rate of the consolidated loan.

-

Loan Rehabilitation: If your loan is already in default, loan rehabilitation might be an option. This involves making nine on-time payments within a specific timeframe to reinstate your loan to good standing.

Choosing the Right Repayment Plan for Your Situation

Selecting the most suitable repayment plan requires careful consideration of your current financial situation, future income projections, and long-term financial goals. Factors to consider include your monthly income, expenses, debt-to-income ratio, and your ability to manage higher payments in the future. It's essential to carefully weigh the pros and cons of each plan, considering the total interest paid over the life of the loan. Consulting with a financial advisor can provide valuable personalized guidance.

What to Do if You're Already in Default

Facing a defaulted student loan is challenging, but it's not insurmountable. Taking swift action is key to minimizing long-term consequences. Keywords for this section include default resolution, loan rehabilitation, student loan forgiveness programs, and bankruptcy and student loans.

-

Contact Your Loan Servicer Immediately: Don't ignore collection notices. Contact your loan servicer to discuss your options and explore potential solutions.

-

Explore Loan Rehabilitation: As mentioned earlier, loan rehabilitation offers a path back to good standing.

-

Understand the Implications of Default: A default severely damages your credit score, limiting future financial opportunities.

-

Investigate Potential Options for Debt Relief: Specific programs like Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and other income-driven repayment plans might offer relief, but eligibility requirements vary significantly. Thoroughly research these programs to see if you qualify.

-

Consult with a Financial Advisor or Credit Counselor: Seeking professional advice can provide valuable insights and personalized guidance in navigating your situation. Remember that while bankruptcy can discharge many debts, it typically doesn't discharge federal student loans.

Conclusion:

The government's increased enforcement of student loan repayment demands proactive management of your student loan debt. Understanding the various enforcement actions, exploring your repayment options, and seeking professional guidance when necessary are crucial steps to avoiding default. By taking control of your student loan repayment, you can mitigate potential financial hardships and build a secure financial future. Don't delay—explore the various repayment plans and resources available to you and take action today to successfully manage your student loan debt. Remember, proactive planning and informed decision-making are essential for successful student loan repayment.

Featured Posts

-

Top Rated Real Money Online Casino 7 Bit Casino Review

May 17, 2025

Top Rated Real Money Online Casino 7 Bit Casino Review

May 17, 2025 -

The Impact Of Josh Cavallos Public Coming Out

May 17, 2025

The Impact Of Josh Cavallos Public Coming Out

May 17, 2025 -

Uber One Kenya Your Guide To Reduced Prices And Free Delivery

May 17, 2025

Uber One Kenya Your Guide To Reduced Prices And Free Delivery

May 17, 2025 -

Best Real Money Online Casinos New Zealand Expert Ratings And Reviews

May 17, 2025

Best Real Money Online Casinos New Zealand Expert Ratings And Reviews

May 17, 2025 -

Trumps Relationships With Arab Leaders A Complex Dynamic Of Handsome Attractive And Tough

May 17, 2025

Trumps Relationships With Arab Leaders A Complex Dynamic Of Handsome Attractive And Tough

May 17, 2025

Latest Posts

-

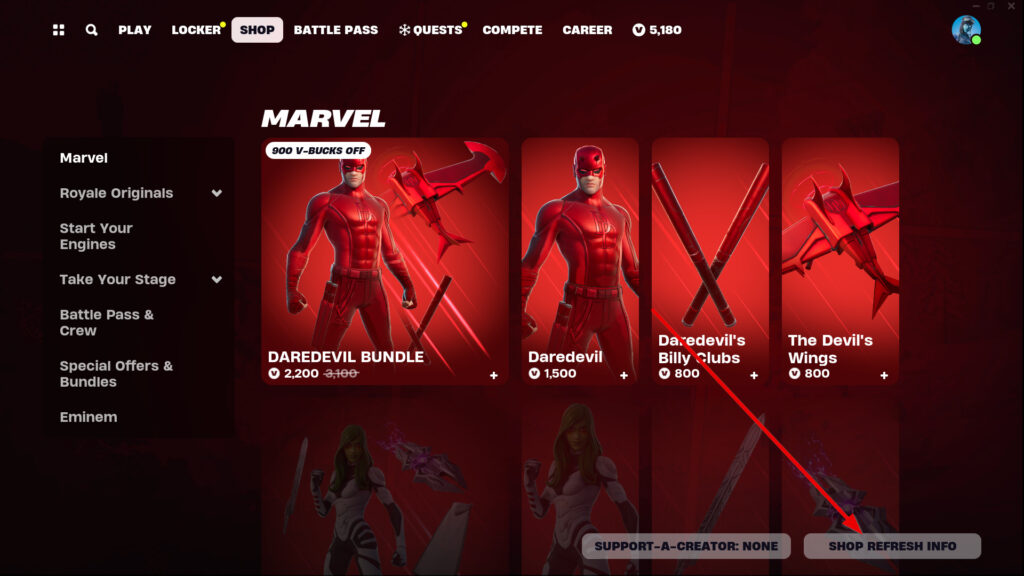

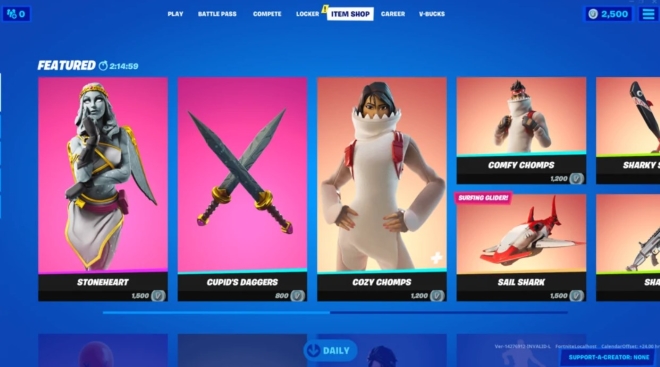

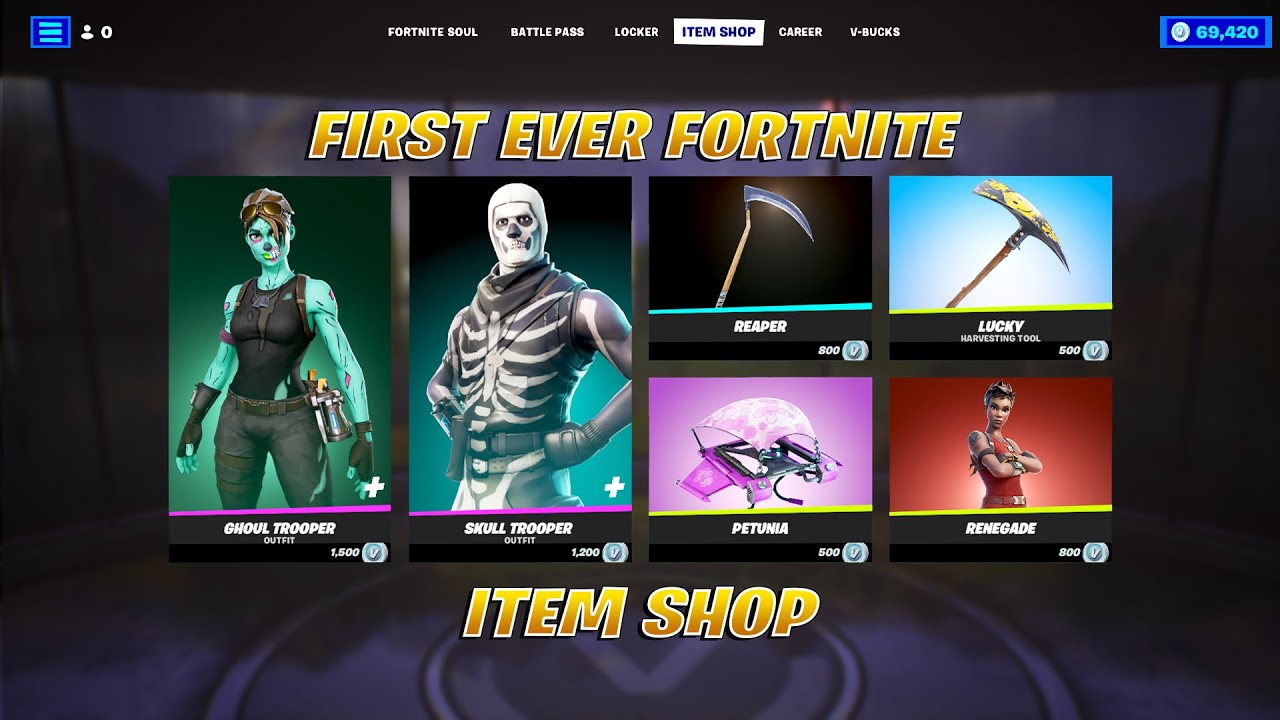

Fortnite Item Shop Enhancement A Helpful New Feature

May 17, 2025

Fortnite Item Shop Enhancement A Helpful New Feature

May 17, 2025 -

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025 -

Fortnite Item Shop Gets A Helpful New Feature For Players

May 17, 2025

Fortnite Item Shop Gets A Helpful New Feature For Players

May 17, 2025 -

New Feature In Fortnite Item Shop Makes Shopping Easier

May 17, 2025

New Feature In Fortnite Item Shop Makes Shopping Easier

May 17, 2025 -

Fortnite Item Shop Update Helpful New Feature Added

May 17, 2025

Fortnite Item Shop Update Helpful New Feature Added

May 17, 2025