Governor's Decision On Mississippi Income Tax Could Reshape Hernando's Economy

Table of Contents

Potential Economic Growth in Hernando Due to Tax Changes

The proposed Mississippi tax cuts could inject a significant boost into Hernando's economy, primarily through increased disposable income and a more attractive business climate.

Increased Disposable Income and Consumer Spending

Lower Mississippi income taxes translate directly into more disposable income for Hernando residents. This increased purchasing power is likely to fuel a surge in local consumer spending. Restaurants, retail shops, and other businesses catering to local consumers will likely see a considerable uptick in sales. For example, a family saving $500 a year due to tax cuts might allocate that money to dining out more frequently, buying new clothes, or undertaking home improvements.

- Current Mississippi Tax Rates: Understanding the current rates and the proposed changes is crucial. While specific figures need to be referenced from official sources, a comparison highlighting the percentage reduction will effectively demonstrate the potential impact.

- Projected Consumer Spending Increase: While precise predictions are difficult, citing relevant economic models or expert opinions on the relationship between tax cuts and consumer spending can strengthen the argument.

- Businesses to Benefit: Focusing on specific business sectors such as restaurants, retail, and entertainment helps paint a clearer picture of the potential economic ripple effect. Mentioning specific examples of businesses in Hernando would further personalize the impact.

Keywords: Hernando MS economy, Mississippi tax cuts, consumer spending, economic growth, Mississippi income tax.

Attraction of New Businesses and Investment

Lower taxes can serve as a powerful magnet, attracting new businesses and investment to Hernando. This influx of capital could lead to significant job creation and diversify the town's economic base, reducing reliance on specific industries. However, realizing this potential requires complementary strategies.

- Improved Infrastructure: Investing in infrastructure—roads, utilities, and broadband internet—is crucial to attract businesses seeking a reliable and efficient operating environment.

- Workforce Development: A skilled workforce is essential. Hernando needs to invest in education and training programs to ensure its residents possess the skills demanded by new businesses.

- Pro-Business Policies: Local government policies that streamline business permits and regulations can create a welcoming environment for entrepreneurs and investors.

Keywords: business investment, job creation, economic diversification, Hernando MS growth, Mississippi income tax.

Potential Challenges and Risks for Hernando's Economy

While the potential benefits are significant, it's crucial to acknowledge the potential downsides of the Mississippi income tax changes.

Impact on Public Services

Reduced tax revenue could necessitate cuts in public services, potentially impacting areas like education, infrastructure maintenance, and public safety. This requires careful consideration of budgetary priorities to minimize negative consequences.

- Prioritization of Essential Services: Hernando's local government needs a strategic plan to prioritize essential services and minimize cuts to critical programs.

- Exploring Alternative Revenue Streams: Investigating alternative funding sources such as grants, public-private partnerships, and innovative financing models is crucial.

- Community Engagement: Open communication with residents regarding budget decisions and potential service adjustments is vital for maintaining public trust and support.

Keywords: public services funding, budget cuts, Mississippi state budget, Hernando MS infrastructure, Mississippi income tax.

Income Inequality and its Effects

Tax cuts might disproportionately benefit higher-income earners, potentially widening the gap between the rich and poor in Hernando. This could lead to social unrest and hamper overall economic progress.

- Targeted Support Programs: Implementing social safety nets and targeted support programs for low-income families is vital to mitigate potential negative impacts.

- Investing in Education and Job Training: Equipping low-income individuals with marketable skills can improve their economic prospects and reduce income inequality.

- Progressive Tax Policies: While this article focuses on the current changes, exploring alternative, more progressive taxation approaches can stimulate further discussions on equitable economic development.

Keywords: income inequality, tax reform, social equity, economic disparity, Hernando MS community, Mississippi income tax.

Uncertainty and Market Volatility

Economic predictions are inherently uncertain, and market volatility could undermine the anticipated positive effects. Hernando's leadership needs a robust economic development plan to navigate potential challenges.

- Diversification of the Economy: Reducing reliance on single industries makes the local economy more resilient to market fluctuations.

- Strategic Planning and Contingency Measures: Developing a comprehensive economic plan that anticipates potential risks and includes contingency measures is crucial.

- Transparency and Communication: Openly communicating potential challenges and strategies to address them will maintain public confidence and build community resilience.

Keywords: economic uncertainty, market volatility, Hernando MS future, economic planning, Mississippi income tax.

Conclusion: The Future of Hernando's Economy and the Mississippi Income Tax

The Governor's decision on the Mississippi income tax will profoundly shape Hernando's economic trajectory. While the potential for economic growth through increased consumer spending and business attraction is significant, the potential risks associated with reduced public services and exacerbated income inequality cannot be ignored. Careful planning, responsible budgeting, and a commitment to social equity are essential to ensure that the changes benefit all residents of Hernando. Stay informed about the ongoing debate surrounding the Mississippi income tax and its implications for your community. Engage with your local government to advocate for policies that promote sustainable and equitable economic growth. The future of Hernando's economy depends on it.

Featured Posts

-

Investing In Ubers Self Driving Technology An Etf Approach

May 19, 2025

Investing In Ubers Self Driving Technology An Etf Approach

May 19, 2025 -

Cohep Participa En La Observacion Del Proceso Electoral Garantizando La Transparencia

May 19, 2025

Cohep Participa En La Observacion Del Proceso Electoral Garantizando La Transparencia

May 19, 2025 -

Ierosolymon T Heofilos I Zoi Kai I Klironomia Toy Agioy

May 19, 2025

Ierosolymon T Heofilos I Zoi Kai I Klironomia Toy Agioy

May 19, 2025 -

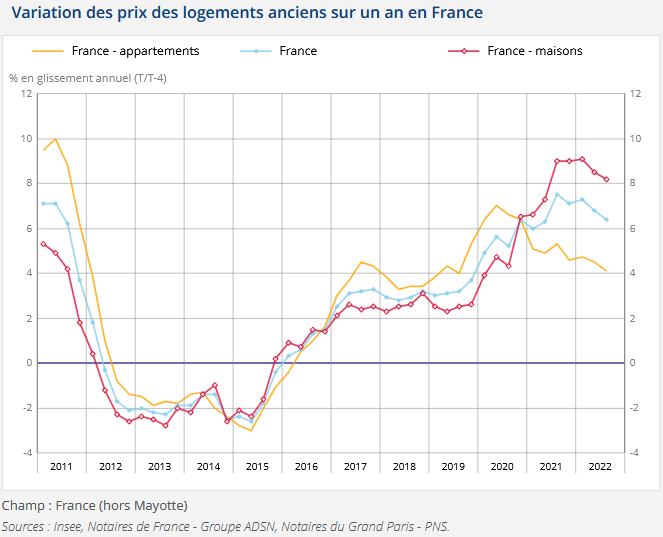

Consultez La Carte Des Prix Immobiliers Donnees Notariales Sur Les Prix Des Maisons En France

May 19, 2025

Consultez La Carte Des Prix Immobiliers Donnees Notariales Sur Les Prix Des Maisons En France

May 19, 2025 -

Londons Live Music Under Threat The Impact Of Increased Regulation

May 19, 2025

Londons Live Music Under Threat The Impact Of Increased Regulation

May 19, 2025