GPB Capital Founder Receives 7-Year Sentence For Fraudulent Activities

Table of Contents

The Charges Against GPB Capital and its Founder

David Gentile, the founder of GPB Capital Holdings, faced a multitude of serious charges related to his orchestration of a complex investment fraud. The indictment included counts of securities fraud, wire fraud, and conspiracy to commit fraud. Prosecutors argued that Gentile and his associates misled investors about the financial health and performance of GPB Capital's portfolio companies, using false representations to attract significant sums of money. The alleged fraudulent activities involved misrepresenting the value of assets, concealing losses, and engaging in practices consistent with a Ponzi scheme, where payments to existing investors were funded by new investments.

- Securities Fraud: Gentile was accused of making false and misleading statements in offering documents and communications to investors, violating federal securities laws.

- Wire Fraud: The charges included using wire communications, such as emails and phone calls, to further the fraudulent scheme.

- Conspiracy to Commit Fraud: The indictment alleged a conspiracy involving multiple individuals within GPB Capital to defraud investors.

- Evidence presented: The prosecution presented evidence including internal GPB Capital documents, emails, and testimony from former employees and investors detailing the deceptive practices.

The Trial and the Verdict

The trial, held in federal court, spanned several weeks and included testimony from numerous witnesses. Key witnesses included former employees who detailed the inner workings of the fraudulent scheme and investors who described their significant financial losses. The prosecution presented compelling evidence of Gentile's direct involvement in the fraudulent activities, highlighting his role in creating and disseminating misleading information to investors. After careful deliberation, the jury returned a guilty verdict on all counts. The judge, in handing down the 7-year prison sentence, cited the significant investor losses and the egregious nature of Gentile's actions as factors in determining the sentence.

- Key Witnesses: Testimonies from former GPB Capital employees provided crucial insights into the fraudulent operations.

- Significant Evidence: Internal documents and emails revealed the deceptive nature of the investment offerings.

- Guilty Verdict: The jury found Gentile guilty on all charges related to securities fraud, wire fraud, and conspiracy.

- Sentencing Hearing: The sentencing hearing included statements from victims detailing the financial and emotional impact of the fraud.

The Impact on Investors and the Financial Market

The GPB Capital scandal resulted in devastating financial losses for countless investors. Estimates of investor losses run into the hundreds of millions of dollars, leaving many individuals with significant financial hardship. The case has had a broader impact on investor confidence and regulatory oversight. It highlights the vulnerabilities within the investment landscape and the need for increased scrutiny and stricter regulations to protect investors from similar fraudulent schemes. The SEC investigation and subsequent regulatory actions aim to prevent future occurrences of this scale.

- Investor Losses: Hundreds of millions of dollars were lost by investors due to GPB Capital's fraudulent activities.

- Market Impact: The scandal eroded trust in the investment market and led to increased caution among investors.

- Regulatory Response: The SEC and other regulatory bodies have implemented increased scrutiny and oversight of investment firms.

- Financial Repercussions: Many investors faced significant financial hardship, impacting their retirement plans and financial security.

Potential Future Legal Ramifications

While the sentencing of David Gentile marks a significant step, the legal ramifications of the GPB Capital scandal are far from over. Further investigations are likely, and civil lawsuits are ongoing. Investors may seek restitution through civil proceedings, aiming to recover some of their lost funds. The government may also pursue asset forfeiture to recover assets obtained through fraudulent activities. The ongoing investigations could uncover further details about the scheme and potentially lead to additional charges against other individuals involved.

- Civil Lawsuits: Numerous civil lawsuits are pending against GPB Capital and its associates.

- Restitution: Investors are seeking restitution to recover their financial losses.

- Asset Forfeiture: The government may seek to seize assets obtained through fraudulent activities.

- Ongoing Investigations: Further investigations could uncover additional details and lead to more charges.

Conclusion

The 7-year prison sentence handed down to David Gentile, the founder of GPB Capital, sends a strong message about the consequences of investment fraud. The case highlights the devastating impact such schemes have on investors and the importance of robust regulatory oversight. The scale of investor losses and the complexity of the fraudulent activities underscore the need for greater vigilance and due diligence in the investment world. Learn how to protect yourself from investment fraud like the GPB Capital case by conducting thorough due diligence and consulting with a financial advisor before making any investment decisions. Don't become another victim of investment fraud; protect your investments wisely.

Featured Posts

-

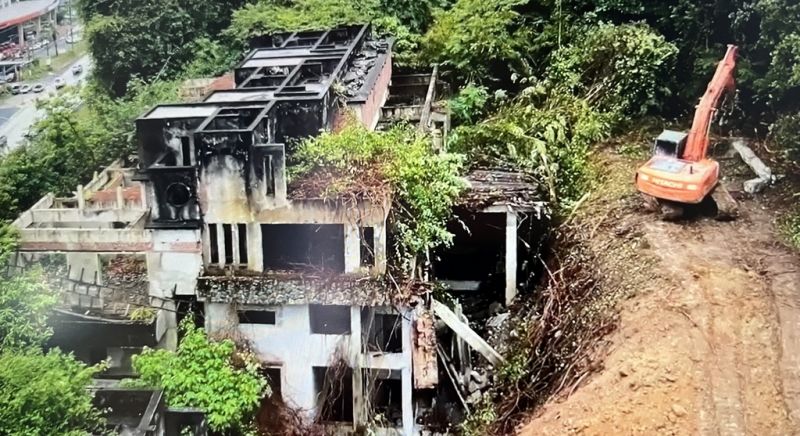

Demolition Of Beloved Broad Street Diner For New Hyatt Hotel

May 10, 2025

Demolition Of Beloved Broad Street Diner For New Hyatt Hotel

May 10, 2025 -

Comparison To Harry Styles Benson Boones Perspective

May 10, 2025

Comparison To Harry Styles Benson Boones Perspective

May 10, 2025 -

How Elon Musk Made His Billions A Deep Dive Into His Financial Empire

May 10, 2025

How Elon Musk Made His Billions A Deep Dive Into His Financial Empire

May 10, 2025 -

Inside The Reimagined Queen Elizabeth 2 A Cruise Ship Transformed

May 10, 2025

Inside The Reimagined Queen Elizabeth 2 A Cruise Ship Transformed

May 10, 2025 -

Judge Who Jailed Becker To Chair Nottingham Attacks Investigation

May 10, 2025

Judge Who Jailed Becker To Chair Nottingham Attacks Investigation

May 10, 2025