Greenko Founders Explore New Deal To Acquire Orix Stake In India

Table of Contents

Details of the Potential Greenko-Orix Deal

Greenko, a leading renewable energy independent power producer (IPP), boasts an impressive portfolio of wind, solar, and hydro projects across India. Currently, its ownership structure involves several investors, including Orix Corporation, a significant Japanese financial services group. While the exact percentage of Orix's stake in Greenko remains undisclosed publicly, industry sources suggest it’s a substantial holding. The Greenko founders' proposed acquisition aims to consolidate their control over the company. The exact nature of the deal – whether it's a complete buyout or a partial acquisition – and the financial details, including the estimated value and funding sources, are yet to be officially confirmed. Speculation points towards a significant investment, further solidifying Greenko's position in the Indian renewable energy market. Key aspects of the potential Greenko acquisition include:

- Target Stake: The precise percentage of Orix's stake targeted for acquisition remains unconfirmed, though it is expected to be substantial.

- Acquisition Type: It's unclear whether this will be a full buyout or a partial acquisition of Orix’s shares.

- Funding: The funding mechanism for the proposed Greenko acquisition is currently unknown, however, various financing options could be explored.

- Deal Terms: Details of the deal terms, including timelines and conditions, are yet to be publicly disclosed.

Motivations Behind the Acquisition

The founders' interest in acquiring Orix's stake likely stems from several strategic considerations. Gaining complete control offers Greenko several key advantages:

- Increased Control and Decision-Making Power: A complete or increased stake allows the founders to implement their long-term vision for Greenko without needing to consult with other shareholders.

- Enhanced Strategic Flexibility: Greater control allows for faster and more decisive action in response to market opportunities and challenges, enhancing the company's competitiveness within the Indian renewable energy investment landscape.

- Streamlined Operations: Internal decision-making processes could be optimized, eliminating potential conflicts or delays caused by differing shareholder interests.

- Expansion Plans: The acquisition could fuel ambitious expansion plans, allowing Greenko to pursue new renewable energy projects and consolidate its market position.

From Orix's perspective, the divestment could be part of a broader strategic shift, perhaps focusing on other investment opportunities or a strategic exit from the Indian renewable energy market. Market conditions and overall investment strategy could also be influencing factors.

Impact on the Indian Renewable Energy Sector

The successful completion of the Greenko acquisition will have far-reaching consequences for India's renewable energy sector. The deal could:

- Increase Competition: While potentially leading to market consolidation, the impact on competition depends on the strategic direction Greenko takes post-acquisition.

- Boost Renewable Energy Capacity: With increased control and resources, Greenko may accelerate its project development, contributing to India's ambitious renewable energy targets.

- Attract Further Investment: The deal could signal confidence in the Indian renewable energy market, attracting further domestic and international investment.

- Influence Regulatory Landscape: The transaction could potentially influence policy and regulatory discussions, though its immediate effects are difficult to predict.

Potential Challenges and Obstacles

While the potential benefits are significant, several challenges could hinder the acquisition:

- Regulatory Hurdles: Obtaining necessary regulatory approvals and complying with Indian foreign investment regulations could prove time-consuming and complex.

- Funding Constraints: Securing sufficient financing to fund the acquisition could be a significant challenge, requiring careful financial planning and securing investor confidence.

- Opposition from Stakeholders: Potential opposition from other stakeholders, including existing minority shareholders or regulatory bodies, could delay or even prevent the deal from proceeding.

- Valuation Disputes: Reaching an agreeable valuation for Orix's stake may prove challenging, leading to potential negotiations and delays.

Conclusion: The Future of Greenko and the Indian Renewable Energy Market

The potential Greenko-Orix deal represents a significant development in the Indian renewable energy landscape. Its success would consolidate Greenko's position, potentially accelerating the growth of renewable energy in India. However, navigating the regulatory, financial, and stakeholder-related challenges will be crucial for the deal's success. The outcome of this acquisition will undoubtedly shape the future of both Greenko and the Indian renewable energy market. Stay informed about further developments in this evolving situation by following credible news sources for updates on the "Greenko Founders Explore New Deal to Acquire Orix Stake in India." The unfolding events promise to be impactful for clean energy and investment in India.

Featured Posts

-

Tom Cruises Relationships A Comprehensive Overview

May 17, 2025

Tom Cruises Relationships A Comprehensive Overview

May 17, 2025 -

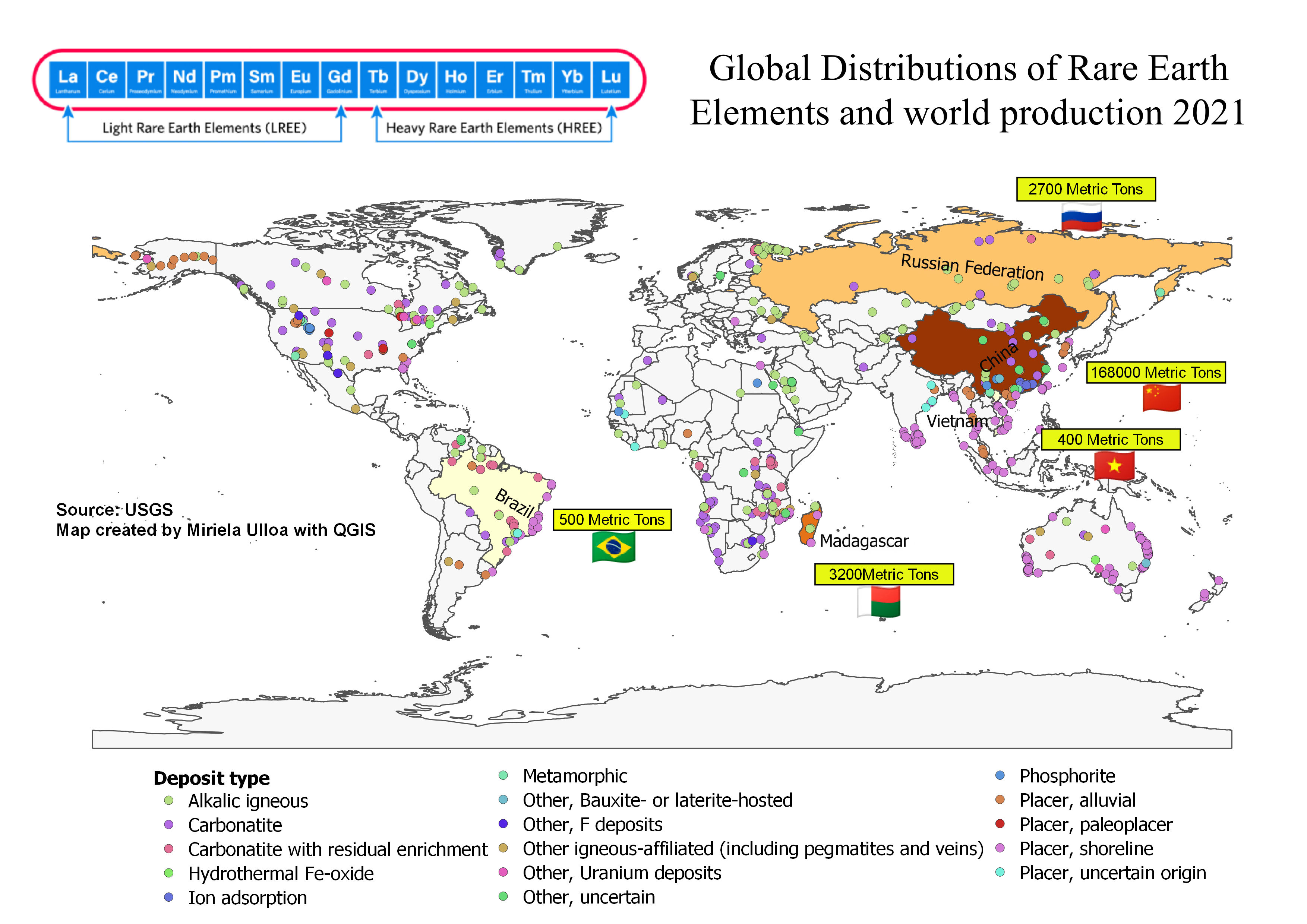

Global Heavy Rare Earths Market Lynass Rise As A Major Player

May 17, 2025

Global Heavy Rare Earths Market Lynass Rise As A Major Player

May 17, 2025 -

New York Knicks Thibodeaus Take On Game 2 Referee Performance

May 17, 2025

New York Knicks Thibodeaus Take On Game 2 Referee Performance

May 17, 2025 -

Trump Proposes New F 55 Fighter Jet And F 22 Upgrade Details And Analysis

May 17, 2025

Trump Proposes New F 55 Fighter Jet And F 22 Upgrade Details And Analysis

May 17, 2025 -

Tom Thibodeau And Mikal Bridges Resolving Post Game Tensions

May 17, 2025

Tom Thibodeau And Mikal Bridges Resolving Post Game Tensions

May 17, 2025

Latest Posts

-

Angel Reeses Brother Wins Ncaa Game Her Sweet Mom Message

May 17, 2025

Angel Reeses Brother Wins Ncaa Game Her Sweet Mom Message

May 17, 2025 -

Family First Angel Reeses Message To Mom After Brothers Ncaa Win

May 17, 2025

Family First Angel Reeses Message To Mom After Brothers Ncaa Win

May 17, 2025 -

Reese Shows Motherly Love Supporting Brothers Ncaa Game Win

May 17, 2025

Reese Shows Motherly Love Supporting Brothers Ncaa Game Win

May 17, 2025 -

The Chrisean Rock Interview Controversy Angel Reeses Response

May 17, 2025

The Chrisean Rock Interview Controversy Angel Reeses Response

May 17, 2025 -

Angel Reese Supports Brothers Ncaa Win With Heartfelt Mothers Day Tribute

May 17, 2025

Angel Reese Supports Brothers Ncaa Win With Heartfelt Mothers Day Tribute

May 17, 2025