Gridlock On GOP Tax Bill: Conservatives Demand Changes To Medicaid And Clean Energy Spending

Table of Contents

Conservative Concerns Regarding Medicaid Expansion

The GOP tax bill's proposed changes to Medicaid are at the heart of the conservative revolt. Current Medicaid provisions, already a significant budgetary item, are facing further adjustments within the bill. Conservatives argue that the bill's approach to Medicaid lacks fiscal responsibility and represents excessive government overreach. They cite concerns about the long-term financial sustainability of the program and advocate for greater state control.

- Concerns about long-term costs and unsustainable growth: Critics point to projections indicating a dramatic increase in Medicaid spending under the proposed bill, straining the federal budget and potentially leading to future tax increases or cuts in other essential programs. They argue that the current trajectory is unsustainable.

- Arguments for state-level control and flexibility: Conservatives emphasize the importance of allowing individual states to tailor their Medicaid programs to meet their specific needs and circumstances. They believe a one-size-fits-all approach is inefficient and ignores the diverse challenges faced by different states.

- Proposed alternatives to the bill's Medicaid provisions: Many conservatives advocate for block grants or per-capita caps on federal Medicaid funding, giving states more autonomy and budgetary flexibility. They believe this would promote efficiency and reduce overall spending.

- Key conservative figures voicing these concerns: Prominent Republican senators and representatives have publicly expressed their opposition to the current Medicaid provisions, calling for significant changes before they will support the bill. Their vocal opposition is a key driver of the gridlock.

The Clean Energy Debate and its Impact on the Tax Bill

Another major point of contention within the GOP tax bill is the inclusion of tax credits or incentives for clean energy initiatives. Conservative Republicans are strongly opposed to these provisions, arguing that they represent unwarranted government intervention in the energy market.

- Arguments for free-market approaches to energy development: Conservatives maintain that energy markets should be allowed to function freely, without government subsidies distorting competition and potentially hindering innovation. They believe that a free market will naturally drive the development of efficient and affordable energy solutions.

- Concerns about the economic impact of clean energy subsidies: Critics argue that government subsidies for clean energy are inefficient, costly, and may not necessarily lead to the desired environmental outcomes. They also express concern that these subsidies could harm other sectors of the economy.

- Alternative energy policy proposals favored by conservatives: Instead of subsidies, conservatives suggest focusing on deregulation and reducing barriers to entry for energy companies, creating a more competitive market that fosters innovation and drives down costs.

- Relevant political figures and their stances: High-profile figures within the Republican Party have openly challenged the clean energy provisions, further exacerbating the divisions within the party and contributing to the gridlock.

Potential Compromises and Paths Forward

Breaking the gridlock on the GOP tax bill requires finding common ground on Medicaid and clean energy spending. Several potential compromises could alleviate the current stalemate.

- Suggestions for alternative spending cuts or revenue increases: One approach involves identifying areas for spending reductions elsewhere in the budget to offset the cost of Medicaid and clean energy provisions. Alternatively, exploring alternative revenue streams could help fund these programs without significantly increasing the deficit.

- Potential changes to Medicaid or clean energy provisions that might gain bipartisan support: Modifying the existing provisions to address some of the conservatives' concerns, such as incorporating greater state control into Medicaid or focusing clean energy subsidies on specific technologies, could foster bipartisan support.

- The role of party leadership in resolving the impasse: Effective negotiation and compromise from party leadership will be crucial in navigating the disagreements and forging a path forward.

- Analysis of the potential consequences of inaction: Failure to reach a compromise could have severe economic and political consequences, potentially damaging investor confidence and undermining the party's legislative agenda.

Impact on the Overall Economy and Future Legislation

The outcome of the current gridlock on the GOP tax bill will have significant ramifications for the US economy and shape future legislative efforts.

- Potential impact on job growth and economic productivity: The bill's passage or failure could significantly impact job growth and overall economic productivity, depending on its effects on various sectors.

- Consequences for the national debt and deficit: The budgetary implications of the bill’s provisions will have a considerable impact on the national debt and deficit.

- How the outcome will influence future tax reform debates: The success or failure of this bill will undoubtedly influence the approach to future tax reform and legislative efforts.

Resolving the Gridlock on the GOP Tax Bill: A Call to Action

The gridlock on the GOP tax bill highlights a deep divide within the Republican Party regarding the role of government in healthcare and energy policy. Conservative opposition to the bill's Medicaid expansion and clean energy spending threatens to derail the entire legislative process. The potential economic consequences of inaction are substantial, emphasizing the urgent need for compromise and negotiation. We urge readers to contact their representatives to express their views on the bill and encourage them to seek solutions. Engage with the political process and make your voice heard to help resolve the gridlock on the GOP tax bill. For further reading on this complex issue, consult reputable news sources and policy analysis organizations.

Featured Posts

-

Ufc Fight Night Live Blog Complete Coverage Of Burns Vs Morales

May 18, 2025

Ufc Fight Night Live Blog Complete Coverage Of Burns Vs Morales

May 18, 2025 -

Mike Trout And Mickey Moniak Homer In Angels Loss To Dodgers

May 18, 2025

Mike Trout And Mickey Moniak Homer In Angels Loss To Dodgers

May 18, 2025 -

Marcello Hernandez And The Suitcase Dog Breakdown Of The Snl Sketch

May 18, 2025

Marcello Hernandez And The Suitcase Dog Breakdown Of The Snl Sketch

May 18, 2025 -

Pedro Pascal Conquering The Internet Once More With Vibrant Fantasy

May 18, 2025

Pedro Pascal Conquering The Internet Once More With Vibrant Fantasy

May 18, 2025 -

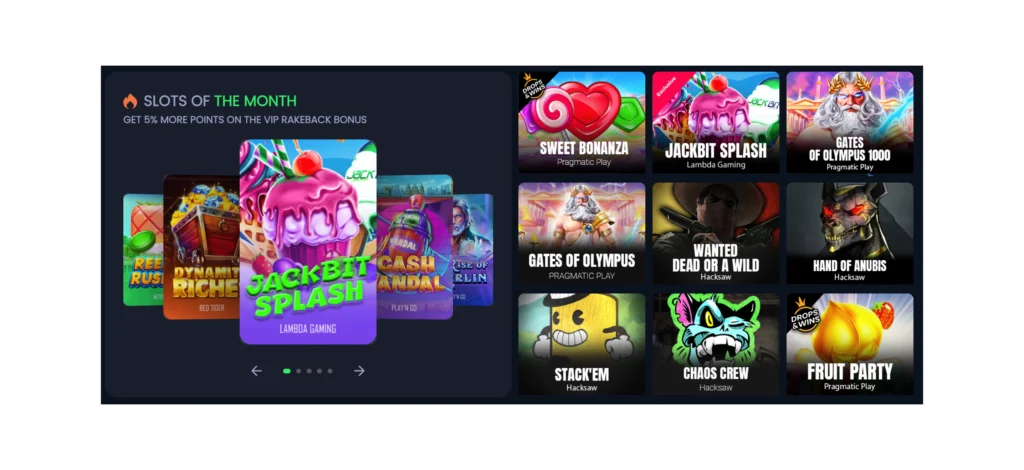

Best Crypto Casino 2025 A Jack Bit Analysis

May 18, 2025

Best Crypto Casino 2025 A Jack Bit Analysis

May 18, 2025