Guaranteed Approval Payday Loans For Bad Credit: A Direct Lender Comparison

Table of Contents

Understanding Guaranteed Approval Payday Loans for Bad Credit

What are Guaranteed Approval Payday Loans?

Guaranteed approval payday loans are short-term loans designed to help individuals cover immediate financial needs. While the term "guaranteed approval" suggests automatic approval, it's crucial to understand that it means a higher likelihood of approval compared to traditional loans, not a certainty. Lenders still assess your application, considering factors like your income and employment history.

- Payday Loan: A short-term loan typically repaid on your next payday.

- Bad Credit: A credit score indicating a history of missed or late payments.

- Direct Lender: A financial institution that directly provides loans to borrowers, eliminating intermediaries.

- Loan Application Process: Typically involves submitting an online application with personal and financial information.

- Fees and Interest Rates: Payday loans come with fees and high interest rates; understanding these charges upfront is vital.

Mythbusting: "Guaranteed Approval" Doesn't Mean Risk-Free

While the prospect of a guaranteed approval payday loan is appealing, it's vital to approach these loans responsibly. "Guaranteed approval" doesn't eliminate the risks associated with borrowing.

- APR (Annual Percentage Rate): This represents the total cost of borrowing, including interest and fees. A high APR can significantly increase the overall loan cost.

- Debt Cycles: Failing to repay on time can lead to a cycle of debt, with further fees and interest accumulating.

- Repayment Plan: Create a realistic repayment plan before applying for a loan to ensure you can comfortably afford the repayments.

Benefits of Using Direct Lenders for Payday Loans

Avoiding Middlemen and Hidden Fees

Using a direct lender for payday loans offers several advantages. By cutting out the middleman (brokers), you potentially save on hidden fees and enjoy faster processing.

- Direct Lender Fees vs. Broker Fees: Brokers often charge additional fees, inflating the overall cost. Direct lenders typically have more transparent fee structures.

- Transparency: Direct lenders provide clear and upfront information about their fees and terms.

Faster Processing and Approval Times

Direct lenders often provide faster processing and approval times compared to traditional lenders.

- Processing Time Comparison: Direct lenders typically process applications much quicker than banks or credit unions.

- Online Application Convenience: Applying online is quick and convenient, often resulting in a same-day decision.

Enhanced Privacy and Data Security

When dealing with sensitive financial information, choosing a reputable direct lender for payday loans is critical.

- Data Encryption: Reputable direct lenders use encryption to protect your personal data.

- Privacy Policies: Review the lender's privacy policy to ensure they comply with data protection regulations.

- Reputable Lenders: Research lenders and choose only those with a proven track record of secure data handling.

Comparing Direct Lenders for Guaranteed Approval Payday Loans

Key Factors to Consider

Before applying, compare lenders based on several key factors:

- APR: The lower the APR, the better.

- Loan Terms: Consider the loan repayment period and its implications.

- Fees: Compare origination fees, late payment fees, and other charges.

- Customer Reviews: Check online reviews to gauge the lender's reputation and customer service.

| Lender | APR (Example) | Fees (Example) | Customer Reviews | Website |

|---|---|---|---|---|

| Lender A | 200% | $30 | 4/5 stars | [Example Website Link] |

| Lender B | 180% | $25 | 4.5/5 stars | [Example Website Link] |

| Lender C | 250% | $40 | 3.5/5 stars | [Example Website Link] |

| (Note: These are example figures. Always check the lender's website for the most up-to-date information.) |

Checking Lender Reputation and Reviews

Thorough research is essential. Check for reviews from other borrowers to gauge their experience.

- Review Websites: Use websites like Trustpilot, the Better Business Bureau (BBB), or others to check reviews.

- Identifying Scams: Be cautious of lenders with extremely low rates, vague terms, or high-pressure sales tactics.

Understanding Loan Terms and Repayment Options

Carefully review the loan agreement before signing.

- Read the Fine Print: Don't rush; understand every term and condition before committing.

- Repayment Options: Inquire about available repayment options – lump sum or installment payments.

Conclusion

Securing a guaranteed approval payday loan for bad credit can provide short-term relief, especially when using a reputable direct lender. However, remember that these loans come with high interest rates and fees. By carefully comparing lenders, understanding the terms, and borrowing responsibly, you can navigate this financial tool effectively. Always research lenders thoroughly, check reviews, and create a realistic repayment plan. Remember to explore alternative financial solutions whenever possible before resorting to payday loans. Choose wisely and borrow responsibly when considering guaranteed approval payday loans.

Featured Posts

-

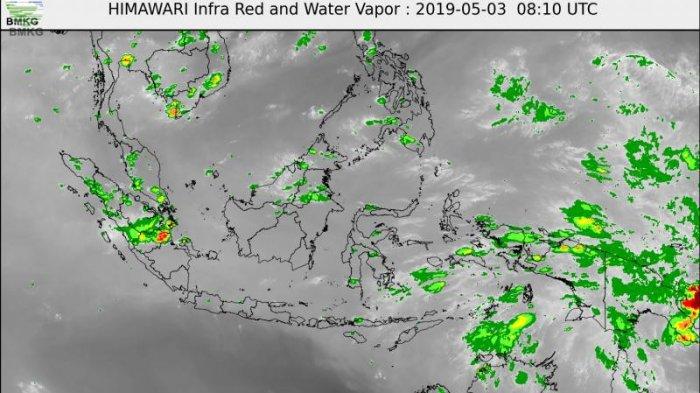

Update Prakiraan Cuaca Kalimantan Timur Ikn Balikpapan Samarinda

May 28, 2025

Update Prakiraan Cuaca Kalimantan Timur Ikn Balikpapan Samarinda

May 28, 2025 -

The Blue Jays And Padres Made A Trade How Will It Affect Vladdy Jr

May 28, 2025

The Blue Jays And Padres Made A Trade How Will It Affect Vladdy Jr

May 28, 2025 -

Liverpool Transfer News 25m Stars Agent Contacts Man Utd

May 28, 2025

Liverpool Transfer News 25m Stars Agent Contacts Man Utd

May 28, 2025 -

Pacers Beat Nets In Overtime Mathurins Stellar Performance

May 28, 2025

Pacers Beat Nets In Overtime Mathurins Stellar Performance

May 28, 2025 -

A Roman Champions Journey Beyond The Triumph

May 28, 2025

A Roman Champions Journey Beyond The Triumph

May 28, 2025

Latest Posts

-

Marcelo Rios Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

Marcelo Rios Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Andre Agassi Una Nueva Pista Un Nuevo Juego

May 30, 2025

Andre Agassi Una Nueva Pista Un Nuevo Juego

May 30, 2025 -

Controversial Revelaciones Un Tenista Argentino Y Su Opinion Sobre Marcelo Rios

May 30, 2025

Controversial Revelaciones Un Tenista Argentino Y Su Opinion Sobre Marcelo Rios

May 30, 2025 -

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025 -

Un Tenista Argentino Arremete Contra Rios Era Un Dios Del Tenis

May 30, 2025

Un Tenista Argentino Arremete Contra Rios Era Un Dios Del Tenis

May 30, 2025