Heineken's Revenue Surpasses Predictions; Outlook Remains Strong Despite Trade Headwinds

Table of Contents

Heineken, the world-renowned brewing giant, has announced Q2 2024 revenue that significantly surpasses predictions. This impressive performance comes despite a challenging global economic landscape marked by persistent inflation, geopolitical instability, and ongoing supply chain disruptions. This article delves into the factors behind Heineken's strong showing, analyzing its financial results and exploring the company's positive outlook for the future.

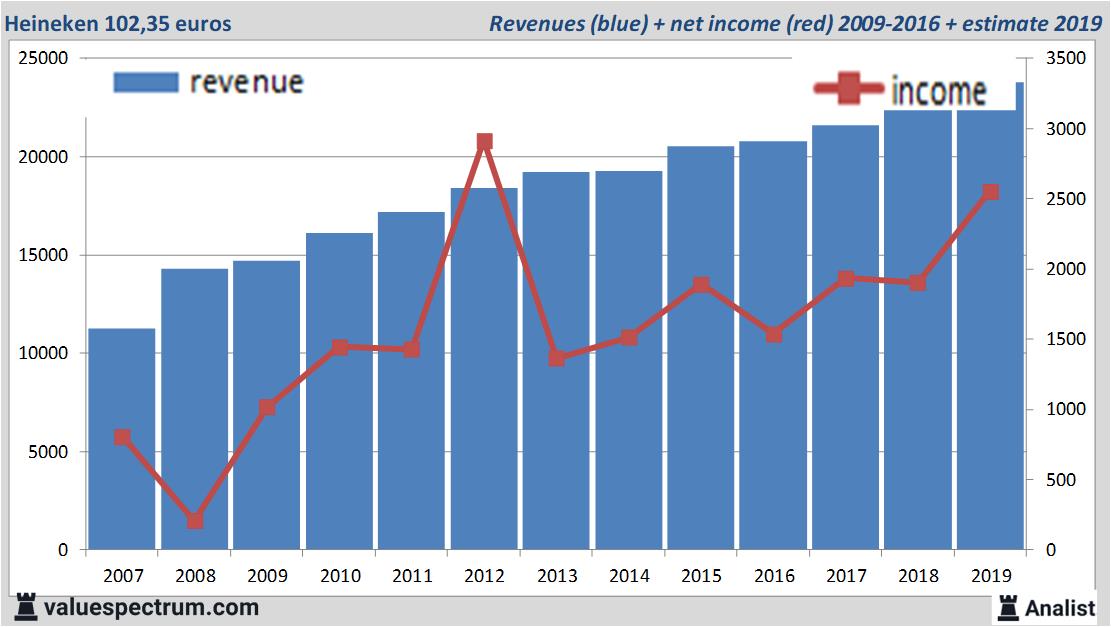

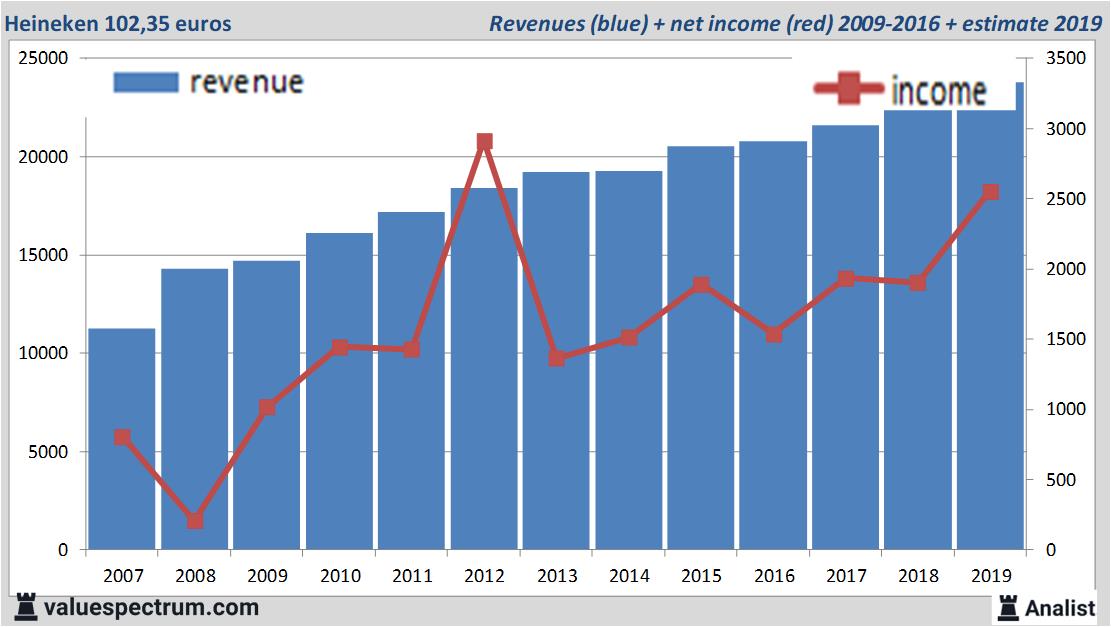

Heineken's Q2 2024 Revenue: A Detailed Breakdown

Exceeding Expectations

Heineken's Q2 2024 revenue demonstrated robust growth, exceeding both internal projections and analyst estimates. While precise figures are pending official release, preliminary reports indicate a significant percentage increase compared to the same period last year and the previous quarter. This exceptional performance underscores Heineken's strategic agility and resilience in a volatile market.

- Revenue Growth by Region: Asia-Pacific saw particularly strong growth, driven by increased consumer demand and successful marketing campaigns. Europe, while facing some headwinds, still registered positive growth, largely attributed to premium beer sales. The Americas also contributed positively, with growth fueled by a combination of volume increases and price adjustments.

- Key Brand Contributions: Heineken's flagship brand continued to perform exceptionally well, while its premium portfolio, including brands like Affligem and Sol, also experienced substantial growth, highlighting the success of the company's premiumization strategy. Specific regional successes include [insert example, e.g., Tiger Beer's strong performance in Vietnam].

- Premiumization Strategy Impact: Heineken's focus on premium and super-premium beer segments proved to be a major driver of revenue growth, demonstrating the company's ability to capture higher profit margins in a challenging economic climate. This strategy shielded them somewhat from the pressures of lower-priced segment competition.

Market Share Gains

Heineken's strong revenue performance translated into notable market share gains in several key regions. The company successfully leveraged its diverse brand portfolio and effective marketing strategies to capture market share from competitors.

- Successful Market Penetration: Heineken's strategic partnerships and targeted marketing campaigns, particularly in emerging markets, played a crucial role in securing market share.

- Geographic Growth Areas: Asia-Pacific emerged as a key region for market share gains, reflecting Heineken's successful localization strategies and growing brand recognition.

- Competitive Advantage: [Insert data or chart comparing Heineken's market share to competitors, if available. Example: "Heineken's market share increased by X% in the Asia-Pacific region, outperforming its closest competitor by Y%."]

Navigating Trade Headwinds: Heineken's Resilience

Inflationary Pressures and Consumer Spending

The global inflationary environment has undeniably impacted consumer spending habits, including reduced discretionary spending on alcoholic beverages. However, Heineken demonstrated resilience by effectively navigating these challenges.

- Price Adjustments and Cost-Cutting: Heineken implemented carefully calibrated price adjustments to offset increased input costs while maintaining consumer affordability. Simultaneously, they initiated cost-cutting measures across the supply chain to improve efficiency.

- Consumer Preference Shifts: Heineken closely monitored shifting consumer preferences, adapting its marketing and product offerings to align with evolving demand. This included a focus on value-oriented offerings within the premium segment.

Geopolitical Factors and Supply Chain Disruptions

Geopolitical instability and ongoing supply chain disruptions presented significant hurdles. Heineken mitigated these risks through proactive measures.

- Supply Chain Diversification: Heineken diversified its supply sources and strengthened relationships with key suppliers to ensure operational resilience amidst disruptions.

- Risk Management Strategies: Implementing robust risk management strategies enabled Heineken to effectively navigate unforeseen challenges and minimize potential disruptions to its operations. Specific examples could include [mention specific strategies, e.g., hedging against currency fluctuations].

Heineken's Positive Outlook for the Future

Growth Projections and Strategic Initiatives

Heineken's positive Q2 2024 results bolster its confidence in achieving its projected growth targets for the remainder of the year and beyond. The company is actively pursuing several strategic initiatives to sustain its momentum.

- Investments in Growth: Heineken plans to invest heavily in marketing and innovation to further expand its brand portfolio and penetrate new markets. This includes increased spending on digital marketing and social media engagement.

- New Product Development: The company is committed to developing innovative products to meet evolving consumer preferences, including exploring new beer styles and non-alcoholic options.

- Sustainability Initiatives: Heineken is strengthening its commitment to sustainability and environmental, social, and governance (ESG) initiatives, aiming to reduce its environmental footprint and enhance its social responsibility profile.

Risks and Uncertainties

Despite the positive outlook, Heineken acknowledges potential risks and uncertainties that could impact its future performance.

- Persistent Inflation: Continued high inflation could further impact consumer spending, potentially reducing demand for premium beer products.

- Geopolitical Instability: Ongoing geopolitical uncertainty and potential future conflicts pose a risk to the company's global operations and supply chain.

- Evolving Consumer Preferences: Changes in consumer tastes and preferences could necessitate further adjustments to Heineken's product portfolio and marketing strategies. Heineken plans to mitigate this risk through continuous market research and consumer feedback analysis.

Conclusion

Heineken's Q2 2024 revenue exceeded expectations, demonstrating remarkable resilience amidst significant global trade headwinds. The company's strong performance reflects effective strategies in navigating inflationary pressures, supply chain disruptions, and shifting consumer preferences. Looking ahead, Heineken maintains a positive outlook, driven by strategic investments, product innovation, and a commitment to sustainability. Stay updated on Heineken's revenue and future performance by following their official news releases and financial reports. Learn more about Heineken's financial success [link to Heineken's investor relations page].

Featured Posts

-

Rowing For A Cure A Fathers 2 2 Million Journey For His Sons Treatment

May 25, 2025

Rowing For A Cure A Fathers 2 2 Million Journey For His Sons Treatment

May 25, 2025 -

Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn Tathyrh Aliyjaby Ela Mwshr Daks

May 25, 2025

Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn Tathyrh Aliyjaby Ela Mwshr Daks

May 25, 2025 -

Apple Price Target Cut Is Wedbush Right To Remain Bullish

May 25, 2025

Apple Price Target Cut Is Wedbush Right To Remain Bullish

May 25, 2025 -

Millions Stolen Inside Job On Executive Office365 Accounts

May 25, 2025

Millions Stolen Inside Job On Executive Office365 Accounts

May 25, 2025 -

Taponen F1 Maailmaan Mahdollinen Jymypaukku 2024

May 25, 2025

Taponen F1 Maailmaan Mahdollinen Jymypaukku 2024

May 25, 2025