High Down Payments: A Major Barrier To Homeownership In Canada

Table of Contents

The Rising Cost of Down Payments in Canada

Canadian housing prices have skyrocketed in recent years, directly impacting the required down payment amount. This increase isn't uniform across the country; major cities like Toronto, Vancouver, and Montreal experience significantly higher prices and, consequently, higher down payment requirements. The escalating costs create a significant barrier to entry for many Canadians, particularly those seeking to purchase their first home. Let's examine the numbers:

- Average down payment percentages required: For a typical detached home, a 20% down payment is often the norm to avoid CMHC mortgage insurance premiums, translating to hundreds of thousands of dollars in upfront costs. Condos and townhouses might require less (sometimes as low as 5% with CMHC insurance), but still represent a formidable savings hurdle.

- Impact of location: The average home price, and therefore the down payment needed, varies drastically across Canada. In Toronto and Vancouver, the required down payment can easily surpass $200,000 for a modest home. In smaller cities, while the amounts are lower, they still present a significant challenge for many potential homebuyers.

- The role of CMHC insurance: While CMHC insurance allows for smaller down payments (as low as 5% in certain cases), it also increases the overall cost of the mortgage due to the insurance premiums. This adds another layer of financial complexity for those already struggling to save for a down payment.

- The effect of the mortgage stress test: The Bank of Canada's stress test necessitates qualifying for a mortgage at a higher interest rate than the current one, making it more difficult for borrowers to qualify and demanding a larger down payment to compensate for the increased mortgage payments.

The Impact on First-Time Homebuyers

The difficulties presented by high down payments are particularly acute for first-time homebuyers in Canada. Saving a substantial sum while simultaneously managing rent, student loans, and other everyday expenses is an enormous challenge. This creates a significant barrier to entry and delays or prevents homeownership for many. The emotional and psychological toll of this financial strain shouldn't be underestimated. Consider these factors:

- Statistics on first-time homebuyer rates and challenges: Data consistently shows a decline in first-time homeownership rates, directly linked to the increasing difficulty in saving for a large down payment.

- Common obstacles faced by first-time homebuyers: Beyond saving, first-time buyers face fierce competition from investors and experienced homeowners in a tight market, making it harder to secure a property even with a sufficient down payment.

- Government programs and incentives aimed at assisting first-time homebuyers: Several federal and provincial programs offer assistance, such as the First-Time Home Buyers' Incentive, but these often have eligibility requirements and limited availability.

- Alternative financing options: Gifting from family can help, but this isn't always feasible for everyone. Other solutions are limited and require careful consideration.

Solutions and Potential Strategies

Addressing the problem of high down payments requires a multi-pronged approach involving government intervention, innovative mortgage products, and adjustments to lending practices. Some potential strategies include:

- Advocacy for increased government support for affordable housing: Increased funding and incentives for affordable housing developments are crucial to increase the supply of more attainable homes.

- Exploration of alternative mortgage options: Shared equity mortgages, where the lender invests in a portion of the property, could potentially reduce down payment requirements, but require careful analysis of the long-term implications.

- Discussion of the potential for revised down payment requirements: While risky, adjustments to down payment requirements could significantly ease the burden for many, though this carries its own set of risks regarding market stability.

- Review of existing down payment assistance programs in different provinces: A comprehensive review and expansion of existing programs, ensuring accessibility and equity, could provide much-needed relief.

The Role of Government Policy in Addressing the Issue

Government housing policy in Canada plays a crucial role in shaping the accessibility of homeownership. Current policies, while aiming to support homebuyers, have not effectively countered the rising costs of housing and the impact of high down payments. More aggressive and innovative policies, such as targeted subsidies for first-time homebuyers, changes to land use regulations to promote higher-density housing, and stricter regulations on speculation, are needed to create a more sustainable and equitable housing market.

Conclusion

The challenges posed by high down payments in the Canadian housing market are undeniable. Their significant impact on affordability and access to homeownership for many Canadians, especially first-time buyers, is a critical issue that demands attention. The dream of owning a home should not be an unattainable luxury. It's crucial that we continue to discuss solutions and advocate for policies that promote greater affordability and make the dream of homeownership a reality for more Canadians. Explore available resources and assistance programs to understand your options and take the first step towards achieving your homeownership goals, even with the challenge of high down payments.

Featured Posts

-

The Death Of Americas First Non Binary Individual A Tragedy

May 10, 2025

The Death Of Americas First Non Binary Individual A Tragedy

May 10, 2025 -

Agression Au Lac Kir A Dijon Bilan Et Circonstances

May 10, 2025

Agression Au Lac Kir A Dijon Bilan Et Circonstances

May 10, 2025 -

Dakota Johnson Pedro Pascal Kai Chris Evans Stin Tainia Materialists

May 10, 2025

Dakota Johnson Pedro Pascal Kai Chris Evans Stin Tainia Materialists

May 10, 2025 -

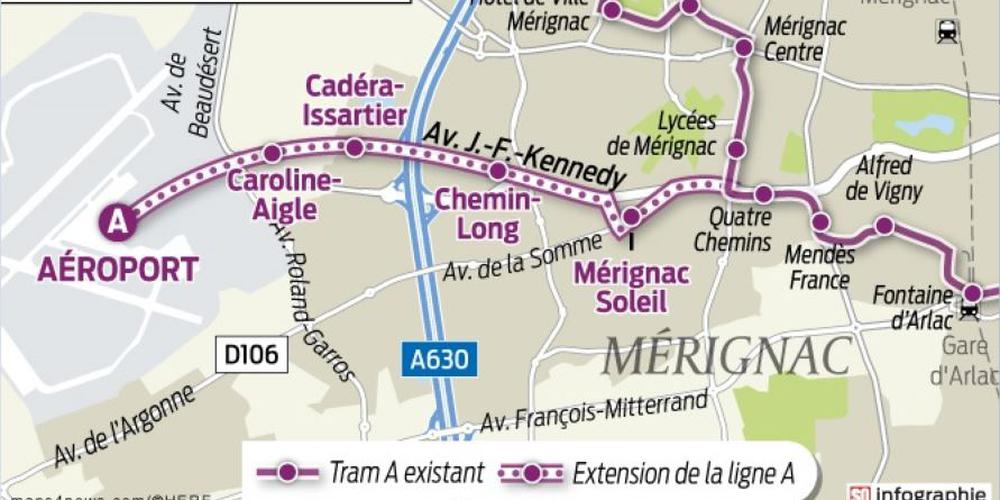

Dijon Concertation Adoptee Pour La Troisieme Ligne De Tram

May 10, 2025

Dijon Concertation Adoptee Pour La Troisieme Ligne De Tram

May 10, 2025 -

Thailands Transgender Community A Push For Equality Featured In The Bangkok Post

May 10, 2025

Thailands Transgender Community A Push For Equality Featured In The Bangkok Post

May 10, 2025