High Stock Market Valuations: A BofA Analyst's Take

Table of Contents

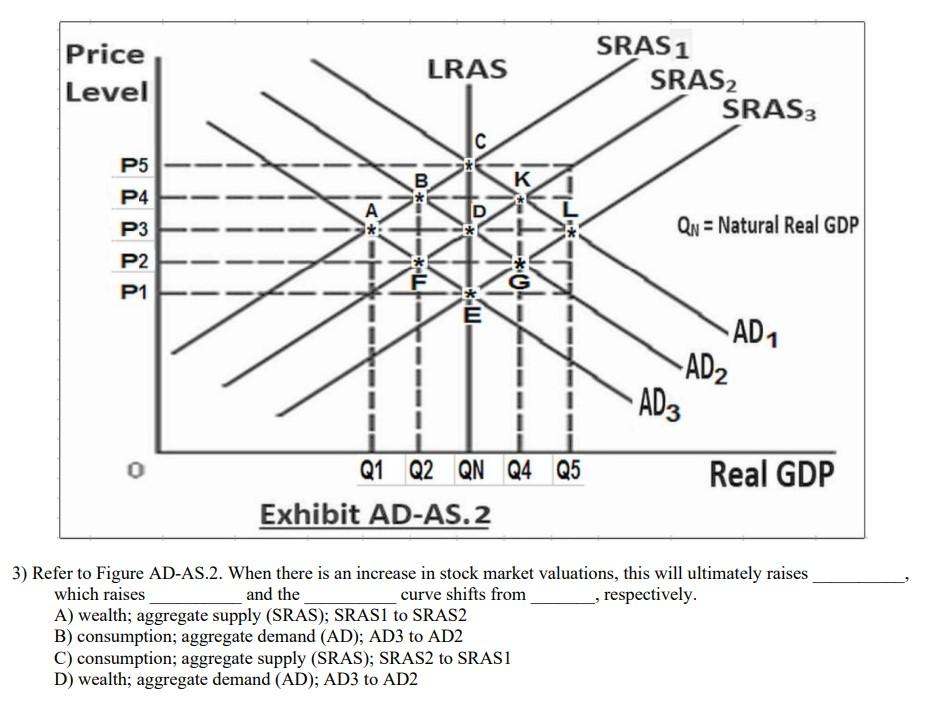

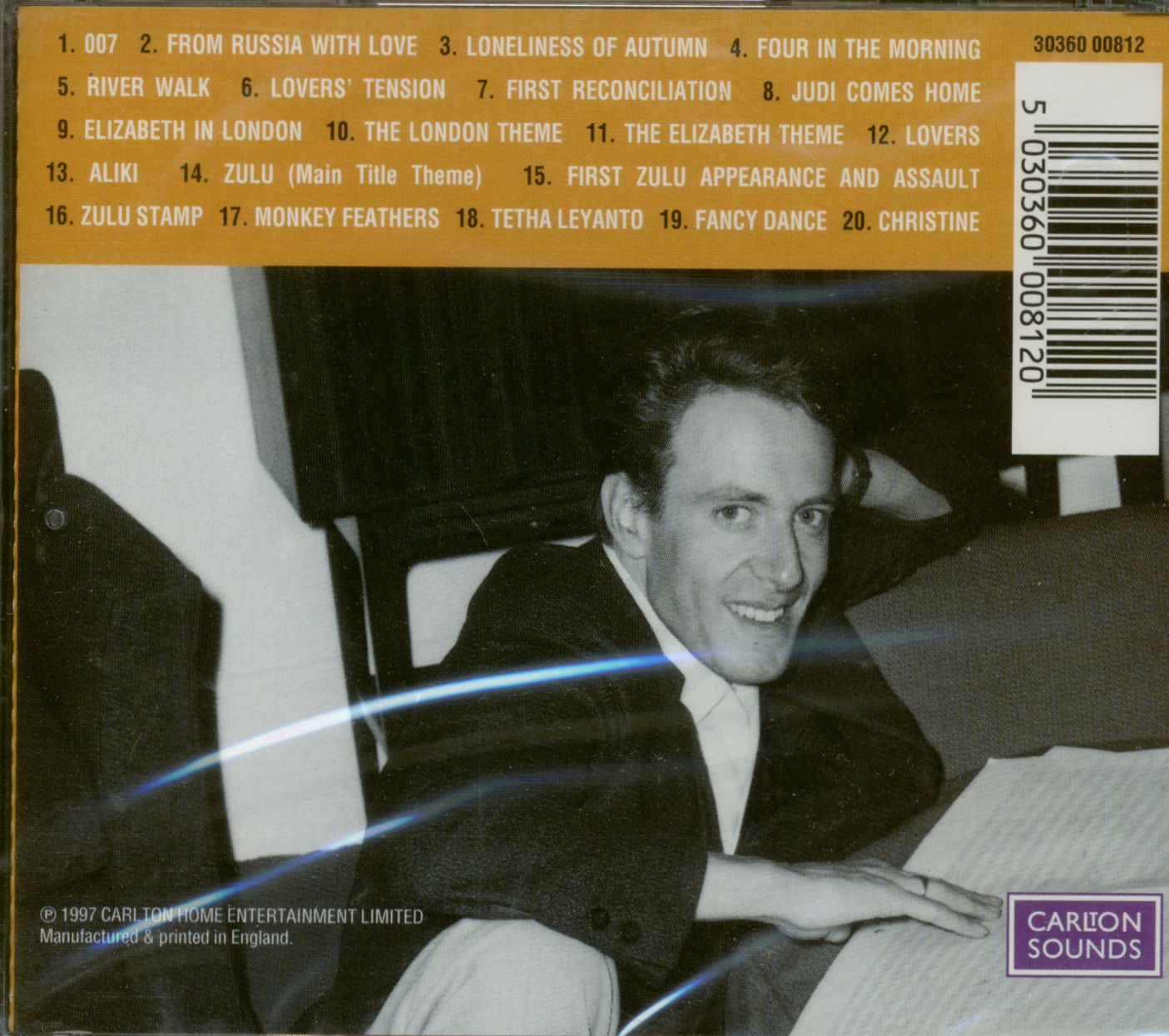

Factors Contributing to High Stock Market Valuations

Several key elements have contributed to the elevated stock market valuations we're currently witnessing. Understanding these factors is crucial for navigating the market effectively.

Low Interest Rates and Monetary Policy

Historically low interest rates have profoundly impacted investor behavior and fueled stock market growth. The prolonged period of quantitative easing (QE) implemented by central banks globally has flooded the market with liquidity, driving down bond yields and pushing investors towards higher-yielding assets, including stocks.

- Quantitative Easing (QE): QE programs injected massive amounts of capital into the financial system, lowering borrowing costs and encouraging investment.

- Low Bond Yields: With bond yields near historic lows, investors sought higher returns in the stock market, increasing demand and driving up prices.

- Search for Yield: The low-yield environment forced investors to search for yield in riskier assets, further boosting stock valuations.

For example, the current 10-year Treasury yield (insert current yield here) is significantly lower than historical averages (insert historical average here), demonstrating the impact of monetary policy on investor behavior and stock valuations.

Strong Corporate Earnings and Growth Prospects

Robust corporate earnings and optimistic growth projections have also played a vital role in supporting high stock market valuations. Many companies have reported strong profits, fueled by various factors, including technological advancements and increasing consumer demand.

- Strong Earnings Growth: Several sectors, such as technology and consumer staples (mention specific examples with data points if available), have demonstrated exceptional earnings growth, boosting overall market performance.

- Future Growth Expectations: Investor confidence in future growth prospects, particularly in emerging technologies and sustainable energy, has contributed to higher valuations.

- Potential Risks: However, supply chain disruptions, inflationary pressures, and geopolitical uncertainty pose significant threats to these earnings forecasts and could trigger a market correction.

Investor Sentiment and Market Psychology

Market psychology plays a significant role in driving valuations. A combination of optimism, fueled by strong earnings and low interest rates, and the fear of missing out (FOMO) has encouraged both institutional and retail investors to pour money into the market, pushing valuations higher.

- Retail Investor Participation: The increased participation of retail investors, often driven by social media trends and easy access to trading platforms, has injected additional liquidity into the market.

- Institutional Investment Strategies: Institutional investors, such as pension funds and mutual funds, have also played a key role, deploying significant capital into the market.

- Behavioral Biases: Behavioral biases, such as confirmation bias and overconfidence, can lead to irrational exuberance and contribute to inflated valuations.

BofA's Analysis and Outlook on High Stock Market Valuations

BofA, a leading financial institution, offers valuable insights into the current market environment. Their analysis provides crucial context for understanding the sustainability of high stock market valuations.

BofA's Valuation Metrics

BofA employs various valuation metrics to assess market conditions, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and other relevant indicators. (Insert specific data from BofA reports here, comparing current valuations to historical averages and industry benchmarks. For example: "BofA's analysis shows that the current S&P 500 P/E ratio is X, compared to the historical average of Y."). These metrics help determine whether current valuations are justified based on historical data and fundamental analysis.

Potential Risks and Challenges

Despite the positive aspects, high valuations present significant risks. These include:

- Market Corrections: High valuations often precede market corrections or crashes, as investor exuberance can lead to unsustainable price increases.

- Inflation: Rising inflation could erode corporate profits and increase interest rates, potentially leading to a decline in stock prices.

- Interest Rate Hikes: Central bank actions to curb inflation through interest rate hikes could negatively impact stock valuations by increasing borrowing costs for companies.

- Geopolitical Risks: Unforeseen geopolitical events can create volatility and negatively impact investor sentiment.

BofA's Recommendations and Investment Strategies

Based on its analysis, BofA's recommendations might include (insert specific recommendations from BofA reports if available. Examples include):

- Diversification: Diversifying across different asset classes, sectors, and geographies is crucial to mitigate risk.

- Sector Rotation: Shifting investments from overvalued sectors to undervalued ones can enhance returns.

- Risk Management: Employing appropriate risk management strategies, such as stop-loss orders, is essential to protect capital.

- Value Investing: Focusing on undervalued companies with strong fundamentals could provide better returns in a potentially volatile market.

Conclusion: Navigating High Stock Market Valuations

BofA's analysis highlights that while strong corporate earnings and low interest rates have contributed to high stock market valuations, significant risks remain. Understanding these factors – from low interest rates and strong earnings to investor sentiment and potential market corrections – is crucial for informed decision-making. Investors should carefully consider BofA's perspective and incorporate its insights into their investment strategies. Understanding high stock market valuations is crucial for informed investment decisions. Stay informed on market trends and consult with a financial advisor to develop a strategy that aligns with your risk tolerance and financial goals.

Featured Posts

-

Best Trips And Activities For Seniors A Yearly Calendar

May 13, 2025

Best Trips And Activities For Seniors A Yearly Calendar

May 13, 2025 -

Zelenskys Plea Trumps Role In Ukraine Peace Talks

May 13, 2025

Zelenskys Plea Trumps Role In Ukraine Peace Talks

May 13, 2025 -

Aktualizacia Atlasu Romskych Komunit Zber Dat Sa Zacina V Aprili

May 13, 2025

Aktualizacia Atlasu Romskych Komunit Zber Dat Sa Zacina V Aprili

May 13, 2025 -

Doom The Dark Ages Early Access And Full Game Launch Dates

May 13, 2025

Doom The Dark Ages Early Access And Full Game Launch Dates

May 13, 2025 -

Protecting Her Children Scarlett Johanssons Views On Privacy And Anonymity

May 13, 2025

Protecting Her Children Scarlett Johanssons Views On Privacy And Anonymity

May 13, 2025

Latest Posts

-

Dodgers Defeat Diamondbacks In 14 11 Slugfest Ohtanis Late Power

May 14, 2025

Dodgers Defeat Diamondbacks In 14 11 Slugfest Ohtanis Late Power

May 14, 2025 -

14 11 Thriller Ohtanis Heroics Secure Dodgers Win Against Diamondbacks

May 14, 2025

14 11 Thriller Ohtanis Heroics Secure Dodgers Win Against Diamondbacks

May 14, 2025 -

Dodgers Rally Past Diamondbacks Ohtanis Late Homer The Key

May 14, 2025

Dodgers Rally Past Diamondbacks Ohtanis Late Homer The Key

May 14, 2025 -

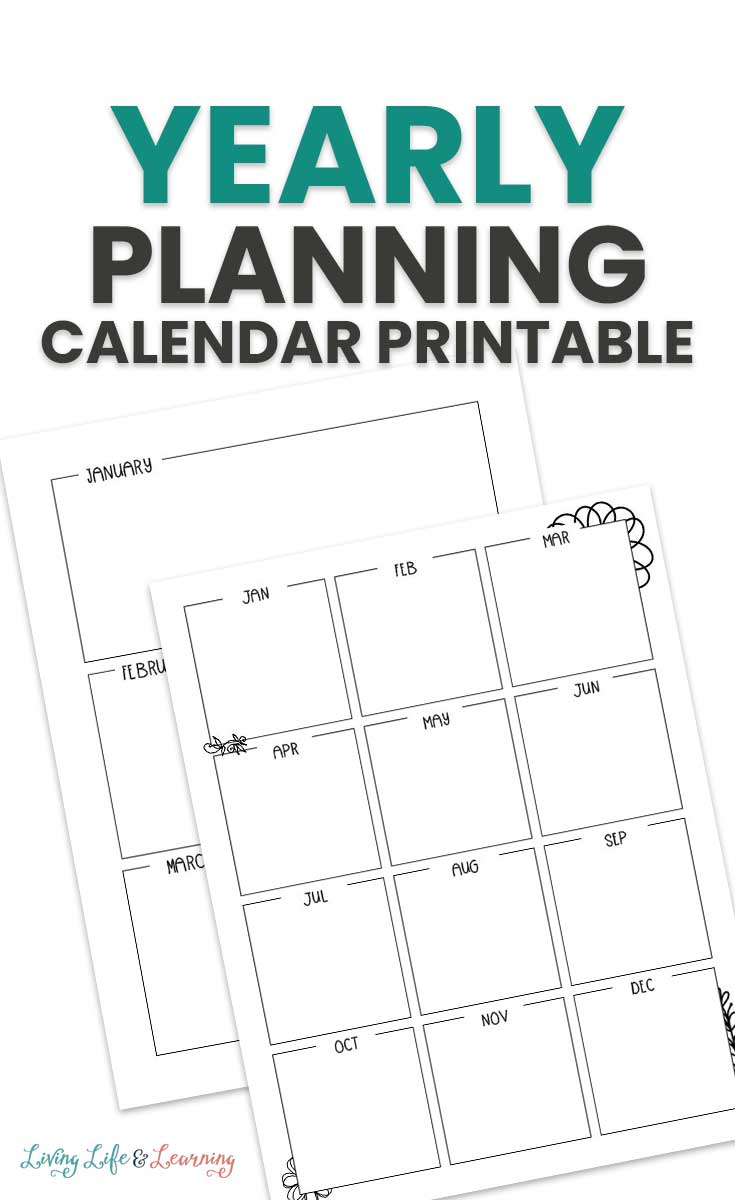

Experience John Barrys From York With Love At Your Local Everyman

May 14, 2025

Experience John Barrys From York With Love At Your Local Everyman

May 14, 2025 -

John Barrys From York With Love Film Screening At Everyman

May 14, 2025

John Barrys From York With Love Film Screening At Everyman

May 14, 2025