High Stock Market Valuations: BofA's Case For Investor Calm

Table of Contents

BofA's Arguments for Continued Market Growth Despite High Valuations

BofA's optimistic outlook rests on several key pillars, suggesting that continued market growth is possible even with elevated valuations.

Low Interest Rates and Monetary Policy

BofA likely points to persistently low interest rates as a primary driver of continued asset price appreciation. The impact of years of quantitative easing (QE) continues to be felt, with low borrowing costs making equities more attractive than bonds for both companies and investors.

- Impact of QE: The injection of liquidity into the market through QE programs has artificially depressed interest rates, making borrowing cheap and fueling investment.

- Low Borrowing Costs: Companies can easily access capital for expansion and share buybacks, boosting earnings and driving up stock prices.

- Equities vs. Bonds: With bond yields remaining relatively low, the higher potential returns offered by equities make them a more appealing investment option for many.

Data shows that current interest rates remain historically low compared to previous decades. This environment provides continued support for asset prices, including stocks.

Strong Corporate Earnings and Profitability

BofA's bullish stance is also underpinned by the strong performance of corporate earnings and profit margins. Many sectors are demonstrating robust growth, leading to positive earnings revisions and fueling investor confidence.

- High-Performing Sectors: Technology, healthcare, and consumer staples, among others, have shown impressive earnings growth.

- Positive Earnings Revisions: Analysts are continually upgrading their earnings forecasts for many companies, reflecting a positive outlook.

- Profit Margin Analysis: While some margins are being squeezed by inflation, overall profit margins remain relatively healthy for many companies.

The projected S&P 500 earnings growth for the coming year further reinforces this argument, suggesting that strong corporate performance can offset concerns about high valuations.

Long-Term Growth Potential and Technological Innovation

BofA likely emphasizes the long-term growth potential driven by technological innovation and global expansion. These factors, they argue, can justify current valuations, given their potential to drive future earnings growth.

- Technological Advancements: Disruptive technologies in areas like artificial intelligence, renewable energy, and biotechnology offer immense growth opportunities.

- Global Growth Opportunities: Emerging markets present significant expansion potential for many companies, providing a catalyst for future earnings growth.

- Demographic Shifts: Global demographic trends, such as an aging population in developed countries, create demand for specific products and services, stimulating further growth.

The emergence of innovative sectors and their impressive growth trajectories underpin BofA's long-term optimistic outlook.

Counterarguments and Potential Risks

While BofA's arguments are compelling, it's crucial to acknowledge potential counterarguments and risks.

Valuation Metrics and Historical Comparisons

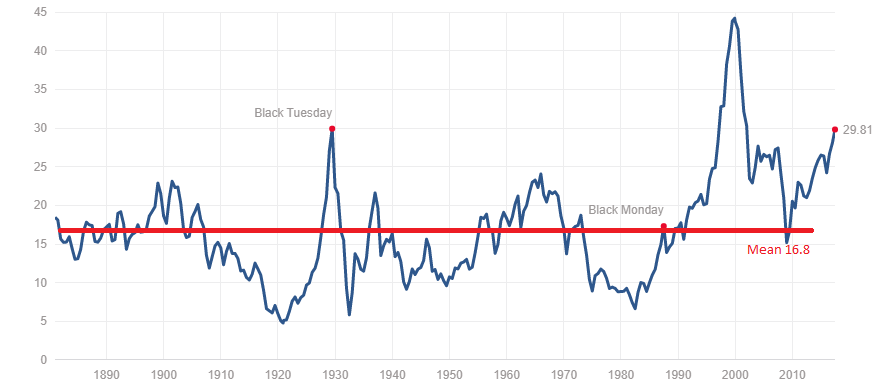

Critics might point to historically high valuation metrics as a significant red flag. Comparing current price-to-earnings (P/E) ratios, price-to-sales ratios, and other metrics to historical averages reveals that current valuations are indeed elevated, raising concerns about a potential market bubble.

- PE Ratios: Current P/E ratios for the S&P 500 are significantly higher than their long-term average, suggesting overvaluation.

- Price-to-Sales Ratios: Similarly, price-to-sales ratios are also elevated, adding to concerns about inflated valuations.

- Bubble Scenarios: Historical comparisons to past market bubbles raise caution, reminding investors of the potential for sharp corrections.

Geopolitical Risks and Economic Uncertainty

Geopolitical tensions, supply chain disruptions, and rising inflation present significant headwinds that could impact market performance negatively.

- Inflation: Persistently high inflation erodes purchasing power and can dampen economic growth, impacting corporate profitability.

- Supply Chain Disruptions: Global supply chain bottlenecks can lead to shortages and price increases, affecting both businesses and consumers.

- Geopolitical Tensions: Uncertainties surrounding geopolitical events can trigger volatility and negatively affect investor sentiment.

Interest Rate Hikes and Inflationary Pressures

Central banks' response to inflation through interest rate hikes presents a substantial risk. Higher rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate profitability. They can also reduce the attractiveness of equities relative to bonds.

- Impact on Bond Yields: Rising interest rates lead to higher bond yields, making bonds a more competitive investment compared to stocks.

- Potential for Market Corrections: Interest rate hikes can trigger market corrections as investors reassess valuations and risk appetites.

- Effect on Company Profitability: Higher borrowing costs can squeeze profit margins and hinder companies' ability to invest and grow.

Strategies for Investors Amidst High Stock Market Valuations

Navigating this environment requires a strategic approach.

Diversification

Diversifying across various asset classes is crucial for mitigating risk.

- Asset Classes: Including bonds, real estate, commodities, and alternative investments in your portfolio can help reduce overall volatility.

- Risk Management: Diversification spreads risk across different asset classes, reducing the impact of any single asset's underperformance.

Long-Term Investing

Maintaining a long-term investment horizon is vital to weathering market fluctuations.

- Dollar-Cost Averaging: Investing a fixed amount regularly, regardless of market conditions, helps mitigate the risk of buying high and selling low.

- Emotional Discipline: Avoid making impulsive decisions based on short-term market movements.

- Fundamental Analysis: Focus on the underlying fundamentals of companies and sectors, rather than just market sentiment.

Risk Tolerance Assessment

Before making any investment decisions, investors should carefully assess their risk tolerance.

- Risk Profiles: Different investors have different levels of risk tolerance, affecting their investment strategies.

- Aligning Strategies: Investment strategies should be aligned with individual risk profiles to ensure comfort and long-term success.

Conclusion: Maintaining Calm in the Face of High Stock Market Valuations

BofA's case for investor calm rests on low interest rates, robust corporate earnings, and long-term growth potential. However, high valuations, geopolitical risks, and potential interest rate hikes pose significant counterarguments. Understanding both sides of this argument is crucial before making investment decisions. A well-defined investment strategy tailored to your risk tolerance and long-term goals is essential for navigating the challenges presented by these high stock market valuations. Conduct thorough research and consult with qualified financial advisors to effectively manage your portfolio and understand high stock market valuations in the context of your own financial situation. Learn to effectively manage high stock valuations through diversification and long-term planning.

Featured Posts

-

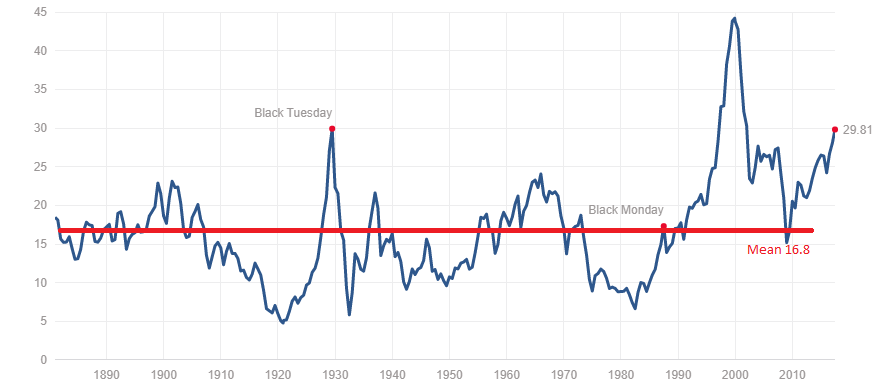

Obamacare Supreme Court Case Trumps Role And Rfk Jr S Potential Gain

Apr 22, 2025

Obamacare Supreme Court Case Trumps Role And Rfk Jr S Potential Gain

Apr 22, 2025 -

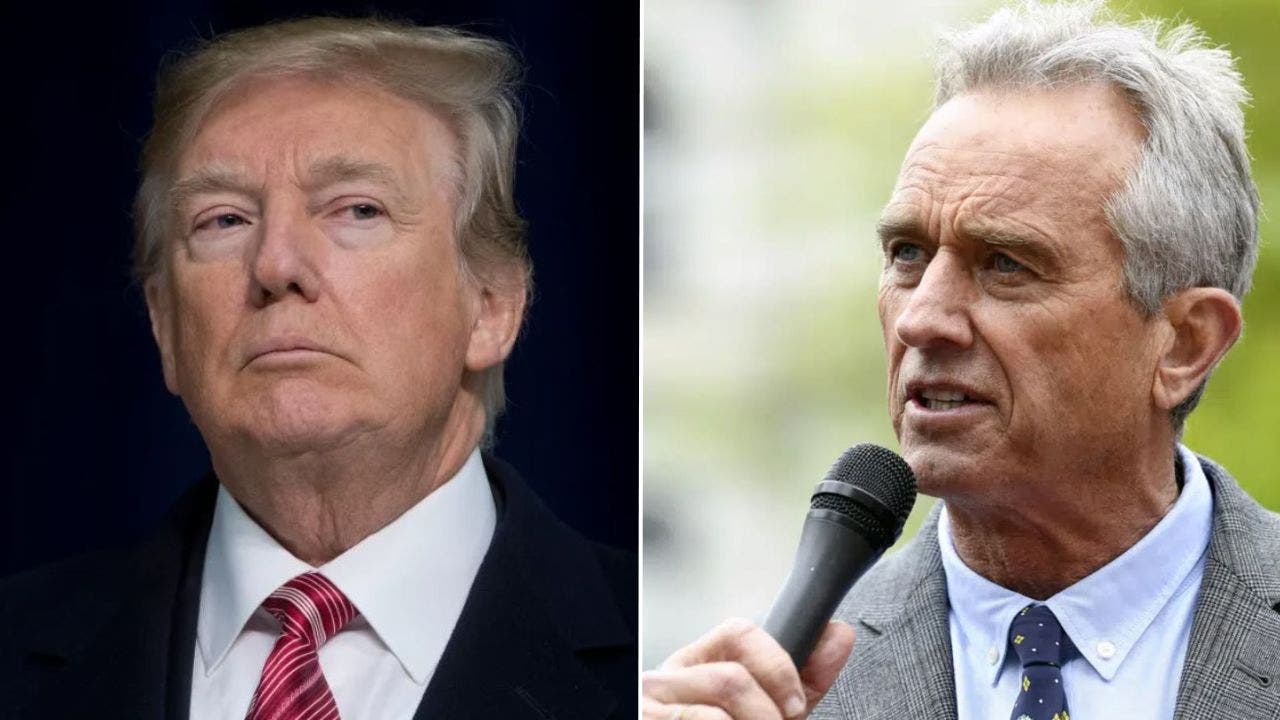

Country Name S Booming Business Regions An Interactive Map And Analysis

Apr 22, 2025

Country Name S Booming Business Regions An Interactive Map And Analysis

Apr 22, 2025 -

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 22, 2025

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 22, 2025 -

The Case For Breaking Up Google Examining The Risks And Rewards

Apr 22, 2025

The Case For Breaking Up Google Examining The Risks And Rewards

Apr 22, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Halt

Apr 22, 2025