High Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Argument: Strong Corporate Earnings as a Justification for High Valuations

BofA's core argument rests on the strength of corporate earnings. They contend that robust profit growth justifies the current high valuations, arguing that the market isn't overvalued when considering the underlying fundamentals. This perspective is supported by several key observations:

- Evidence of strong corporate earnings data: Numerous reports, including those from the S&P 500, show consistent growth in earnings per share (EPS) across various sectors. (Source: [Insert credible source, e.g., S&P 500 report]). This sustained growth suggests that companies are generating substantial profits, supporting the current market capitalization.

- Specific sectors showing strong performance: Technology, healthcare, and consumer staples, among others, have demonstrated particularly robust earnings growth, contributing significantly to the overall market strength. This sector-specific strength suggests broad-based economic health.

- Earnings growth supports current market capitalization: The relationship between earnings and market capitalization is crucial. When companies demonstrate consistent EPS growth, it justifies higher price-to-earnings ratios (P/E), thus supporting higher stock valuations. This positive feedback loop suggests the market's current valuation reflects underlying strength.

The Role of Low Interest Rates in Supporting High Stock Market Valuations

Low interest rates play a significant role in BofA's analysis. The argument is that in a low-interest-rate environment, equities become a more attractive investment compared to bonds. This shift in investor preference contributes to the elevated stock market valuations.

- Current interest rate environment: Central banks globally maintain low interest rates, a consequence of policies aimed at stimulating economic growth following periods of economic uncertainty. (Source: [Insert credible source, e.g., Federal Reserve statement]).

- Inverse relationship between interest rates and stock valuations: As interest rates fall, the return on bonds diminishes, making stocks a relatively more appealing investment, even with higher valuations. This inverse relationship drives capital into equity markets.

- Impact of quantitative easing (QE) on market liquidity: The implementation of quantitative easing programs has increased market liquidity, providing ample capital for investment, further fueling the rise in stock valuations.

BofA's View on Future Growth and its Impact on High Stock Market Valuations

BofA's optimistic outlook extends to future economic growth. They predict continued expansion, suggesting that current high stock market valuations are not only justified by present performance but also reflect anticipated future earnings growth.

- BofA's predictions for economic growth: BofA forecasts [Insert specific percentage] GDP growth for the coming year, driven by [mention key drivers, e.g., consumer spending, investment]. (Source: [Cite BofA report or credible source]).

- Projected impact on corporate earnings: This projected economic growth is expected to translate into further increases in corporate earnings, bolstering the case for sustained high stock market valuations.

- Potential risks or caveats to their optimistic outlook: BofA acknowledges potential risks, such as inflation or geopolitical uncertainty, that could impact their forecasts. However, their overall outlook remains positive.

Addressing the Risk of High Stock Market Valuations: BofA's Mitigation Strategies

While acknowledging the risks associated with high stock market valuations – including the potential for market corrections and the formation of speculative bubbles – BofA emphasizes the importance of risk management. They suggest strategies that investors can employ to mitigate these risks.

- Potential market corrections and their impact: Market corrections are a natural part of the market cycle. While they can lead to short-term volatility, BofA suggests that long-term investors should view them as opportunities.

- Importance of portfolio diversification: Diversification is crucial for mitigating risk. Spreading investments across different asset classes and sectors reduces exposure to any single market downturn.

- Strategies like dollar-cost averaging and stop-loss orders: Dollar-cost averaging helps reduce the impact of market volatility by investing regularly regardless of price fluctuations. Stop-loss orders help limit potential losses.

Conclusion: Understanding High Stock Market Valuations and the Path Forward

BofA's analysis provides a nuanced perspective on high stock market valuations. They argue that strong corporate earnings, low interest rates, and positive future growth prospects justify the current market levels. However, they also acknowledge the inherent risks. Understanding both the potential for growth and the associated risks is crucial for informed investment decisions. To make sound investment choices regarding high stock market valuations, further research is vital. Consult with financial professionals to tailor a strategy that aligns with your personal risk tolerance and investment goals. Consider exploring BofA's full report for a more in-depth analysis of these complex market dynamics.

Featured Posts

-

Kentucky Governor Issues State Of Emergency Due To Imminent Heavy Rain And Flooding

Apr 29, 2025

Kentucky Governor Issues State Of Emergency Due To Imminent Heavy Rain And Flooding

Apr 29, 2025 -

Double Trouble In Hollywood Writers And Actors Strike Brings Production To Halt

Apr 29, 2025

Double Trouble In Hollywood Writers And Actors Strike Brings Production To Halt

Apr 29, 2025 -

Willie Nelsons Spouse Denies Inaccurate News Story

Apr 29, 2025

Willie Nelsons Spouse Denies Inaccurate News Story

Apr 29, 2025 -

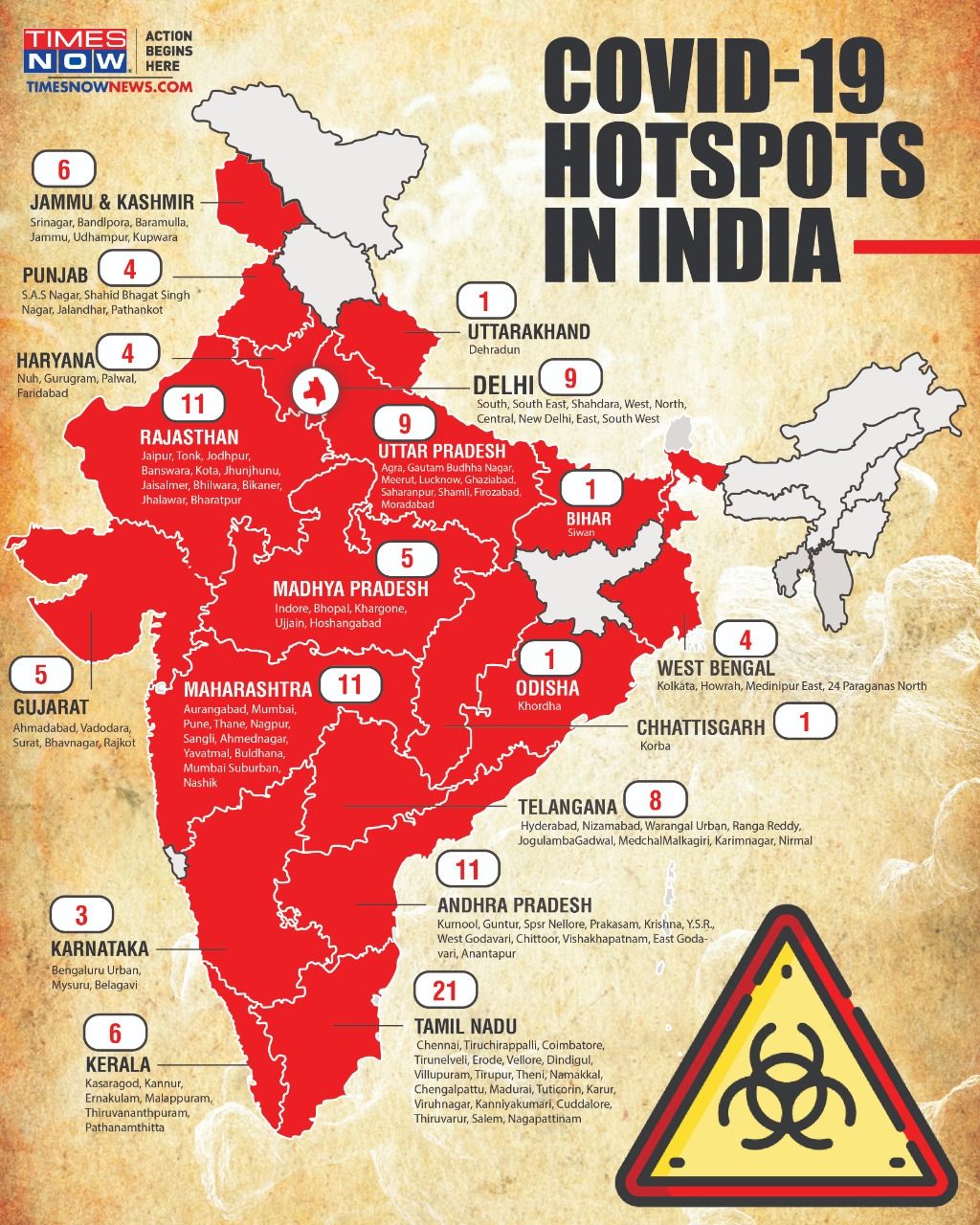

New Business Hotspots Across The Country A Comprehensive Map And Analysis

Apr 29, 2025

New Business Hotspots Across The Country A Comprehensive Map And Analysis

Apr 29, 2025 -

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025

Dsv Leoben Praesentiert Neues Trainerteam In Der Regionalliga Mitte

Apr 29, 2025

Latest Posts

-

Nyt Strands Hints And Answers Thursday April 10 Game 403

May 09, 2025

Nyt Strands Hints And Answers Thursday April 10 Game 403

May 09, 2025 -

Nyt Strands Hints And Answers Saturday April 12 Game 405

May 09, 2025

Nyt Strands Hints And Answers Saturday April 12 Game 405

May 09, 2025 -

Nyt Spelling Bee April 4 2025 Complete Guide To Solving The Puzzle

May 09, 2025

Nyt Spelling Bee April 4 2025 Complete Guide To Solving The Puzzle

May 09, 2025 -

Nyt Strands April 9 2025 Complete Walkthrough And Answers

May 09, 2025

Nyt Strands April 9 2025 Complete Walkthrough And Answers

May 09, 2025 -

Nyt Strands Today April 4 2025 Clues Hints And Solutions

May 09, 2025

Nyt Strands Today April 4 2025 Clues Hints And Solutions

May 09, 2025