High Stock Valuations: BofA's View And Investor Implications

Table of Contents

BofA's Stance on Current High Stock Valuations

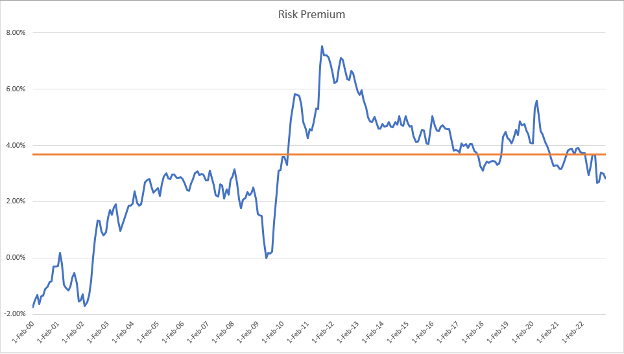

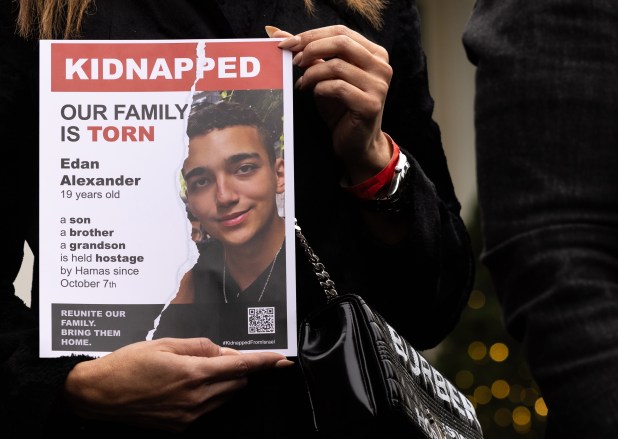

BofA's analysts regularly publish reports assessing market conditions and offering insights into asset pricing. Their recent analyses concerning elevated stock prices often reference key metrics like the Price-to-Earnings ratio (P/E ratio) and the cyclically adjusted price-to-earnings ratio (Shiller PE), both indicators of market valuation relative to earnings. These reports frequently incorporate macroeconomic factors and qualitative assessments of market sentiment.

-

BofA's Overall Assessment: BofA's stance on high stock valuations tends to fluctuate depending on current economic data and market trends. While they may not explicitly declare a universally "bullish," "bearish," or "neutral" position, their analyses often point toward specific concerns or opportunities. For example, they might express caution about certain overvalued sectors while highlighting potentially undervalued opportunities in others.

-

Specific Sectors and Companies: BofA's research frequently pinpoints specific sectors or companies that they believe are either overvalued or undervalued based on their fundamental analysis and prevailing market conditions. These assessments are often detailed in their research reports, highlighting potential risks and rewards for investors.

-

Influencing Economic Factors: BofA's analysis incorporates several economic factors influencing stock valuations. These commonly include interest rate levels (higher rates tend to decrease valuations), inflation rates (high inflation erodes purchasing power and impacts corporate earnings), and overall economic growth projections.

Factors Contributing to High Stock Valuations

Several interwoven factors contribute to the current environment of high stock valuations. Understanding these factors is crucial for investors seeking to make informed decisions.

-

Low Interest Rates: Historically low interest rates encourage investors to seek higher returns in riskier assets like stocks. This increased demand pushes up stock prices, contributing to higher valuations. Low-yield bonds make stocks a relatively more attractive investment.

-

Quantitative Easing and Monetary Policy: Central banks' quantitative easing (QE) programs, involving the injection of liquidity into financial markets, have played a significant role in inflating asset prices, including stocks. This monetary policy aims to stimulate economic growth but can inadvertently lead to inflated valuations.

-

Strong Corporate Earnings (or Expectations Thereof): Robust corporate earnings, or even the expectation of strong future earnings, can support higher stock valuations. Investors are willing to pay a premium for companies demonstrating consistent growth and profitability.

-

Technological Advancements and Disruptive Innovation: Rapid technological advancements and disruptive innovations often drive significant investment in specific sectors, leading to elevated valuations for companies at the forefront of these trends. Think of the high valuations associated with technology giants.

-

Investor Sentiment and Market Psychology: Market psychology, characterized by investor optimism or pessimism, significantly impacts stock valuations. Periods of heightened optimism and speculation can lead to inflated prices, regardless of underlying fundamentals. "FOMO" (Fear Of Missing Out) can further exacerbate this effect.

Risks Associated with High Stock Valuations

Investing in a market with high stock valuations carries several inherent risks. Understanding these risks is paramount for prudent investment decision-making.

-

Increased Market Volatility and Potential for Corrections: High valuations often correlate with increased market volatility and the potential for significant price corrections. Overvalued markets are inherently more susceptible to sharp declines.

-

Reduced Returns: High valuations generally imply reduced future returns. Investors paying high prices for assets can expect lower returns compared to investing at lower valuations.

-

The Potential for a Market Bubble: Sustained high valuations can create the conditions for a market bubble, which, when it bursts, can lead to a substantial and rapid decline in asset prices.

-

Sector-Specific Risks: Certain sectors might be more vulnerable to a market correction than others. Overvalued sectors, particularly those reliant on continued growth and investor sentiment, are particularly at risk.

Strategies for Navigating High Stock Valuations

Navigating a market characterized by high stock valuations requires a strategic approach focusing on risk mitigation and long-term growth.

-

Diversification: Diversifying your portfolio across various asset classes (stocks, bonds, real estate, etc.) can help mitigate risk. Don't put all your eggs in one basket.

-

Value Investing: Focus on identifying undervalued companies with strong fundamentals. Value investing seeks to capitalize on market inefficiencies, finding companies trading below their intrinsic value.

-

Defensive Investing: Adopt defensive strategies to preserve capital during market uncertainty. This might involve investing in lower-risk assets or focusing on companies with stable earnings and dividends.

-

Rebalancing Your Portfolio: Regularly rebalance your portfolio to maintain your desired asset allocation. This involves selling some overvalued assets and buying undervalued ones to maintain your target risk level.

-

Dollar-Cost Averaging: Employ dollar-cost averaging, investing a fixed amount at regular intervals, regardless of market fluctuations. This strategy reduces the impact of market timing.

Conclusion

This analysis of BofA's perspective on high stock valuations underscores the need for a cautious and strategic approach to investing. Understanding the factors driving these valuations, as well as the associated risks, is crucial for making informed decisions. By diversifying your portfolio, considering value investing strategies, and actively managing your risk exposure, you can better navigate the complexities of this market environment. Remember to regularly review your investment strategy and adjust it based on changing economic conditions and the ongoing assessment of high stock valuations. Don't hesitate to consult with a financial advisor to develop a personalized investment plan tailored to your specific needs and risk tolerance. Careful monitoring of high stock valuations is essential for long-term investment success.

Featured Posts

-

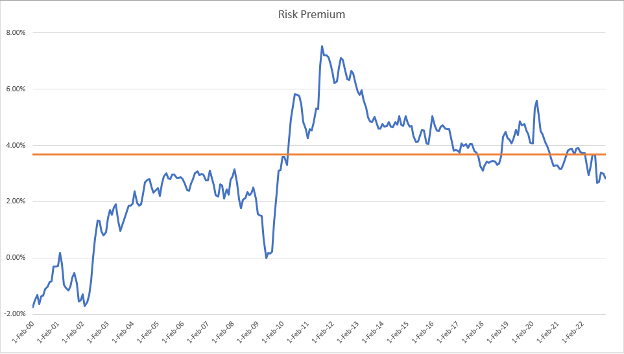

Update Edan Alexanders Imprisonment By Hamas Potential Release

May 12, 2025

Update Edan Alexanders Imprisonment By Hamas Potential Release

May 12, 2025 -

Ufc 315 A Complete Breakdown Of Tonights Fights

May 12, 2025

Ufc 315 A Complete Breakdown Of Tonights Fights

May 12, 2025 -

Knicks Edge Bulls Again Secure Second Straight Overtime Victory

May 12, 2025

Knicks Edge Bulls Again Secure Second Straight Overtime Victory

May 12, 2025 -

Benny Blanco Cheating Rumors 10 Photos That Spark Speculation

May 12, 2025

Benny Blanco Cheating Rumors 10 Photos That Spark Speculation

May 12, 2025 -

Marvels Nova The Henry Cavill Casting Rumor Explained

May 12, 2025

Marvels Nova The Henry Cavill Casting Rumor Explained

May 12, 2025

Latest Posts

-

Barnli I Lids Se Vrakjaat Vo Premier Ligata

May 13, 2025

Barnli I Lids Se Vrakjaat Vo Premier Ligata

May 13, 2025 -

I Fanela Kai O Panigyrismos I Periptosi Mpalntok Stin Sefilnt Gioynaitent

May 13, 2025

I Fanela Kai O Panigyrismos I Periptosi Mpalntok Stin Sefilnt Gioynaitent

May 13, 2025 -

Sefilnt Gioynaitent O Panigyrismos Toy Mpalntok Kai I Antidrasi Ton Filathlon

May 13, 2025

Sefilnt Gioynaitent O Panigyrismos Toy Mpalntok Kai I Antidrasi Ton Filathlon

May 13, 2025 -

Texas Longhorns Deja Kelly Leading The Charge In Oregon

May 13, 2025

Texas Longhorns Deja Kelly Leading The Charge In Oregon

May 13, 2025 -

Cp Music Productions Father And Son Teamwork In Music Production

May 13, 2025

Cp Music Productions Father And Son Teamwork In Music Production

May 13, 2025