HMRC Child Benefit Warning: Messages You Shouldn't Ignore

Table of Contents

Understanding HMRC Child Benefit Communication Methods

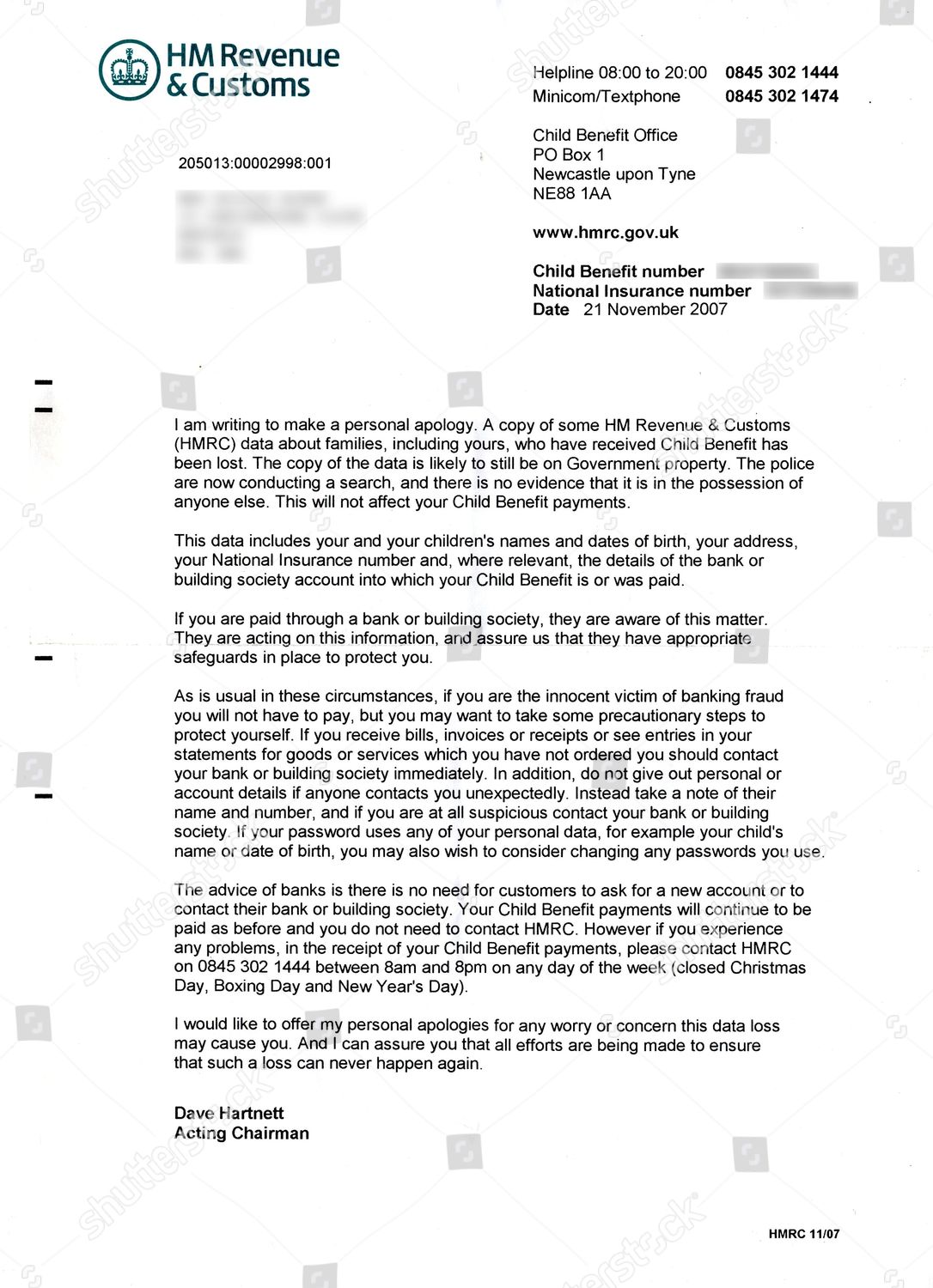

HMRC uses various methods to contact you about your Child Benefit. Knowing these channels is crucial to ensure you don't miss important information and updates regarding your tax credits and benefits. Failing to respond to HMRC contact can result in delays or suspension of your payments.

-

Letters: HMRC frequently uses traditional mail to send important updates about your Child Benefit. It's vital to check your postal mail regularly, paying close attention to any envelopes from HMRC. Look for official letterheads and addresses to verify authenticity.

-

Online Portal: Accessing your personal HMRC online account is the most efficient way to stay updated on your Child Benefit. Registering for online access allows you to view your payment history, update your personal details, and receive instant notifications about any changes or requests. This is often the quickest and most reliable way to manage your Child Benefit information.

-

Emails: While less frequent for significant updates, HMRC may use email for less critical communications. However, be extremely cautious. Always verify the sender's email address and never click on links in emails unless you are absolutely certain they are legitimate. Phishing scams are prevalent, so exercise caution.

-

Phone Calls: HMRC rarely initiates unsolicited phone calls regarding Child Benefit. If you receive a call claiming to be from HMRC about your benefits, do not share any personal or financial information. Instead, hang up and contact HMRC directly using the official contact details found on their website.

-

Text Messages: Similar to phone calls, HMRC rarely uses text messages for important Child Benefit updates. Be wary of any texts requesting personal information or asking you to click on links. Report any suspicious text messages immediately.

Common HMRC Child Benefit Messages Requiring Immediate Action

Several HMRC Child Benefit messages demand your immediate attention. Failing to respond promptly can result in significant financial repercussions.

-

Overpayment Notices: Receiving a notice about an overpayment means HMRC believes you've received more Child Benefit than you were entitled to. You must respond promptly, explaining the discrepancy and arranging a repayment plan. Ignoring this could lead to further penalties and debt recovery action.

-

Underpayment Notices: If you receive a notice about an underpayment, it signifies that HMRC believes you haven't received the full amount of Child Benefit you're owed. You'll need to provide any missing information or documentation to rectify the situation and avoid future issues.

-

Verification Requests: HMRC may request additional information to verify your eligibility for Child Benefit. This is common when circumstances change. Respond swiftly and accurately to these requests to avoid suspension of your benefits. Provide all necessary documentation as quickly as possible.

-

Change of Circumstances Notifications: It's your responsibility to inform HMRC of any changes affecting your Child Benefit entitlement, including changes in your address, income, or family status. Failing to report changes promptly can lead to incorrect payments and potential penalties.

-

Penalty Notices: Ignoring requests for information or failing to comply with HMRC's requirements can result in penalty notices. These carry serious financial consequences, so it's crucial to address them immediately.

What to Do if You Receive a Suspicious Message

If you receive a message that you suspect is fraudulent, follow these steps:

-

Never click on links in suspicious emails or texts. These links could lead to malicious websites designed to steal your personal information.

-

Contact HMRC directly using official contact details found on their website. Do not use any contact information provided in the suspicious message.

-

Report scams to Action Fraud. Action Fraud is the UK's national reporting centre for fraud and cybercrime. Reporting suspicious activity helps protect others from becoming victims.

Maintaining Accurate Child Benefit Information

Providing and maintaining accurate information is crucial to avoid problems with your Child Benefit payments. Proactive management of your details is essential.

-

Regularly review your Child Benefit information online. Log into your HMRC online account regularly to check for updates and ensure your details are accurate.

-

Report any changes promptly. Immediately report any changes to your circumstances, such as a change of address, income, or family status. Use the HMRC online portal or contact them directly via phone or letter.

-

Keep records of all communications with HMRC. Keep copies of all letters, emails, and other correspondence with HMRC related to your Child Benefit. This will be helpful if any issues arise.

Conclusion:

Staying informed about your Child Benefit is paramount. Ignoring messages from HMRC can lead to serious financial and legal consequences. By understanding the different communication methods and promptly responding to official requests, you can ensure the continued and accurate payment of your Child Benefit. Remember to always verify the authenticity of any communication before responding. Don’t ignore those important HMRC Child Benefit messages – your future financial stability may depend on it. Visit the official HMRC website today to check your Child Benefit status and update your details.

Featured Posts

-

Jutarnji List Tko Je Sve Zablistao Na Premijeri

May 20, 2025

Jutarnji List Tko Je Sve Zablistao Na Premijeri

May 20, 2025 -

F1 Drama Hamilton Och Leclerc Far Diskvalificering Analys Och Reaktioner

May 20, 2025

F1 Drama Hamilton Och Leclerc Far Diskvalificering Analys Och Reaktioner

May 20, 2025 -

Kaoset I F1 Hamilton Och Leclerc En Djupdykning I Kontroversen

May 20, 2025

Kaoset I F1 Hamilton Och Leclerc En Djupdykning I Kontroversen

May 20, 2025 -

Typhon Missiles In The Philippines Assessing The Effectiveness Against Chinese Aggression

May 20, 2025

Typhon Missiles In The Philippines Assessing The Effectiveness Against Chinese Aggression

May 20, 2025 -

Ewdt Ajatha Krysty Bfdl Aldhkae Alastnaey Thlyl Wtathyr

May 20, 2025

Ewdt Ajatha Krysty Bfdl Aldhkae Alastnaey Thlyl Wtathyr

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025