HMRC Letters To UK Households Earning Over £23,000: What You Need To Know

Table of Contents

Understanding the £23,000 Threshold and its Implications

What does the £23,000 threshold signify?

The £23,000 threshold isn't a magic number that automatically means you owe more tax. However, it's a common point where many individuals' tax affairs become more complex and often trigger communication from HMRC. It signifies a point where many people may need to take further action regarding their tax responsibilities, moving beyond the simpler PAYE (Pay As You Earn) system.

- Higher earners often fall into a self-assessment tax bracket. This means you'll need to file a self-assessment tax return annually, declaring your income and any allowable expenses.

- Certain allowances and tax codes may change above this threshold. Your tax code, which dictates how much income tax is deducted from your salary, might be adjusted based on your earnings.

- It's important to review your personal tax situation. Understanding your tax liability is crucial to avoid potential penalties or unexpected tax bills.

- It's a common point at which HMRC will contact you. HMRC uses this threshold as a guideline to identify taxpayers who may require further attention regarding their tax returns and payments.

Types of HMRC Letters and Their Meaning

Tax Return Reminders

Receiving a tax return reminder from HMRC means it's time to file your self-assessment tax return. Failing to submit your return by the deadline can result in significant penalties. Understanding the deadline and the implications of late submission is paramount.

- Details on what constitutes a late return: The deadline is typically 31 January following the tax year (6 April to 5 April). Even a day late can incur penalties.

- Explanation of potential penalties for late filing: Penalties can range from a fixed penalty to interest charges on any unpaid tax. The longer the delay, the higher the penalty.

- Guidance on how to file your tax return online: HMRC provides a user-friendly online portal for submitting self-assessment tax returns.

Tax Code Changes

A letter concerning tax code changes indicates an alteration to the amount of tax deducted from your earnings. These changes can be due to various factors, including changes in your income, allowances, or tax reliefs.

- Explain common tax code changes and what they mean: A tax code change might reflect a change in your employment status, a new allowance, or a correction from HMRC.

- Advise readers to contact HMRC if they have questions about their tax code: Don't hesitate to reach out to HMRC if you're unsure about the implications of a tax code change.

- Link to relevant HMRC resources on understanding tax codes: HMRC's website provides comprehensive information and guidance on tax codes.

Tax Liability Notices

A tax liability notice indicates a difference between the tax you've already paid (through PAYE or other methods) and the tax you're liable to pay based on your declared income. This might mean you owe additional tax or are due a refund.

- Explain how to verify your tax liability: Carefully review the notice and your tax calculations to ensure accuracy.

- Provide guidance on paying any outstanding tax owed: HMRC offers various payment options, and prompt payment is crucial to avoid further penalties.

- Advise readers on claiming any tax refunds due: If you're due a refund, follow the instructions in the letter to initiate the claim process.

Responding to HMRC Correspondence: A Step-by-Step Guide

Understanding the Letter

The first step in responding to any HMRC letter is carefully reading and understanding its content. Pay close attention to deadlines, requirements, and any specific actions you need to take.

- Highlight key dates and information included in HMRC letters: Look for deadlines, reference numbers, and contact details.

- Encourage readers to keep records of all correspondence: Maintain a file containing all HMRC letters and your responses.

Taking Action

Your next step depends on the content of the letter. This might involve filing a tax return, making a tax payment, or contacting HMRC for clarification.

- Provide links to relevant HMRC online services: Use the online services provided by HMRC to manage your tax affairs efficiently.

- Explain the process of contacting HMRC and obtaining assistance: HMRC offers various contact methods, including phone, email, and online chat.

- Explain how to check your tax account online: Regularly checking your online tax account allows you to monitor your tax status and identify any potential issues proactively.

Avoiding HMRC Issues: Proactive Tax Management

Keeping Accurate Records

Maintaining accurate records of your income, expenses, and other relevant financial information is vital for avoiding HMRC issues.

- Suggest methods for record-keeping (digital or paper): Choose a method that suits your needs and ensures easy access to your records.

- Explain the importance of accurate record-keeping in case of an audit: Accurate records can help you demonstrate compliance with tax regulations during an audit.

Seeking Professional Advice

For complex tax situations or if you're unsure about any aspect of your tax obligations, consider seeking professional advice from a qualified tax advisor.

- Suggest advantages of professional tax advice: A tax advisor can help you optimize your tax planning and avoid costly mistakes.

- Mention potential tax savings from professional advice: A tax advisor can help you identify potential tax savings and allowances you might be eligible for.

Conclusion

Receiving an HMRC letter regarding your tax affairs can be daunting, but understanding the process and taking appropriate action is vital. By carefully reviewing your tax liability, responding promptly to HMRC correspondence, and maintaining accurate records, you can avoid penalties and ensure you’re complying with UK tax laws. Remember to check your HMRC online account regularly and seek professional advice if needed. If you're earning over £23,000 and have questions about your HMRC letter, take action today and don't delay! Don't hesitate to contact HMRC directly or seek professional advice regarding your HMRC letter and UK tax obligations.

Featured Posts

-

Atkinsrealis Droit Inc Expertise Juridique Pour Entreprises Et Particuliers

May 20, 2025

Atkinsrealis Droit Inc Expertise Juridique Pour Entreprises Et Particuliers

May 20, 2025 -

Fenerbahce Yildizi Ajax A Transfer Olundu Mourinho Nun Rolue Ne

May 20, 2025

Fenerbahce Yildizi Ajax A Transfer Olundu Mourinho Nun Rolue Ne

May 20, 2025 -

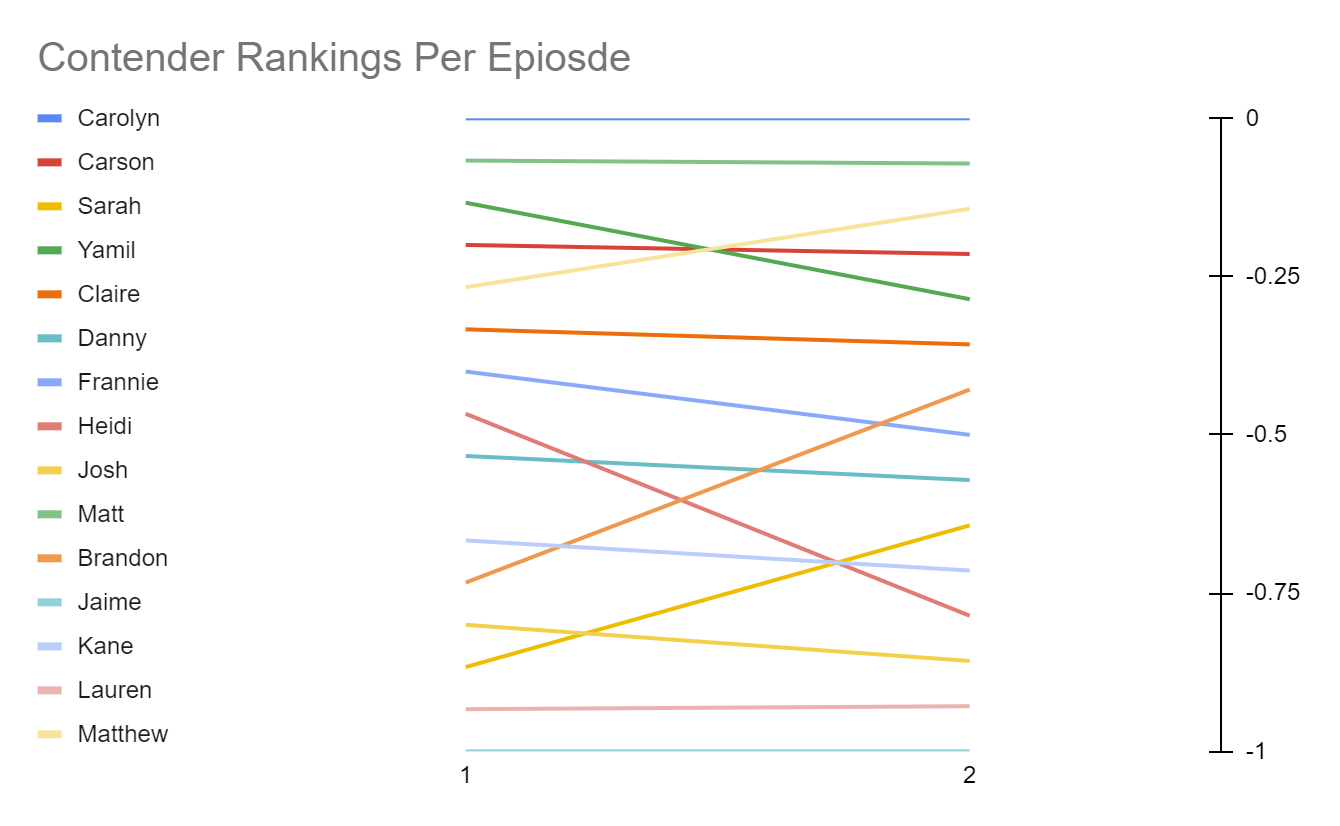

Eurovision Final 2025 Top 5 Predictions And Contender Analysis

May 20, 2025

Eurovision Final 2025 Top 5 Predictions And Contender Analysis

May 20, 2025 -

Solo Travel Finding Yourself On The Open Road

May 20, 2025

Solo Travel Finding Yourself On The Open Road

May 20, 2025 -

Hmrcs Voice Recognition System Faster Call Handling For Taxpayers

May 20, 2025

Hmrcs Voice Recognition System Faster Call Handling For Taxpayers

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025