HMRC Nudge Letters: EBay, Vinted, And Depop Sellers Beware

Table of Contents

What are HMRC Nudge Letters? Recognizing the Signs

HMRC's approach to tackling tax evasion is evolving. Instead of immediately launching full-scale investigations, they often begin with "nudge" letters – a less aggressive initial step aimed at encouraging compliance. These letters aren't formal tax assessments; they're requests for information to clarify potential discrepancies.

Identifying a Nudge Letter: HMRC nudge letters typically use polite but firm language. They might:

- Request clarification on your income figures.

- Ask for supporting documentation to verify your sales and expenses.

- Inquire about your tax registration status (Self Assessment).

Why You Might Receive an HMRC Nudge Letter: Several factors can trigger an HMRC nudge letter. Common reasons include:

- Significant discrepancies: A noticeable difference between your declared income and HMRC's estimations.

- Missing tax returns: Failure to file your Self Assessment tax return on time.

- Unusual trading patterns: A sudden spike in sales or inconsistent reporting of income.

- High sales volume: Selling a large number of items without proper record-keeping may raise red flags.

- Cash transactions: Conducting substantial sales in cash without maintaining accurate records can easily trigger an HMRC nudge letter.

Responding to an HMRC Nudge Letter: A Step-by-Step Guide

Receiving an HMRC nudge letter can be daunting, but ignoring it is never the answer. Prompt and accurate responses are crucial to avoiding escalating penalties.

Don't Ignore It: Failure to respond can result in more serious consequences, including a full tax investigation and substantial penalties.

Gather Your Records: Before responding, meticulously gather all relevant documents, including:

- Detailed sales records (dates, amounts, buyer details).

- Bank statements showing all income and expenses related to your online sales.

- Proof of expenses (packaging, postage, materials, etc.). Keep detailed receipts and invoices.

- Records of any VAT payments.

Understanding Your Tax Obligations: As an online seller, you’re likely liable for Income Tax and potentially VAT, depending on your turnover. Familiarize yourself with HMRC's guidance on:

- Self Assessment tax returns: [link to relevant HMRC guidance page]

- VAT registration thresholds: [link to relevant HMRC guidance page]

Seeking Professional Advice: If your situation is complex or you're unsure how to proceed, consult a qualified accountant or tax advisor. They can help you understand your obligations and ensure a compliant response.

Step-by-Step Response: Your response should:

- Acknowledge receipt of the letter.

- Clearly address each point raised in the letter.

- Provide the requested documentation.

- Explain any mitigating circumstances honestly and concisely.

- Keep a copy of your response and all supporting documents.

Preventing Future HMRC Nudge Letters: Best Practices for Online Sellers

Proactive tax planning is essential for avoiding future HMRC nudge letters. Here are some key strategies:

Accurate Record Keeping: Maintain meticulous records of every transaction. Use accounting software like Xero or FreeAgent to simplify this process and help you stay organized.

Regular Tax Returns: File your Self Assessment tax returns on time and accurately report all your income.

Understanding VAT Thresholds: Be aware of the current VAT registration threshold. If your turnover exceeds this threshold, you're legally required to register for VAT.

Using Accounting Software: Accounting software automates many aspects of record-keeping and tax calculations, reducing the risk of errors and simplifying your tax obligations.

Professional Guidance: Regularly consult a tax advisor for guidance on tax planning and compliance. Proactive advice can help you avoid potential problems before they arise.

Conclusion: Avoiding the Penalties of Ignoring HMRC Nudge Letters

Ignoring an HMRC nudge letter is a risky strategy. The key takeaways are: respond promptly, maintain accurate records, and seek professional help if needed. Failure to comply can lead to substantial penalties and a full-blown tax investigation. Don't let an HMRC nudge letter become a full-blown tax investigation. Take control of your tax obligations today and avoid future HMRC nudge letters. Review your tax records now and, if you have any concerns about your compliance, seek professional advice immediately.

Featured Posts

-

Miami Gp Tea Break Hamilton Ferrari Dispute Reignites

May 20, 2025

Miami Gp Tea Break Hamilton Ferrari Dispute Reignites

May 20, 2025 -

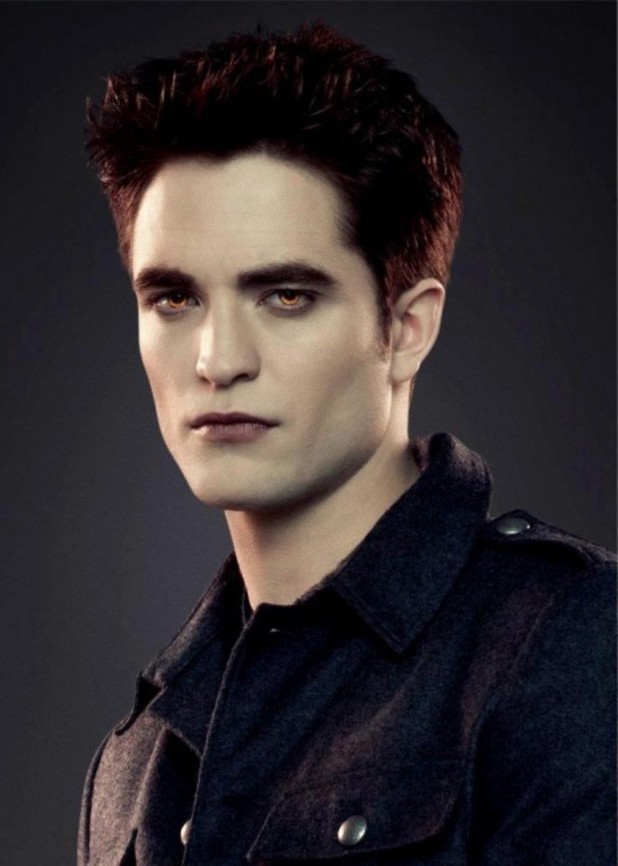

Beyond Edward Cullen Robert Pattinsons Relationships Explored

May 20, 2025

Beyond Edward Cullen Robert Pattinsons Relationships Explored

May 20, 2025 -

Restrictions Pour Les 2 Et 3 Roues Sur Le Boulevard Fhb Ex Vge Debut Le 15 Avril

May 20, 2025

Restrictions Pour Les 2 Et 3 Roues Sur Le Boulevard Fhb Ex Vge Debut Le 15 Avril

May 20, 2025 -

Amazon Hercule Poirot Per Ps 5 A Prezzo Scontato Sotto I 10 E

May 20, 2025

Amazon Hercule Poirot Per Ps 5 A Prezzo Scontato Sotto I 10 E

May 20, 2025 -

Incendio Em Escola Na Tijuca Repercussao E Memorias De Ex Alunos

May 20, 2025

Incendio Em Escola Na Tijuca Repercussao E Memorias De Ex Alunos

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025