HMRC Payslip Check: Millions May Qualify For Refunds

Table of Contents

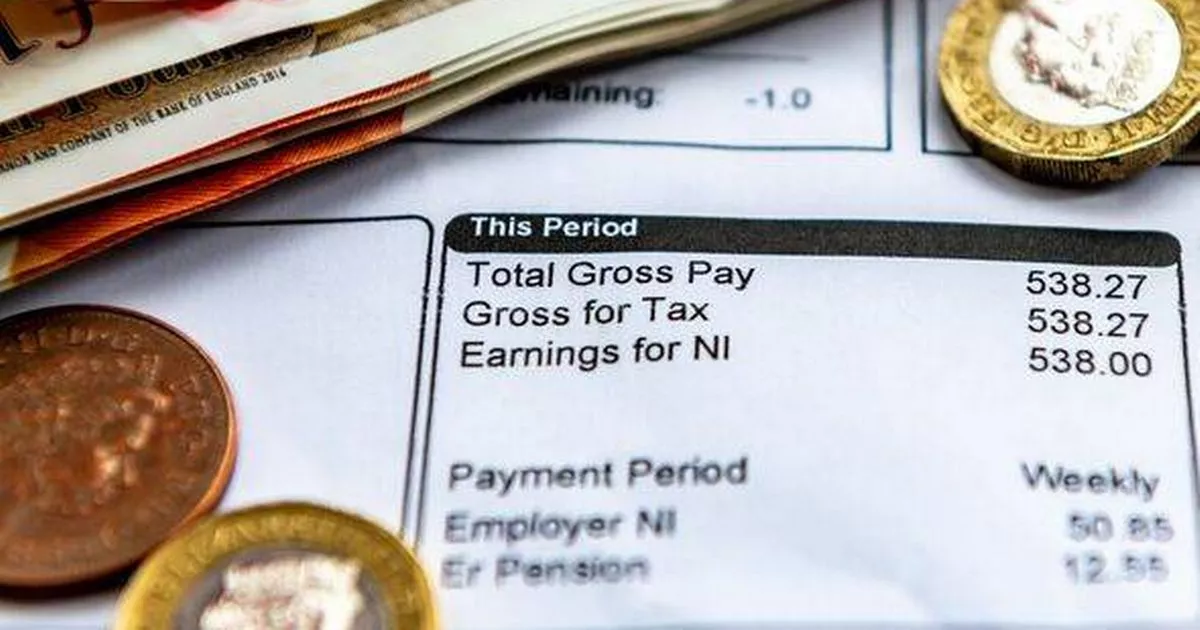

An HMRC payslip check involves carefully reviewing your payslips to ensure your tax calculations are accurate. It's a crucial step in verifying that you're neither overpaying nor underpaying tax. By identifying potential errors, you can reclaim any overpaid tax and avoid future discrepancies. This article aims to empower you to take control of your finances and potentially secure a substantial refund.

Understanding Your Payslip and Tax Codes

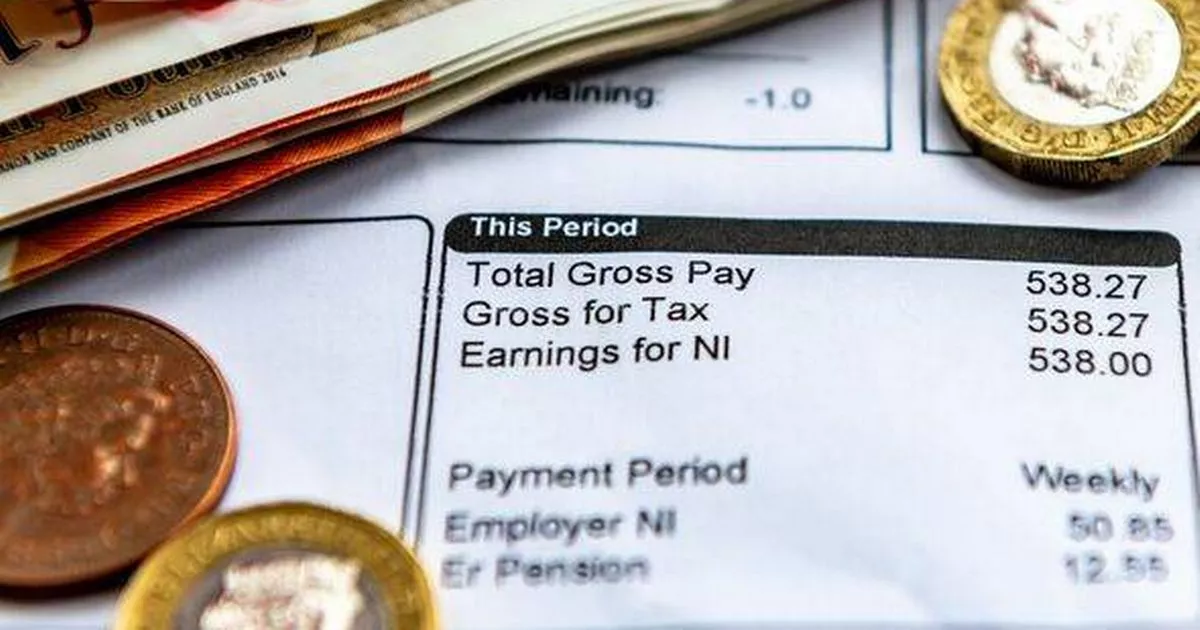

Understanding your payslip is the first step towards identifying potential tax refund opportunities. Key components to focus on include your tax code, National Insurance contributions, gross pay (your earnings before deductions), and net pay (your take-home pay after deductions).

Key definitions:

- Tax Code: This code determines how much Income Tax is deducted from your pay each month. Common examples include 1257L, 1185L, and BR. An incorrect tax code can significantly affect your tax liability.

- National Insurance Contributions (NICs): These are contributions towards the UK's social security system. Errors in NIC calculations can also lead to overpayment.

- Gross Pay: Your total earnings before any deductions (tax, NICs, pension contributions, etc.).

- Net Pay: Your earnings after all deductions have been made. This is your take-home pay.

How tax code errors lead to overpayment:

- Incorrect allocation: A wrong tax code assigned by your employer can result in too much tax being deducted throughout the year.

- Unreported changes: Life events like marriage, changes in employment status, or starting a pension may require a tax code update. Failure to update your code may lead to overpayment.

- Administrative mistakes: Simple data entry errors by your employer or HMRC can lead to incorrect tax codes.

Example: A person assigned the wrong tax code might find themselves paying an extra £50 per month in tax, totaling £600 annually—a substantial sum that could be reclaimed with a thorough HMRC payslip check.

Common Reasons for HMRC Tax Refunds

Several scenarios can result in an HMRC tax refund. Let’s explore some common situations:

Incorrect Tax Code

Incorrect tax codes are a leading cause of overpayment. This can happen after:

- Marriage or civil partnership: Your tax code may need updating to reflect your new marital status.

- Change of job: Switching employers can sometimes lead to incorrect tax code transfer.

- Starting a pension: Contributions to a pension scheme usually affect your tax code.

- Changes to your income: A significant drop or increase in income can also require an adjustment.

Underpaid Tax Credits

You might be entitled to tax credits like Working Tax Credit or Child Tax Credit but haven't claimed them. An HMRC payslip check could reveal if you’re eligible for back payments.

Overpaid National Insurance Contributions

Errors in your employment records or self-assessment can lead to overpayment of National Insurance contributions. Reviewing your payslips can help identify these discrepancies.

Pension Contributions

You can receive tax relief on pension contributions. Errors in claiming this relief can lead to underpayment. Make sure your payslip accurately reflects your pension contributions and the associated tax relief.

How to Conduct an HMRC Payslip Check

Conducting an HMRC payslip check is a systematic process. Follow these steps:

- Gather your payslips: Collect all your payslips from the past tax year (April 6th to April 5th).

- Review key information: Check your tax code, National Insurance contributions, gross and net pay for consistency and accuracy. Look for any unusual deductions or discrepancies.

- Compare to previous years: Note any changes in tax deductions from one year to the next. Significant changes may warrant further investigation.

- Utilize online resources: The HMRC website provides detailed information on tax codes, allowances and how to calculate your tax.

- Identify red flags: Discrepancies in your tax code, unusually high tax deductions, or unexplained deductions are all red flags.

- Keep detailed records: Note down any discrepancies you find, including dates and amounts.

Key information to look for:

- Consistent tax code throughout the year.

- Accurate reflection of National Insurance contributions.

- Correct gross and net pay calculations.

- Any unusual deductions or adjustments.

Claiming Your HMRC Refund

If you've identified an overpayment, claiming a refund is relatively straightforward.

- Gather necessary documentation: This typically includes your payslips showing the discrepancies and potentially other supporting documents such as P60s and P45s.

- Contact HMRC: You can contact HMRC online through their website, by phone, or by post. Their website offers online forms for claiming refunds.

- Complete the necessary forms: HMRC provides specific forms for different types of claims. Ensure you accurately complete all required fields.

- Allow sufficient processing time: Processing times for refunds vary, so be patient.

Secure Your HMRC Refund Today!

Many people are unknowingly entitled to an HMRC tax refund due to incorrect tax codes, underclaimed tax credits, or overpaid National Insurance contributions. Regularly reviewing your payslips is essential to identify potential errors and claim what's rightfully yours. Don't delay – conduct your HMRC payslip check today! Use the resources provided by HMRC to understand your payslip and claim your refund. Share this article with friends and family who might also benefit from an HMRC payslip check. Don't miss out on potentially thousands of pounds – reclaim your tax refund now! [Link to HMRC website]

Featured Posts

-

Us Military Deployment In Australia Missile Launcher Tests And Chinas Response

May 20, 2025

Us Military Deployment In Australia Missile Launcher Tests And Chinas Response

May 20, 2025 -

Premijera Filma Zvijezde Na Crvenom Tepihu Jutarnjeg Lista

May 20, 2025

Premijera Filma Zvijezde Na Crvenom Tepihu Jutarnjeg Lista

May 20, 2025 -

The Philippines And China Tensions Rise Over Missile Deployment In South China Sea

May 20, 2025

The Philippines And China Tensions Rise Over Missile Deployment In South China Sea

May 20, 2025 -

Suki Waterhouses On This Love Lyrics Deep Dive Meaning And Interpretation

May 20, 2025

Suki Waterhouses On This Love Lyrics Deep Dive Meaning And Interpretation

May 20, 2025 -

Solo Travel Finding Yourself On The Open Road

May 20, 2025

Solo Travel Finding Yourself On The Open Road

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025