HMRC Tax Letters: Over £23,000 Earners Targeted In UK-Wide Campaign

Table of Contents

Why are HMRC Sending Tax Letters?

The increased scrutiny of higher earners by HMRC, leading to a surge in HMRC tax letters, stems from several key objectives:

-

Tackling tax avoidance and evasion: HMRC is actively pursuing individuals and businesses suspected of underreporting income or employing illegal tax avoidance schemes. This crackdown aims to level the playing field and ensure everyone contributes their fair share. An HMRC tax investigation can result from suspicions of this nature.

-

Ensuring accurate tax reporting: The campaign aims to improve the overall accuracy of tax returns. Many self-assessment tax returns, particularly those from the self-employed, can be complex, leading to unintentional errors. HMRC is working to identify and correct these.

-

Closing the tax gap: The tax gap represents the difference between the tax that should be collected and the tax that is actually collected. This initiative is a significant effort to reduce this gap by focusing on higher earners, a group often associated with more complex tax affairs.

-

Focus on specific sectors or income types: While targeting higher earners broadly, HMRC may be focusing on particular sectors known for higher instances of non-compliance, such as the self-employed, those receiving significant dividends, or those with complex property portfolios. This targeted approach allows for a more efficient allocation of resources within their HMRC tax investigation teams.

Non-compliance with HMRC's requests can lead to significant consequences, including:

- Increased tax liabilities: HMRC may assess additional tax owed, plus interest.

- Penalties: Late filing or inaccurate reporting can result in substantial financial penalties.

- Criminal prosecution: In cases of deliberate tax evasion, individuals may face criminal charges and potentially imprisonment.

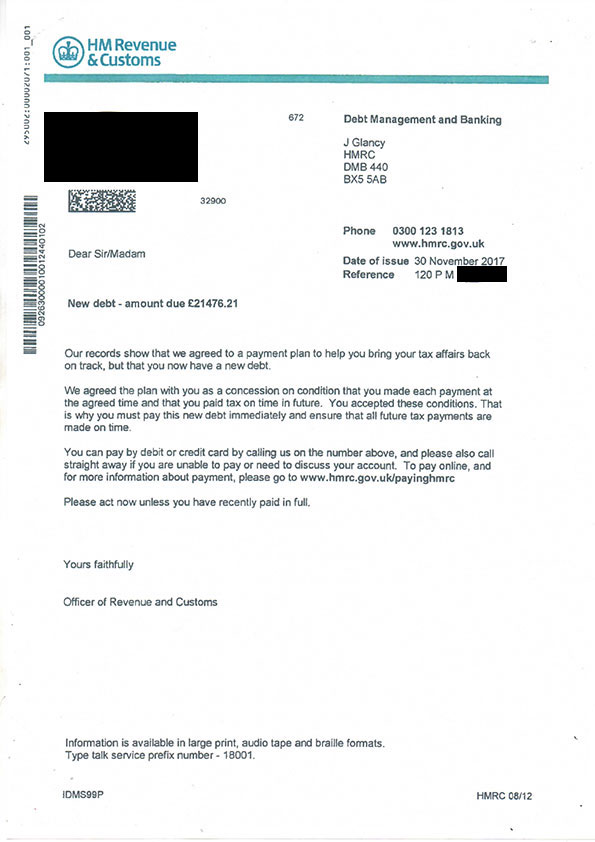

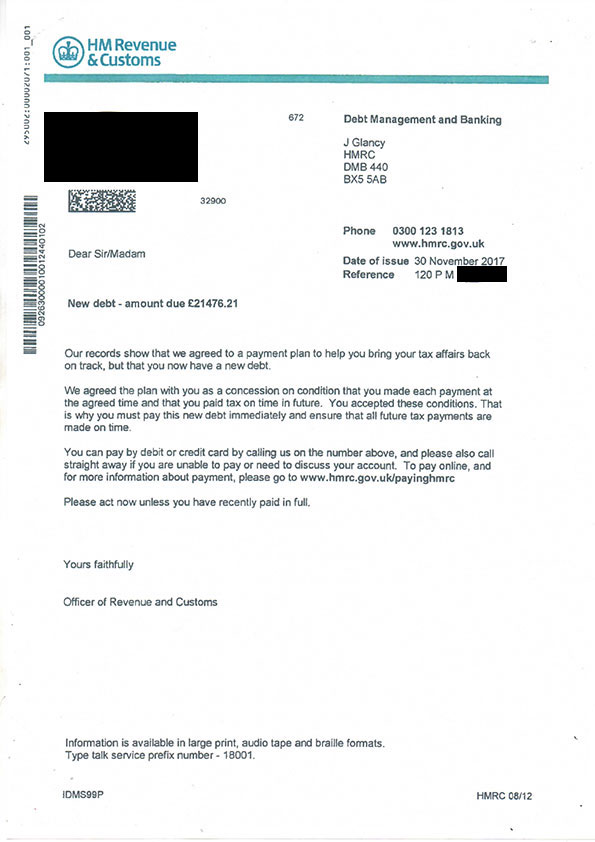

What Do the HMRC Tax Letters Contain?

HMRC tax letters vary in their specific content, but common elements include:

-

Request for further information: These letters often ask for supporting documentation to verify income, expenses, or other relevant financial details. This might include requests for bank statements, invoices, or P60s.

-

Notification of discrepancies: HMRC may identify discrepancies between the information provided in your tax return and the information they hold. They'll outline these differences and request clarification.

-

Demand for additional tax payments: If HMRC finds you owe additional tax, the letter will detail the amount due, the deadline for payment, and potential penalties for late payment. This is often related to a specific tax HMRC enquiry.

-

Invitation to an HMRC enquiry: In more serious cases, you might receive an invitation for a formal meeting or enquiry to discuss the issues in more detail. This can be a formal HMRC tax investigation.

Examples of phrases you might see include "further information required," "discrepancy identified," "tax demand," or "enquiry into your tax affairs."

How to Respond to an HMRC Tax Letter

Responding effectively to an HMRC tax letter is crucial. Here's how:

-

Gather all relevant documentation: Collect all supporting documents relevant to the issues raised in the letter. This typically includes P60s, payslips, bank statements, invoices, and any other financial records.

-

Respond promptly and professionally: Acknowledge the letter promptly and provide a detailed response within the specified timeframe. Maintain a professional and courteous tone throughout your correspondence.

-

Seek professional advice if necessary: If you're unsure about how to respond or if the issues are complex, seek guidance from a qualified tax advisor or accountant. They can help you navigate the process and ensure compliance.

-

Understand your rights and responsibilities: Familiarize yourself with your rights as a taxpayer and your responsibilities in responding to HMRC's requests. The HMRC website provides helpful information.

Accurate and timely responses are paramount to avoiding unnecessary penalties and resolving any issues efficiently.

Avoiding Future HMRC Tax Letters

Proactive tax management is key to avoiding future HMRC tax letters:

-

Keep accurate and organized financial records: Maintain meticulous records of all income and expenses. This will significantly simplify the process of completing your tax return and responding to any HMRC queries.

-

File tax returns on time and accurately: Ensure your self-assessment tax returns are completed and submitted by the deadline. Accuracy is crucial to avoid discrepancies and potential penalties.

-

Understand your tax obligations: Take the time to understand your tax obligations based on your income, employment status, and other relevant factors.

-

Seek professional tax advice regularly: Regular consultations with a tax advisor can help you proactively manage your tax affairs, plan for future tax liabilities, and stay compliant with all relevant regulations. This can encompass a wide range of services, from tax planning to advice on the specifics of a self-assessment.

Proactive tax management offers peace of mind and helps prevent costly mistakes. Effective tax compliance is an investment in your financial security.

Conclusion

The increase in HMRC tax letters targeting higher earners signifies a heightened focus on tax compliance. Understanding the content of these letters, responding appropriately, and implementing preventative measures are crucial for avoiding penalties and maintaining a good standing with HMRC. Ignoring an HMRC tax letter is never advisable.

Don't ignore your HMRC tax letter! If you've received a letter or are concerned about your tax position, seek professional advice immediately. Understanding your obligations regarding HMRC tax letters is vital for peace of mind. Contact a qualified tax advisor today to ensure you are fully compliant.

Featured Posts

-

Manchester Uniteds Pursuit Of Premier League Forward Newcastles Potential Challenge

May 20, 2025

Manchester Uniteds Pursuit Of Premier League Forward Newcastles Potential Challenge

May 20, 2025 -

Jennifer Lawrence A Jej Tajne Druhe Dieta Potvrdene

May 20, 2025

Jennifer Lawrence A Jej Tajne Druhe Dieta Potvrdene

May 20, 2025 -

Robert Pattinson Shares New Role With Suki Waterhouse

May 20, 2025

Robert Pattinson Shares New Role With Suki Waterhouse

May 20, 2025 -

Transfert De Melvyn Jaminet Les Declarations Explosives De Kylian Jaminet

May 20, 2025

Transfert De Melvyn Jaminet Les Declarations Explosives De Kylian Jaminet

May 20, 2025 -

Cunha To Manchester United Deal Update And Backup Striker Option

May 20, 2025

Cunha To Manchester United Deal Update And Backup Striker Option

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025