HMRC Tax Return Changes: Who's Exempt And What You Need To Know

Table of Contents

Key Changes in the Latest HMRC Tax Return Update

The latest HMRC tax return update incorporates several significant modifications designed to improve tax collection efficiency and transparency. These changes affect various aspects of the tax return process.

- New Deadlines: HMRC has adjusted the filing deadlines for certain tax returns. It's crucial to check the official HMRC website for the specific deadlines applicable to your circumstances. Missing these deadlines can lead to penalties.

- Enhanced Online Filing Requirements: HMRC is increasingly focusing on digital tax returns. This means greater reliance on online portals and digital submission methods. Familiarity with these systems is now more critical than ever.

- Changes to Allowable Expenses: Certain allowable business expenses may have been modified or clarified. Staying updated on these changes is vital for accurate tax reporting and minimizing your tax liability. Understanding the latest guidelines on expenses is crucial to avoid potential errors.

- Updated Reporting Procedures: The methods for reporting income, expenses, and other relevant financial information might have been streamlined or altered. This requires careful review of the updated HMRC guidelines.

The reasoning behind these changes is to enhance the accuracy and efficiency of the tax system. Improved data collection allows HMRC to better allocate resources and address tax evasion more effectively. [Link to relevant HMRC guidance on updated procedures].

Who is Exempt from Filing a Tax Return with HMRC?

Not everyone is required to file a tax return with HMRC. Exemption depends on several factors, including income level and the type of income received.

- Individuals with income below the personal allowance threshold: If your total income (from all sources) falls below the personal allowance, you generally won't need to file a self-assessment tax return. The personal allowance amount is subject to change, so always check the latest HMRC figures.

- Individuals with simple income sources (e.g., employment only): If your only income is from employment and your employer has already deducted the correct amount of income tax, you might not need to file a return. However, always double-check with HMRC to confirm your eligibility for exemption.

- Specific business types with simplified reporting requirements: Certain types of businesses may have different reporting requirements. For example, some micro-businesses or partnerships might fall under simplified reporting schemes.

It's crucial to understand that even if you believe you are exempt, it's always advisable to verify your status on the HMRC website. [Link to HMRC guidance on tax return exemptions]. Failure to file when required can result in penalties.

Understanding Your Tax Obligations: A Guide to HMRC Compliance

Non-compliance with HMRC tax return requirements can lead to significant penalties, including late filing penalties, interest charges, and in serious cases, legal action. Accurate record-keeping is essential for demonstrating compliance.

- Maintain detailed records: Keep meticulous records of all income and expenses. This includes invoices, receipts, bank statements, and any other relevant documentation.

- Use appropriate accounting software: Consider utilizing accounting software to manage your finances and simplify the tax return process.

- Seek professional advice if needed: If you’re uncertain about your tax obligations or the tax return process, seeking advice from a qualified tax advisor or accountant is recommended.

HMRC provides various resources to assist taxpayers. You can find helpful information on their website, or contact them directly for assistance. [Link to HMRC helpline and support pages].

New Online Tools and Resources from HMRC

HMRC continues to enhance its online services to make tax returns easier to file.

- Improved online portal: The HMRC online portal offers a user-friendly interface for managing your tax affairs, including filing returns, making payments, and accessing your tax records. [Link to HMRC online portal]

- App support: HMRC provides mobile apps for easier access to tax information and tools. [Link to HMRC app (if applicable)]

These tools are designed to simplify the process and reduce the administrative burden associated with completing your tax return.

Troubleshooting Common HMRC Tax Return Issues

Several common issues may arise during the HMRC tax return process.

- Password resets: If you forget your password, use the password reset function on the HMRC website to regain access to your account. [Link to HMRC password reset page]

- Technical difficulties: If you encounter any technical issues while filing your return, contact HMRC's helpdesk for assistance. [Link to HMRC helpdesk contact information]

- Form completion: If you need help understanding specific sections of the tax return form, refer to the HMRC's online guidance notes or seek professional assistance. [Link to HMRC guidance notes]

Staying Informed About HMRC Tax Return Changes

Understanding and complying with HMRC regulations is paramount. This article highlighted key changes, exemptions, and resources related to HMRC tax return changes. Remember to regularly check the HMRC website for the latest updates and announcements. If you're unsure about any aspect of your tax obligations, seek professional advice to ensure compliance and avoid potential penalties. Review your tax obligations promptly and take the necessary steps to ensure compliance with the latest HMRC tax return changes. [Link to HMRC website]

Featured Posts

-

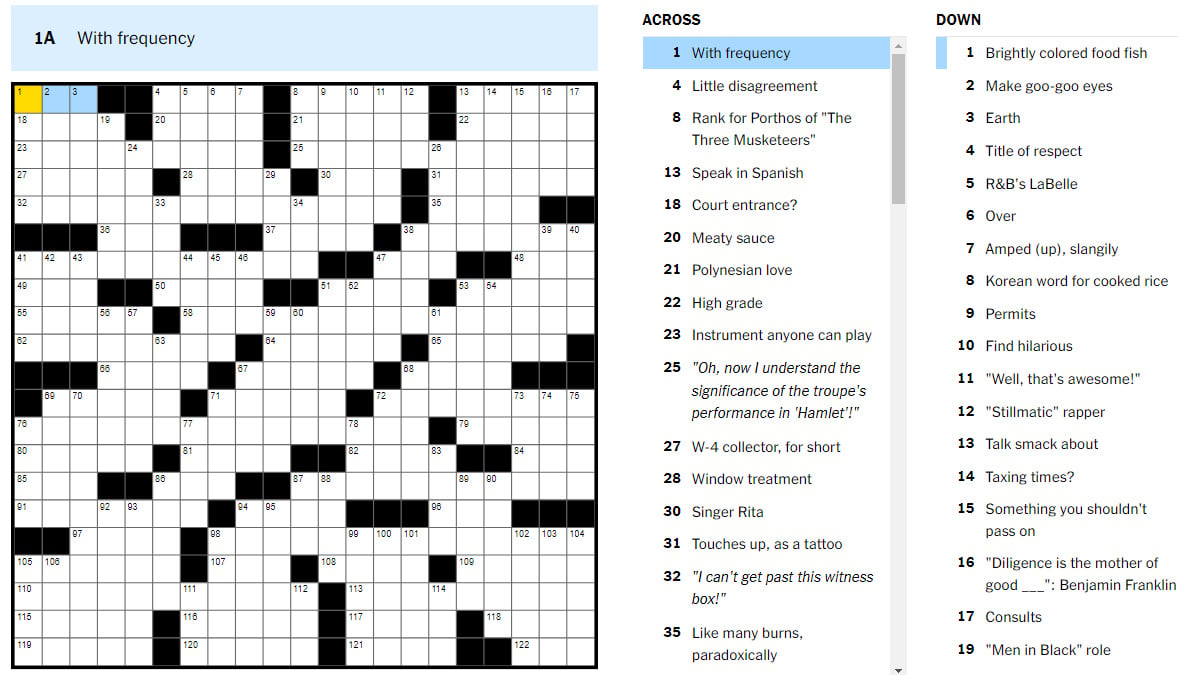

Todays Nyt Mini Crossword Answers For March 15

May 20, 2025

Todays Nyt Mini Crossword Answers For March 15

May 20, 2025 -

The Ultimate Guide To Solo Travel Freedom And Exploration

May 20, 2025

The Ultimate Guide To Solo Travel Freedom And Exploration

May 20, 2025 -

Nea Stoixeia Rixnoyn Fos Se Ypothesi Tampoy Oi Fonoi

May 20, 2025

Nea Stoixeia Rixnoyn Fos Se Ypothesi Tampoy Oi Fonoi

May 20, 2025 -

Kathe Evdomada Sto Mega Tampoy Nea Sezon

May 20, 2025

Kathe Evdomada Sto Mega Tampoy Nea Sezon

May 20, 2025 -

Exploring Agatha Christies Poirot His Cases Techniques And Enduring Legacy

May 20, 2025

Exploring Agatha Christies Poirot His Cases Techniques And Enduring Legacy

May 20, 2025

Latest Posts

-

Nyt Mini Crossword Answers And Clues March 24 2025

May 20, 2025

Nyt Mini Crossword Answers And Clues March 24 2025

May 20, 2025 -

Nyt Mini Crossword Hints And Answers March 20 2025

May 20, 2025

Nyt Mini Crossword Hints And Answers March 20 2025

May 20, 2025 -

Solve The Nyt Mini Crossword Answers For March 24 2025

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 24 2025

May 20, 2025 -

Unlock The Nyt Mini Crossword Answers For April 18 2025

May 20, 2025

Unlock The Nyt Mini Crossword Answers For April 18 2025

May 20, 2025 -

Todays Nyt Mini Crossword Answers March 20 2025

May 20, 2025

Todays Nyt Mini Crossword Answers March 20 2025

May 20, 2025