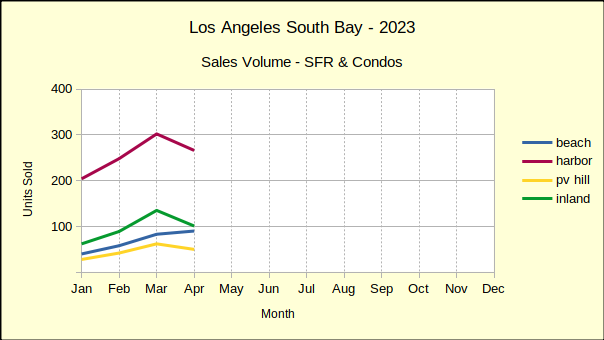

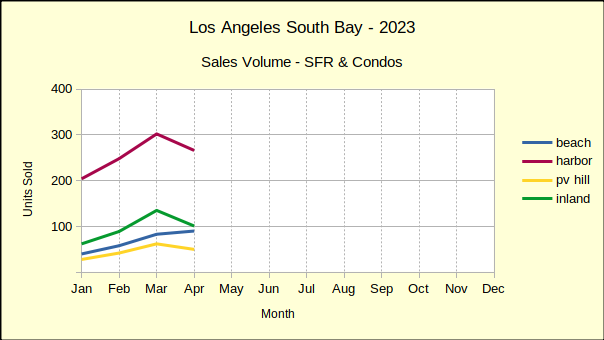

Home Sales Plummet: Crisis Levels Hit Sagging Real Estate Market

Table of Contents

Soaring Interest Rates: The Primary Culprit

The most significant driver behind the plummeting home sales is the sharp increase in interest rates. The impact on affordability is undeniable, effectively pricing many potential buyers out of the market.

Impact of Increased Mortgage Rates

Higher interest rates translate directly into significantly higher monthly mortgage payments.

- A $300,000 mortgage at 3% interest results in approximately a $1,265 monthly payment.

- The same mortgage at 7% interest jumps to roughly $2,000 per month – a 58% increase.

- This substantial increase significantly reduces purchasing power, particularly for first-time homebuyers with limited savings.

- Many potential buyers, facing these increased costs, are forced to reconsider or postpone their home-buying plans, directly contributing to the decline in home sales.

Predictive Models and Future Rate Projections

Experts offer varying predictions regarding future interest rate trajectories. While some models suggest rates may plateau, others foresee further increases, prolonging the slump in the real estate market.

- The Federal Reserve's ongoing efforts to combat inflation influence these predictions.

- Forecasting models, like those from the National Association of Realtors (NAR), provide valuable insights into potential future rate scenarios and their consequent effects on home sales.

- [Insert chart or graph here visualizing the correlation between interest rates and home sales data]. This visual representation would dramatically enhance the impact of this section.

Inflation and Economic Uncertainty Fueling the Slowdown

Beyond interest rates, rampant inflation and pervasive economic uncertainty are significantly contributing to the slowdown in home sales.

The Impact of Inflation on Consumer Spending

Rising inflation erodes purchasing power by increasing the cost of everyday goods and services.

- Food prices, energy costs, and transportation expenses have all seen substantial increases.

- This reduced disposable income forces consumers to prioritize essential spending, leaving less money available for significant purchases like homes.

- Inflation also negatively impacts consumer confidence, making individuals less willing to take on large debts like mortgages.

Economic Recession Fears and Buyer Hesitancy

Growing fears of an economic recession further dampen buyer enthusiasm.

- Economic forecasts vary widely, but the uncertainty itself is enough to make many potential buyers hesitant.

- This hesitancy is reflected in lower consumer confidence indices, directly correlating to decreased home-buying activity.

- Investor activity in the real estate market is also affected, with investors adopting a more cautious approach due to economic uncertainty.

Inventory Shortage Eases, But Prices Remain High

While the housing inventory shortage is easing in some areas compared to the previous year, it remains a factor influencing the current market dynamics. Prices, however, remain stubbornly high.

Shifting Inventory Levels

Although inventory is increasing in certain regions, supply still lags behind demand in many markets.

- [Include data here showing inventory increases/decreases in different geographical areas]. This data should be sourced from reputable real estate data providers.

- New construction, while increasing in some areas, has not kept pace with demand, leaving the inventory shortage a persistent issue in many locations.

Persistent High Home Prices

Despite the decrease in home sales, home prices remain elevated due to several persistent factors.

- Land scarcity, particularly in desirable urban areas, continues to support high prices.

- Construction costs, also affected by inflation, contribute to higher home prices.

- Existing mortgage rates, while impacting affordability, still play a part in determining the price range for sellers.

- [Include comparative data here on current home prices versus previous years, highlighting the persistence of high prices].

Conclusion

The plummet in home sales is a multifaceted issue stemming from the interplay of soaring interest rates, persistent inflation, economic uncertainty, and high home prices. The near-term outlook remains cautious, as these factors continue to exert pressure on the market. While inventory is increasing somewhat, it hasn't significantly reduced the impact of high prices and elevated mortgage rates. Understanding the factors driving this current plummet in home sales is crucial for navigating the ever-evolving real estate market. Stay informed on the latest developments in home sales and the broader real estate market by subscribing to our updates, following reputable news sources, or consulting with a real estate professional.

Featured Posts

-

Visualiza Tu Asiento Con El Nuevo Venue Virtual De Ticketmaster

May 30, 2025

Visualiza Tu Asiento Con El Nuevo Venue Virtual De Ticketmaster

May 30, 2025 -

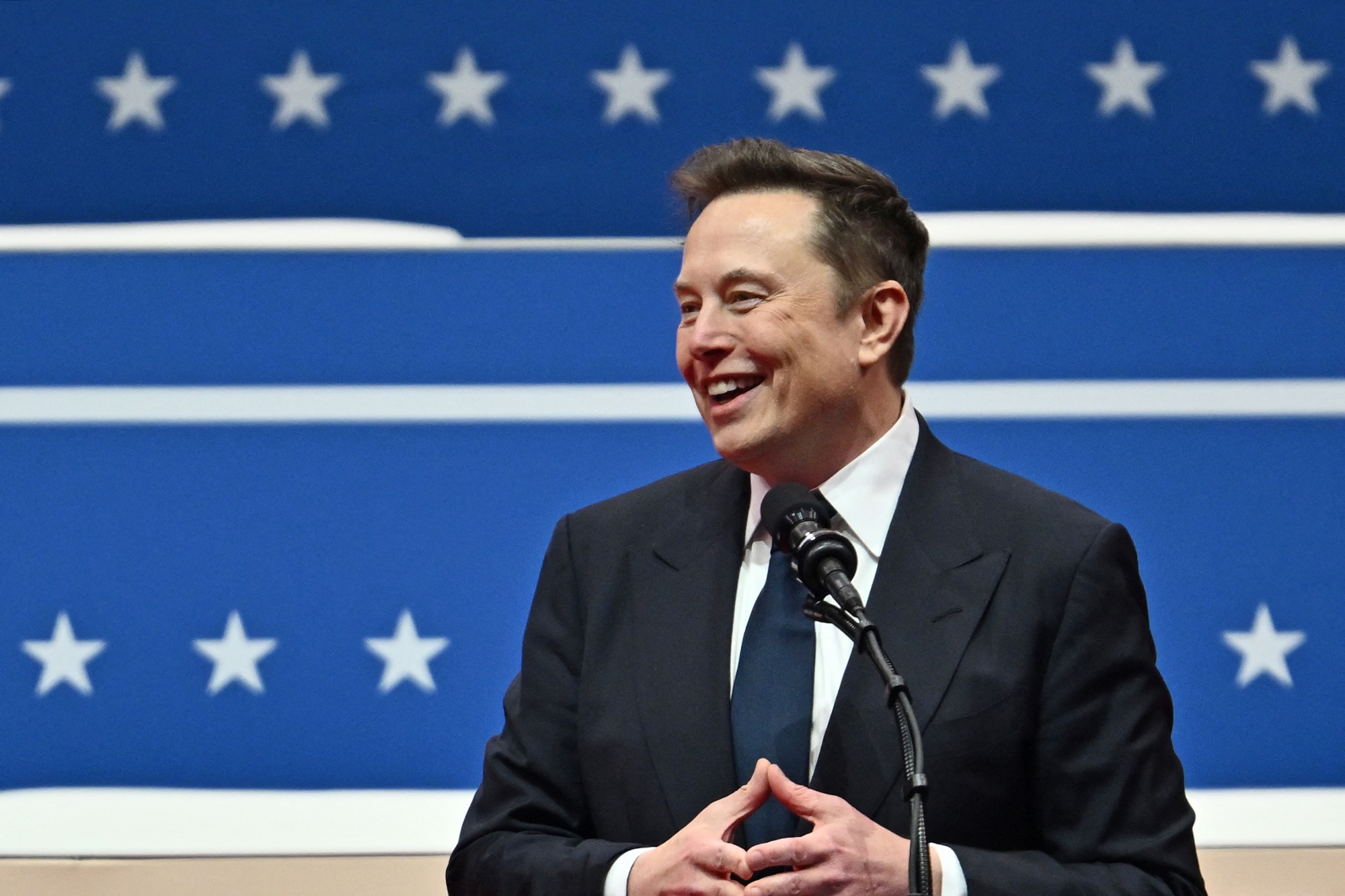

The Truth About Elon Musks Family Fortune Years Of Hard Work And Perseverance

May 30, 2025

The Truth About Elon Musks Family Fortune Years Of Hard Work And Perseverance

May 30, 2025 -

25 Mal For Dolberg Et Realistisk Mal Efter Et Potentielt Chokskifte

May 30, 2025

25 Mal For Dolberg Et Realistisk Mal Efter Et Potentielt Chokskifte

May 30, 2025 -

Deutsche Bank Und Fina Xai Kooperieren Bei Der Tokenisierung Von Fonds

May 30, 2025

Deutsche Bank Und Fina Xai Kooperieren Bei Der Tokenisierung Von Fonds

May 30, 2025 -

Aumenta El Riesgo En Las Carreras Sprint De Moto Gp Una Evaluacion

May 30, 2025

Aumenta El Riesgo En Las Carreras Sprint De Moto Gp Una Evaluacion

May 30, 2025

Latest Posts

-

May Day In Kingston Images From A Robust Rally Daily Freeman

May 31, 2025

May Day In Kingston Images From A Robust Rally Daily Freeman

May 31, 2025 -

Bmw Open 2025 Zverev Griekspoor Quarter Final Showdown In Munich

May 31, 2025

Bmw Open 2025 Zverev Griekspoor Quarter Final Showdown In Munich

May 31, 2025 -

Madrid Open 2024 Berrettini Loses To Giron Despite Comeback Attempt

May 31, 2025

Madrid Open 2024 Berrettini Loses To Giron Despite Comeback Attempt

May 31, 2025 -

Analysis Elon Musks Exit From The Trump Administration

May 31, 2025

Analysis Elon Musks Exit From The Trump Administration

May 31, 2025 -

Zverev And Griekspoor Face Off In Bmw Open 2025 Quarter Finals

May 31, 2025

Zverev And Griekspoor Face Off In Bmw Open 2025 Quarter Finals

May 31, 2025