Honeywell International Inc. (HON) And Johnson Matthey: Catalyst For A Merger?

Table of Contents

Synergies and Overlapping Businesses

The core argument for a Honeywell-Johnson Matthey merger rests on the significant synergies between their operations. Both companies operate within closely related sectors, creating ample opportunities for cost reduction, expanded market reach, and strengthened competitive positioning.

Shared Technologies and Expertise:

- Catalysis and Materials Science: Both Honeywell and Johnson Matthey possess deep expertise in catalysis and materials science, two crucial fields driving innovation across various industries. A merger would combine their R&D capabilities, potentially leading to breakthroughs in areas like emission control technologies and advanced materials.

- Combined R&D Initiatives: By pooling their resources, the combined entity could undertake larger-scale and more ambitious R&D projects, accelerating innovation and reducing development time. This could lead to the creation of entirely new product lines and technologies.

- Economies of Scale: The merger would offer significant opportunities for cost reduction through economies of scale in manufacturing, procurement, and distribution. This efficiency boost could significantly improve profitability.

Expanded Market Reach and Customer Base:

- Global Network Expansion: Honeywell's vast global presence could complement Johnson Matthey's established networks, allowing the combined entity to reach new markets and customer segments more effectively.

- Increased Market Share: The combined market share of Honeywell and Johnson Matthey would establish a formidable player, potentially driving significant market share gains in their respective sectors.

- Synergistic Sales and Marketing: Integrating sales and marketing functions could streamline operations and leverage both companies' brand recognition, creating a powerful marketing force.

Strengthened Competitive Positioning:

- Increased Market Capitalization: A merger would dramatically increase the combined market capitalization, enhancing the company's financial strength and bargaining power.

- Enhanced Supplier Relationships: The larger scale would provide superior bargaining power with suppliers, potentially securing better pricing and supply chain reliability.

- Competitive Advantage: The merged entity would be exceptionally well-positioned to compete against larger rivals, creating a dominant force in the global marketplace.

Potential Challenges and Obstacles to a Merger

While the potential synergies are compelling, several significant hurdles could derail a Honeywell-Johnson Matthey merger.

Regulatory Hurdles and Antitrust Concerns:

- Antitrust Scrutiny: A merger of this magnitude would inevitably attract significant antitrust scrutiny from regulatory bodies worldwide. Concerns about reduced competition and potential market dominance could lead to lengthy investigations and delays.

- Regulatory Approvals: Securing the necessary regulatory approvals could prove a complex and time-consuming process, fraught with uncertainty. The merger might face conditions imposed by regulatory authorities to mitigate antitrust concerns.

- Potential Litigation: The possibility of legal challenges from competitors or consumer groups cannot be ruled out, further complicating the process.

Integration Challenges and Cultural Differences:

- Cultural Integration: Merging two distinct corporate cultures can be challenging. Differences in management styles, organizational structures, and employee values could create friction and hinder integration efforts.

- Operational Integration: Integrating diverse operational processes, systems, and technologies can be complex and costly, requiring significant investment and expertise.

- Employee Retention: The merger could lead to redundancies and job losses, potentially impacting employee morale and productivity. Effective retention strategies are crucial for success.

Valuation and Financial Considerations:

- Valuation Discrepancies: Determining a fair valuation for both companies could prove difficult, potentially leading to disagreements and negotiations between parties involved.

- Financing the Merger: Securing the necessary financing for a deal of this size presents a significant challenge. Factors like interest rates and overall market conditions will play a crucial role.

- Shareholder Approval: Securing the approval of both companies' shareholders is crucial. Any negative impact on shareholder value could lead to opposition from stakeholders.

Market Speculation and Analyst Opinions

Market sentiment regarding a potential Honeywell/Johnson Matthey merger is currently mixed. While some analysts see the potential for significant synergies, others point to the substantial integration challenges and regulatory hurdles. Recent stock performance reflects this uncertainty, with both HON and JMAT experiencing fluctuations linked to merger speculation. No official statements from either company explicitly suggest an active pursuit of a merger.

Conclusion

A merger between Honeywell International Inc. (HON) and Johnson Matthey presents a compelling but complex scenario. While significant synergies exist in shared technologies, market reach, and competitive positioning, substantial challenges related to regulatory hurdles, integration difficulties, and financial considerations remain. The likelihood of such a merger remains uncertain. However, the potential benefits are significant enough to warrant continued monitoring. Further research into the companies' financial statements, ongoing regulatory updates, and analyst reports is recommended. Follow the latest news on "Honeywell merger," "Johnson Matthey acquisition," "HON stock," and "industry consolidation" to stay informed. Share your thoughts: What do you believe the likelihood of a Honeywell and Johnson Matthey merger is?

Featured Posts

-

Zimbabwe Vs England Sam Cook Makes Test Debut

May 23, 2025

Zimbabwe Vs England Sam Cook Makes Test Debut

May 23, 2025 -

Ten Hags Next Move Is Rb Leipzig The Destination After Manchester United

May 23, 2025

Ten Hags Next Move Is Rb Leipzig The Destination After Manchester United

May 23, 2025 -

El Tiempo Hoy Lluvias Moderadas Segun La Prediccion Meteorologica

May 23, 2025

El Tiempo Hoy Lluvias Moderadas Segun La Prediccion Meteorologica

May 23, 2025 -

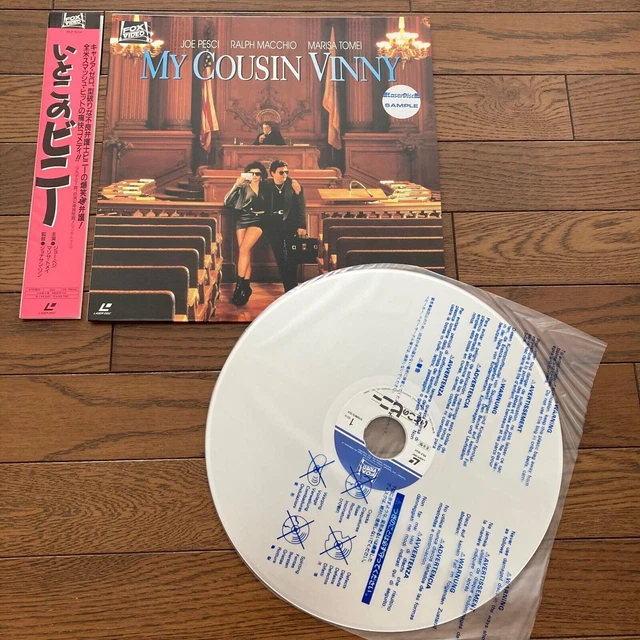

Ralph Macchio On My Cousin Vinny Reboot Latest Update And Joe Pescis Involvement

May 23, 2025

Ralph Macchio On My Cousin Vinny Reboot Latest Update And Joe Pescis Involvement

May 23, 2025 -

Ankhfad Mstwa Qtr Amam Alkhwr Dwr Ebd Alqadr

May 23, 2025

Ankhfad Mstwa Qtr Amam Alkhwr Dwr Ebd Alqadr

May 23, 2025

Latest Posts

-

The End Of The Penny U S To Halt Penny Circulation By Early 2026

May 23, 2025

The End Of The Penny U S To Halt Penny Circulation By Early 2026

May 23, 2025 -

U S Penny Phase Out No More Pennies In Circulation By 2026

May 23, 2025

U S Penny Phase Out No More Pennies In Circulation By 2026

May 23, 2025 -

Palisades Fire Aftermath Celebrities Facing Home Loss

May 23, 2025

Palisades Fire Aftermath Celebrities Facing Home Loss

May 23, 2025 -

Antony On His Near Transfer To Manchester Uniteds Rivals

May 23, 2025

Antony On His Near Transfer To Manchester Uniteds Rivals

May 23, 2025 -

Revealed Antonys Close Call With Manchester Uniteds Arch Rivals

May 23, 2025

Revealed Antonys Close Call With Manchester Uniteds Arch Rivals

May 23, 2025