How A Lack Of Funds Impacts Your Life And How To Reclaim Control

Table of Contents

The Psychological Impact of Insufficient Funds

The constant worry associated with a lack of funds takes a significant toll on mental well-being. Financial hardship is strongly linked to various psychological issues, impacting your ability to thrive.

Stress and Anxiety

- Increased stress levels

- Anxiety disorders

- Depression

- Relationship strain

The constant worry about meeting basic needs, paying bills, or avoiding debt can severely impact sleep quality, concentration, and overall well-being. This chronic stress can lead to anxiety disorders and depression. Financial strain often puts a strain on relationships, leading to arguments and resentment. If you're struggling with the psychological impact of financial hardship, seeking support is crucial. Consider reaching out to mental health professionals or support groups specializing in financial stress management. Many resources are available to help you cope.

Reduced Self-Esteem and Confidence

A lack of funds can significantly impact self-esteem and confidence.

- Difficulty making decisions

- Feelings of shame and guilt

- Avoidance of social situations

Financial insecurity can lead to feelings of inadequacy and hopelessness, making it difficult to make even simple decisions. The shame and guilt associated with financial struggles can lead to social isolation. It's important to remember that your self-worth is not defined by your financial situation. Focus on your strengths, build positive self-talk, and seek support from friends, family, or a therapist to help you rebuild your confidence.

The Impact on Your Physical Health

The psychological stress caused by insufficient funds often manifests physically. Financial struggles are linked to various health problems.

Physical Symptoms of Stress

- Headaches

- Digestive problems

- Sleep disturbances

- Weakened immune system

Chronic stress, stemming from financial worries, can trigger a cascade of physiological responses. These responses can lead to headaches, digestive issues, sleep problems, and a weakened immune system, increasing your susceptibility to illness.

Difficulty Accessing Healthcare

Lacking sufficient funds significantly limits access to necessary healthcare.

- Delayed or forgone medical treatment

- Inability to afford medication

- Difficulty finding affordable healthcare options

When facing financial hardship, many individuals postpone or forgo essential medical care, leading to worsening health conditions and increased long-term costs. The inability to afford medication or regular checkups can have severe consequences. Explore options like community clinics, government assistance programs (like Medicaid in the US), and affordable care acts to ensure you receive the necessary healthcare. Preventative care is vital, even during financial difficulties.

The Ripple Effect on Relationships

Financial pressure significantly impacts personal relationships, creating strain and sometimes leading to breakdown.

Strain on Family Dynamics

- Increased arguments

- Resentment

- Strained communication

- Marital problems

Financial stress can escalate tensions within families, leading to increased arguments, resentment, and strained communication. Open and honest communication is crucial during such times. Collaborative problem-solving can help navigate these challenges. Seeking couples counseling or family therapy can provide support and guidance.

Social Isolation

Insufficient funds often lead to social isolation.

- Inability to participate in social activities

- Feelings of exclusion

- Damaged social networks

The inability to afford social outings or entertainment can lead to feelings of isolation and exclusion. However, maintaining social connections is vital for mental well-being. Explore free or low-cost options, such as free community events, online social groups, or simply spending quality time with loved ones at home.

Reclaiming Control: Practical Steps to Improve Your Financial Situation

Taking proactive steps can significantly improve your financial situation and reduce the impact of insufficient funds.

Budgeting and Financial Planning

Creating and sticking to a budget is fundamental to managing your finances effectively.

- Tracking expenses

- Identifying areas for savings

- Creating a realistic budget

Start by tracking your expenses for a month to understand where your money is going. Identify areas where you can cut back and create a realistic budget that aligns with your income. Many budgeting apps and online resources are available to help you create and manage your budget.

Seeking Financial Assistance

Several resources are available to assist individuals struggling financially.

- Government assistance programs

- Non-profit organizations

- Debt consolidation options

Explore government assistance programs like unemployment benefits, food stamps, and housing assistance. Numerous non-profit organizations offer financial counseling and support. Debt consolidation options can help manage overwhelming debt. Research available resources in your area.

Developing New Income Streams

Exploring additional income streams can alleviate financial pressure.

- Part-time jobs

- Freelance work

- Selling unused items

- Investing (long-term strategy)

Consider part-time jobs, freelance work, or selling unused items online. Investing is a long-term strategy that can generate income over time, but requires careful planning and research.

Conclusion

A lack of funds significantly impacts mental and physical health, relationships, and overall well-being. However, regaining control of your finances is achievable through proactive steps. Key takeaways include the importance of budgeting, seeking financial assistance when needed, and exploring ways to increase your income. Don't let a lack of funds control your life any longer. Take the first step toward reclaiming your financial stability today! Start by creating a budget, exploring available resources, and seeking professional guidance if needed. Remember, you're not alone in this journey.

Featured Posts

-

Trinidad Defence Minister Weighs Age Limit And Song Ban For Kartel Concert

May 21, 2025

Trinidad Defence Minister Weighs Age Limit And Song Ban For Kartel Concert

May 21, 2025 -

Runner William Goodge Sets New Australian Crossing Record

May 21, 2025

Runner William Goodge Sets New Australian Crossing Record

May 21, 2025 -

Police Cite Safety Concerns For Kartels Restrictions

May 21, 2025

Police Cite Safety Concerns For Kartels Restrictions

May 21, 2025 -

Prediksi Juara Liga Inggris 2024 2025 Akankah Liverpool Menang

May 21, 2025

Prediksi Juara Liga Inggris 2024 2025 Akankah Liverpool Menang

May 21, 2025 -

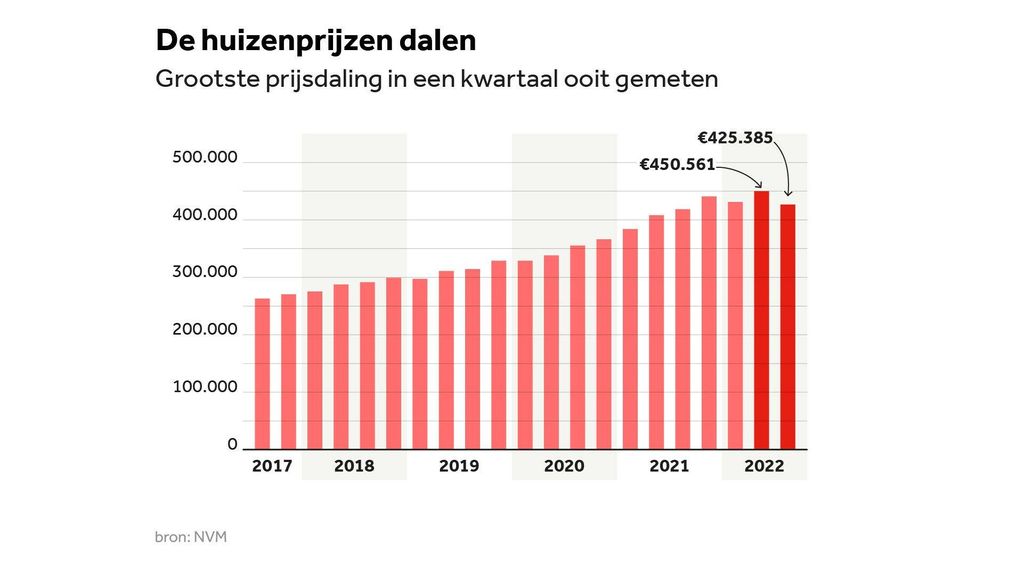

Huizenprijzen Nederland Analyse Van Abn Amro En De Kritiek Van Geen Stijl

May 21, 2025

Huizenprijzen Nederland Analyse Van Abn Amro En De Kritiek Van Geen Stijl

May 21, 2025

Latest Posts

-

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 21, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 21, 2025 -

Trans Australia Run A Record In Jeopardy

May 21, 2025

Trans Australia Run A Record In Jeopardy

May 21, 2025 -

Antiques Roadshow Couple Arrested After Shocking National Treasure Appraisal

May 21, 2025

Antiques Roadshow Couple Arrested After Shocking National Treasure Appraisal

May 21, 2025 -

New Attempt To Break The Trans Australia Run Record

May 21, 2025

New Attempt To Break The Trans Australia Run Record

May 21, 2025 -

Antiques Roadshow Stolen Artwork Results In Couples Imprisonment

May 21, 2025

Antiques Roadshow Stolen Artwork Results In Couples Imprisonment

May 21, 2025