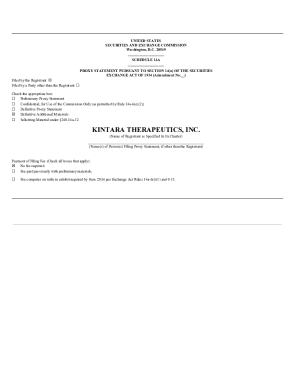

How To Interpret Proxy Statements (Form DEF 14A): A Beginner's Guide

Table of Contents

Understanding the Basics of Proxy Statements (DEF 14A)

What is a Proxy Statement?

A proxy statement, officially known as a DEF 14A filing, is a document companies send to their shareholders before annual meetings or other important votes. It outlines the matters up for vote, providing shareholders with the information they need to make informed decisions. This legal requirement, mandated by the Securities and Exchange Commission (SEC), ensures transparency and allows shareholders to exercise their voting rights effectively. Public companies, those with publicly traded stock, are required to file a DEF 14A. Failure to comply can result in significant penalties.

Key Components of a Proxy Statement:

A proxy statement contains several crucial sections:

- Notice of Meeting: Details the date, time, and location (physical or virtual) of the shareholder meeting.

- Proposals to be Voted On: This section lists all the resolutions shareholders will vote on, including the election of directors, executive compensation plans, and any shareholder proposals.

- Director Nominees: Provides background information on candidates for the board of directors, including their experience, qualifications, and potential conflicts of interest.

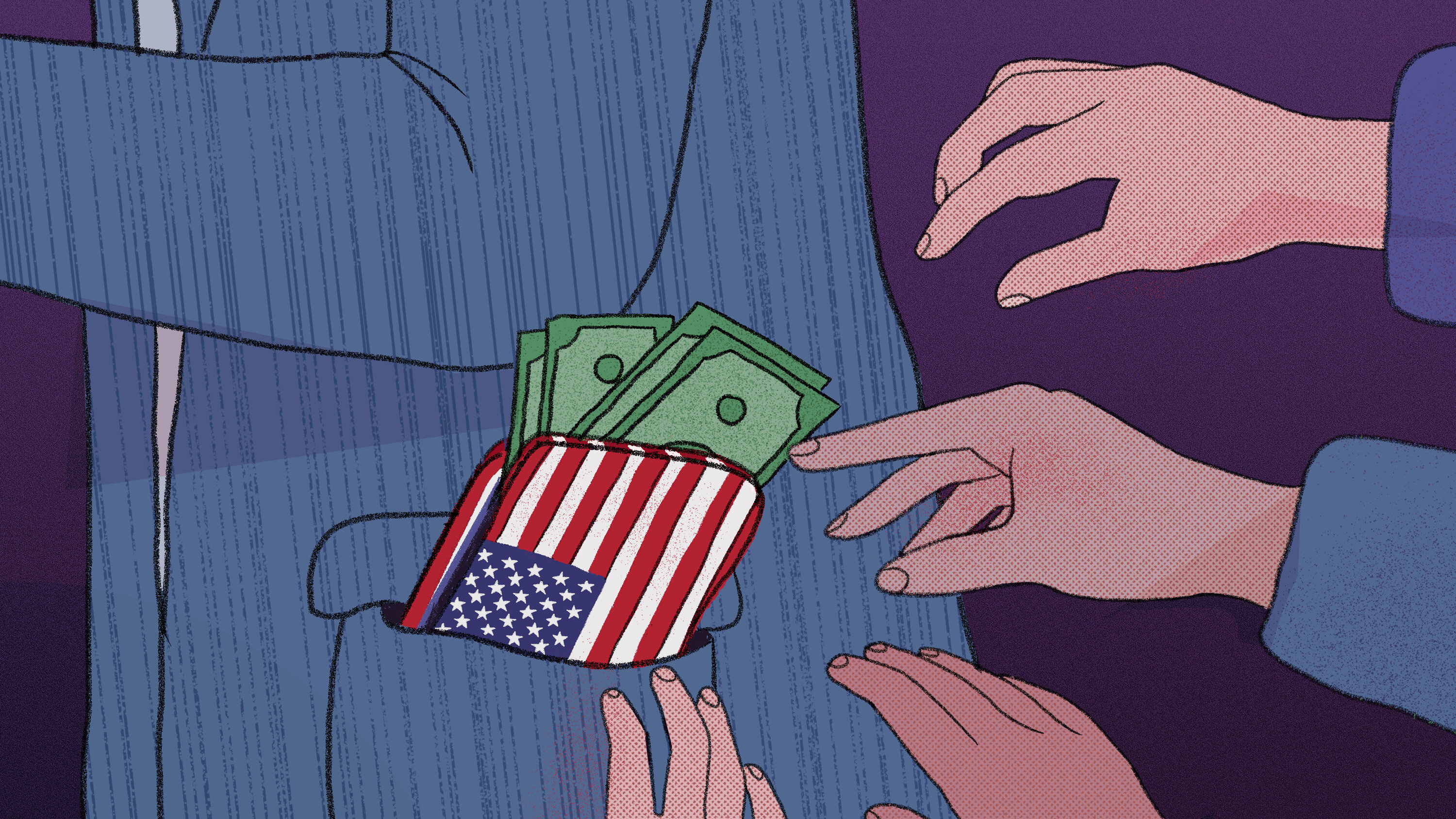

- Executive Compensation: This section discloses the compensation packages of top executives, including salaries, bonuses, stock options, and other benefits. Understanding this section is critical for evaluating company performance and governance.

- Shareholder Proposals: If shareholders submitted proposals, this section details their content and the board's recommendation.

- Financial Statements: Often, a summary of the company's recent financial performance is included to provide context for the proposals.

Understanding these sections is key to making informed decisions during shareholder voting. Each section offers a crucial piece of the puzzle for evaluating the company's leadership, strategy, and financial health.

Deciphering Key Information Within the Proxy Statement

Analyzing Executive Compensation:

Executive compensation is a critical aspect of any proxy statement. Scrutinize salaries, bonuses, stock options, and other forms of compensation. Compare executive pay to company performance and industry benchmarks. Look for excessive pay packages that may signal poor corporate governance. Identifying potential conflicts of interest is crucial here; for example, are compensation structures tied to short-term gains that might incentivize risky behavior?

Evaluating Director Nominees:

Carefully review the background and experience of each director nominee. Assess their independence and any potential conflicts of interest. A diverse and independent board is crucial for good corporate governance. Consider the board's composition; is there a balance of experience and expertise? Does the board adequately represent shareholder interests?

Understanding Shareholder Proposals:

Shareholder proposals often address significant issues like environmental sustainability, social responsibility, or executive compensation. Understanding the proposal's purpose and potential impact on the company and shareholders is crucial. Pay close attention to the board's recommendation on each proposal and the reasoning behind it. This insight can inform your own voting decisions.

Utilizing Online Resources and Tools for Proxy Statement Analysis:

SEC's EDGAR Database:

The SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system is the primary source for accessing corporate filings, including proxy statements (DEF 14A). Learning to navigate EDGAR effectively is crucial for any serious investor. Use the search function to locate filings by company name or ticker symbol.

Third-Party Proxy Voting Services:

Several third-party services offer analysis and recommendations on proxy votes. These services can simplify the process, particularly for investors with a large portfolio. However, be aware of potential biases and always conduct your own independent analysis.

Utilizing Financial News and Analysis Websites:

Reputable financial news sources frequently provide commentary and analysis of proxy statements, offering valuable context and insights. This additional perspective can help you understand the implications of various proposals and voting decisions.

Conclusion:

Mastering the interpretation of proxy statements (Form DEF 14A) is vital for informed shareholder participation. By understanding the key sections—executive compensation, director nominees, and shareholder proposals—and utilizing online resources effectively, you can become a more active and responsible investor. Don't let complex proxy statements (Form DEF 14A) intimidate you. Use this guide to make informed voting decisions and contribute to better corporate governance. Become a more effective shareholder today!

Featured Posts

-

Boston Celtics 6 1 Billion Sale Analyzing The Impact On Fans And The Franchise

May 17, 2025

Boston Celtics 6 1 Billion Sale Analyzing The Impact On Fans And The Franchise

May 17, 2025 -

Rune Osvaja Barselonu Pobeda Nad Povredjenim Alkarasom

May 17, 2025

Rune Osvaja Barselonu Pobeda Nad Povredjenim Alkarasom

May 17, 2025 -

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025 -

Analyzing The Impact Jalen Brunsons Departure Vs A Potential Luka Doncic Trade For The Dallas Mavericks

May 17, 2025

Analyzing The Impact Jalen Brunsons Departure Vs A Potential Luka Doncic Trade For The Dallas Mavericks

May 17, 2025 -

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 17, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 17, 2025

Latest Posts

-

Get Your Boston Celtics Championship Gear Under 20 Today

May 17, 2025

Get Your Boston Celtics Championship Gear Under 20 Today

May 17, 2025 -

Secure Your Boston Celtics Finals Gear Prices Under 20

May 17, 2025

Secure Your Boston Celtics Finals Gear Prices Under 20

May 17, 2025 -

Knicks Offensive Woes Brunsons Return And The Road To Recovery

May 17, 2025

Knicks Offensive Woes Brunsons Return And The Road To Recovery

May 17, 2025 -

Limited Time Boston Celtics Finals Gear For Less Than 20

May 17, 2025

Limited Time Boston Celtics Finals Gear For Less Than 20

May 17, 2025 -

Assessing The Damage Comparing The Impact Of Jalen Brunsons And A Hypothetical Luka Doncics Departure From The Mavericks

May 17, 2025

Assessing The Damage Comparing The Impact Of Jalen Brunsons And A Hypothetical Luka Doncics Departure From The Mavericks

May 17, 2025