How To Interpret The Net Asset Value (NAV) For The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

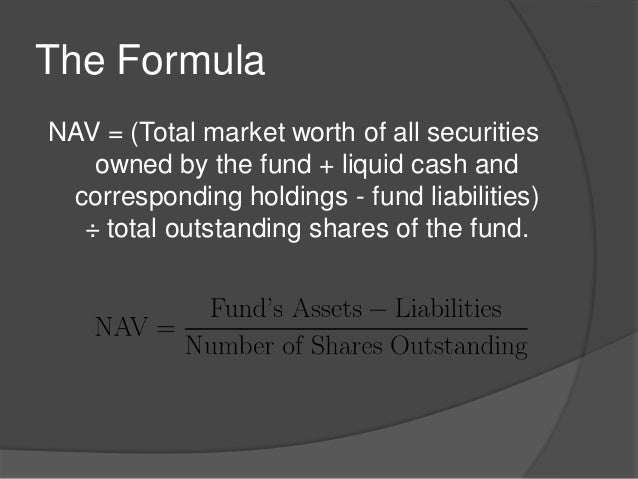

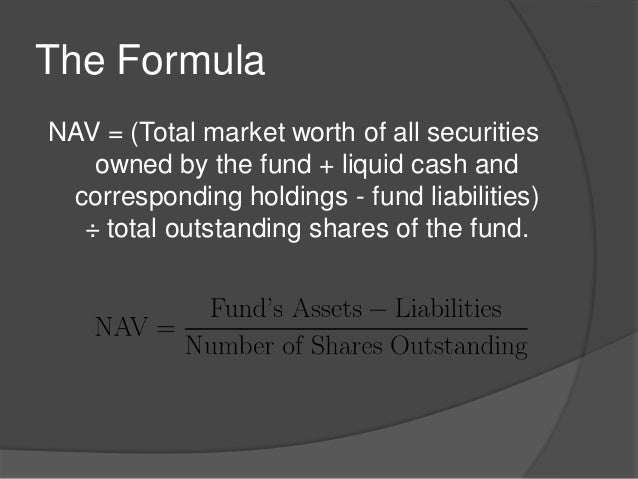

What is Net Asset Value (NAV)?

Net Asset Value (NAV) is a crucial metric representing the underlying value of an ETF's holdings. It's a fundamental concept in ETF valuation, providing a snapshot of the ETF's intrinsic worth. Simply put, the NAV is calculated by taking the total market value of all the assets held within the ETF, subtracting any liabilities (such as expenses), and then dividing the result by the total number of outstanding shares. This provides a per-share valuation.

- NAV reflects the intrinsic value of the ETF's holdings. It shows what the ETF's assets are worth at a given point in time.

- It is calculated daily, typically at the end of the trading day. This ensures the NAV reflects the most up-to-date market values.

- NAV fluctuations reflect changes in the value of the underlying assets. If the value of the underlying assets increases, so too will the NAV.

- Understanding NAV helps assess ETF performance and compare it to market benchmarks. By tracking the NAV over time, you can monitor the ETF's performance and compare it to other investments or market indices.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

The Amundi Dow Jones Industrial Average UCITS ETF NAV calculation is directly tied to the performance of the Dow Jones Industrial Average (DJIA). Since the ETF tracks this index, its NAV is heavily influenced by the collective performance of the 30 constituent companies.

- The ETF tracks the Dow Jones Industrial Average, so its NAV is directly influenced by the performance of the 30 constituent companies. Each company's weighting within the DJIA directly impacts its contribution to the overall NAV.

- The calculation considers the market value of each holding, weighted according to its representation in the index. Larger companies with a greater weighting in the DJIA will have a more significant impact on the ETF's NAV.

- Expenses and other liabilities are deducted from the total asset value. These expenses include management fees and other operating costs associated with running the ETF.

- The final NAV is then calculated per share. This provides an easily understandable figure representing the value of one share in the ETF. Currency fluctuations between the ETF's base currency and the currencies of the underlying assets might also be factored in, affecting the final NAV calculation.

Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Numerous factors influence the daily NAV fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is essential for informed investment decisions.

- Performance of the Dow Jones Industrial Average companies: The primary driver of the ETF's NAV is the collective performance of the 30 companies in the DJIA. Strong performance by these companies leads to a higher NAV, and vice-versa.

- Changes in the overall market sentiment and investor confidence: Broad market trends, such as bull or bear markets, significantly impact the NAV. Positive sentiment generally boosts the NAV, while negative sentiment can depress it.

- Economic news and announcements impacting the US economy: Macroeconomic factors, such as interest rate changes, inflation reports, and economic growth figures, influence the performance of the DJIA and, consequently, the ETF's NAV.

- Individual company performance within the Dow Jones Industrial Average: News specific to individual companies within the DJIA (earnings reports, product launches, regulatory changes) can also cause fluctuations in the NAV.

- Currency exchange rates (if applicable): If the ETF holds assets denominated in currencies other than its base currency, fluctuations in exchange rates can impact the calculated NAV.

Using NAV to Make Informed Investment Decisions

Understanding the NAV is crucial for effective ETF investing. Investors can leverage NAV information to make better-informed investment choices.

- Compare the NAV to the ETF's market price to identify potential discrepancies (premium or discount). Sometimes the market price of an ETF can trade at a premium or discount to its NAV. This can present buying or selling opportunities.

- Analyze historical NAV data to understand long-term trends and volatility. Tracking the NAV over time provides insights into the ETF's historical performance and volatility.

- Use NAV information in conjunction with other investment indicators. NAV should be considered alongside other factors, such as the ETF's expense ratio, trading volume, and overall market conditions.

- Consult with a financial advisor for personalized investment advice. A financial advisor can help you incorporate NAV data into your broader investment strategy.

Conclusion

Understanding the Net Asset Value (NAV) is paramount for successful investment in ETFs such as the Amundi Dow Jones Industrial Average UCITS ETF. By grasping how the NAV is calculated and what factors influence it, investors can make more informed decisions and better manage their portfolio. Regularly monitoring the NAV, alongside other relevant market indicators, provides a comprehensive understanding of your investment's performance. Learn more about interpreting the Net Asset Value (NAV) for various ETFs and refine your investment strategies. Stay informed about the Amundi Dow Jones Industrial Average UCITS ETF's NAV and make confident investment choices.

Featured Posts

-

Frances Next Election Jordan Bardella And The Opposition

May 24, 2025

Frances Next Election Jordan Bardella And The Opposition

May 24, 2025 -

Listen Now Joy Crookes Drops New Song Carmen

May 24, 2025

Listen Now Joy Crookes Drops New Song Carmen

May 24, 2025 -

The 10 Fastest Ferrari Production Cars Lap Times

May 24, 2025

The 10 Fastest Ferrari Production Cars Lap Times

May 24, 2025 -

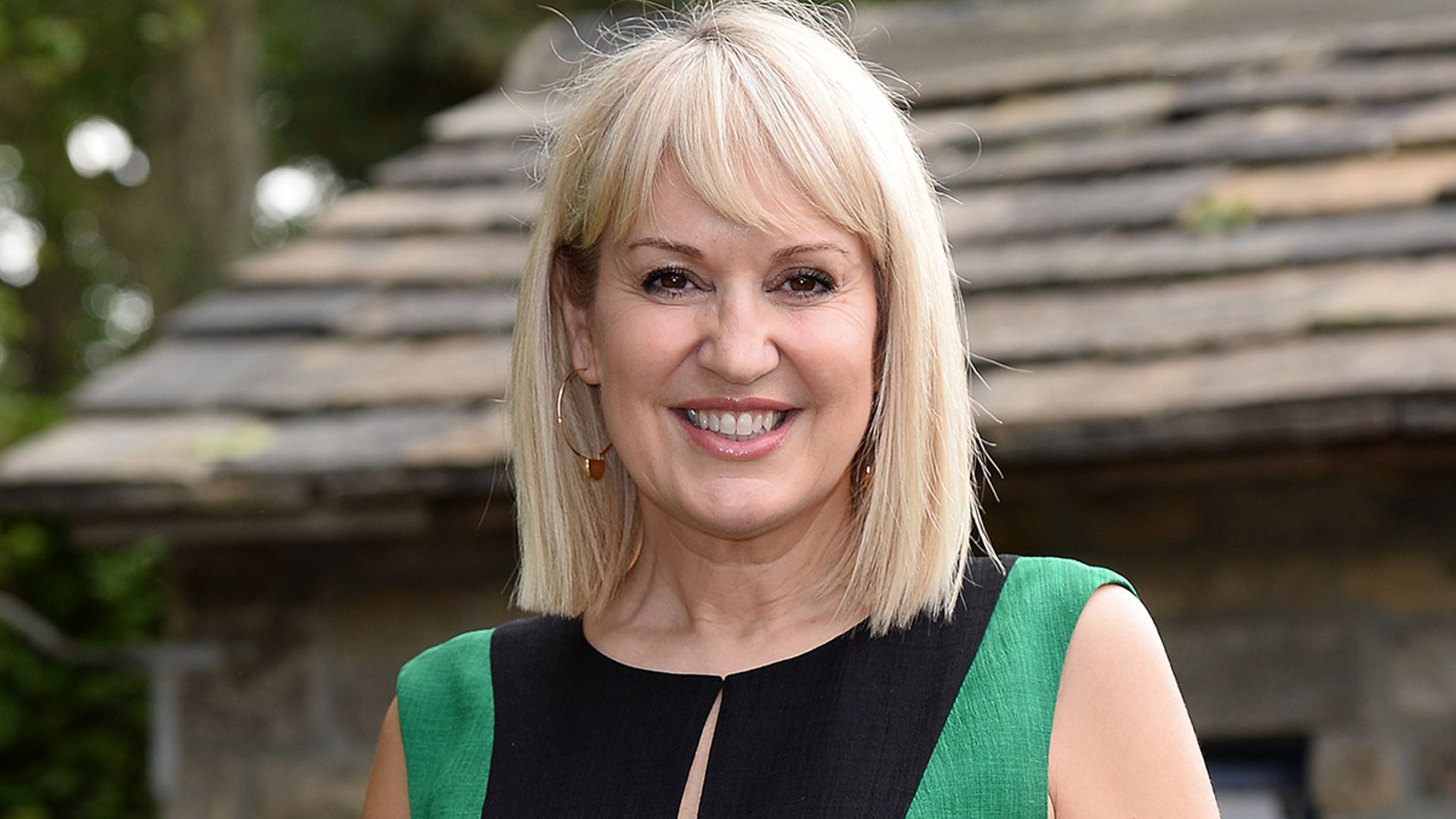

Escape To The Country Designing A Garden Like Nicki Chapmans

May 24, 2025

Escape To The Country Designing A Garden Like Nicki Chapmans

May 24, 2025 -

Major Crash Closes Road One Person Hospitalized

May 24, 2025

Major Crash Closes Road One Person Hospitalized

May 24, 2025

Latest Posts

-

Experience Local And Global Travel The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025

Experience Local And Global Travel The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025 -

New Ae Xplore Campaign Boosts Travel From England Airpark And Alexandria International Airport

May 24, 2025

New Ae Xplore Campaign Boosts Travel From England Airpark And Alexandria International Airport

May 24, 2025 -

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025 -

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025 -

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 24, 2025

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 24, 2025