Hudson Bay Receives Court Approval To Extend Financial Restructuring

Table of Contents

Details of the Court-Approved Restructuring Extension

The court's approval grants Hudson Bay an extension to its existing financial restructuring plan. While the exact length of the extension remains undisclosed pending official filings, sources suggest it will provide several additional months. This additional time is crucial for HBC to finalize negotiations with creditors and implement key elements of its restructuring strategy, including debt restructuring and operational adjustments. This extension wasn't granted without conditions. The court mandated specific performance milestones that Hudson Bay must meet to maintain the extended timeframe. These conditions likely include demonstrable progress in reducing operational costs, securing additional financing, and achieving improved sales figures.

- Length of extension: [Insert length of extension once officially released – e.g., "six months"]

- Key conditions of the extension: [Insert specifics of conditions – e.g., "achievement of specific sales targets," "reduction of operating expenses by X%," "secured financing of Y dollars"]

- Impact on creditors and shareholders: Creditors will likely see a delay in full debt repayment, but the extension offers a higher likelihood of eventual recovery compared to immediate liquidation. Shareholders may experience further dilution or even potential loss, depending on the restructuring plan’s outcome.

- Changes to the original restructuring plan: [Insert details of any modifications to the original plan, if applicable]

Significant stakeholders, including some major creditors, initially expressed concerns about the extension. However, after further negotiations and a demonstration of HBC's commitment to its turnaround strategy, these concerns were largely addressed, paving the way for court approval.

Impact on Hudson Bay's Operations and Future Strategy

The restructuring extension will undoubtedly influence Hudson Bay's operations and long-term strategy. While the company aims to avoid widespread store closures, some consolidations or closures in underperforming locations remain a possibility. Similarly, workforce adjustments, potentially including job losses, are being considered as part of the cost-cutting measures. However, the extension also allows Hudson Bay to focus on improving customer experience, streamlining its supply chain, and investing in its online presence to enhance its competitiveness.

- Potential store closures or consolidations: While not confirmed, specific underperforming locations may face closure to optimize resource allocation.

- Impact on staffing levels: A reduction in workforce is likely, though the exact number of job losses remains unclear. Restructuring efforts may include voluntary severance packages or natural attrition.

- Changes to marketing and sales strategies: Expect a renewed focus on digital marketing and customer loyalty programs to drive sales growth.

- Revised long-term financial projections: The extended timeline should allow for more realistic financial projections, incorporating the impact of the restructuring initiatives.

This extended period provides an opportunity to refine its long-term vision, allowing it to adapt to the evolving retail landscape and emerge as a more competitive player.

Analysis of the Court's Decision and Market Reaction

The court's decision to approve the extension reflects a careful consideration of various factors, including the potential impact on creditors, employees, and the broader economy. The judge likely weighed the potential benefits of a successful restructuring against the risks of immediate liquidation. Legal precedents related to similar retail restructurings were likely reviewed, influencing the final judgment.

- Key legal arguments considered by the court: [Insert details of legal arguments presented by both sides]

- Immediate market reaction to the news (stock price changes): [Insert details of stock price changes following the announcement]

- Analyst opinions and predictions for Hudson Bay's future: [Summarize analyst predictions regarding the success of the restructuring and the future stock price.]

The market's reaction to the court's approval has been mixed. While some investors view the extension as a positive sign, others remain cautious. The current stock price reflects this uncertainty, with volatility expected until further developments unfold.

Conclusion: Hudson Bay's Restructuring: Looking Ahead

The court's approval to extend Hudson Bay's financial restructuring marks a crucial turning point for the company. This extension is not merely a reprieve; it's a chance to implement a comprehensive turnaround strategy aimed at long-term viability and success. The successful execution of this plan will hinge on its ability to meet the conditions set by the court, manage its operations effectively, and adapt to the evolving retail landscape. The coming months will be critical in determining whether Hudson Bay can successfully navigate this challenging period.

Stay updated on the latest developments in Hudson Bay’s financial restructuring and turnaround strategy. Learn more about the implications of this extended financial restructuring for Hudson Bay and its future.

Featured Posts

-

Kim Kardashians Testimony Fear For Her Life During Robbery

May 15, 2025

Kim Kardashians Testimony Fear For Her Life During Robbery

May 15, 2025 -

Hondas 15 Billion Ev Project In Ontario A Pause In Production

May 15, 2025

Hondas 15 Billion Ev Project In Ontario A Pause In Production

May 15, 2025 -

Bigface Employee Discount Jimmy Butlers Special Offer For Golden State Warriors

May 15, 2025

Bigface Employee Discount Jimmy Butlers Special Offer For Golden State Warriors

May 15, 2025 -

Get Ready Nhl 25s Arcade Mode Is Back

May 15, 2025

Get Ready Nhl 25s Arcade Mode Is Back

May 15, 2025 -

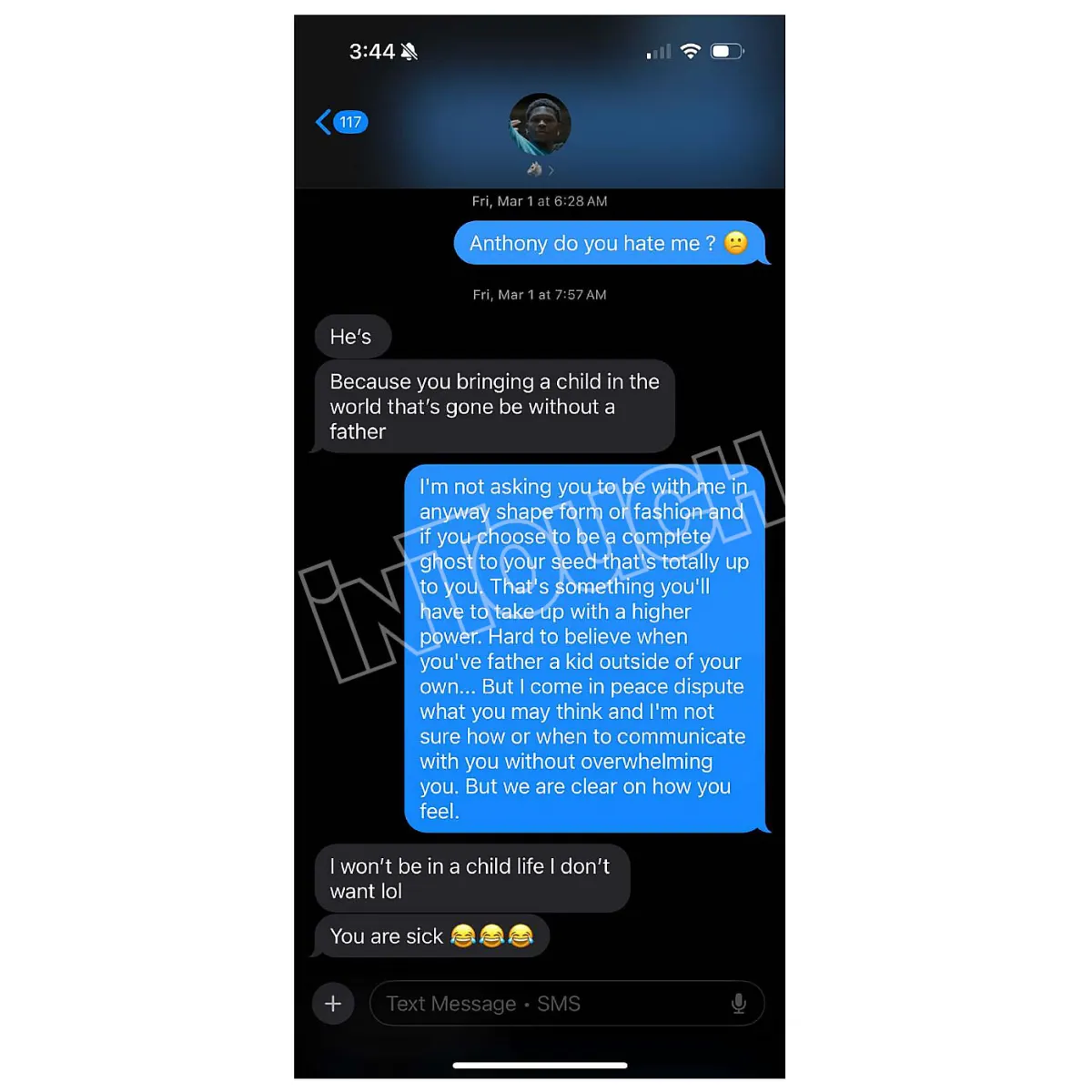

Anthony Edwards And The Baby Mama Drama A Twitter Firestorm

May 15, 2025

Anthony Edwards And The Baby Mama Drama A Twitter Firestorm

May 15, 2025

Latest Posts

-

Reshayuschiy Match Pley Off Karolina Protiv Vashingtona

May 15, 2025

Reshayuschiy Match Pley Off Karolina Protiv Vashingtona

May 15, 2025 -

Karolina Vashington Podrobniy Otchet O Matche Pley Off N Kh L

May 15, 2025

Karolina Vashington Podrobniy Otchet O Matche Pley Off N Kh L

May 15, 2025 -

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Pley Off N Kh L

May 15, 2025

Razgromnoe Porazhenie Vashingtona Ot Karoliny V Pley Off N Kh L

May 15, 2025 -

Ovechkin I Demidov Vashington I Monreal Vstrechayutsya V Pley Off N Kh L

May 15, 2025

Ovechkin I Demidov Vashington I Monreal Vstrechayutsya V Pley Off N Kh L

May 15, 2025 -

Pley Off N Kh L Karolina Oderzhivaet Krupnuyu Pobedu Nad Vashingtonom

May 15, 2025

Pley Off N Kh L Karolina Oderzhivaet Krupnuyu Pobedu Nad Vashingtonom

May 15, 2025