Hudson's Bay Extends Creditor Protection Until July 31st: Court Approval Secured

Table of Contents

Court Approval and Extended Timeline

The court's decision to grant HBC an extension to its creditor protection signifies a crucial step in the company's restructuring efforts. HBC initially filed for creditor protection on [Insert Original Filing Date], seeking legal protection from creditors while it works to reorganize its finances. The newly approved extension provides the company until July 31st to finalize its restructuring plan.

- Confirmation of court approval details: The court officially approved the extension on [Insert Date of Approval], outlining specific conditions that HBC must adhere to.

- Specifics of the extension: The extension allows HBC to continue operating its businesses, negotiate with creditors, and explore strategic options without the immediate pressure of creditor claims.

- Conditions attached to the extension: The court likely imposed certain conditions on the extension, potentially including regular reporting requirements, limitations on certain expenditures, and milestones to be achieved by a specified date. These details will likely be available in court documents.

- Quote from HBC or legal representatives: “[Insert quote from HBC CEO or legal representative regarding the court's decision and the significance of the extension for the company's future.]”

Impact on HBC's Restructuring Efforts

The extended creditor protection timeline offers HBC valuable time to refine its restructuring plans. This period will likely be used to implement various strategies aimed at improving the company's financial health and long-term viability.

- Potential store closures or sales: HBC may choose to close underperforming stores or sell off non-core assets to reduce its overall debt burden and streamline operations.

- Negotiations with creditors and landlords: This extended period will be crucial for negotiating favorable terms with creditors and landlords, potentially leading to debt reduction or lease renegotiations.

- Exploration of strategic partnerships or investments: HBC might actively seek strategic partnerships or investments to bolster its financial position and gain access to new resources and expertise.

- Potential for asset sales or divestitures: The company may explore selling off profitable but non-essential parts of its business to raise capital and focus on its core strengths.

Implications for Employees and Customers

The Hudson's Bay creditor protection process has significant implications for both employees and customers. While the extension offers some stability, uncertainties remain.

- Status of current employment contracts: While job security isn't guaranteed, the extension provides a degree of stability for employees during the restructuring process. However, potential layoffs remain a possibility.

- Plans for employee communication and support: HBC is expected to maintain open communication with its employees, providing updates on the restructuring progress and offering support during this period of uncertainty.

- Changes to store hours or operations: While the company aims to maintain normal operations, some adjustments to store hours or services might occur depending on the progress of the restructuring.

- Updates on customer loyalty programs and return policies: HBC is likely to continue its customer loyalty programs and maintain standard return policies, but customers should stay informed about any potential changes.

Financial Market Reaction and Analyst Commentary

The news of the extended Hudson's Bay creditor protection has understandably impacted the stock market.

- Stock price fluctuations: HBC's stock price likely experienced fluctuations following the court's decision, reflecting investor sentiment towards the company's restructuring prospects. [Insert details on stock price changes]

- Analyst predictions: Financial analysts will be closely watching HBC's progress during this extended period, offering predictions and commentary on the company's future based on its performance and the success of its restructuring plan.

- Comparison to other retail bankruptcies or restructurings: Analysts may draw comparisons to other retail companies that have undergone similar restructuring processes, offering insights into potential outcomes for HBC.

- Mention of any rating agency actions: Rating agencies may adjust HBC's credit rating based on the extension and the progress of its restructuring efforts.

Conclusion

The court's approval to extend Hudson's Bay's creditor protection until July 31st is a significant development in the company's financial restructuring. This extension provides crucial time to negotiate with creditors, implement strategic changes, and address the concerns of employees and customers. The impact on the company's future, the Canadian retail landscape, and the financial markets will depend heavily on the success of its restructuring efforts. The coming months will be critical for HBC.

Call to Action: Stay informed on the ongoing developments in the Hudson's Bay Company's financial restructuring. Follow [link to relevant news source or HBC website] for updates on the Hudson's Bay creditor protection process and its impact on the company. Regularly check for news regarding the Hudson's Bay's financial restructuring and creditor protection updates.

Featured Posts

-

Vont Weekend Photos 97 3 Kissfms April 4 6 Event

May 16, 2025

Vont Weekend Photos 97 3 Kissfms April 4 6 Event

May 16, 2025 -

Warriors Game Today Jimmy Butlers Status And Injury Report

May 16, 2025

Warriors Game Today Jimmy Butlers Status And Injury Report

May 16, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increases

May 16, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increases

May 16, 2025 -

Oakland As News Muncys Immediate Impact On The Team

May 16, 2025

Oakland As News Muncys Immediate Impact On The Team

May 16, 2025 -

Ontarios Commitment Permanent Gas Tax Relief And Highway 407 East Toll Elimination

May 16, 2025

Ontarios Commitment Permanent Gas Tax Relief And Highway 407 East Toll Elimination

May 16, 2025

Latest Posts

-

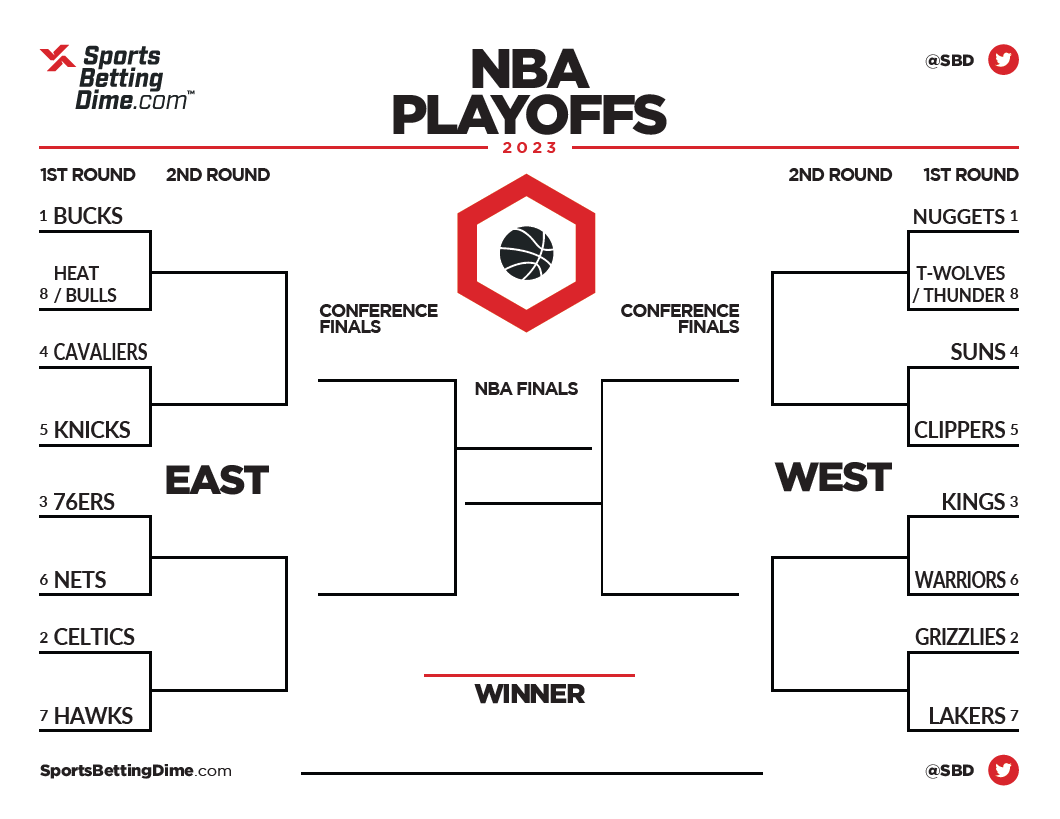

Profitable Bets Nba And Nhl Second Round Playoffs

May 16, 2025

Profitable Bets Nba And Nhl Second Round Playoffs

May 16, 2025 -

Top Betting Picks Nba And Nhl Playoffs Round 2

May 16, 2025

Top Betting Picks Nba And Nhl Playoffs Round 2

May 16, 2025 -

Smart Betting Nba And Nhl Playoffs Round 2

May 16, 2025

Smart Betting Nba And Nhl Playoffs Round 2

May 16, 2025 -

Best Bets Round 2 Nba And Nhl Playoff Action

May 16, 2025

Best Bets Round 2 Nba And Nhl Playoff Action

May 16, 2025 -

Keine Einigung Bvg Tarifverhandlungen Nach Schlichtung Was Nun

May 16, 2025

Keine Einigung Bvg Tarifverhandlungen Nach Schlichtung Was Nun

May 16, 2025