Hypotheken Intermediair: Karin Polman Neemt Directie Bij ABN AMRO, Florius En Moneyou Over

Table of Contents

Karin Polman's Background and Experience

Karin Polman brings a wealth of experience in finance and the mortgage sector to her new role. Her extensive financiële ervaring and proven hypotheken expertise make her a strong candidate to lead these three major players in the Dutch mortgage market. Her demonstrated leiderschap will be crucial in navigating the complexities of the current economic climate and ensuring the continued success of ABN AMRO, Florius, and Moneyou.

- Previous roles and accomplishments: [Insert details of Polman's previous positions and achievements, highlighting relevant experience in mortgage lending, risk management, or strategic planning. Quantify achievements whenever possible – e.g., "increased market share by 15%," "reduced operational costs by 10%."]

- Specific skills and expertise: [List key skills relevant to the role, such as strategic planning, financial modeling, regulatory compliance, team leadership, and customer relationship management.]

- Awards and recognition: [Mention any awards or industry recognition Polman has received, demonstrating her expertise and standing within the financial community.]

Impact on ABN AMRO's Mortgage Strategy

Polman's appointment is likely to significantly impact ABN AMRO's hypotheken strategie. Her fresh perspective and expertise could lead to several changes:

- Potential changes in interest rates or lending criteria: [Discuss potential adjustments to interest rates based on market conditions and ABN AMRO's strategic goals. Mention potential changes to lending criteria, such as stricter or more lenient requirements for mortgage applications.]

- Expected impact on competition within the market: [Analyze how ABN AMRO's adjusted strategie might impact its competitive position against other major banks in the Netherlands. Discuss potential responses from competitors.]

- Potential for new product offerings or services: [Speculate on potential new mortgage products or services that might be introduced under Polman's leadership. This could include innovative offerings targeting specific customer segments or leveraging new technologies.]

Implications for Florius and Moneyou

The appointment also has significant implications for Florius and Moneyou. Polman's leadership could foster greater integratie between the three brands, potentially leading to:

- Potential synergies between the three brands: [Explore possible synergies, such as shared resources, streamlined processes, or cross-promotion opportunities. Discuss potential benefits for customers, such as enhanced service offerings or wider product choices.]

- Changes in marketing strategies or target audiences: [Discuss potential changes to marketing strategies to better reach and engage target audiences. This could include focusing on digital marketing, targeted advertising, or personalized customer experiences.]

- Analysis of the combined market share and competitive advantage: [Analyze the combined market share of ABN AMRO, Florius, and Moneyou after the integration and discuss the resulting competitive advantage. This could involve a comparison to other key players in the market.]

The Broader Impact on the Hypotheken Intermediair Market

This appointment will undeniably affect hypotheken intermediairs who work with these banks. The changes in strategy and operations could lead to:

- Potential changes in collaboration models between banks and intermediaries: [Discuss potential changes in the way ABN AMRO, Florius, and Moneyou collaborate with hypotheken adviseurs. This could include adjustments to commission structures, communication protocols, or the provision of training and support.]

- Impact on commission structures and fees: [Analyze the potential impact on commission structures and fees for hypotheken intermediairs. This could involve discussing potential increases, decreases, or changes in the way commissions are calculated.]

- Analysis of the long-term effects on the market for mortgage advice: [Discuss the long-term effects on the marktontwikkelingen for mortgage advice, considering the potential consolidation or fragmentation within the intermediary market.]

Conclusion

The appointment of Karin Polman to oversee the mortgage divisions of ABN AMRO, Florius, and Moneyou represents a significant development in the Dutch mortgage market. Her experience and leadership will likely shape the future strategies of these key players, influencing interest rates, product offerings, and the overall competitive landscape. This, in turn, will have a considerable impact on hypotheken intermediairs and the consumers they serve. Staying informed about these changes is crucial for both hypotheken intermediairs and anyone seeking a mortgage in the Netherlands. Keep following our updates to remain abreast of the latest developments in the world of hypotheken intermediairs and their evolving relationship with major banking institutions.

Featured Posts

-

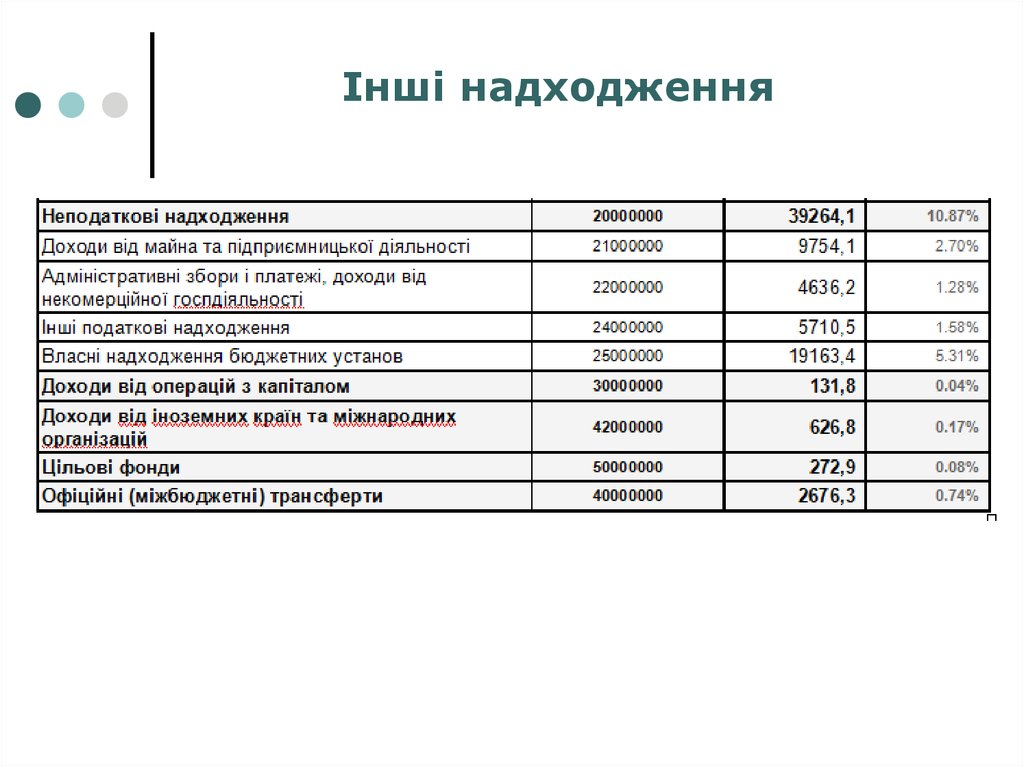

Naybilshi Finansovi Kompaniyi Ukrayini Analiz Dokhodiv Za 2024 Rik

May 21, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Analiz Dokhodiv Za 2024 Rik

May 21, 2025 -

Official Peppa Pigs Mum Shares The Gender Of Her New Baby

May 21, 2025

Official Peppa Pigs Mum Shares The Gender Of Her New Baby

May 21, 2025 -

William Goodge Fastest Foot Crossing Of Australia

May 21, 2025

William Goodge Fastest Foot Crossing Of Australia

May 21, 2025 -

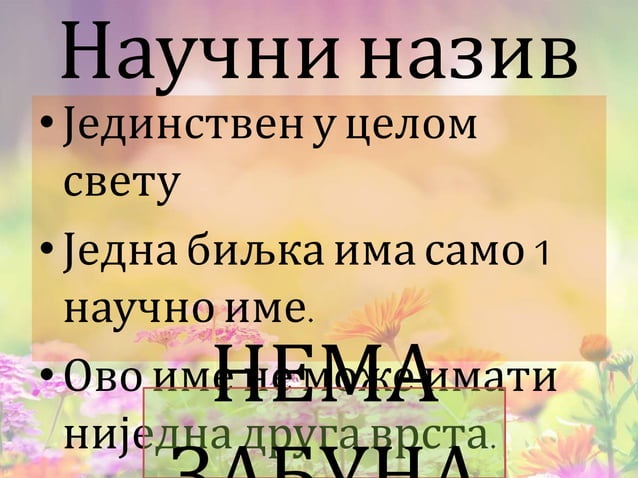

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025 -

220 Million Lawsuit Kahnawake Casino Owners Take On Mohawk Council

May 21, 2025

220 Million Lawsuit Kahnawake Casino Owners Take On Mohawk Council

May 21, 2025

Latest Posts

-

Bucharest Tiriac Open Flavio Cobolli Secures Maiden Atp Title

May 21, 2025

Bucharest Tiriac Open Flavio Cobolli Secures Maiden Atp Title

May 21, 2025 -

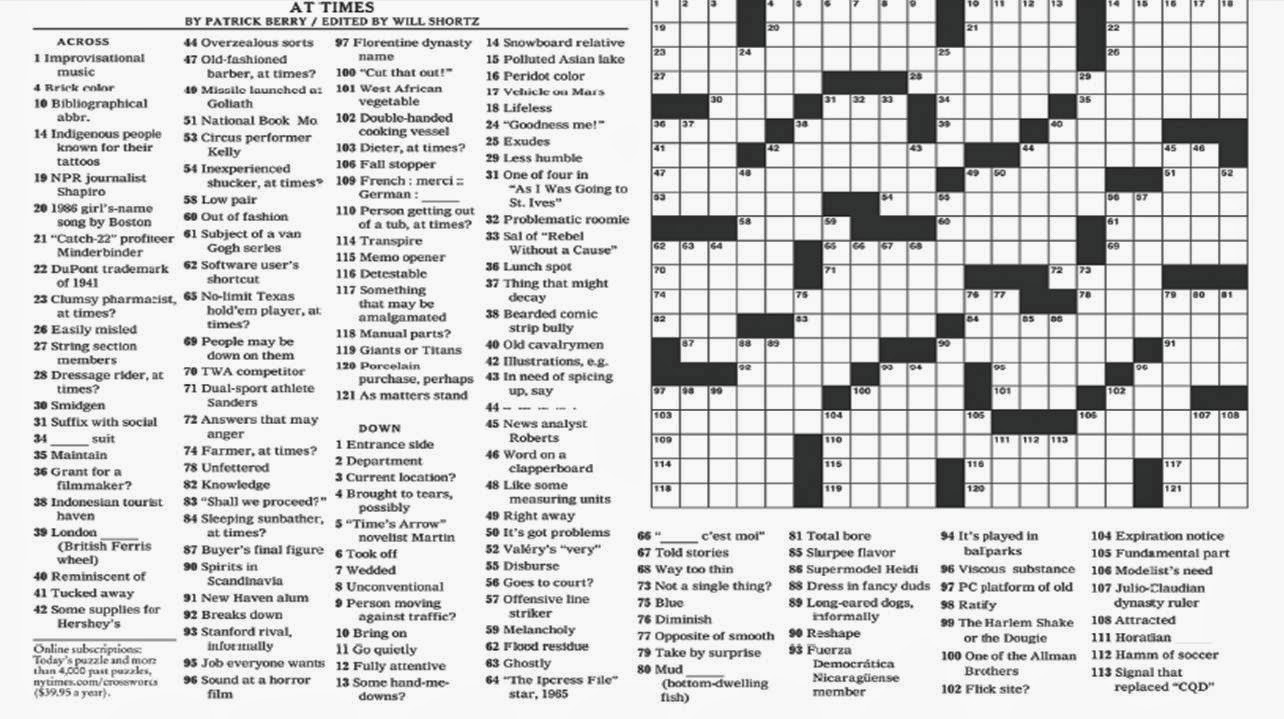

Solve The Nyt Crossword April 25 2025 Answers

May 21, 2025

Solve The Nyt Crossword April 25 2025 Answers

May 21, 2025 -

Cobolli Claims First Atp Win At Bucharest Tiriac Open

May 21, 2025

Cobolli Claims First Atp Win At Bucharest Tiriac Open

May 21, 2025 -

Complete Guide To Nyt Crossword Answers April 25 2025

May 21, 2025

Complete Guide To Nyt Crossword Answers April 25 2025

May 21, 2025 -

Nyt Crossword Solutions April 25 2025

May 21, 2025

Nyt Crossword Solutions April 25 2025

May 21, 2025