Ignoring High Stock Market Valuations: BofA's Rationale

Table of Contents

BofA's Macroeconomic Outlook and its Impact on Valuation

BofA's view on current valuations is deeply rooted in its macroeconomic outlook. Their analysts predict a specific economic trajectory that, in their estimation, justifies the current, seemingly elevated, prices. This outlook considers several key factors:

- Projected GDP Growth Rates: BofA projects continued, albeit perhaps moderating, GDP growth in the coming years. This expectation fuels their belief that corporate earnings will remain robust, supporting current valuations.

- Inflationary Expectations: While acknowledging inflationary pressures, BofA anticipates a gradual decline in inflation. This expectation suggests that interest rates may not rise as aggressively as some fear, potentially mitigating the negative impact on stock prices.

- Anticipated Interest Rate Changes: BofA’s analysts foresee a less drastic increase in interest rates than many market participants anticipate. A more moderate increase could keep borrowing costs manageable for corporations and support continued investment and growth, bolstering stock valuations.

These predictions collectively influence BofA's view on valuations. While traditional metrics might suggest overvaluation, their macroeconomic outlook suggests that current high valuations are sustainable, or at least justifiable, in the medium term. [Insert relevant chart/graph showing BofA's GDP, inflation, and interest rate projections, if available].

The Role of Corporate Earnings in BofA's Valuation Strategy

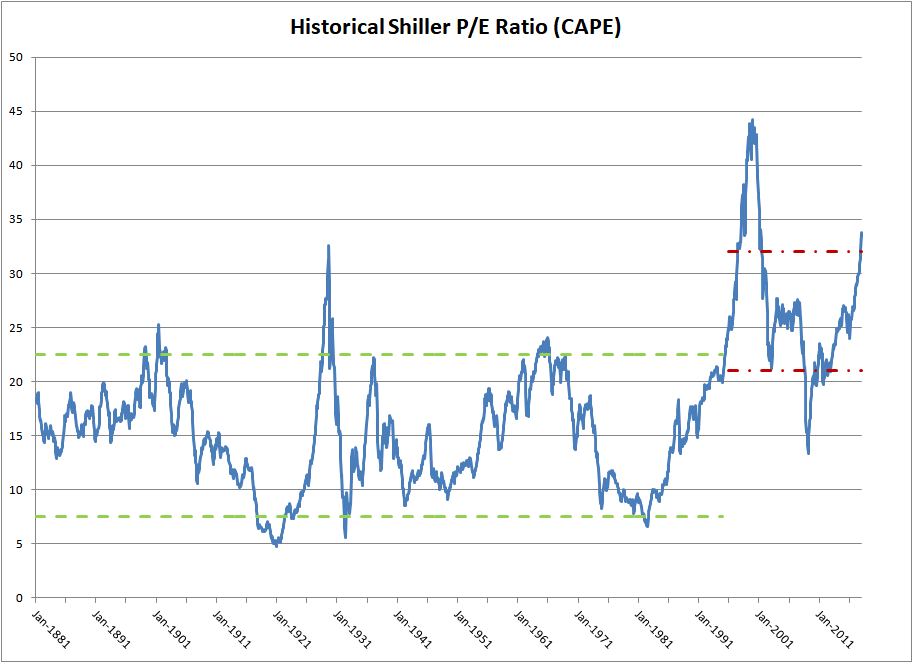

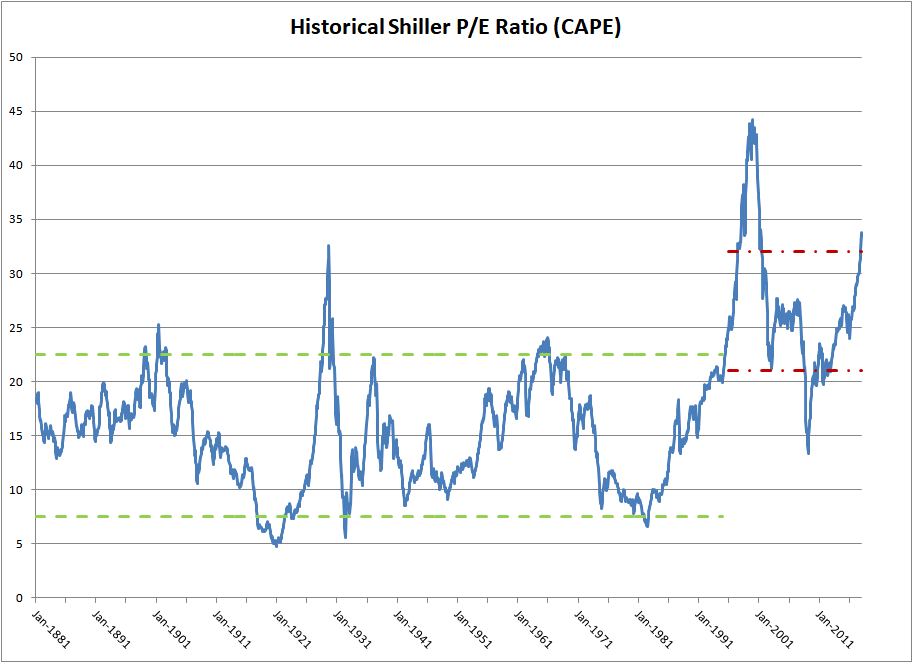

BofA's valuation strategy heavily relies on projected corporate earnings growth. They believe that robust earnings growth can offset high price-to-earnings (P/E) ratios, a common indicator of overvaluation.

- BofA's Expected Earnings Growth for Specific Sectors: BofA anticipates strong earnings growth in specific sectors like technology and healthcare, driven by innovation and increasing demand.

- Analysis of Factors Driving This Growth: This growth is attributed to several factors, including technological advancements, global expansion, and increasing consumer spending.

- Comparison of Earnings Growth to Historical Data: BofA’s analysis compares projected earnings growth to historical data, suggesting that the current growth trajectory is not unprecedented, particularly when considering specific sectors.

However, it's crucial to acknowledge potential risks. Earnings disappointments in key sectors could significantly impact valuations. This underscores the inherent uncertainty in any market prediction and highlights the importance of ongoing monitoring.

Alternative Valuation Metrics Beyond Traditional Measures

BofA's confidence in its approach also stems from its reliance on alternative valuation metrics. They understand that traditional metrics like P/E ratios can be misleading in periods of high growth and low interest rates.

- Advantages and Disadvantages of Each Alternative Metric: Metrics like free cash flow (FCF) and discounted cash flow (DCF) offer a different perspective, focusing on a company's actual cash generation and long-term profitability. While offering a more nuanced view, these metrics are also sensitive to variations in discount rate assumptions.

- How These Metrics Support BofA's Position: BofA argues that these alternative metrics suggest a more reasonable valuation, even considering the high P/E ratios.

- Examples of Specific Companies: [Insert examples of companies where BofA uses alternative metrics to justify high valuations.]

Using alternative metrics in a high-valuation market provides a more holistic assessment and reduces the overreliance on a single, potentially misleading, indicator.

Geopolitical and Market Risks Considered by BofA

BofA isn't ignoring the risks. Their assessment incorporates several geopolitical and market factors:

- Specific Geopolitical Risks: Trade wars, political instability in key regions, and geopolitical tensions are all considered.

- Market Risks: Interest rate hikes, potential recession, and unexpected market volatility are factored into their analysis.

- BofA's Strategies for Mitigating These Risks: BofA likely employs diversification and hedging strategies to mitigate potential losses from these risks.

By actively managing these risks, BofA believes the potential rewards of maintaining exposure in the market outweigh the perceived concerns of high valuations.

Conclusion: Navigating High Stock Market Valuations with BofA's Insight

BofA's rationale for potentially overlooking high stock market valuations rests on a combination of factors: a positive macroeconomic outlook, strong projected earnings growth, the use of alternative valuation metrics, and a proactive approach to risk management. Their perspective highlights the importance of considering multiple viewpoints and evaluating market conditions through various lenses. While their approach may seem bold, it underscores the complexity of market analysis and the need to look beyond simplistic valuation metrics. Before making any investment decisions regarding ignoring high stock market valuations, conduct your own thorough research, carefully considering BofA's rationale alongside other analyses, and stay informed about market trends and expert opinions. Understanding different perspectives on high stock market valuations is crucial for informed investment choices.

Featured Posts

-

Taylor Swift Kendrick Lamar And Simone Biles Among Webby Award Winners

May 18, 2025

Taylor Swift Kendrick Lamar And Simone Biles Among Webby Award Winners

May 18, 2025 -

Improving Code Efficiency Meet Chat Gpts Ai Coding Agent

May 18, 2025

Improving Code Efficiency Meet Chat Gpts Ai Coding Agent

May 18, 2025 -

Cassie Announces Happy News Following Diddy Assault Claims

May 18, 2025

Cassie Announces Happy News Following Diddy Assault Claims

May 18, 2025 -

Naytilia Kai Nisiotiki Politiki Omilia Kasselaki Kommati Tis Taytotitas Mas

May 18, 2025

Naytilia Kai Nisiotiki Politiki Omilia Kasselaki Kommati Tis Taytotitas Mas

May 18, 2025 -

Novaku Se Ovo Jedini Put Desilo Pre 19 Godina Neverovatni Podatak O Njegovom Uspehu

May 18, 2025

Novaku Se Ovo Jedini Put Desilo Pre 19 Godina Neverovatni Podatak O Njegovom Uspehu

May 18, 2025