Impact Of 5% 30-Year Yield On The "Sell America" Strategy

Table of Contents

Understanding the 5% 30-Year Yield and its Implications

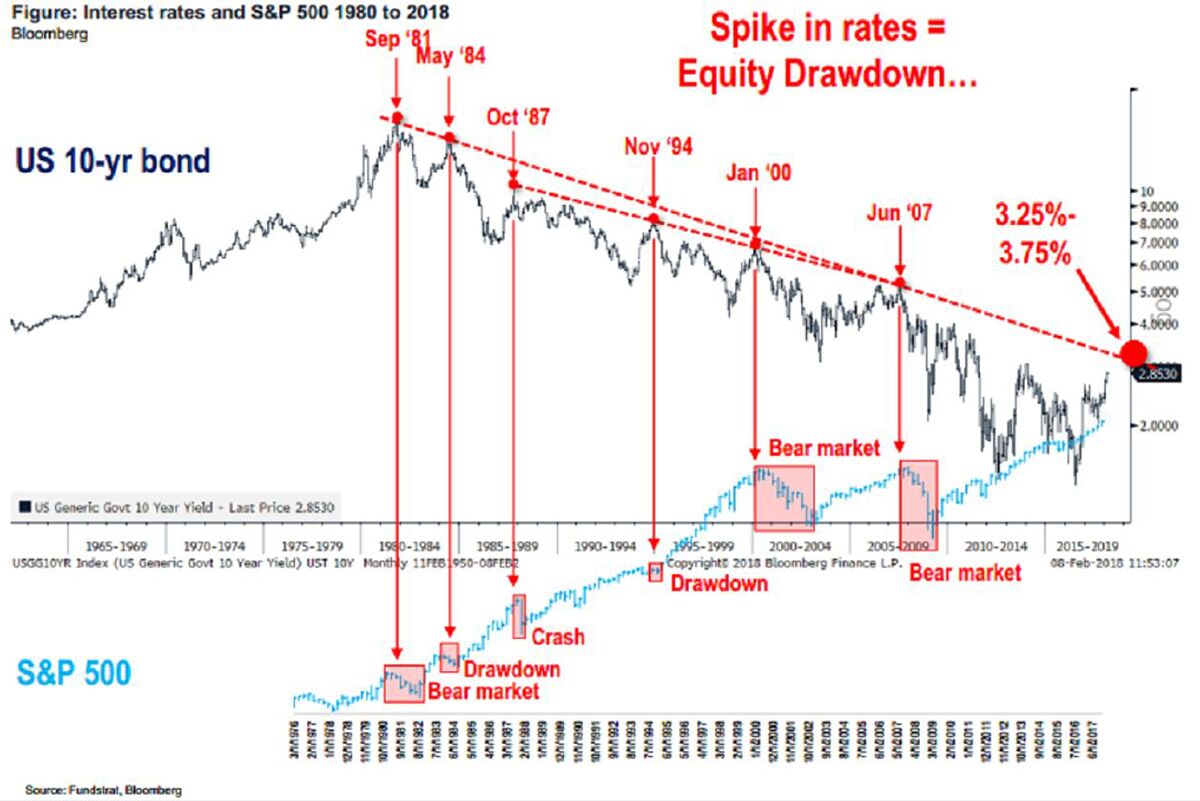

The 30-year Treasury yield serves as a benchmark interest rate, influencing borrowing costs across the economy. A 5% yield signals a significant shift in the market, primarily driven by factors such as persistent inflation and the Federal Reserve's monetary policy tightening. This higher yield has several key ramifications:

- Bond Prices: Higher yields lead to a decrease in existing bond prices (inverse relationship). Investors holding long-term US Treasury bonds experience capital losses.

- Mortgage Rates: Increased borrowing costs translate to higher mortgage rates, making home purchases less affordable and potentially cooling the housing market.

- Corporate Borrowing Costs: Companies face increased costs for borrowing money, potentially impacting investment and expansion plans.

- Overall Economic Growth: Higher interest rates can curb economic growth by reducing consumer spending and business investment. The potential for a recession becomes a significant concern.

The "Sell America" Strategy: A Detailed Overview

The "Sell America" strategy involves selling US assets, such as real estate, stocks, and bonds, to foreign investors. This approach can be driven by various factors, including a desire to capitalize on higher returns in foreign markets or to diversify investment portfolios. However, it's not without risk.

- Rationale: Investors may employ this strategy to take advantage of favorable exchange rates, higher potential returns in international markets, or to hedge against potential risks in the US economy.

- Targeted Assets: This strategy commonly targets a variety of asset classes, including US real estate (particularly commercial properties), blue-chip stocks, and government bonds.

- Benefits: Potential for higher returns, currency diversification, and reduced exposure to US market volatility.

- Risks: Fluctuations in exchange rates, geopolitical risks in target markets, and potential capital controls can all impact the success of the strategy.

The Interplay Between 5% 30-Year Yield and the "Sell America" Strategy

A 5% 30-year yield significantly impacts the attractiveness of US assets to foreign investors. Higher yields, while seemingly beneficial, also increase borrowing costs, creating a complex interplay.

- Attractiveness of US Assets: Higher yields on US Treasury bonds might initially attract foreign investors seeking higher returns.

- Capital Flows: The impact on capital flows is uncertain. Increased yields could attract investment, but higher borrowing costs could deter it. The net effect depends on the relative strength of these opposing forces.

- US Dollar Exchange Rate: Higher yields can strengthen the US dollar, potentially making US assets more expensive for foreign investors.

- Potential Scenarios:

- Increased Foreign Investment: If the allure of higher yields outweighs the increased borrowing costs, foreign investment could surge.

- Decreased Foreign Investment: Higher borrowing costs and a stronger dollar could make US assets less attractive, leading to decreased foreign investment.

- Shift in Investor Preferences: Investors might shift their preferences towards other asset classes, such as emerging market equities or commodities, offering better risk-adjusted returns.

Alternative Investment Strategies in a High-Yield Environment

In a high-yield environment, investors need to explore alternatives to the "Sell America" strategy. Several options offer different risk-reward profiles.

- Emerging Markets: These markets often offer higher growth potential, but also carry higher risks, including political and economic instability.

- Value Stocks: Focusing on undervalued companies can offer attractive returns, but requires thorough fundamental analysis.

- Diversification: Spreading investments across various asset classes and geographies helps mitigate risk and improve the overall portfolio performance.

Conclusion: Navigating the Impact of the 5% 30-Year Yield on Your "Sell America" Strategy

The 5% 30-year yield presents both opportunities and challenges for investors employing the "Sell America" strategy. Understanding the intricate relationship between interest rates, currency exchange rates, and asset prices is crucial. The impact on capital flows and investor sentiment is uncertain, requiring a careful assessment of potential risks and rewards. To refine your 5% 30-year yield strategy and mitigate the impact of the 5% 30-year yield on your "Sell America" plan, consider diversifying your portfolio, exploring alternative investment avenues, and seeking professional advice. Don't hesitate to consult a financial advisor to optimize your investment approach in this complex, high-yield environment.

Featured Posts

-

Trans Australia Run Record A New World Standard

May 21, 2025

Trans Australia Run Record A New World Standard

May 21, 2025 -

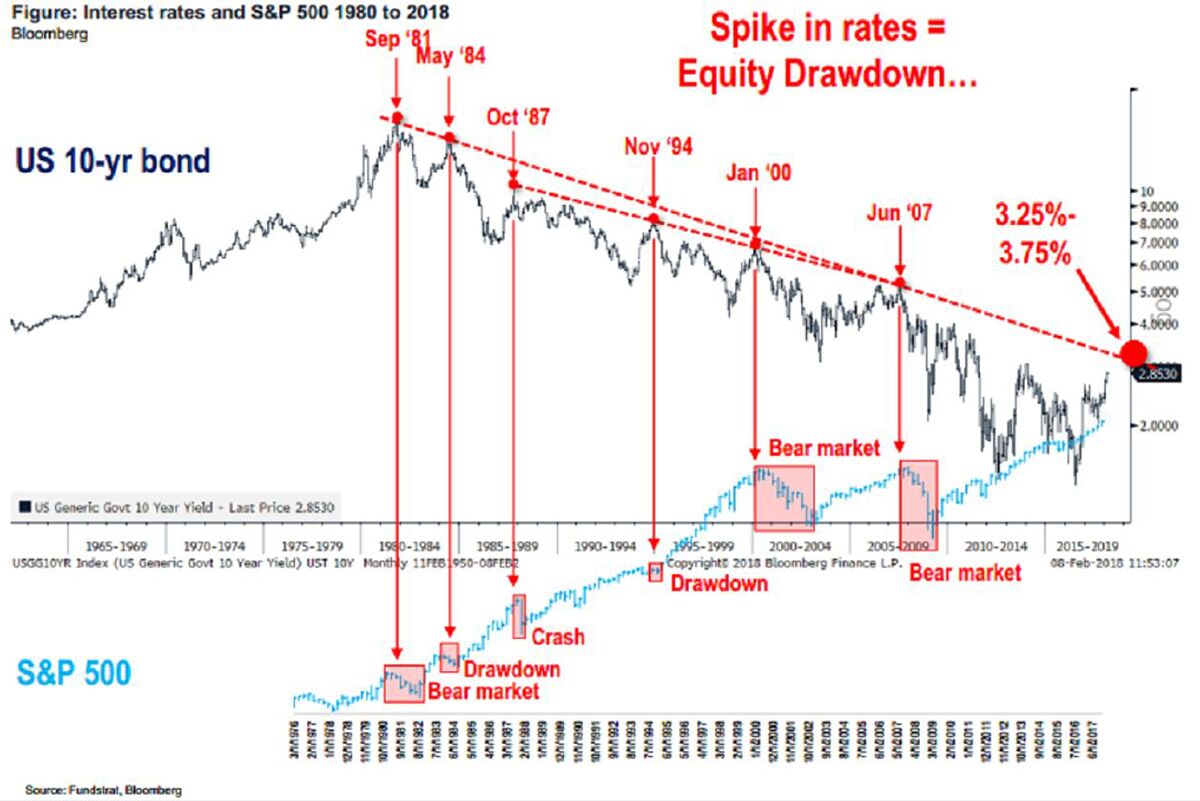

Your Guide To A Successful Screen Free Week With Children

May 21, 2025

Your Guide To A Successful Screen Free Week With Children

May 21, 2025 -

Securing A European Passport Why Americans Are Leaving The Us

May 21, 2025

Securing A European Passport Why Americans Are Leaving The Us

May 21, 2025 -

Lawsuit Update Ex Tory Councillors Wifes Racial Hatred Tweet Case

May 21, 2025

Lawsuit Update Ex Tory Councillors Wifes Racial Hatred Tweet Case

May 21, 2025 -

Fut Birthday 2024 Ea Fc 24 Player Tier List And Team Building Guide

May 21, 2025

Fut Birthday 2024 Ea Fc 24 Player Tier List And Team Building Guide

May 21, 2025

Latest Posts

-

Goretzka In Nations League Squad Nagelsmanns Selection

May 21, 2025

Goretzka In Nations League Squad Nagelsmanns Selection

May 21, 2025 -

Goretzkas Nations League Call Up A Nagelsmann Decision

May 21, 2025

Goretzkas Nations League Call Up A Nagelsmann Decision

May 21, 2025 -

Dissecting A Hell Of A Run A Critical Look At Ftv Live

May 21, 2025

Dissecting A Hell Of A Run A Critical Look At Ftv Live

May 21, 2025 -

The Power Of Resilience Protecting And Improving Your Mental Health

May 21, 2025

The Power Of Resilience Protecting And Improving Your Mental Health

May 21, 2025 -

World Cup Quarterfinal Germanys Path To Victory Against Italy

May 21, 2025

World Cup Quarterfinal Germanys Path To Victory Against Italy

May 21, 2025