Impact Of China's Lithium Export Controls: Positive Outlook For Eramet

Table of Contents

Disruption of the Global Lithium Supply Chain

China's export controls on lithium significantly disrupt the existing global lithium supply chain. For years, many countries have relied heavily on Chinese processing and refining capabilities, creating a degree of dependence that now leaves them vulnerable. This dependence, coupled with surging global demand, is leading to shortages and significant price volatility. The consequences are far-reaching:

- Increased demand for alternative lithium sources: Countries are scrambling to diversify their lithium sourcing, leading to increased competition and higher prices.

- Price increases for lithium products: The reduced supply and increased demand inevitably drive up the cost of lithium carbonate, lithium hydroxide, and other lithium-based products.

- Geopolitical instability: The reliance on a single nation for such a critical resource introduces geopolitical risks and uncertainties.

Several countries are particularly vulnerable due to their heavy reliance on Chinese lithium imports:

- Japan

- South Korea

- Several European Union member states

- United States

This disruption creates an environment ripe for companies like Eramet to capitalize on the increased need for secure and reliable lithium supplies.

Eramet's Strategic Positioning and Advantages

Eramet is uniquely positioned to benefit from this disruption. Unlike many competitors heavily reliant on Chinese processing, Eramet possesses a strategically diversified portfolio of lithium projects located outside China. Its vertically integrated business model, encompassing mining, processing, and refining, provides greater control over its supply chain and reduces its vulnerability to external factors.

- Diversified lithium source locations reduce reliance on China: Eramet's geographically dispersed assets minimize its exposure to geopolitical risks associated with China's export controls.

- Own processing facilities for greater supply chain control: This ensures consistent supply and reduces dependence on external processors.

- Strong environmental, social, and governance (ESG) credentials enhance investor appeal: Eramet’s commitment to sustainable and responsible lithium mining practices makes it an attractive partner for environmentally conscious companies.

This combination of geographic diversification, vertical integration, and a strong ESG profile positions Eramet as a reliable and sustainable lithium supplier in a market increasingly demanding these qualities.

Increased Demand and Market Opportunities for Eramet

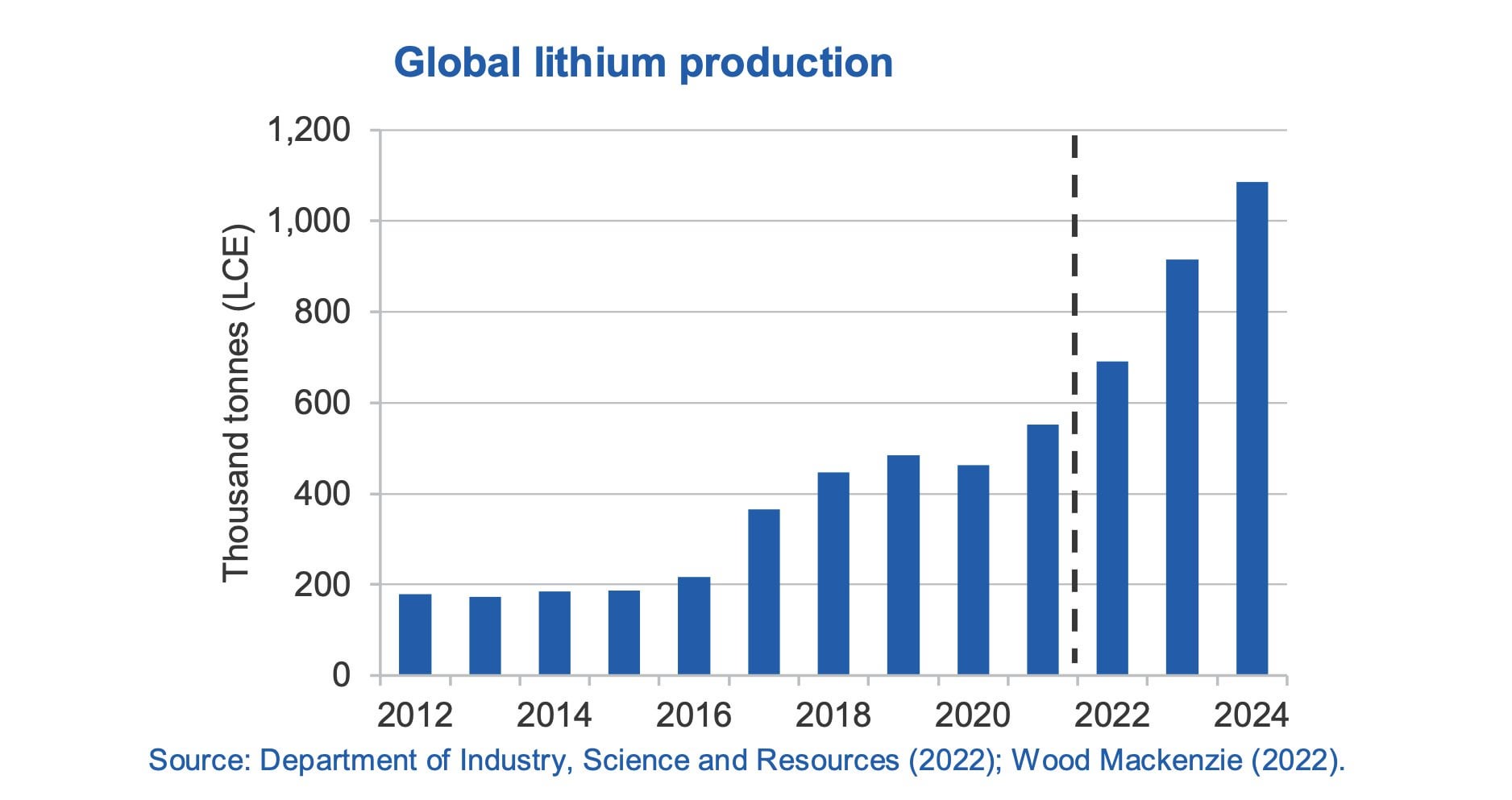

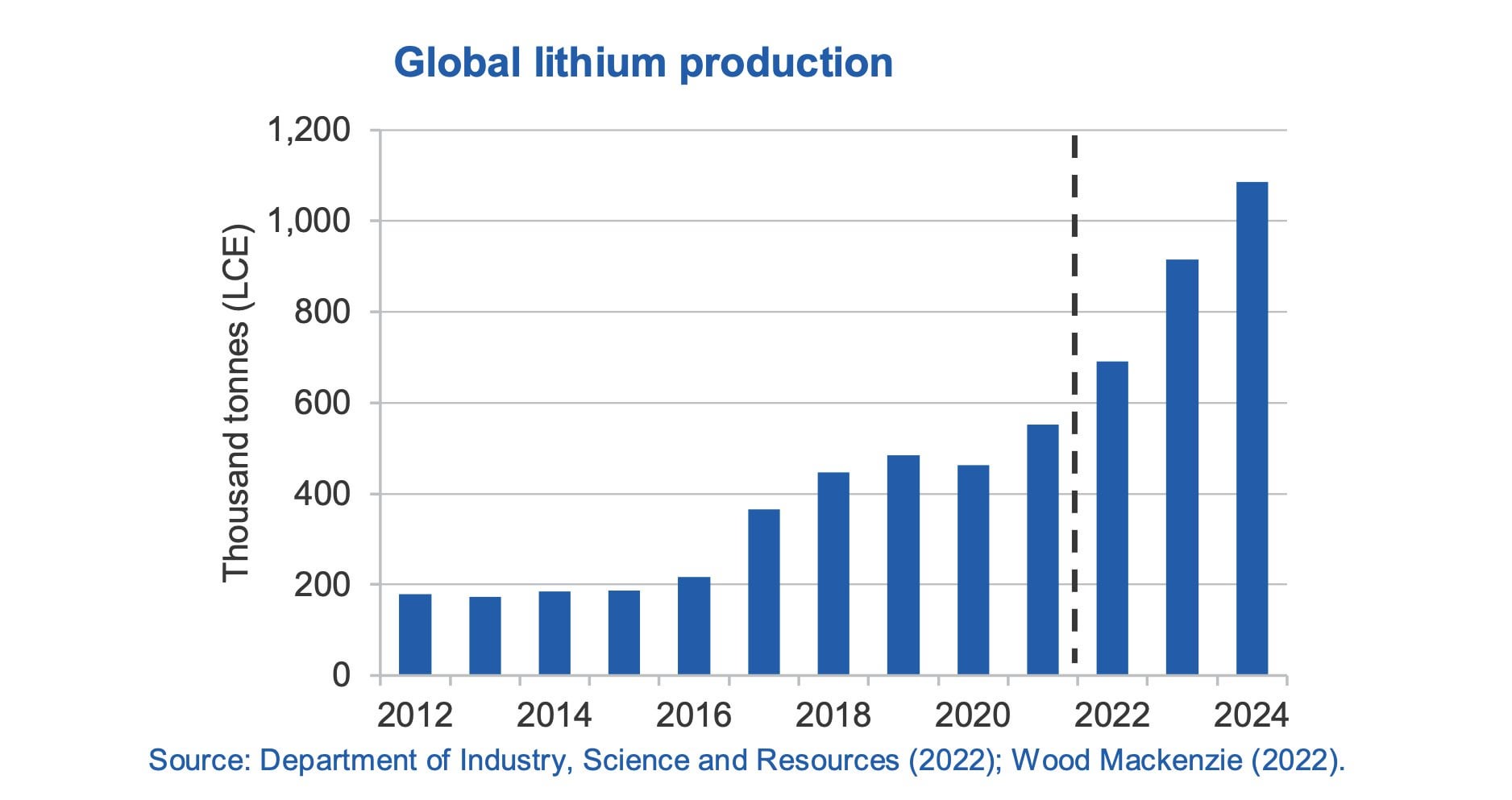

The burgeoning electric vehicle (EV) and energy storage systems (ESS) markets are driving unprecedented demand for lithium. China's export controls only exacerbate this already intense demand, creating a significant market gap that Eramet is ideally suited to fill.

- Significant growth in EV and battery storage markets: The global transition to electric mobility and renewable energy is fueling explosive growth in lithium demand.

- Opportunities to supply lithium to auto manufacturers and battery producers directly: Eramet can leverage its robust supply chain to forge direct relationships with key players in the EV and battery industries.

- Potential for strategic alliances with technology companies: Collaborations with technology companies can further enhance Eramet’s market reach and technological capabilities.

Financial Implications and Growth Projections for Eramet

The confluence of factors—increased lithium prices, expanding market share, and robust supply chain control—suggests significant financial benefits for Eramet. While precise forecasts require detailed financial modeling, the potential for increased revenue and market capitalization is substantial. The increased demand and the resulting higher lithium prices translate to higher profit margins for Eramet. This, in turn, is likely to boost investor confidence and positively influence the Eramet stock price, presenting an attractive investment opportunity for those seeking exposure to the burgeoning lithium market.

Conclusion: The Future of Lithium and Eramet's Promising Trajectory

China's lithium export controls have created significant challenges for the global lithium market, but also a considerable opportunity for companies like Eramet. Eramet's strategic positioning within the lithium value chain, its commitment to sustainable practices, and its ability to meet the growing demand for lithium, position it for substantial growth. The company’s diversified sourcing, vertical integration, and strong ESG profile make it a key beneficiary of the reshaped global lithium landscape. Learn more about Eramet's strategic position in this burgeoning market and explore the investment opportunities it presents by visiting [link to Eramet's investor relations page]. The future of lithium is bright, and Eramet is poised to play a leading role in shaping that future.

Featured Posts

-

The Suits La Premiere A Deeper Look At The Shocking Twist

May 14, 2025

The Suits La Premiere A Deeper Look At The Shocking Twist

May 14, 2025 -

Riverhead Police Blotter Week Of February 9 2025

May 14, 2025

Riverhead Police Blotter Week Of February 9 2025

May 14, 2025 -

Is Vince Vaughn Italian Exploring His Ethnicity

May 14, 2025

Is Vince Vaughn Italian Exploring His Ethnicity

May 14, 2025 -

Watch The Sweetest Tribute Scotty Mc Creerys Son Sings George Strait

May 14, 2025

Watch The Sweetest Tribute Scotty Mc Creerys Son Sings George Strait

May 14, 2025 -

Indulge In Chocolate Lindt Opens Flagship Store In Central London

May 14, 2025

Indulge In Chocolate Lindt Opens Flagship Store In Central London

May 14, 2025

Latest Posts

-

Premier League Bound Dean Huijsens Transfer Decision Revealed

May 14, 2025

Premier League Bound Dean Huijsens Transfer Decision Revealed

May 14, 2025 -

Liverpool Eye Bournemouths Huijsen Transfer Update

May 14, 2025

Liverpool Eye Bournemouths Huijsen Transfer Update

May 14, 2025 -

Huijsen To Bournemouth Real Madrids Transfer Strategy Explained

May 14, 2025

Huijsen To Bournemouth Real Madrids Transfer Strategy Explained

May 14, 2025 -

Huijsen Chooses His Premier League Future Club Announced

May 14, 2025

Huijsen Chooses His Premier League Future Club Announced

May 14, 2025 -

Liverpool Transfers Reds Tracking Bournemouths Dean Huijsen

May 14, 2025

Liverpool Transfers Reds Tracking Bournemouths Dean Huijsen

May 14, 2025