Impact Of Trump's 30% Tariffs On China: A 2025 Outlook

Table of Contents

This article analyzes the long-term effects of the 30% tariffs imposed on Chinese goods by the Trump administration, examining their lingering impact on the global economy, specifically focusing on the year 2025 and projecting future trends. We delve into the lasting effects on various sectors, supply chains, and geopolitical relations. The ripple effects of this trade war continue to shape the economic landscape, and understanding these impacts is crucial for navigating the future.

Impact on US Consumers

Increased Prices

The Trump tariffs directly led to higher prices for US consumers on a wide range of goods. This increase wasn't evenly distributed; some sectors felt the impact more severely than others.

- Electronics: Tariffs on electronic components and finished goods resulted in increased costs for computers, smartphones, and televisions.

- Furniture: Furniture imports from China faced significant tariffs, leading to noticeably higher prices for consumers.

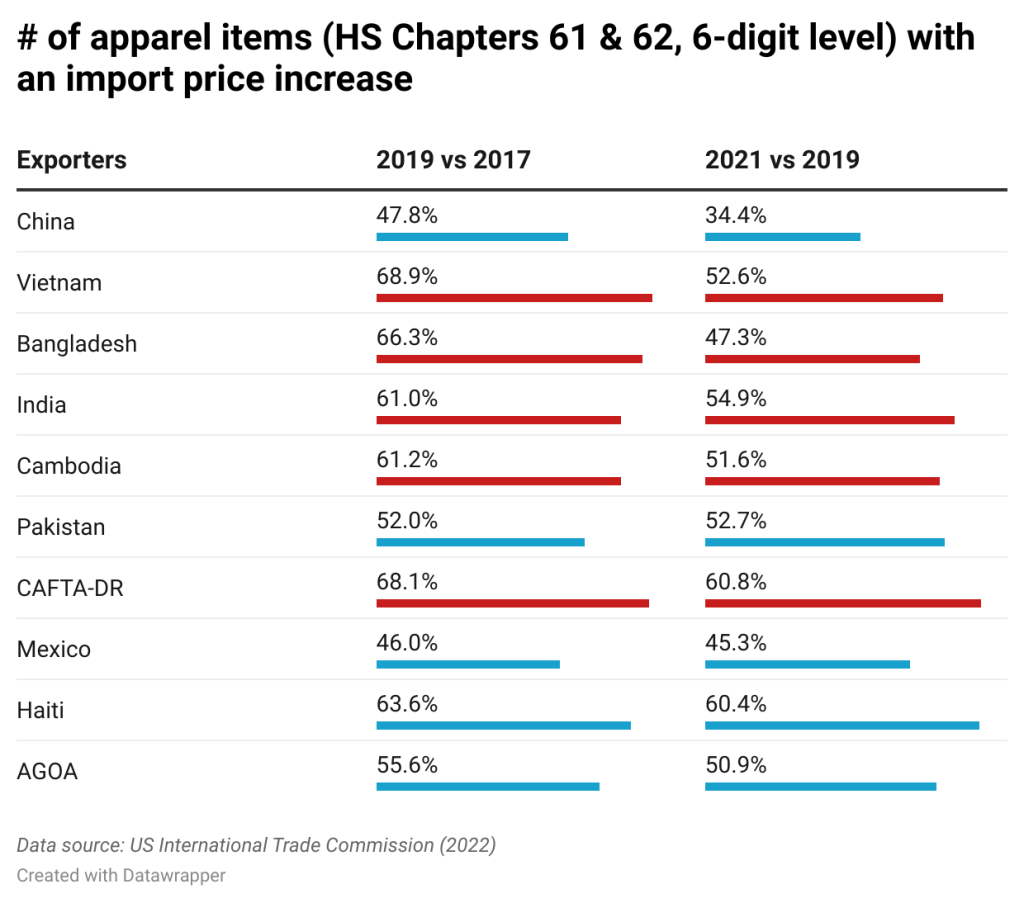

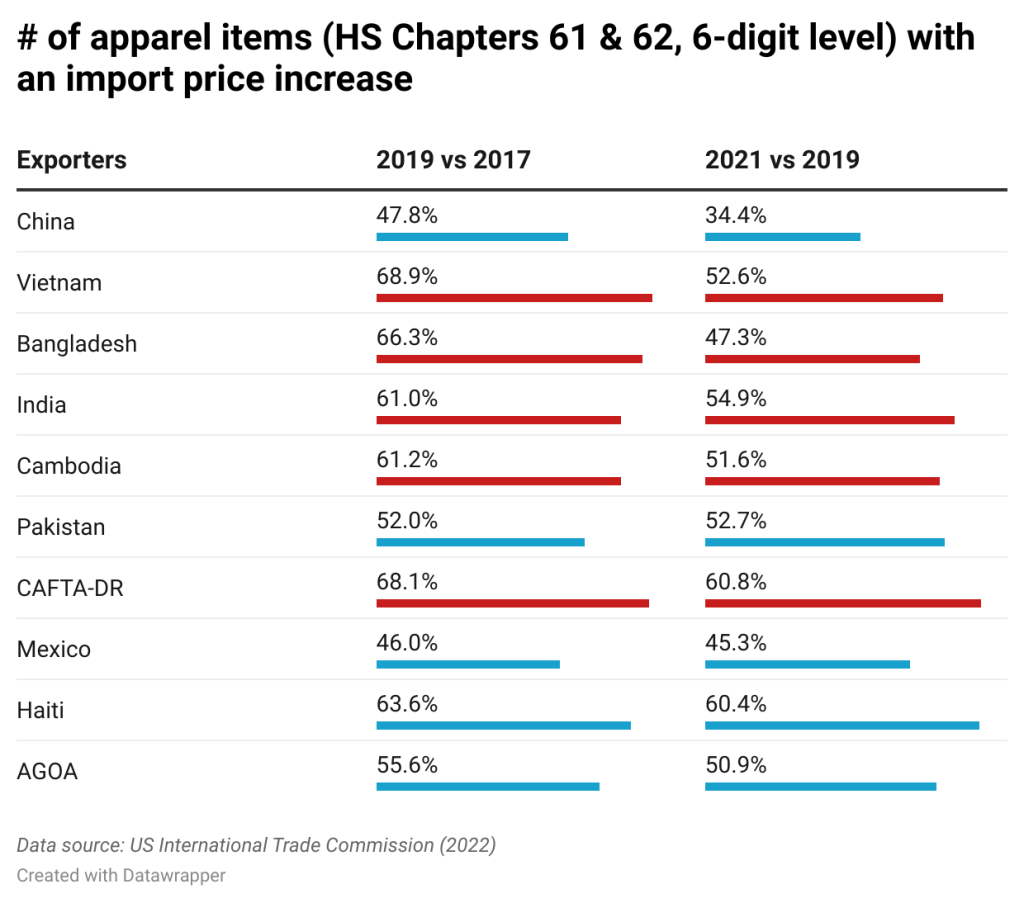

- Clothing and Apparel: The cost of clothing and footwear also increased due to tariffs on imported textiles and finished garments.

Data from the Bureau of Labor Statistics showed a significant correlation between the implementation of tariffs and increases in the Consumer Price Index (CPI) for these categories. The inflationary pressures spurred by these tariffs contributed to a broader economic challenge for American households. Estimates suggest that the average American family saw an annual increase in spending of several hundred dollars due to these increased prices.

Shifts in Consumer Behavior

Faced with higher prices, US consumers adjusted their purchasing habits. This shift had profound implications for both domestic and international markets.

- Increased demand for domestically produced goods: Consumers sought out American-made alternatives, boosting some domestic industries.

- Shift towards cheaper alternatives: Consumers also turned to lower-priced goods from other countries, benefiting producers in countries like Vietnam and Mexico.

- Decreased overall consumption: For some goods, the price increase was enough to deter purchases altogether, leading to decreased overall consumption in certain sectors.

Market share data clearly indicates a shift in consumer preferences. Domestic manufacturers experienced a temporary surge in demand, while importers from China faced a significant downturn. This shift highlights the intricate interplay between trade policy and consumer behavior.

Effects on US Businesses

Increased Production Costs

Businesses relying on Chinese imports faced significantly increased production costs due to the tariffs. This impact varied across different industries.

- Manufacturing: Manufacturers heavily reliant on Chinese-made components experienced major cost increases, impacting profitability.

- Retail: Retailers selling imported goods faced pressure to absorb the increased costs or pass them on to consumers, affecting their margins and competitiveness.

Analyzing business profitability data reveals a clear decline in certain sectors after the tariff implementation. Many companies responded by exploring alternative sourcing strategies.

Competitive Landscape Shifts

The tariffs reshaped the competitive landscape, benefiting some businesses while harming others.

- Reshoring and nearshoring initiatives: Some US businesses responded by bringing production back to the US (reshoring) or relocating it to nearby countries (nearshoring), attempting to mitigate tariff impacts.

- Impact on smaller businesses vs. larger corporations: Smaller businesses, with less financial flexibility, were often disproportionately affected compared to larger corporations with greater resources to adjust their supply chains.

Changes in global trade rankings and market share analyses reveal a complex picture. While some US businesses gained a competitive edge, others struggled to adapt, showcasing the uneven impact of the tariffs across different business sizes and sectors.

Consequences for the Chinese Economy

Economic Slowdown and Adjustments

China's economy experienced a noticeable slowdown in response to the tariffs, forcing economic adjustments.

- Changes in export strategies: China diversified its export markets, reducing its reliance on the US market.

- Diversification of trade partners: China strengthened trade relationships with countries like the EU, ASEAN, and Africa.

GDP growth rates and trade volume data reflect China's response. While initially impacted, China’s economy demonstrated resilience, adapting its strategies to mitigate the effects of the trade war.

Technological Advancement and Self-Reliance

The tariffs accelerated China's focus on technological independence and self-reliance.

- Investment in domestic technology: China significantly increased investment in domestic technology sectors, aiming to reduce its dependence on US technology.

- Reduced reliance on US technology: This push toward self-sufficiency led to the growth of domestic tech companies and reduced reliance on US imports in certain key areas.

Government spending on research and development (R&D) surged, fostering innovation and growth within China's tech sector. This resulted in a noticeable acceleration of technological development in key areas.

Geopolitical Ramifications

Strained US-China Relations

The tariffs significantly strained US-China relations, escalating trade tensions and impacting diplomatic interactions. The trade war became a symbol of broader geopolitical competition.

Global Trade Restructuring

The Trump tariffs contributed to a broader restructuring of global trade patterns.

- Shifting alliances: Countries reassessed their relationships with the US and China, leading to shifts in alliances and trade agreements.

- Formation of new trade blocs: The trade war spurred discussions and the formation of new regional trade blocs as countries sought to diversify their economic partnerships.

Conclusion

Trump's 30% tariffs on China had profound and lasting impacts, extending far beyond the initial trade dispute. By 2025, the consequences were evident across various sectors: increased prices for US consumers, adjustments in US business strategies, significant shifts in the Chinese economy, and a restructuring of global geopolitical relations. The inflationary pressures and supply chain disruptions stemming from the tariffs continue to reverberate throughout the global economy. The complexities and long-term ripple effects of such trade policies serve as a cautionary tale.

Understanding the lingering impact of Trump's 30% tariffs on China is crucial for businesses and policymakers alike. Further research into the evolving US-China trade relationship and the continued effects of these tariffs is essential for navigating the complex landscape of global trade in 2025 and beyond. Stay informed on the latest developments concerning the impact of the Trump tariffs on China and its global implications.

Featured Posts

-

Ucapan Selamat Ulang Tahun Untuk Jusuf Kalla Dari Gaza Harapan Perdamaian Israel Palestina

May 18, 2025

Ucapan Selamat Ulang Tahun Untuk Jusuf Kalla Dari Gaza Harapan Perdamaian Israel Palestina

May 18, 2025 -

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance Radio 94 5

May 18, 2025

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance Radio 94 5

May 18, 2025 -

7 Bit Casino A Comprehensive Guide To The Best Online Casino Experience In Canada

May 18, 2025

7 Bit Casino A Comprehensive Guide To The Best Online Casino Experience In Canada

May 18, 2025 -

Las Vegas Sands Ends Pursuit Of Nassau Coliseum Casino Resort

May 18, 2025

Las Vegas Sands Ends Pursuit Of Nassau Coliseum Casino Resort

May 18, 2025 -

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025