Important Information For BigBear.ai (BBAI) Investors Regarding Legal Action

Table of Contents

Understanding Potential Legal Risks for BBAI Investors

Investing in the technology sector, particularly in smaller-cap companies like BBAI, inherently carries significant risk. These risks are amplified when legal issues arise.

-

General Investment Risks: The technology sector is known for its rapid changes and intense competition. Smaller companies like BBAI often face challenges related to scaling operations, securing funding, and managing rapid growth. These factors contribute to increased volatility in their stock prices.

-

Increased Scrutiny: Publicly traded companies, especially those in the technology sector, are under intense scrutiny from regulators like the SEC. Strict compliance with financial reporting standards is paramount. Any deviation can lead to investigations and potential legal action.

-

Impact of Lawsuits: Lawsuits or SEC investigations can severely impact BBAI's stock price and investor confidence. Negative publicity associated with legal battles can erode investor trust, leading to sell-offs and a decline in the stock's value. Even if the company is ultimately exonerated, the legal process itself can create significant uncertainty and volatility.

-

Keywords: Investment risk, BBAI stock price, SEC investigation, financial reporting, compliance, technology sector, small-cap stocks.

Analyzing Recent SEC Filings and Public Statements

Staying informed about BBAI's legal situation requires carefully reviewing its SEC filings and public statements.

-

Accessing SEC Filings: Investors can access crucial information through the SEC's EDGAR database (www.sec.gov). Key filings to monitor include 10-K (annual report), 10-Q (quarterly report), and 8-K (current reports).

-

Interpreting Filings: Pay close attention to sections detailing litigation, legal proceedings, and any potential regulatory issues. Look for mentions of lawsuits, settlements, or investigations that could impact BBAI's financial performance.

-

Public Statements: Press releases and other public statements issued by BBAI should also be carefully reviewed. These announcements may offer insights into the company's response to legal challenges and their potential impact.

-

Keywords: SEC filings, 10-K, 10-Q, 8-K, press release, public statement, litigation, legal proceedings.

Assessing the Impact of Legal Action on BBAI's Future

The outcome of any legal action against BBAI could significantly impact its future.

-

Financial Performance: Legal battles can consume significant resources, affecting the company's profitability and financial stability. Fines, settlements, and legal fees can strain BBAI's finances, impacting its ability to invest in research, development, and growth.

-

Business Operations: Lawsuits can disrupt BBAI's business operations, potentially delaying projects, harming its reputation, and damaging relationships with clients and partners.

-

Investor Sentiment: Negative news surrounding legal issues can severely damage investor sentiment, leading to decreased stock valuation and making it more challenging to attract future investments.

-

Keywords: Financial performance, BBAI future, stock valuation, investor sentiment, contracts, partnerships, business operations.

Protecting Yourself as a BBAI Investor

Mitigating risk and protecting your investment requires a proactive approach.

-

Consult Professionals: Before making any investment decisions, consult with a qualified financial advisor and legal professional. They can provide personalized guidance based on your financial situation and risk tolerance.

-

Diversification: Diversifying your investment portfolio is crucial to reduce overall risk. Don't put all your eggs in one basket. Spread your investments across different asset classes and companies to minimize the impact of any single investment's underperformance.

-

Risk Assessment: Conduct thorough due diligence before investing in BBAI or any other company. Understand the company's business model, financial health, and the potential risks associated with its industry and operations.

-

Keywords: Risk mitigation, investment strategy, diversification, financial advisor, legal professional.

Making Informed Decisions as a BigBear.ai (BBAI) Investor

Investing in BigBear.ai (BBAI) requires understanding the potential legal risks and staying informed about the company's legal developments. By carefully reviewing SEC filings, public statements, and seeking professional advice, investors can make more informed decisions. Remember, staying updated on BigBear.ai (BBAI) legal matters is crucial for mitigating risk and protecting your investment. Consult financial and legal professionals for personalized advice tailored to your situation. Stay informed about BigBear.ai (BBAI) and its legal developments to make sound investment decisions. Understanding the intricacies of BBAI investment requires a diligent approach to evaluating the legal landscape. Careful consideration of the BBAI legal risks will allow for more informed investment choices.

Featured Posts

-

Expanded Balikatan Exercises Philippines And Us Strengthen Military Ties

May 20, 2025

Expanded Balikatan Exercises Philippines And Us Strengthen Military Ties

May 20, 2025 -

Up To 60 Off Hugo Boss Perfumes Amazons Spring 2025 Sale

May 20, 2025

Up To 60 Off Hugo Boss Perfumes Amazons Spring 2025 Sale

May 20, 2025 -

Nyt Mini Crossword Clues And Answers March 13 2025

May 20, 2025

Nyt Mini Crossword Clues And Answers March 13 2025

May 20, 2025 -

Former Munster Prop James Cronin Leads Highfield

May 20, 2025

Former Munster Prop James Cronin Leads Highfield

May 20, 2025 -

Lewis Hamiltonin Ja Ferrarin Yhteistyoe Taeydellinen Katastrofi

May 20, 2025

Lewis Hamiltonin Ja Ferrarin Yhteistyoe Taeydellinen Katastrofi

May 20, 2025

Latest Posts

-

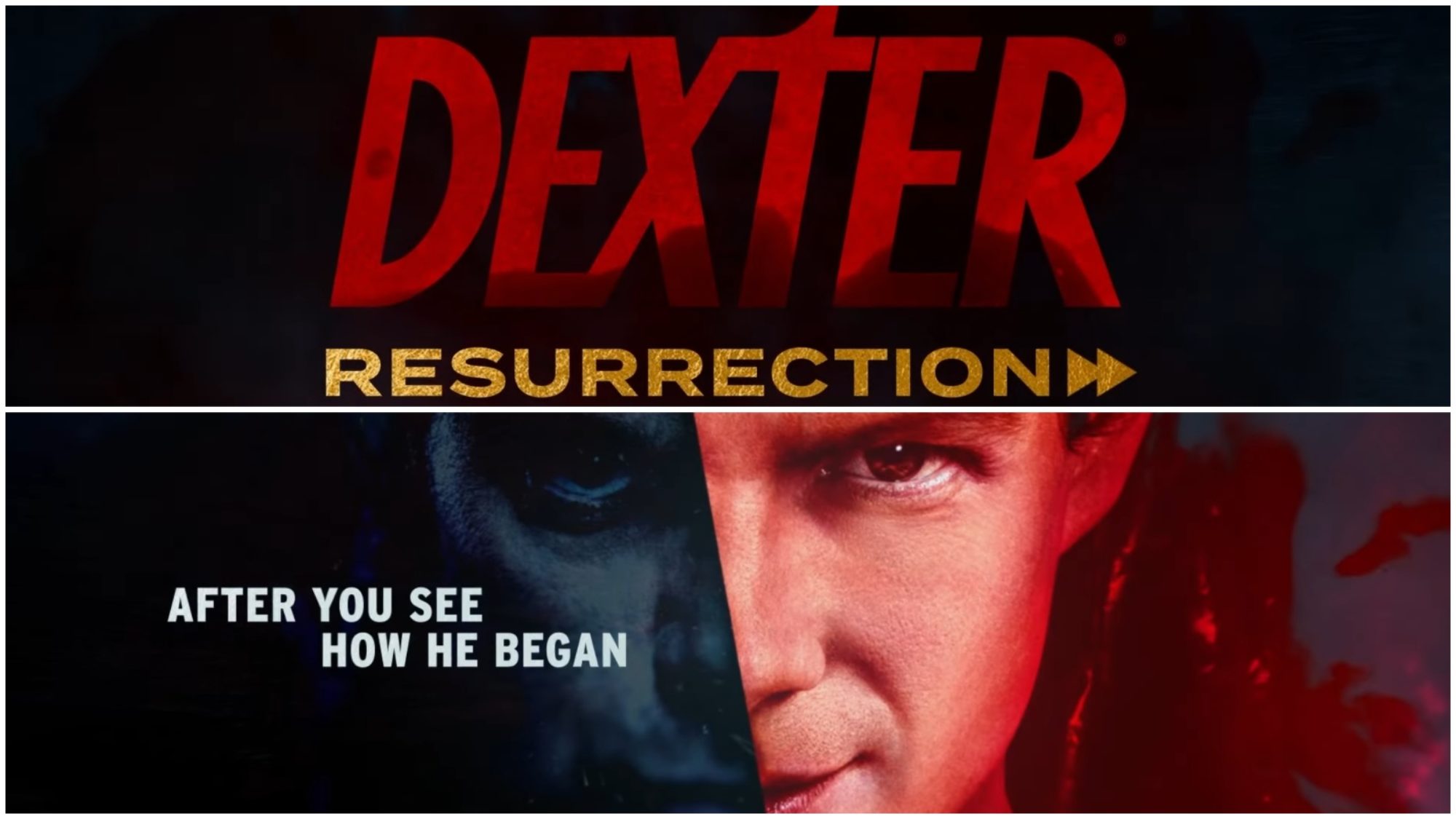

Is The Dexter Resurrection Trailer Release Date Out

May 21, 2025

Is The Dexter Resurrection Trailer Release Date Out

May 21, 2025 -

Fan Favorite Villain Returns In Dexter Resurrection

May 21, 2025

Fan Favorite Villain Returns In Dexter Resurrection

May 21, 2025 -

Dexter Revival New Trailer Release Date Hints Emerge

May 21, 2025

Dexter Revival New Trailer Release Date Hints Emerge

May 21, 2025 -

Dexter New Blood Prepare With The Original Sin Steelbook Blu Ray

May 21, 2025

Dexter New Blood Prepare With The Original Sin Steelbook Blu Ray

May 21, 2025 -

Original Sin Season 1 Finale How It Makes Dexters Debra Morgan Mistake Worse

May 21, 2025

Original Sin Season 1 Finale How It Makes Dexters Debra Morgan Mistake Worse

May 21, 2025