Income Tax Scrutiny: HMRC Sending Letters To High Earners In The UK

Table of Contents

Reasons for Increased HMRC Scrutiny of High Earners

HMRC's increased focus on high earners isn't arbitrary. Several factors contribute to this intensified income tax scrutiny:

- Higher Potential Tax Revenue: High-net-worth individuals (HNWIs) naturally contribute a larger portion of overall tax revenue. Even small discrepancies in their tax returns can represent substantial sums for the government. This makes them a priority target for HMRC investigations.

- Sophisticated Tax Avoidance Schemes: High earners often have access to complex financial structures and sophisticated tax avoidance schemes designed to minimize their tax liabilities. HMRC is actively working to identify and counteract these strategies. This includes the use of offshore accounts and complex investment vehicles.

- Offshore Accounts and Complex Financial Structures: The use of offshore accounts and complex financial structures to reduce tax burdens is a major focus of HMRC's investigations. International collaborations and data sharing agreements are making it increasingly difficult for individuals to conceal income.

- Data Sharing Agreements: HMRC is increasingly collaborating with international tax authorities through data sharing agreements. This allows them to access information about UK residents' offshore accounts and assets, significantly improving their ability to identify and investigate potential tax evasion.

Bullet Points:

- HMRC utilizes advanced data analytics to identify discrepancies and anomalies in tax returns, flagging potentially suspicious activity.

- Specific sectors known for complex tax structures, such as finance and property, are subject to increased scrutiny.

- Penalties for non-compliance with tax regulations have increased significantly, creating a stronger deterrent against tax evasion and avoidance.

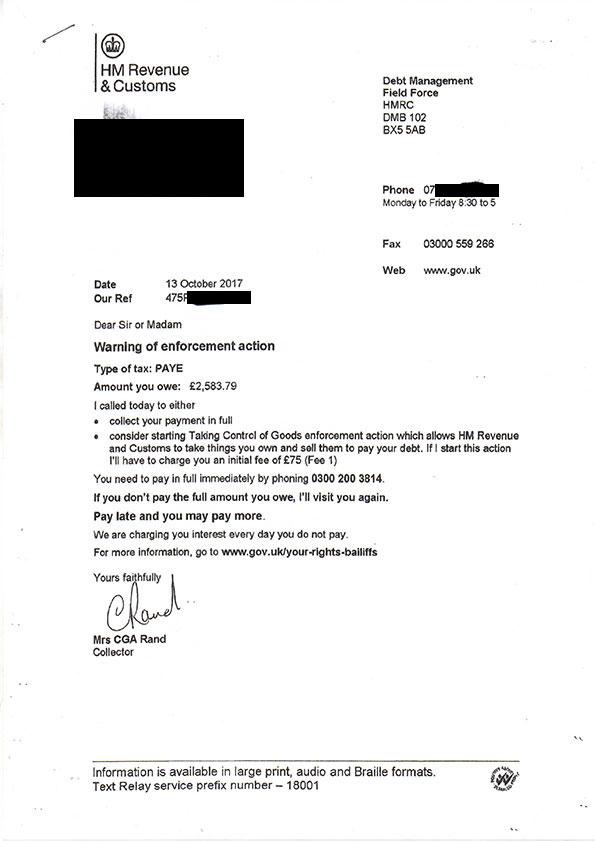

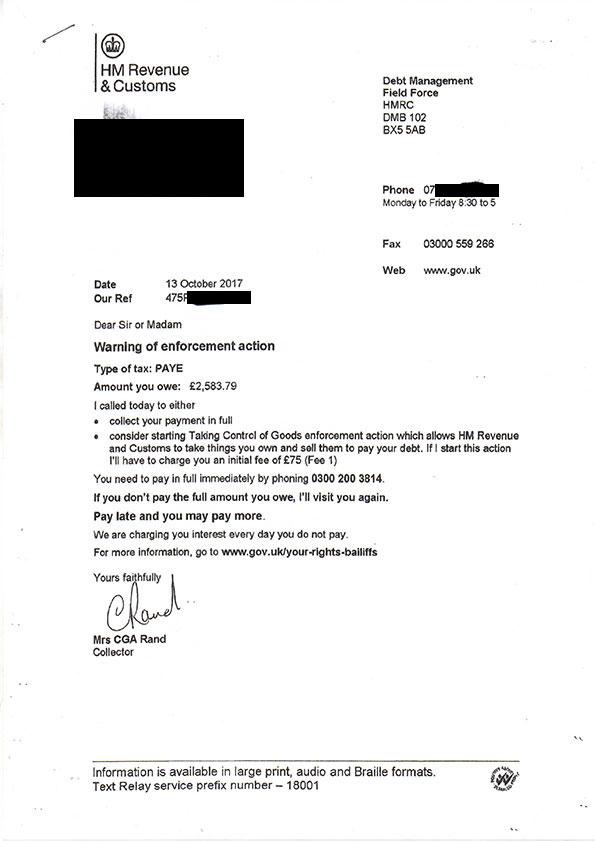

What to Do if You Receive an HMRC Letter

Receiving a letter from HMRC regarding an income tax enquiry can be unsettling. However, a proactive and informed response is crucial. Here's what you should do:

- Don't Ignore the Letter: Ignoring an HMRC letter will only exacerbate the situation and lead to more severe consequences. Prompt action is essential.

- Gather Relevant Documents: Immediately begin collecting all relevant financial documents, including bank statements, investment records, and tax returns. Accurate record-keeping is vital throughout the process.

- Seek Professional Advice: Contact a qualified tax advisor or tax investigation specialist immediately. They possess the expertise to navigate the complexities of tax legislation and represent your interests effectively during an HMRC enquiry. This is especially important if your situation involves complex financial structures or offshore accounts.

- Understand Your Rights: Familiarize yourself with your rights and the procedures involved in an HMRC tax investigation. Your advisor can guide you through this process.

- Cooperate Fully (But Protect Your Interests): While cooperation with HMRC is essential, it's equally important to protect your interests and ensure your rights are respected. This requires careful consideration and skilled representation.

Bullet Points:

- Maintain detailed records of all communication with HMRC, including emails, letters, and phone calls.

- Professional representation is strongly advised to interpret complex tax legislation and effectively communicate with HMRC.

- Understand the potential penalties for non-compliance, including financial penalties and even criminal prosecution in severe cases.

- Prepare for a potential tax audit, where HMRC may request further documentation and clarification.

Preventing Income Tax Scrutiny

Proactive tax planning and compliance are the best ways to minimize the risk of an HMRC investigation. Consider these strategies:

- Accurate Record Keeping: Maintain meticulous and organized financial records. This will significantly simplify any HMRC enquiry and demonstrate your commitment to tax compliance.

- Professional Tax Planning: Engage a qualified tax advisor or accountant to assist with your tax planning and ensure you are compliant with all relevant legislation. They can help you understand and utilize legitimate tax planning strategies.

- Accurate Tax Returns: Ensure all your tax returns are completed accurately and submitted on time. Late submissions or inaccuracies will immediately raise red flags with HMRC.

- Understanding Complex Structures: If you have complex financial structures or offshore accounts, it's crucial to fully understand the tax implications and ensure complete transparency with HMRC.

- Legitimate Tax Planning: Use only legitimate tax planning strategies. Any attempt at tax avoidance will significantly increase your risk of an HMRC investigation.

Bullet Points:

- Regularly review your tax position to identify any potential issues before they escalate.

- Engage a tax accountant to assist with your self-assessment tax return to ensure accuracy and compliance.

- Stay updated on any changes to tax legislation to ensure you remain compliant. Tax laws are frequently updated.

- Maintain transparency in all your financial dealings, avoiding any actions that could be construed as attempts to conceal income or assets.

Conclusion

Increased HMRC scrutiny of high earners is a reality in the UK. Responding appropriately to HMRC correspondence and proactively managing your tax affairs are crucial to mitigating risks. Accurate record keeping, professional tax advice, and a thorough understanding of tax legislation are key to preventing income tax scrutiny. Facing income tax scrutiny from HMRC can be daunting. Don't navigate it alone. Contact a qualified tax advisor today for expert guidance on income tax scrutiny and ensuring your tax compliance. Protect yourself from potential income tax investigations by proactively managing your tax affairs.

Featured Posts

-

The Amorim Effect Assessing Man Utds New Striker

May 20, 2025

The Amorim Effect Assessing Man Utds New Striker

May 20, 2025 -

Chinas Fury The U S Missile System Causing International Tensions

May 20, 2025

Chinas Fury The U S Missile System Causing International Tensions

May 20, 2025 -

Rodina Jennifer Lawrence Sa Opaet Rozrastla Herecka Tajne Porodila Druhe Dieta

May 20, 2025

Rodina Jennifer Lawrence Sa Opaet Rozrastla Herecka Tajne Porodila Druhe Dieta

May 20, 2025 -

Gaite Lyrique La Securite Du Lieu Remise En Question Apres Depart Des Salaries

May 20, 2025

Gaite Lyrique La Securite Du Lieu Remise En Question Apres Depart Des Salaries

May 20, 2025 -

Ferrari And Leclerc Imola Press Conference Statement

May 20, 2025

Ferrari And Leclerc Imola Press Conference Statement

May 20, 2025

Latest Posts

-

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrdeno Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025

Izvor Blizak Jennifer Lawrence Otkriva Detalje O Drugom Djetetu

May 20, 2025 -

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025

Jennifer Lawrence I Njezino Drugo Dijete Sve Sto Znamo

May 20, 2025 -

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Novi Clan Obitelji Lawrence Potvrda O Drugom Djetetu

May 20, 2025 -

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Je Li Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025