Increased Endowment Taxes For Ivy League: Harvard And Yale In Focus

Table of Contents

The Argument for Increased Endowment Taxes

The argument for taxing Ivy League endowments centers on issues of wealth inequality and equitable access to education.

Addressing Wealth Inequality

Taxing these massive endowments could significantly contribute to redistributing wealth and funding crucial social programs.

- Underfunded programs: These funds could bolster underfunded areas like affordable housing, healthcare, and early childhood education.

- Wealth disparity: The extreme wealth concentration represented by these endowments exacerbates existing inequalities, a problem taxing these funds could help alleviate.

- Ethical obligations: Many argue that universities, especially those with vast resources, have a moral obligation to contribute more significantly to the societal good, beyond simply educating their students.

Funding Public Education

Increased taxes on Ivy League endowments could alleviate the chronic underfunding of public universities.

- Funding disparity: Public universities consistently receive significantly less funding per student than their private counterparts.

- Opportunity cost: The massive resources held by Ivy League endowments represent a considerable opportunity cost for public education. These funds could be used to expand access, reduce tuition fees, and improve infrastructure at public institutions.

- Tuition comparison: The stark difference in tuition costs between Ivy League schools and public universities highlights the unequal access to higher education. Taxing endowments could help bridge this gap.

Promoting Transparency and Accountability

Greater transparency in endowment management and spending is crucial.

- Questionable investments: Concerns exist about the ethical implications of some endowment investments, particularly those in fossil fuels or other controversial sectors.

- Public reporting: Increased public scrutiny and reporting requirements could ensure responsible use of these funds.

- Preventing misuse: Stronger oversight can help prevent potential misuse of endowment funds and ensure they're used for their intended purpose: furthering education and research.

Counterarguments Against Increased Endowment Taxes

Opponents of increased endowment taxes raise concerns about several potential negative consequences.

Impact on Research and Financial Aid

Increased taxation could severely curtail research funding and financial aid programs.

- Research funding: A substantial portion of research funding at Ivy League universities comes directly from endowments. Increased taxes could jeopardize critical research projects in various fields.

- Financial aid: Endowments provide significant financial aid to students, making Ivy League education accessible to a wider range of socioeconomic backgrounds. Taxation could drastically reduce the number of students who can afford to attend.

- Reduced opportunities: The reduction in funding could lead to fewer scholarships and research opportunities, hindering student success and scientific advancement.

Stifling Philanthropy

Higher taxes could discourage future donations, threatening the long-term stability of these institutions.

- Charitable giving: Universities rely heavily on philanthropic donations to supplement their endowments. Increased taxes could make such giving less attractive.

- Decreased donations: The fear of increased taxation could lead to a significant decrease in future donations, impacting both current and future students.

- Unintended consequences: Such a decrease could have profound and unintended negative consequences on the universities’ ability to operate and fund vital programs.

Economic Implications

Increased taxes could negatively impact the broader economy.

- Economic contribution: Universities are major economic contributors, creating jobs and driving innovation. Reduced spending could have ripple effects throughout the economy.

- Reduced investment: Higher taxes could discourage investment in endowments, potentially leading to job losses within the institutions and related sectors.

- Negative repercussions: The overall economic impact of decreased university spending could be significant and far-reaching.

Harvard and Yale: Specific Examples and Case Studies

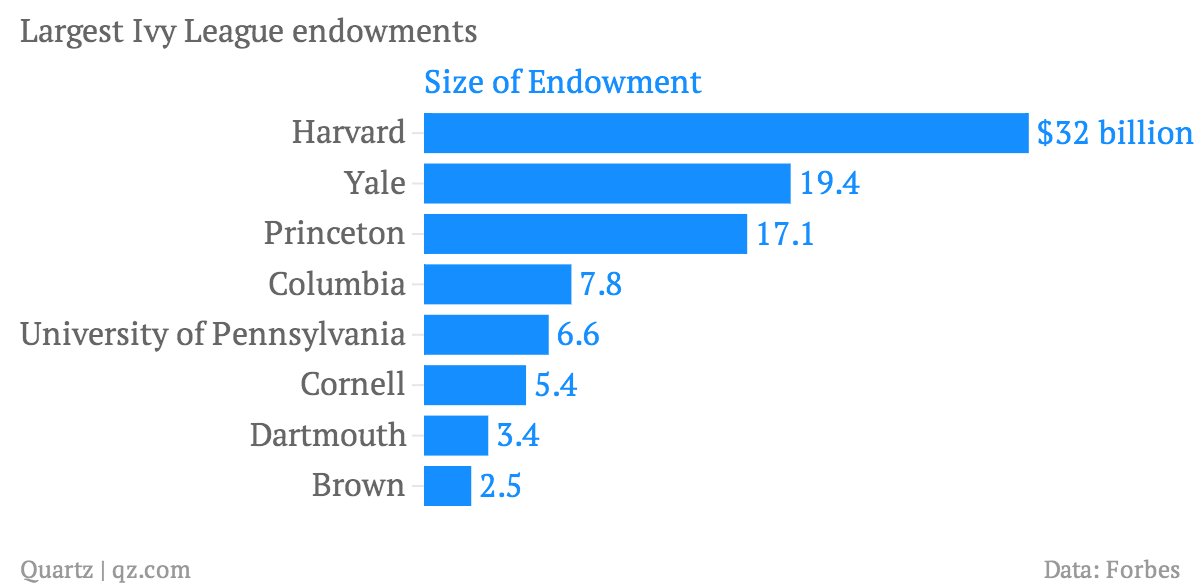

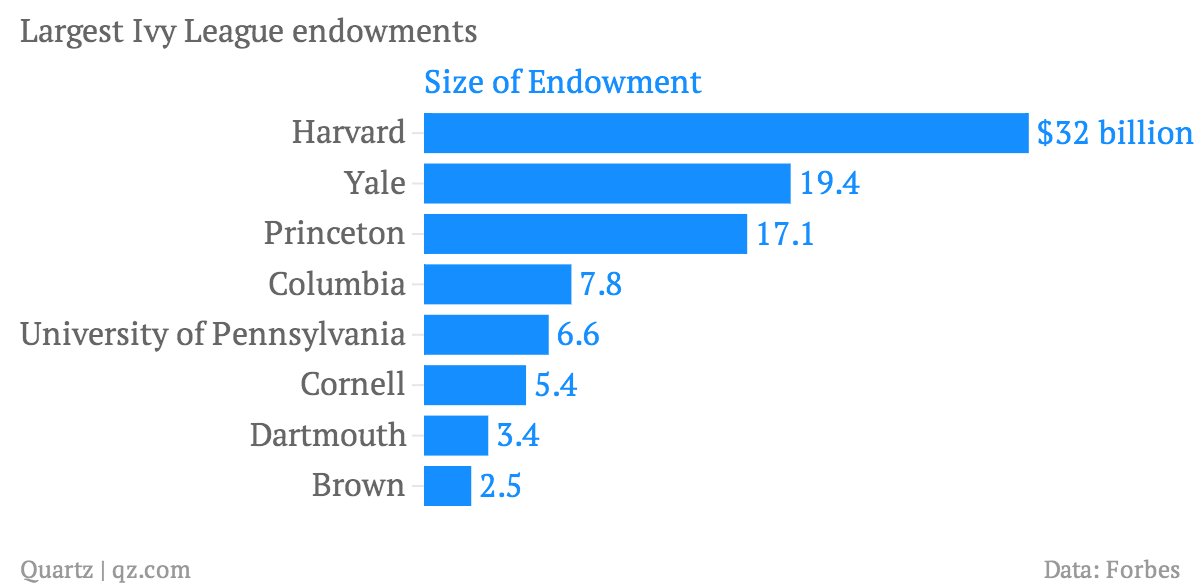

Harvard and Yale’s endowments are enormous, providing significant funding for research, financial aid, and campus operations. However, the potential impact of increased endowment taxes on each institution varies depending on their specific spending priorities and investment strategies. A comparative analysis against other universities with smaller endowments would provide crucial context. Analyzing their spending habits – detailing the proportion allocated to financial aid versus research, for example – would illustrate the potential impact on each program if taxes increased.

Conclusion

The debate surrounding increased endowment taxes for Ivy League institutions like Harvard and Yale is complex, with valid arguments on both sides. While increased taxes could address wealth inequality and improve access to higher education, they also risk stifling research, reducing financial aid, and discouraging philanthropy. A balanced approach is necessary, considering both the potential benefits and drawbacks of such policies. Learn more about increased endowment taxes and join the debate on increased endowment taxes for Ivy League schools. Voice your opinions to your representatives on this critical issue.

Featured Posts

-

Stuttgart Open Ostapenko Defeats Sabalenka In Upset Win

May 13, 2025

Stuttgart Open Ostapenko Defeats Sabalenka In Upset Win

May 13, 2025 -

Big Issue Reveals Young Competition Winner

May 13, 2025

Big Issue Reveals Young Competition Winner

May 13, 2025 -

Premier Ligata Gi Dochekuva Lids I Barnli

May 13, 2025

Premier Ligata Gi Dochekuva Lids I Barnli

May 13, 2025 -

The Struggle For Market Share Examining The Challenges Faced By Bmw Porsche And Competitors In China

May 13, 2025

The Struggle For Market Share Examining The Challenges Faced By Bmw Porsche And Competitors In China

May 13, 2025 -

Delving Into The Science Of Earth Series 1 Inferno

May 13, 2025

Delving Into The Science Of Earth Series 1 Inferno

May 13, 2025

Latest Posts

-

Global Risk Rally Stocks Surge On U S China Trade Deal

May 14, 2025

Global Risk Rally Stocks Surge On U S China Trade Deal

May 14, 2025 -

Will Lower Tariffs Bring More Canadian And American Businesses To Moose Jaw

May 14, 2025

Will Lower Tariffs Bring More Canadian And American Businesses To Moose Jaw

May 14, 2025 -

No More Carbon Tax Hikes Albertas Industrial Pricing Decision

May 14, 2025

No More Carbon Tax Hikes Albertas Industrial Pricing Decision

May 14, 2025 -

Moose Jaws Economic Development Strategy A Focus On Tariff Advantages For Canadians And Americans

May 14, 2025

Moose Jaws Economic Development Strategy A Focus On Tariff Advantages For Canadians And Americans

May 14, 2025 -

1 050 V Mware Price Increase At And T Challenges Broadcoms Acquisition

May 14, 2025

1 050 V Mware Price Increase At And T Challenges Broadcoms Acquisition

May 14, 2025