Increased Trade Uncertainty Drives Gold Prices Higher

Table of Contents

Global Trade Wars and Their Impact on Market Volatility

"Trade wars," characterized by escalating tariffs and trade restrictions between nations, significantly destabilize global markets. These conflicts create uncertainty, making it difficult for businesses to plan and invest, thus impacting economic growth.

- US-China Trade War (2018-present): The imposition of tariffs on billions of dollars worth of goods led to immediate stock market drops and increased volatility.

- EU-US Trade Disputes: Ongoing disagreements over various trade issues have contributed to uncertainty within the transatlantic economic relationship.

- Brexit: The UK's withdrawal from the European Union injected significant uncertainty into global markets, impacting trade and investment flows.

This investor uncertainty translates directly into decreased confidence in equity markets. As stock prices fluctuate wildly, investors seek safer alternatives to preserve their capital. This is where "safe haven assets" come into play. Gold, with its inherent stability and historical performance as a store of value, becomes a highly sought-after refuge during these tumultuous times.

Gold as a Hedge Against Economic Uncertainty

Gold's appeal as a safe haven asset stems from several key characteristics:

- Limited Supply: Unlike fiat currencies, gold's supply is finite, making it a naturally scarce commodity.

- Tangible Asset: Gold is a physical asset, offering investors a sense of security not provided by intangible investments.

- Historical Performance: Throughout history, gold has served as a reliable store of value, maintaining its purchasing power even during periods of economic turmoil.

- Inflation Hedge: Gold often performs well during inflationary periods, acting as a hedge against the erosion of purchasing power.

Gold's price tends to rise inversely with economic uncertainty. When stock markets fall and investors panic, the demand for gold increases, driving its price upward. This makes it a crucial component of a diversified investment portfolio, designed to mitigate risks associated with market volatility.

Analyzing Recent Gold Price Increases and Trade-Related News

Several instances clearly demonstrate the correlation between gold price increases and negative trade-related news.

- Example 1: On [Date], following the announcement of [Specific Trade Action], the price of gold rose by [Percentage] within [Timeframe].

- Example 2: [Chart/Graph visualizing the correlation between gold prices and a specific trade-related news event].

These examples highlight how increased trade uncertainty directly impacts gold’s perceived value as a safe haven. The increased demand for this precious metal in times of global economic turmoil leads to a price increase.

Other Factors Influencing Gold Prices

While increased trade uncertainty is a significant driver of gold prices, it's crucial to acknowledge other contributing factors:

- Inflation: Higher inflation often boosts gold prices as investors seek to protect their purchasing power.

- Interest Rates: Lower interest rates generally encourage investment in gold, as the opportunity cost of holding non-interest-bearing assets decreases.

- Currency Fluctuations: Changes in the value of major currencies can influence gold prices, expressed in different fiat currencies.

Isolating the effect of trade uncertainty alone can be challenging, requiring sophisticated economic modeling. However, understanding its contribution is essential for accurate market analysis and informed investment decisions.

Investing in Gold During Times of Trade Uncertainty

Investing in gold can be accomplished through various methods:

- Physical Gold: Buying gold bars or coins offers direct ownership and tangible security.

- Gold ETFs (Exchange-Traded Funds): ETFs provide diversified exposure to gold without the need to store physical gold.

- Gold Mining Stocks: Investing in companies that mine and produce gold offers leveraged exposure to gold's price movements.

Important Considerations: Investing in gold carries inherent risks. Gold prices can fluctuate significantly, and past performance is not indicative of future results. Consult a qualified financial advisor before making any investment decisions.

Conclusion: Navigating the Market with Gold – The Importance of Understanding Trade Uncertainty

Increased trade uncertainty significantly drives gold prices higher, making gold a valuable asset for diversifying investment portfolios. By understanding the correlation between global trade developments and gold's price fluctuations, investors can better manage risk and potentially benefit from the inherent stability this precious metal provides. Stay informed about global trade developments, and consider incorporating gold into your investment strategy to mitigate risks associated with increased trade uncertainty. For up-to-date gold price charts and further investment advice, visit [link to relevant resource].

Featured Posts

-

Analyzing The Week That Upended Joe Bidens Post Presidency Plans

May 26, 2025

Analyzing The Week That Upended Joe Bidens Post Presidency Plans

May 26, 2025 -

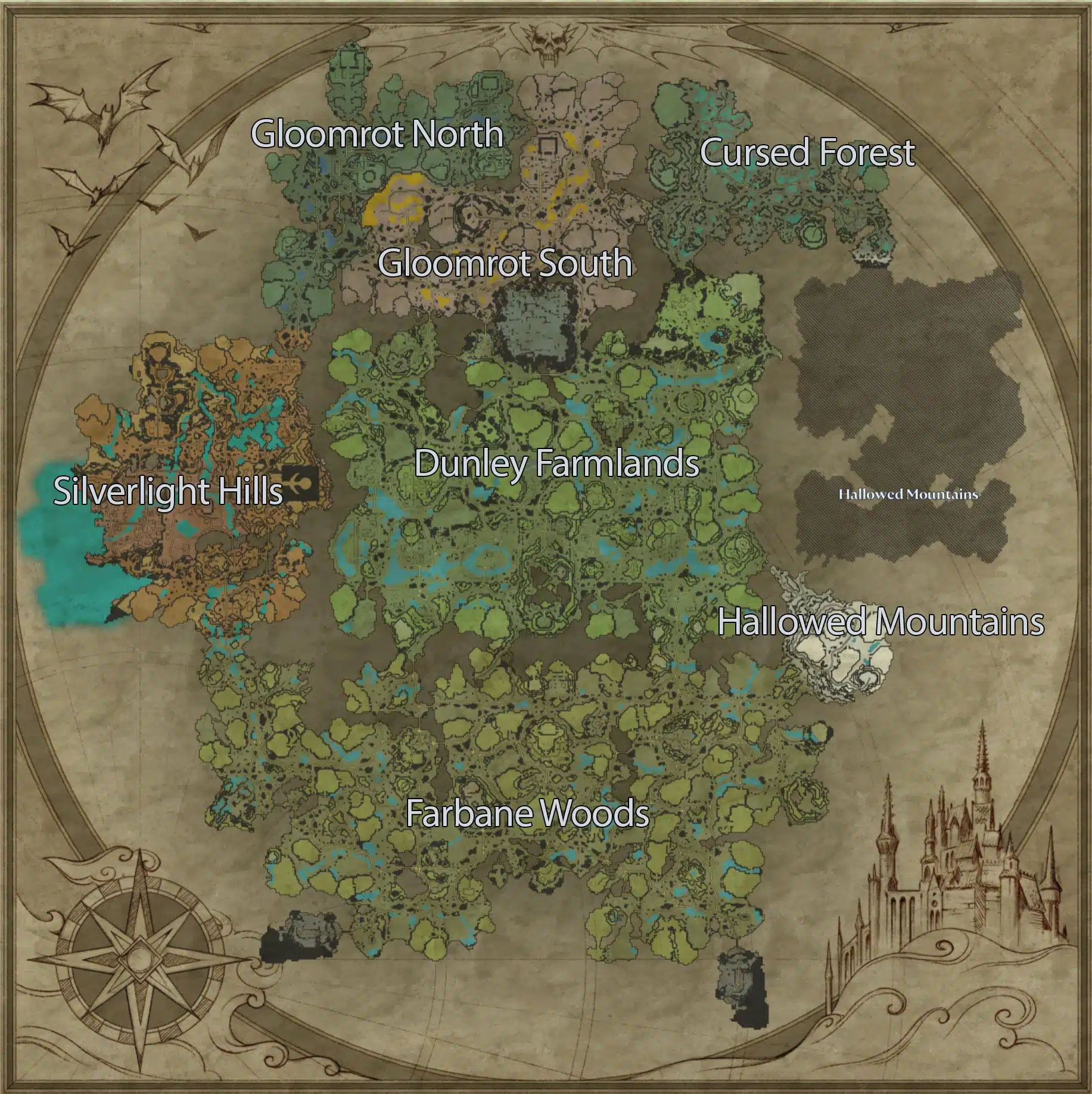

Uncovering The Countrys Rising Business Centers A Detailed Map

May 26, 2025

Uncovering The Countrys Rising Business Centers A Detailed Map

May 26, 2025 -

Rehoboth Beach Your Stress Free Escape

May 26, 2025

Rehoboth Beach Your Stress Free Escape

May 26, 2025 -

Facing A Flash Flood Emergency Your Action Plan

May 26, 2025

Facing A Flash Flood Emergency Your Action Plan

May 26, 2025 -

Shopping Mall Expansion B C Billionaire Seeks Hudsons Bay Space

May 26, 2025

Shopping Mall Expansion B C Billionaire Seeks Hudsons Bay Space

May 26, 2025