Ind AS 117: A Catalyst For Change In The Indian Insurance Sector

Table of Contents

Key Changes Introduced by Ind AS 117

Ind AS 117 (Insurance Contracts) fundamentally alters how insurance companies recognize revenue and measure liabilities. It replaces the previously disparate and often inconsistent approaches with a unified, principles-based framework.

Revenue Recognition

Ind AS 117 introduces a significant shift in revenue recognition. Instead of recognizing revenue upfront, as often done previously, the standard mandates recognizing revenue over the period of the insurance contract. This is achieved by measuring the "contractual service margin," which represents the insurer's expected profit from the contract. This change leads to a more accurate reflection of the insurer's performance over time.

Liability Measurement

Measuring insurance liabilities under Ind AS 117 is complex, requiring sophisticated actuarial models. The standard mandates using a "best estimate" approach to determine the present value of future cash flows required to settle insurance obligations. These "fulfillment cash flows" include claims payments, policyholder benefits, and other related costs. Accurately predicting these future cash flows and discounting them to present value requires advanced analytical capabilities and careful consideration of various risk factors.

Presentation and Disclosure

Ind AS 117 mandates significant changes in the presentation and disclosure requirements of insurance companies' financial statements. This results in improved transparency and comparability.

- Separate presentation of insurance contract liabilities: This provides a clearer picture of the insurer's financial obligations.

- Detailed disclosures on risk and uncertainty: This allows investors to better understand the potential risks associated with the insurer's business.

- Information on the components of insurance contract liabilities: This improves the understanding of the different factors influencing the insurer's liability position.

- More granular disclosures related to revenue recognition: This provides greater insight into how revenue is recognized over the life of the insurance contract.

Impact on Financial Reporting and Analysis

The adoption of Ind AS 117 has had a profound impact on financial reporting and analysis within the Indian insurance sector.

Increased Complexity

Implementing Ind AS 117 has undeniably increased the complexity of financial reporting for insurers. The detailed actuarial calculations and sophisticated modeling required for accurate liability measurement add significantly to the reporting burden.

Impact on Profitability

Ind AS 117's impact on reported profitability is complex and varies depending on individual business models and contract structures. While the new revenue recognition model might lead to smoother revenue recognition over time, the increased rigor in liability measurement could impact reported profits in the short term.

Comparability and Transparency

One significant benefit of Ind AS 117 is improved comparability and transparency across insurance companies. The standardized approach to accounting ensures that financial statements are more consistent and easily comparable, enhancing investor confidence and facilitating informed decision-making.

- Standardized metrics for measuring profitability: Allows for easier comparisons across insurers.

- Improved disclosures of risk factors: Facilitates a more comprehensive risk assessment.

- Enhanced transparency in revenue recognition: Provides greater clarity on the timing and amount of revenue earned.

Challenges in Implementation of Ind AS 117

Despite its benefits, the implementation of Ind AS 117 presents considerable challenges for Indian insurance companies.

Data Requirements

Accurate application of Ind AS 117 requires extensive data. This includes comprehensive historical claims data, detailed policy information, and sophisticated actuarial models to project future cash flows. Many insurance companies lack the necessary data infrastructure or the quality of data required for compliance.

System Upgrades

The increased complexity necessitates significant IT system upgrades. Many insurers need to invest in new software and technology capable of handling the complex calculations and data management required by Ind AS 117.

Skill Development

Effective implementation of Ind AS 117 requires specialized skills and expertise. Insurance companies need to invest in training and upskilling their accounting and actuarial professionals to ensure they can adequately handle the new accounting requirements.

- Actuarial expertise: Needed to develop and validate actuarial models.

- Data management skills: Required to handle and manage the large datasets needed for compliance.

- Understanding of the new accounting standards: Essential for accurate application of Ind AS 117.

Opportunities Presented by Ind AS 117

While the implementation of Ind AS 117 presents challenges, it also unlocks significant opportunities for the Indian insurance sector.

Enhanced Risk Management

Ind AS 117 encourages a more rigorous approach to risk management. The detailed analysis required for liability measurement forces companies to better understand and manage their exposure to various risks, including claims volatility and longevity risk.

Improved Investor Confidence

The increased transparency and comparability brought about by Ind AS 117 can boost investor confidence. Investors are better able to assess the financial health and performance of insurance companies, leading to increased investment and market stability.

Alignment with Global Standards

Aligning Indian accounting standards with international standards facilitates cross-border investment and improves the integration of the Indian insurance sector into the global marketplace. This strengthens the credibility of Indian insurance companies and attracts foreign investment.

- Attracting foreign investment: Ind AS 117 compliance signals a higher degree of transparency and trustworthiness.

- Facilitating mergers and acquisitions: Standardized accounting practices simplify cross-border transactions.

- Enhancing sector competitiveness: Improved financial reporting allows for fairer and more effective competition.

Conclusion: Embracing the Ind AS 117 Transformation

Ind AS 117 represents a transformative shift for the Indian insurance sector. While the implementation presents challenges related to data, systems, and skills, the benefits – enhanced transparency, improved comparability, and greater investor confidence – far outweigh the costs. Understanding and successfully implementing Ind AS 117 is crucial for the continued growth and stability of the Indian insurance sector. Take proactive steps to ensure compliance and maximize the benefits of this transformative accounting standard. Proactive Ind AS 117 implementation is key to future success in the Indian insurance market.

Featured Posts

-

Discussie Leeflang De Rol Van De Npo Toezichthouder En Bruins

May 15, 2025

Discussie Leeflang De Rol Van De Npo Toezichthouder En Bruins

May 15, 2025 -

Bruins En Npo Toezichthouder Bespreking Leeflang Kwestie

May 15, 2025

Bruins En Npo Toezichthouder Bespreking Leeflang Kwestie

May 15, 2025 -

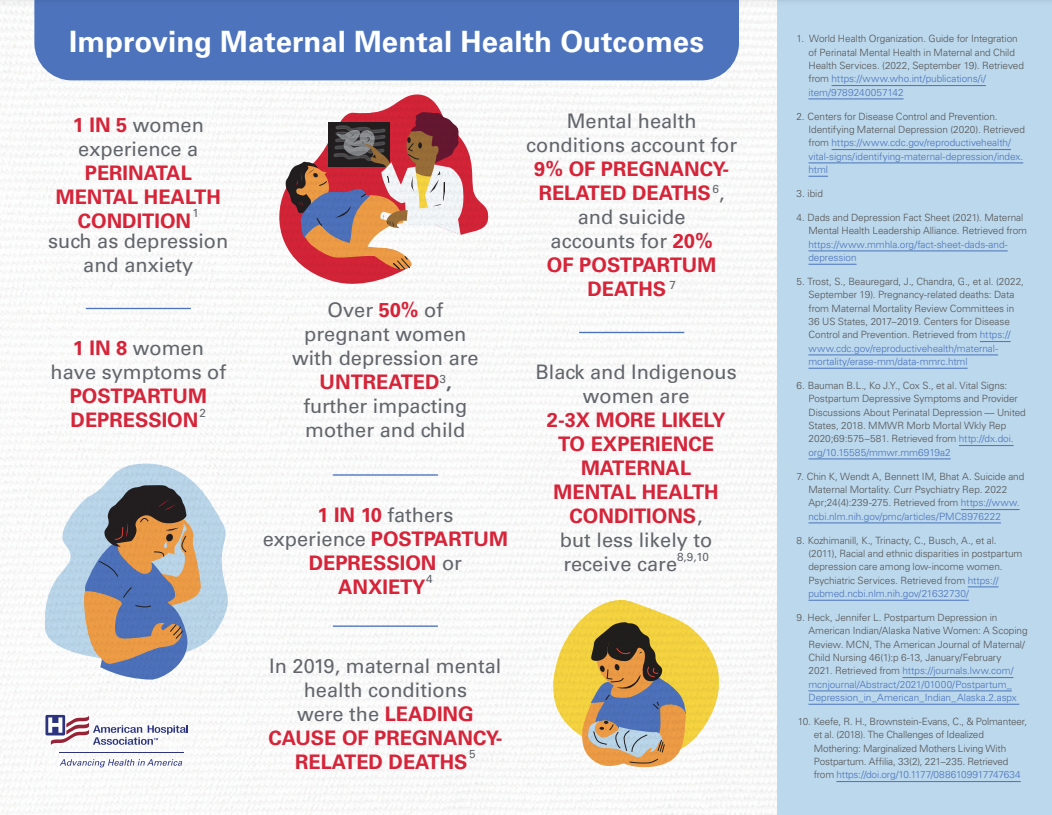

Measuring Gender Euphoria Impact On Transgender Mental Health Outcomes

May 15, 2025

Measuring Gender Euphoria Impact On Transgender Mental Health Outcomes

May 15, 2025 -

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit

May 15, 2025

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit

May 15, 2025 -

College Van Omroepen En Het Herstel Van Vertrouwen Bij De Npo

May 15, 2025

College Van Omroepen En Het Herstel Van Vertrouwen Bij De Npo

May 15, 2025

Latest Posts

-

Analyse De Actie Tegen Npo Baas Frederieke Leeflang En De Gevolgen

May 15, 2025

Analyse De Actie Tegen Npo Baas Frederieke Leeflang En De Gevolgen

May 15, 2025 -

Is Dit Het Begin Van Het Einde Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Is Dit Het Begin Van Het Einde Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025 -

Verdere Escalatie Verwacht Actie Tegen Frederieke Leeflang En De Npo

May 15, 2025

Verdere Escalatie Verwacht Actie Tegen Frederieke Leeflang En De Npo

May 15, 2025 -

Reacties Op De Dreigende Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025

Reacties Op De Dreigende Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025 -

Nieuwe Ontwikkelingen In De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Nieuwe Ontwikkelingen In De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025