Ind AS 117 And The Future Of Insurance In India: Opportunities And Challenges

Table of Contents

Understanding Ind AS 117: Key Provisions and their Implications

Ind AS 117 fundamentally alters the accounting treatment of insurance contracts. Its core principle revolves around accurately reflecting the financial position and performance of insurance companies by more precisely measuring insurance liabilities and recognizing revenue over the life of a contract. This differs significantly from previous accounting standards, which often used simpler, less precise methods.

The standard mandates a detailed analysis of insurance contracts to allocate premiums to different components, such as the coverage component and the service component. This precise allocation directly impacts the recognition of revenue and the measurement of insurance liabilities. Accurate liability measurement is crucial for determining capital adequacy and ensuring solvency, two critical aspects of the insurance business. Failure to adhere to these requirements can result in inaccurate financial reporting and potentially jeopardize the financial stability of an insurance company.

- Changes in revenue recognition: Revenue is recognized over the period the insurance coverage is provided, rather than upfront.

- Impact on insurance liabilities: Liabilities are measured using a more complex, forward-looking approach, considering factors like future claims and discount rates.

- New disclosures required under Ind AS 117: More extensive disclosures are required to enhance transparency and provide a clearer picture of the insurer’s financial position.

- Increased complexity in financial reporting: Implementing Ind AS 117 requires sophisticated systems and processes, significantly increasing the complexity of financial reporting. Keywords: Ind AS 117 provisions, insurance contract recognition, revenue recognition insurance, capital adequacy, solvency, financial reporting.

Opportunities Presented by Ind AS 117 for the Indian Insurance Market

Despite the challenges, Ind AS 117 presents significant opportunities for the Indian insurance market. The enhanced transparency and comparability it brings can significantly boost investor confidence, both domestically and internationally. The improved financial reporting standards will make it easier for foreign investors to assess the risk and potential returns of investing in Indian insurance companies, potentially leading to a significant influx of foreign capital.

Furthermore, the more rigorous approach to risk management inherent in Ind AS 117 can lead to improved operational efficiency. By providing a more accurate picture of the insurer's risk profile, companies can better assess and price risks, leading to more sustainable and profitable businesses.

- Enhanced investor confidence: Improved transparency and comparability lead to greater trust and attract more investment.

- Improved international comparability: Alignment with IFRS 17 facilitates easier comparison with global insurers.

- Attracting foreign investment in Indian insurance: Increased transparency attracts foreign investors seeking stable, well-regulated markets.

- Better risk assessment and pricing: More accurate risk assessment leads to better pricing strategies and improved profitability. Keywords: transparency, comparability, foreign investment, risk management, operational efficiency.

Challenges in Implementing Ind AS 117 in the Indian Context

Implementing Ind AS 117 presents several challenges, particularly for smaller insurance companies in India. The increased complexity in accounting and reporting requires significant technological upgrades. Companies need to invest in new IT infrastructure capable of handling the more complex calculations and data management required by the standard. Furthermore, training and development programs are crucial to ensure that employees possess the necessary skills and knowledge to implement and utilize the new standard effectively.

Data management and reconciliation present further significant challenges. Migrating existing data to new systems and ensuring accurate reconciliation can be time-consuming and expensive. This is especially true for companies with legacy systems and limited resources. The increased compliance costs could impact profitability, particularly for smaller players in the market.

- Technological upgrades needed: Investment in new IT infrastructure and systems is essential.

- Training and skill development requirements: Employees need training to understand and implement the new standard.

- Potential increase in compliance costs: The complexity of Ind AS 117 will lead to higher compliance costs.

- Data migration and integration challenges: Migrating and reconciling data can be a significant hurdle.

- Impact on smaller insurers: Smaller insurers may face disproportionate challenges due to limited resources. Keywords: implementation challenges, IT infrastructure, skilled manpower, compliance costs, data management.

Future Outlook: Adapting to the New Landscape of Indian Insurance

The long-term implications of Ind AS 117 for the competitive landscape of the Indian insurance market are significant. We may see consolidation within the sector as companies with better resources and capabilities adapt more effectively. Simultaneously, opportunities for innovation and the emergence of new business models will arise. Technology will play a crucial role in enabling insurers to adapt to the demands of Ind AS 117 and create new value propositions for customers. The role of regulatory bodies in providing clear guidance and support for the implementation process will be vital for the overall success of this transition.

- Consolidation in the insurance sector: Companies with superior capabilities will thrive while others may struggle.

- Emergence of new business models: Ind AS 117 may pave the way for innovative insurance products and services.

- The role of technology in adapting to Ind AS 117: Technological solutions will be vital for efficient compliance.

- Regulatory support and guidance: Clear guidelines and support from regulators are critical for successful implementation. Keywords: competitive landscape, innovation, growth, regulatory support, future of insurance India.

Conclusion: Embracing the Ind AS 117 Era in Indian Insurance

Ind AS 117 presents both opportunities and challenges for the Indian insurance sector. While implementing the new standard will require significant investment and effort, the improved transparency, comparability, and enhanced risk management capabilities it offers will ultimately benefit the industry. Proactive adaptation and strategic planning are crucial for insurers to thrive in this new environment. Successfully navigating the Ind AS 117 landscape requires proactive planning. Contact us today to discuss how to leverage the opportunities and mitigate the challenges presented by Ind AS 117 for your Indian insurance business. Keywords: Ind AS 117 compliance, Indian insurance regulations, Ind AS 117 solutions.

Featured Posts

-

Isguecue Piyasasi Analizi Dijital Veri Tabani Rehberi Ledra Pal Carsamba

May 15, 2025

Isguecue Piyasasi Analizi Dijital Veri Tabani Rehberi Ledra Pal Carsamba

May 15, 2025 -

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Industries

May 15, 2025

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Industries

May 15, 2025 -

Pagkypria Sygkrisi Timon Kaysimon Breite To Fthinotero Pratirio

May 15, 2025

Pagkypria Sygkrisi Timon Kaysimon Breite To Fthinotero Pratirio

May 15, 2025 -

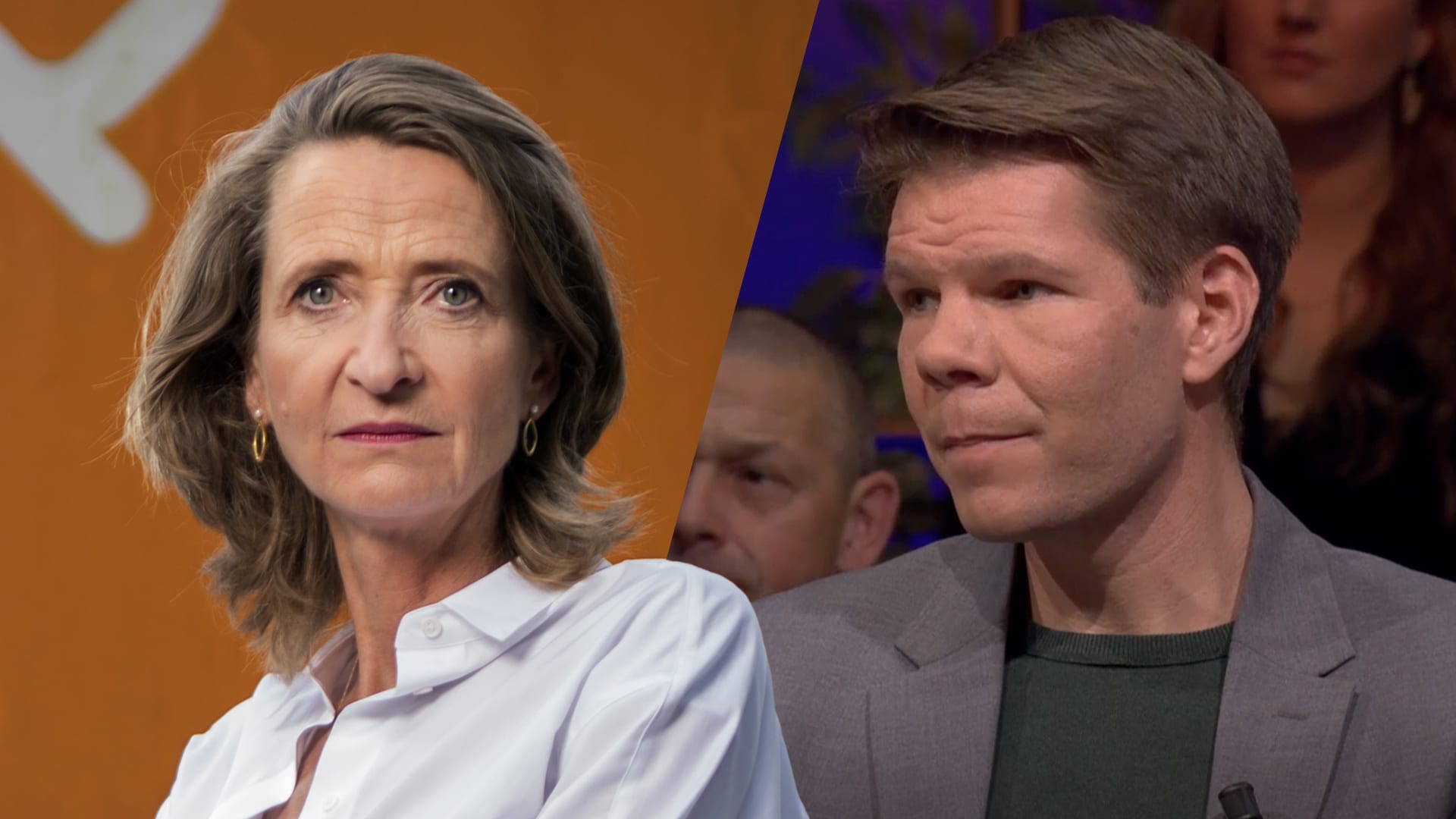

Npo Vertrouwensproblemen College Van Omroepen Zoekt Oplossing

May 15, 2025

Npo Vertrouwensproblemen College Van Omroepen Zoekt Oplossing

May 15, 2025 -

Snelle Actie Npo Na Zorgen Over Frederieke Leeflang

May 15, 2025

Snelle Actie Npo Na Zorgen Over Frederieke Leeflang

May 15, 2025

Latest Posts

-

Analyse De Actie Tegen Npo Baas Frederieke Leeflang En De Gevolgen

May 15, 2025

Analyse De Actie Tegen Npo Baas Frederieke Leeflang En De Gevolgen

May 15, 2025 -

Is Dit Het Begin Van Het Einde Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Is Dit Het Begin Van Het Einde Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025 -

Verdere Escalatie Verwacht Actie Tegen Frederieke Leeflang En De Npo

May 15, 2025

Verdere Escalatie Verwacht Actie Tegen Frederieke Leeflang En De Npo

May 15, 2025 -

Reacties Op De Dreigende Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025

Reacties Op De Dreigende Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025 -

Nieuwe Ontwikkelingen In De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

Nieuwe Ontwikkelingen In De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025