India's Real Estate Sector Witnesses 47% Investment Boost In First Quarter

Table of Contents

Increased Foreign and Domestic Investment Fueling Growth

The remarkable growth in India real estate investment is fueled by a significant influx of both foreign and domestic capital. Foreign investment has seen a substantial increase, with several global investment firms and sovereign wealth funds actively participating in various real estate projects across the country. Simultaneously, domestic investment has also witnessed a remarkable rise, driven by high-net-worth individuals (HNIs) and institutional investors seeking lucrative returns.

-

Examples of major foreign investments: Several large-scale projects have attracted significant foreign investment, including the development of commercial complexes in major metropolitan areas and large-scale residential projects in rapidly growing tier-2 cities. Specific examples (with hypothetical figures for illustrative purposes) could include a $500 million investment by a Singaporean firm in a luxury residential project in Mumbai and a €300 million investment by a European fund in a commercial development in Bengaluru.

-

Statistics on domestic investment growth: Reports suggest a 30% year-on-year increase in domestic investment in real estate market India, with HNIs accounting for a substantial portion of this growth. Institutional investors, such as mutual funds and pension funds, are also increasingly allocating a larger share of their portfolios to the Indian real estate sector.

-

Government initiatives supporting investment: Government initiatives aimed at simplifying regulations and improving the ease of doing business have significantly boosted investor confidence in property investment India.

Government Policies and Infrastructure Development Boosting Confidence

Government policies play a crucial role in shaping the real estate market India. Initiatives focused on streamlining regulatory processes, providing tax benefits, and encouraging infrastructure development have significantly contributed to the sector's growth. The development of smart cities and extensive metro rail networks is not only improving urban infrastructure but also significantly boosting real estate values in these areas.

-

Specific government policies: Initiatives like the Real Estate (Regulation and Development) Act (RERA) have enhanced transparency and accountability, while various tax benefits have incentivized investment. Furthermore, reforms aimed at simplifying land acquisition processes have further accelerated development.

-

Examples of successful infrastructure projects impacting real estate: The development of the Delhi Metro, for instance, has led to a substantial increase in property values along its corridors. Similarly, the development of smart cities across the country is transforming urban landscapes and creating significant opportunities for real estate development.

-

Statistics showing the positive correlation between infrastructure and real estate growth: Data suggests a strong positive correlation between infrastructure investment and real estate growth India, with regions experiencing significant infrastructure development also showing higher rates of real estate appreciation.

Rising Demand Across Residential and Commercial Segments

The current surge in India real estate investment is also driven by a significant rise in demand across both residential and commercial real estate segments. Factors such as rapid population growth, increasing urbanization, and a burgeoning economy are fueling this demand.

-

Statistics on growth in residential and commercial property sales/rentals: Reports indicate a double-digit growth in sales and rental rates for both residential and commercial properties across major Indian cities.

-

Analysis of demand in various cities (tier 1, tier 2, etc.): Demand is particularly strong in major metropolitan areas (tier-1 cities), but it is also expanding rapidly into tier-2 and tier-3 cities, fueled by economic growth and improved infrastructure.

-

Factors driving demand in each segment: In the residential segment, government schemes promoting affordable housing are playing a significant role, while the commercial sector is witnessing strong demand due to the growth of IT, BFSI, and other industries.

Technological Advancements and Changing Consumer Preferences Shaping the Market

The Indian real estate sector is also being significantly reshaped by technological advancements and evolving consumer preferences. The rise of proptech companies is revolutionizing the way properties are bought, sold, and managed. Simultaneously, consumers are increasingly demanding sustainable and smart buildings equipped with advanced technologies.

-

Examples of proptech companies and their impact: Several proptech companies are leveraging technology to improve transparency, efficiency, and accessibility within the real estate market.

-

Trends in sustainable and smart building technologies: The adoption of green building practices and the integration of smart home technologies are becoming increasingly important factors influencing consumer choices.

-

Shift in consumer preferences and their impact on market dynamics: These shifting preferences are influencing the design and development of new projects, with a growing emphasis on sustainability, energy efficiency, and technological integration.

Conclusion: India's Real Estate Sector: A Promising Future for Investment

The 47% surge in India real estate investment during Q1 is a testament to the sector's robust growth and strong potential. This impressive growth is a result of increased foreign and domestic investment, supportive government policies, rising demand, and technological advancements. The positive outlook for the Indian real estate market continues to attract both domestic and international investors. With continued economic growth, improving infrastructure, and supportive government policies, the sector is poised for sustained growth and offers compelling opportunities for investors. Now is the time to explore invest in Indian real estate, capitalize on India real estate market opportunities, and consider Indian property investment for potentially significant returns.

Featured Posts

-

Did Losing Jalen Brunson Hurt The Mavericks More Than Trading Luka Doncic Would Have A Comparison

May 17, 2025

Did Losing Jalen Brunson Hurt The Mavericks More Than Trading Luka Doncic Would Have A Comparison

May 17, 2025 -

Giants Vs Mariners Updated Injury List For April 4 6 Games

May 17, 2025

Giants Vs Mariners Updated Injury List For April 4 6 Games

May 17, 2025 -

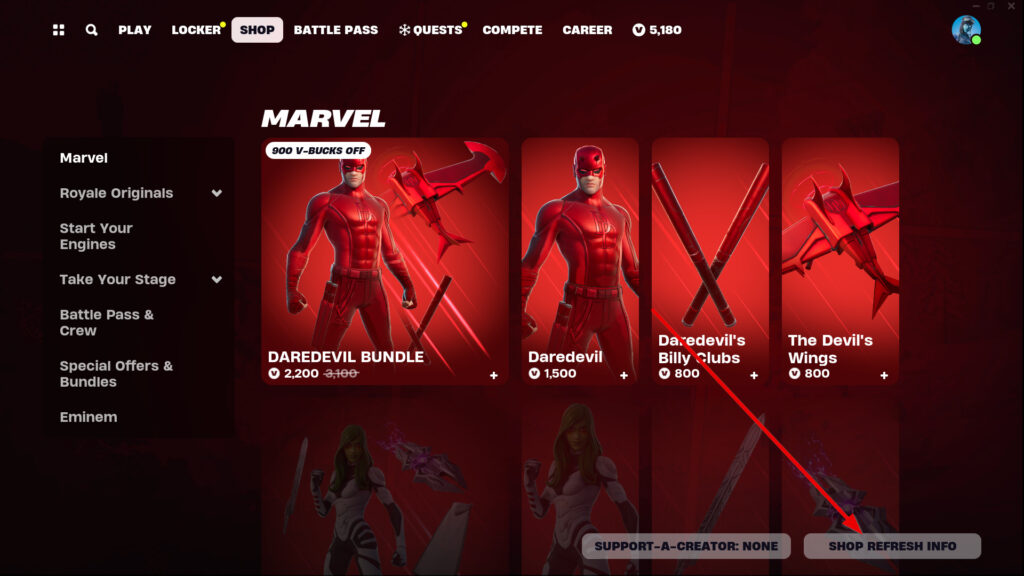

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025 -

Apartment Building Demolition Approved By Davenport Council

May 17, 2025

Apartment Building Demolition Approved By Davenport Council

May 17, 2025 -

Analyzing Cassie Venturas Testimony In Sean Combs Case

May 17, 2025

Analyzing Cassie Venturas Testimony In Sean Combs Case

May 17, 2025

Latest Posts

-

Ankle Injury Forces Jalen Brunson Out Of Knicks Lakers Overtime

May 17, 2025

Ankle Injury Forces Jalen Brunson Out Of Knicks Lakers Overtime

May 17, 2025 -

Analyzing The Impact Jalen Brunsons Departure Vs A Potential Luka Doncic Trade For The Dallas Mavericks

May 17, 2025

Analyzing The Impact Jalen Brunsons Departure Vs A Potential Luka Doncic Trade For The Dallas Mavericks

May 17, 2025 -

Jalen Brunsons Mavericks Exit A More Devastating Loss Than The Hypothetical Doncic Trade

May 17, 2025

Jalen Brunsons Mavericks Exit A More Devastating Loss Than The Hypothetical Doncic Trade

May 17, 2025 -

Jalen Brunson Rolls Ankle Exits Knicks Lakers Game In Overtime

May 17, 2025

Jalen Brunson Rolls Ankle Exits Knicks Lakers Game In Overtime

May 17, 2025 -

The Knicks Impressive Depth A Jalen Brunson Injury Silver Lining

May 17, 2025

The Knicks Impressive Depth A Jalen Brunson Injury Silver Lining

May 17, 2025