Indonesia's Foreign Exchange Reserves Plummet: Two-Year Low Amid Rupiah Weakness

Table of Contents

The Sharp Decline in Indonesia's Forex Reserves

The depletion of Indonesia's foreign exchange reserves is a significant cause for concern. Official data reveals a substantial drop, reaching the lowest level in two years. This decline represents a serious challenge to Indonesia's economic stability and its ability to manage external pressures.

-

Quantitative Analysis: [Insert specific figures and data here, comparing the current level of forex reserves to previous years and regional benchmarks. Include a visually appealing chart or graph illustrating the decline]. For example, "Indonesia's forex reserves stood at [amount] as of [date], a significant decrease of [percentage] compared to [previous year/period]."

-

Implications for External Debt and Imports: A shrinking reserve level directly impacts Indonesia's capacity to service its external debt and maintain sufficient import levels. Reduced reserves limit the country's ability to purchase essential goods and services from abroad, potentially leading to shortages and inflationary pressures.

-

Impact on Investor Confidence: The decline in forex reserves can significantly erode investor confidence. A weakening Rupiah and dwindling reserves can signal economic vulnerability, potentially leading to capital flight and further currency depreciation, creating a vicious cycle.

The Weakening Indonesian Rupiah (IDR): A Key Driver

The weakening Indonesian Rupiah (IDR) is a primary driver behind the decline in forex reserves. Several factors contribute to this devaluation:

-

US Dollar Strength: The strengthening US dollar, driven by aggressive interest rate hikes by the Federal Reserve, has put immense pressure on emerging market currencies, including the Rupiah. A strong dollar makes dollar-denominated assets more attractive, leading to capital outflow from emerging markets.

-

Global Economic Slowdown: The global economic slowdown, characterized by reduced trade and investment, negatively impacts Indonesia's export earnings and foreign direct investment (FDI), further weakening the Rupiah.

-

Domestic Factors: Domestic factors also play a significant role. High inflation erodes the purchasing power of the Rupiah, while a widening current account deficit indicates that Indonesia is importing more than it is exporting. This imbalance puts downward pressure on the currency.

-

Capital Outflow: Investor concerns about Indonesia's economic outlook can lead to significant capital outflow, further weakening the Rupiah's exchange rate. This is exacerbated by global uncertainty and risk aversion.

Government and Central Bank Response

Bank Indonesia (BI), Indonesia's central bank, has implemented several measures to mitigate the impact of the weakening Rupiah and dwindling forex reserves:

-

Monetary Policy Adjustments: BI may adjust its monetary policy, potentially through interest rate hikes to attract foreign investment and curb inflation. [Discuss the effectiveness of past interventions and the potential for future adjustments].

-

Intervention in the Forex Market: The central bank might intervene directly in the forex market to support the Rupiah by selling foreign currency reserves. However, this strategy is limited by the shrinking reserves.

-

Fiscal Policy Support: The Indonesian government can also implement fiscal policies, such as targeted economic stimulus packages or measures to boost exports, to support the economy and indirectly strengthen the Rupiah. [Discuss the government's role in stabilizing the economy during this period].

Potential Long-Term Implications for the Indonesian Economy

The current situation has several potential long-term implications for the Indonesian economy:

-

Economic Growth and Investment: The weakening Rupiah and reduced forex reserves can negatively impact economic growth by hindering investment and potentially leading to slower expansion of key sectors.

-

Inflation and Cost of Living: A weaker Rupiah can increase the cost of imports, leading to higher inflation and a reduced standard of living for many Indonesians.

-

Trade Balance and Debt Sustainability: The ongoing challenges could exacerbate Indonesia's trade deficit and make it more difficult to service its external debt. This increases the risk of a debt crisis.

-

Long-Term Outlook for the Rupiah: The long-term outlook for the Indonesian Rupiah will depend on the effectiveness of government and central bank interventions, global economic conditions, and the resolution of domestic economic challenges.

Conclusion

The plummet in Indonesia's foreign exchange reserves to a two-year low, coupled with the weakening Indonesian Rupiah, presents a serious challenge to the nation's economic stability. While the government and Bank Indonesia are taking steps to address the situation, the ongoing global uncertainty and domestic economic factors warrant close monitoring. Understanding the dynamics of Indonesia's foreign exchange reserves and the Rupiah's performance is crucial for investors and policymakers alike. Stay informed about the latest developments regarding Indonesia's foreign exchange reserves and the Rupiah's fluctuations to make informed decisions. Continuous monitoring of Indonesia's foreign exchange reserves and the health of the Rupiah is vital for navigating the economic landscape.

Featured Posts

-

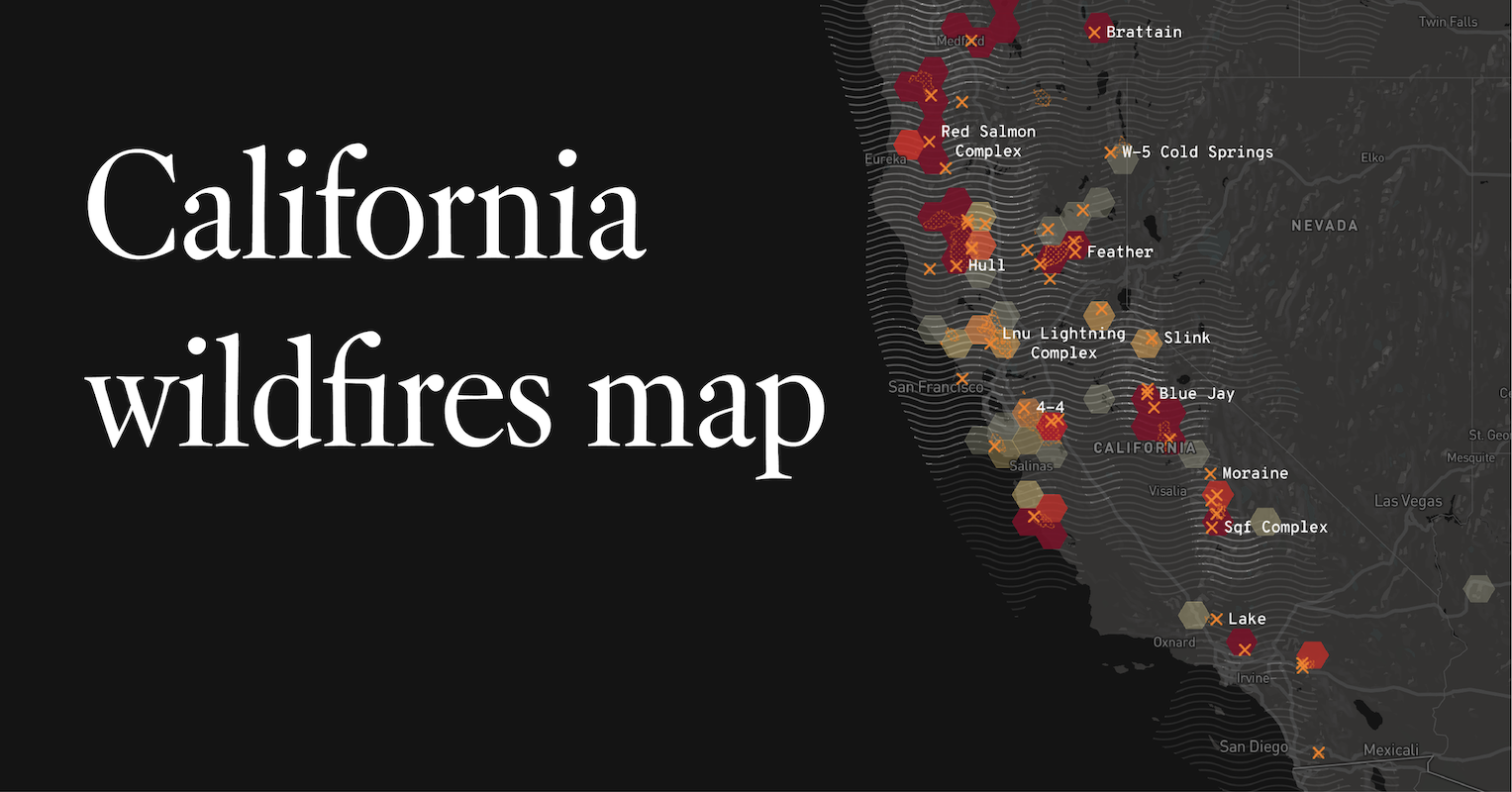

The Los Angeles Wildfires A New Frontier For Disaster Betting

May 10, 2025

The Los Angeles Wildfires A New Frontier For Disaster Betting

May 10, 2025 -

Palantir Stock Outlook Wall Streets Prediction Before May 5th

May 10, 2025

Palantir Stock Outlook Wall Streets Prediction Before May 5th

May 10, 2025 -

Transgender Girls Banned From Ihsaa Sports Following Trumps Order

May 10, 2025

Transgender Girls Banned From Ihsaa Sports Following Trumps Order

May 10, 2025 -

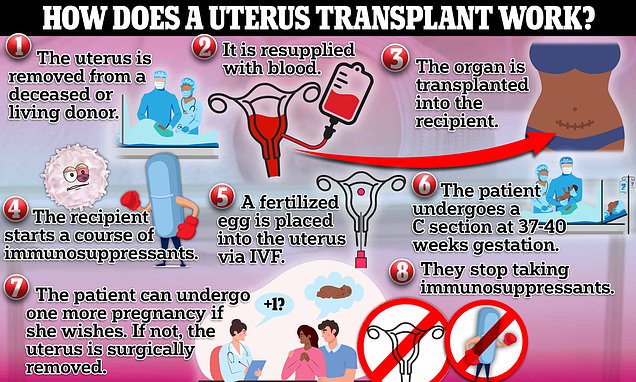

Transgender Women And Pregnancy A Community Activists Proposal For Uterine Transplants

May 10, 2025

Transgender Women And Pregnancy A Community Activists Proposal For Uterine Transplants

May 10, 2025 -

10 Unforgettable Film Noir Movies You Need To See

May 10, 2025

10 Unforgettable Film Noir Movies You Need To See

May 10, 2025