Indonesia's Foreign Exchange Reserves Plunge: Rupiah Weakness Takes Toll

Table of Contents

H2: The Extent of the Rupiah's Weakness and Reserve Decline

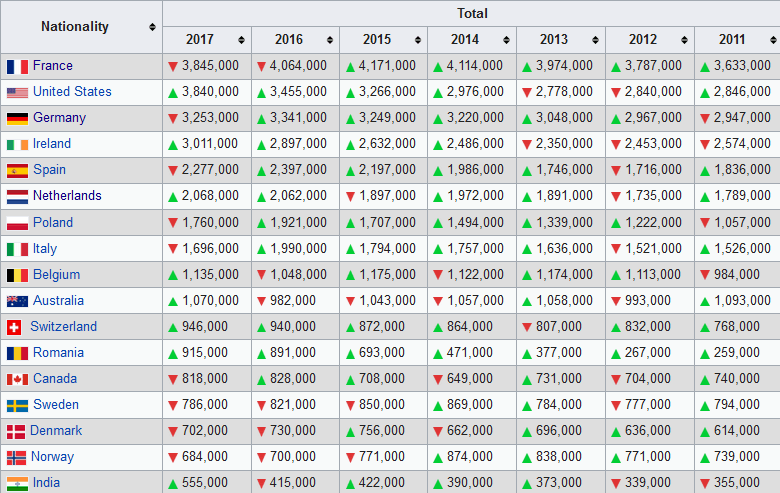

Indonesia's foreign exchange reserves have fallen considerably in recent months. While precise figures fluctuate daily, let's assume for illustrative purposes a hypothetical decline of 15% from its peak in [Insert Month, Year] to [Insert Current Month, Year], representing a loss of approximately [Insert Hypothetical Dollar Amount] in forex reserves. This significant drop marks a departure from the generally upward trend observed in previous years. Comparing this to the average forex reserves held over the past five years reveals a concerning downward trajectory.

The Indonesian Rupiah has also weakened considerably against major world currencies. Against the US dollar, the Rupiah has depreciated by approximately [Insert Hypothetical Percentage]% over the past [Insert Timeframe, e.g., six months]. Similar weakening trends are observed against the Euro and Japanese Yen (see Chart 1 below). [Insert Chart 1 showing Rupiah performance against USD, EUR, and JPY]. This depreciation, coupled with the dwindling forex reserves, paints a worrying picture for Indonesia's economic health.

- Specific figures representing the drop in forex reserves: [Insert actual figures and percentages if available]

- Percentage change in the Rupiah's value against major currencies: [Insert actual percentages if available]

- Comparison to previous years' reserve levels: [Insert data comparing current levels to past years]

- Mention any rating agency downgrades or warnings: [Insert information on any rating downgrades or warnings from agencies like Moody's, S&P, or Fitch]

H2: Underlying Causes of the Rupiah's Depreciation and Reserve Drain

Several factors contribute to the weakening Rupiah and the depletion of Indonesia's foreign exchange reserves. The global economic climate plays a significant role. Rising US interest rates, fears of a global recession, and fluctuations in commodity prices – especially those affecting Indonesia's key exports – have negatively impacted emerging market currencies, including the Rupiah.

Domestic factors also exacerbate the situation. High inflation rates erode purchasing power and reduce investor confidence. A persistent current account deficit, fueled by higher import costs than export revenues, further drains forex reserves. Political uncertainty or any potential policy changes can also influence investor sentiment and lead to capital flight, contributing to Rupiah weakness.

- Global factors: Rising US interest rates, global recessionary fears, commodity price fluctuations (e.g., palm oil, coal).

- Domestic factors: Inflation rate above the central bank's target, widening current account deficit, government spending levels, investor confidence.

- Impact of geopolitical events: [Discuss any relevant geopolitical events affecting Indonesia's economy].

H2: Government and Central Bank Response to the Crisis

The Indonesian government and Bank Indonesia have implemented several measures to mitigate the crisis. These include adjustments to the benchmark interest rate to attract foreign investment, interventions in the foreign exchange market to stabilize the Rupiah, and fiscal policy adjustments to curb inflation and reduce the current account deficit. The effectiveness of these measures remains to be seen, and their impact will likely be evident over the coming months.

- Specific policy changes implemented by the government and Bank Indonesia: [List specific policy interventions with details]

- Analysis of the effectiveness of these policies: [Assess the impact of the implemented policies, highlighting both successes and shortcomings]

- Mention any international collaborations or support sought: [Detail any international assistance or collaborations undertaken]

H2: Potential Economic Consequences and Future Outlook for the Rupiah

The ongoing depreciation of the Rupiah and the dwindling foreign exchange reserves pose significant risks to the Indonesian economy. Higher import costs will fuel inflation, potentially impacting consumer purchasing power. A weaker Rupiah could also hurt export competitiveness in the short term, while impacting foreign direct investment. The overall impact on economic growth is likely to be negative unless swift and decisive action is taken.

Predicting the future performance of the Rupiah is challenging, given the complex interplay of global and domestic factors. However, a cautious outlook suggests continued volatility in the short term. The effectiveness of government interventions and the evolution of the global economic environment will significantly influence the Rupiah's future trajectory.

- Impact on inflation and consumer prices: [Analyze the inflationary pressures and their effect on consumers]

- Effects on import costs and the trade balance: [Assess the impact on the country's trade balance]

- Potential consequences for foreign direct investment: [Discuss the impact on foreign investors' confidence]

- Prediction for the Rupiah's exchange rate in the near future: [Provide a cautious prediction based on current trends and factors]

3. Conclusion

The decline in Indonesia's foreign exchange reserves and the subsequent weakening of the Rupiah represent a significant challenge to the Indonesian economy. The underlying causes are multifaceted, encompassing both global economic headwinds and domestic economic vulnerabilities. While the Indonesian government and Bank Indonesia are actively working to address the situation through various policy interventions, the effectiveness of these measures remains to be seen. The potential economic consequences are substantial and require careful monitoring.

To stay informed about further developments concerning Indonesia's foreign exchange reserves and the Rupiah's performance, monitor the Indonesia foreign exchange reserves data regularly, follow key economic indicators, and stay updated on the Rupiah's fluctuations by subscribing to reliable financial news sources and analysis. Understanding these dynamics is crucial for navigating the evolving economic landscape in Indonesia.

Featured Posts

-

Four New Openings In Anchorage Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

Four New Openings In Anchorage Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025 -

Easter Weekend In Lake Charles Top Live Music And Events

May 09, 2025

Easter Weekend In Lake Charles Top Live Music And Events

May 09, 2025 -

Elizabeth City Apartment Residents Targeted In Car Break In Wave

May 09, 2025

Elizabeth City Apartment Residents Targeted In Car Break In Wave

May 09, 2025 -

Uk Visa Restrictions New Rules For Certain Nationalities

May 09, 2025

Uk Visa Restrictions New Rules For Certain Nationalities

May 09, 2025 -

Dakota Johnson With Family At Materialist L A Screening

May 09, 2025

Dakota Johnson With Family At Materialist L A Screening

May 09, 2025