Infineon (IFX) Stock: Analyzing The Impact Of Missed Sales Guidance

Table of Contents

Reasons Behind Infineon's Missed Sales Guidance

Several factors contributed to Infineon's (IFX) disappointing sales figures. Understanding these underlying issues is crucial for assessing the long-term implications for the company and its stock.

Weakening Macroeconomic Conditions

The global economy is experiencing a slowdown, significantly impacting demand for semiconductors across various sectors. This reduced demand has cascaded through the supply chain, leading to several problems for Infineon.

- Decreased Capital Expenditure: Key clients in the automotive and industrial sectors are reducing capital expenditures due to economic uncertainty, leading to fewer orders for Infineon's products. Reports from industry analysts like Gartner and IDC consistently point to a contraction in semiconductor spending across these key segments.

- Increased Inventory Levels: High inventory levels within the semiconductor supply chain have resulted in decreased orders as companies work to reduce their stockpiles. This oversupply situation is pressuring prices and impacting overall revenue.

- Weakening Demand in Key Markets: The automotive industry, a significant customer for Infineon, is experiencing production slowdowns due to global chip shortages and a decline in consumer demand. Similarly, the industrial sector is facing reduced orders due to decreased capital expenditure and overall economic uncertainty.

Supply Chain Disruptions (Lingering Effects)

While the acute phase of global supply chain disruptions may have passed, their lingering effects continue to hamper Infineon's operations and profitability.

- Increased Logistics Costs: Elevated shipping costs and longer lead times continue to impact profitability, squeezing margins and affecting the overall financial performance. These increased expenses are difficult to pass on completely to customers in a weakening market.

- Raw Material Price Volatility: Fluctuations in the prices of raw materials used in semiconductor manufacturing add another layer of complexity and unpredictability. These costs directly affect Infineon’s production costs and ability to compete effectively on pricing.

- Production Delays: Although improved compared to previous years, some lingering supply chain challenges still cause occasional production delays, leading to missed delivery deadlines and impacting customer satisfaction.

Increased Competition

The semiconductor industry is intensely competitive, with numerous players vying for market share. This fierce competition exerts downward pressure on prices and margins.

- Aggressive Pricing Strategies: Competitors are employing aggressive pricing strategies to win market share, leading to a price war that impacts Infineon's profitability. This necessitates a careful evaluation of Infineon's pricing strategy and its ability to compete effectively.

- Technological Advancements: Constant technological advancements mean that companies must continually innovate to maintain their competitiveness. Falling behind in innovation can lead to a loss of market share and revenue.

- Market Share Erosion: Infineon faces intense competition from established players and new entrants, leading to potential erosion of market share in certain segments. This requires a proactive approach to product development and market penetration.

Investor Reaction to the Missed Guidance

The announcement of Infineon's missed sales guidance triggered a range of reactions from investors.

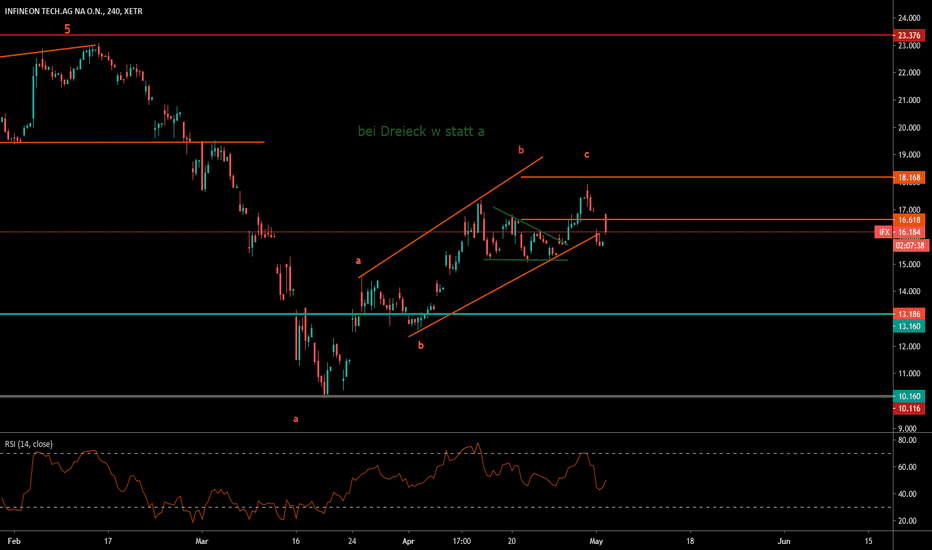

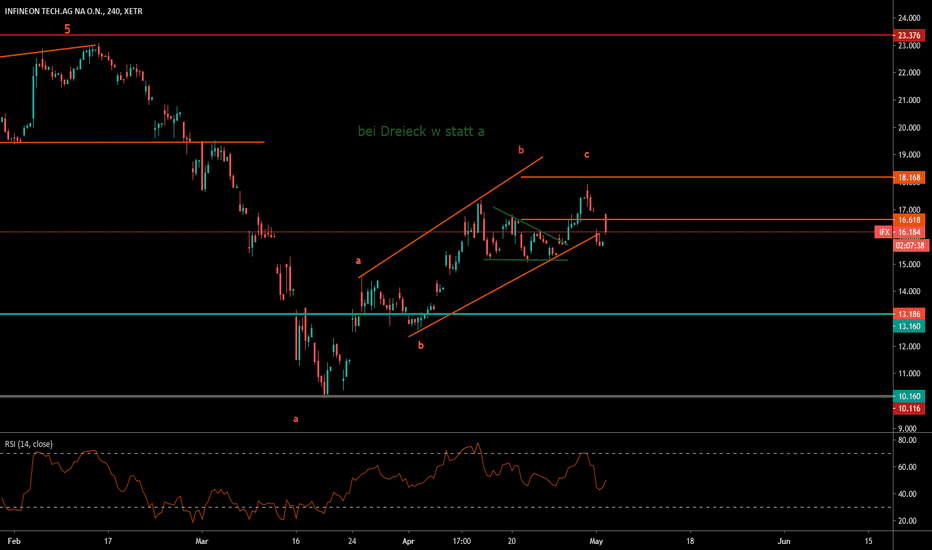

Stock Price Volatility

The IFX stock price experienced significant volatility following the announcement.

- Immediate Drop: The initial reaction was a sharp decline in the stock price, reflecting investor concern and uncertainty about the company's future performance. The percentage drop varied based on market conditions but was noticeable enough to cause concern.

- Subsequent Fluctuations: The following days and weeks saw continued fluctuations as investors digested the news and assessed the long-term implications. This volatility underscores the uncertainty surrounding the company's prospects.

- Chart Analysis: (Insert chart showing IFX stock price fluctuations post-announcement here)

Analyst Ratings and Revisions

Financial analysts responded to the missed guidance by revising their ratings and price targets for Infineon (IFX) stock.

- Rating Downgrades: Several analysts downgraded their ratings from "buy" or "hold" to "sell" or "underperform," reflecting a more pessimistic outlook.

- Lowered Price Targets: Price targets for IFX stock were generally lowered, reflecting the reduced expectations for future earnings and revenue growth.

- Examples: (Include specific examples of analyst actions and their rationale here, citing sources).

Trading Volume and Investor Sentiment

The missed guidance led to increased trading volume in IFX stock.

- Increased Trading Activity: A surge in trading volume indicated heightened investor interest and concern. This reflects the market's reaction to the unexpected news.

- Negative Sentiment: Social media and news articles largely reflected negative investor sentiment, highlighting concerns about the company's near-term prospects.

- Data Points: (Include data on trading volume changes and qualitative descriptions of investor sentiment, citing reliable sources).

Future Outlook for Infineon (IFX) Stock

Despite the setback, the future outlook for Infineon (IFX) stock is not entirely bleak. Several factors need consideration.

Company Response and Strategic Initiatives

Infineon is likely to implement several strategies to address the challenges and recover lost ground.

- Cost-Cutting Measures: The company might initiate cost-cutting measures to improve profitability and offset reduced revenue. This could include streamlining operations, reducing workforce, or renegotiating contracts with suppliers.

- Restructuring: Restructuring initiatives might be implemented to improve operational efficiency and focus on more profitable areas of the business.

- Strategic Investments: Infineon might invest in new technologies and markets to drive future growth and diversify its revenue streams.

Long-Term Growth Potential

The long-term growth potential of the semiconductor industry remains strong, driven by increasing demand from various sectors.

- Electric Vehicles: The growing electric vehicle market presents significant opportunities for Infineon, given its expertise in power semiconductors.

- Renewable Energy: The shift toward renewable energy sources creates demand for power electronics, another area of strength for Infineon.

- IoT Growth: The expanding Internet of Things (IoT) market will fuel demand for various semiconductor components, benefiting companies like Infineon.

Investment Implications

The missed guidance presents a complex situation for investors.

- Cautious Optimism: While the near-term outlook may be challenging, the long-term prospects for Infineon remain relatively positive, contingent upon effective management response and market recovery.

- Recommendation: (Provide a clear and well-justified recommendation—buy, sell, or hold—based on your analysis. Consider stating a timeframe for the recommendation, e.g., "hold for the next 6-12 months.")

- Risk Assessment: Emphasize the importance of thorough risk assessment before making any investment decisions.

Conclusion

Infineon's (IFX) missed sales guidance has created uncertainty, but a comprehensive analysis reveals a nuanced picture. While macroeconomic headwinds and competition pose short-term challenges, the company's strong position in key growth markets and potential strategic responses warrant careful consideration. Before investing in Infineon (IFX) stock, thoroughly analyze the company's response to the current challenges, the broader market conditions, and your own risk tolerance. Remember to conduct thorough due diligence and consult a financial advisor before making any investment decisions regarding Infineon (IFX) or any other semiconductor stock.

Featured Posts

-

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025 -

The Attorney General And Fox News A Daily Occurrence Worth Investigating

May 10, 2025

The Attorney General And Fox News A Daily Occurrence Worth Investigating

May 10, 2025 -

Newark Air Traffic Control System Failure Months Of Prior Safety Concerns

May 10, 2025

Newark Air Traffic Control System Failure Months Of Prior Safety Concerns

May 10, 2025 -

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 10, 2025

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 10, 2025 -

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 10, 2025

Pakistan Stock Exchange Portal Down Volatility And Geopolitical Tensions

May 10, 2025