Infineon (IFX) Stock: Sales Guidance Fallout And Tariff Concerns

Table of Contents

H2: Infineon's Revised Sales Guidance: A Deeper Dive

Infineon's recent downward revision of its sales guidance has sent ripples through the semiconductor industry. Understanding the reasons behind this is crucial for investors seeking to assess the true value of IFX stock. The revised forecast reflects a complex interplay of factors impacting the broader semiconductor market.

-

Weakening Demand: A slowdown in certain key markets, such as automotive and industrial applications, has contributed to lower-than-expected demand for Infineon's chips. This reduced demand translates directly into lower revenue projections.

-

Supply Chain Disruptions: Ongoing supply chain issues, stemming from geopolitical instability and component shortages, continue to plague the semiconductor sector. These challenges have impacted Infineon's ability to meet its production targets and fulfill orders on time.

-

Competitive Pressures: Intense competition within the semiconductor industry also plays a role. Aggressive pricing strategies from competitors can erode Infineon's market share and affect profitability.

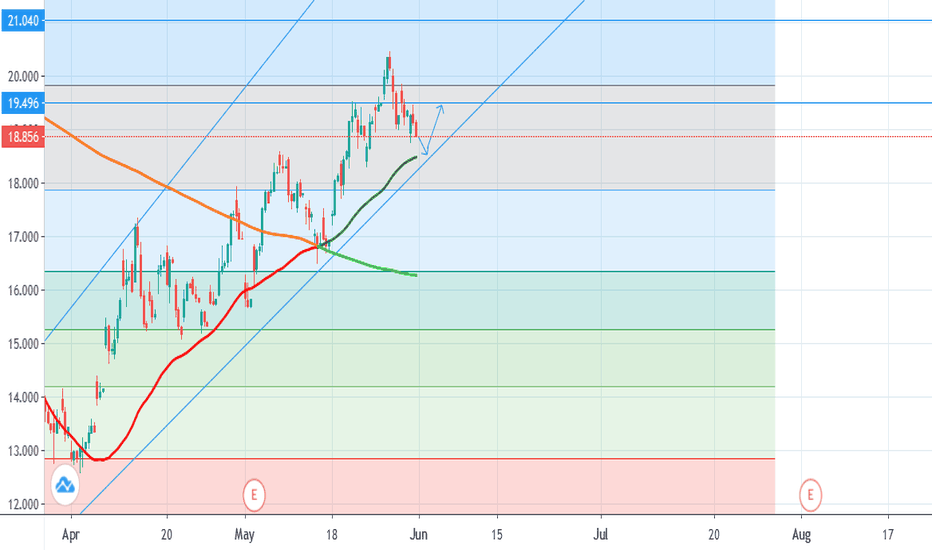

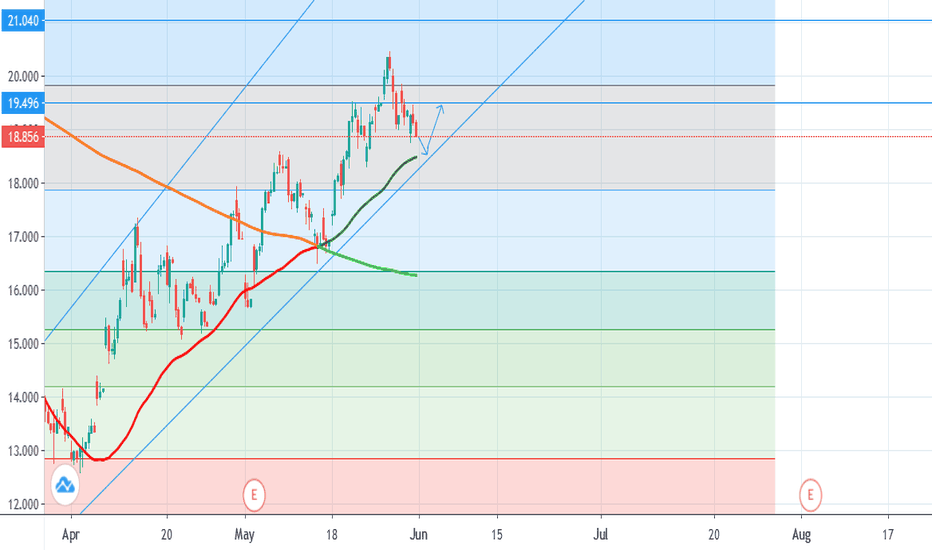

The impact of this revision on investor sentiment is evident in the recent stock price fluctuations. [Insert relevant chart/graph illustrating price fluctuations]. Compared to analyst expectations, Infineon's revised guidance fell short, leading to a reassessment of earnings estimates. Competitors in the semiconductor sector have also experienced similar challenges, but the extent of the impact varies considerably depending on their specific product portfolio and market exposure.

- Bullet points:

- Specific percentage decrease in sales guidance: (Insert specific percentage from Infineon's announcement)

- Impact on Q[Quarter] earnings predictions: (Insert specific impact on earnings predictions)

- Comparison to competitor's performance: (Compare to key competitors like STMicroelectronics, NXP, etc.)

- Key factors contributing to the revision: Weakening demand, supply chain issues, competitive pressures

H2: Tariff Concerns and Their Impact on Infineon (IFX)

The ongoing trade war and resulting tariffs pose a significant threat to Infineon's global operations. These tariffs increase the cost of both importing and exporting goods, impacting profitability and competitiveness.

-

Specific Tariffs: Infineon's operations are affected by tariffs imposed on semiconductor products between various countries, particularly between the US and China. (Specify the types of products and tariff percentages impacting Infineon). These tariffs directly impact the cost of goods sold, potentially squeezing profit margins.

-

Escalation Potential: The ongoing geopolitical tensions increase the risk of further tariff escalation. This uncertainty creates a challenging environment for long-term planning and investment decisions. Any significant increase in tariffs could significantly harm Infineon's bottom line.

-

Mitigation Strategies: Infineon is actively pursuing strategies to mitigate the impact of tariffs. These include diversifying its supply chain, exploring alternative sourcing options, and potentially relocating some manufacturing capacity to reduce reliance on tariff-affected regions.

-

Bullet points:

- Specific tariff percentages impacting IFX products: (Insert specific percentages)

- Potential cost increases due to tariffs: (Estimate the potential impact on costs)

- Infineon's response strategies to tariff challenges: Supply chain diversification, alternative sourcing, potential manufacturing relocation

- Geopolitical risks associated with ongoing trade disputes: Uncertainty regarding future trade policies and potential for further escalation

H2: Investing in Infineon (IFX) Stock Amidst Uncertainty

Despite the current challenges, Infineon holds a strong position in the long-term growth of the semiconductor industry. The company's focus on automotive, industrial, and power semiconductors positions it well for future growth, even amidst short-term headwinds.

-

Long-Term Growth Prospects: The increasing demand for semiconductors in electric vehicles, renewable energy, and industrial automation presents significant opportunities for Infineon. Its technological leadership and strong customer relationships provide a solid foundation for future success.

-

Risk Assessment: Investing in Infineon stock involves inherent risks, including the continued impact of tariffs, supply chain disruptions, and competition. A comprehensive risk assessment is crucial before making any investment decision.

-

Investment Strategy: The current market situation necessitates a cautious approach. A "hold" strategy may be prudent for investors who already hold IFX stock, while potential new investors should carefully weigh the risks and rewards before committing capital. A long-term perspective is crucial in navigating the current volatility.

-

Bullet points:

- Potential upside and downside scenarios for IFX stock: (Outline potential scenarios based on various market factors)

- Key factors to consider before making an investment decision: Sales guidance, tariff implications, competitive landscape, long-term growth potential

- Alternative investment strategies for mitigating risk: Diversification, dollar-cost averaging

- Long-term potential for the semiconductor industry: Strong growth expected due to technological advancements and increasing demand

3. Conclusion:

Infineon (IFX) stock presents a complex investment case. While revised sales guidance and tariff concerns create short-term uncertainty, the long-term prospects remain promising. A thorough understanding of these challenges and Infineon's response strategies is crucial for informed investment decisions. Before investing in Infineon (IFX) stock, conduct thorough due diligence, analyze market trends, and consider consulting with a financial advisor. Continuously monitor Infineon's performance, paying close attention to updates regarding sales guidance and the evolving tariff landscape. Remember that investing in Infineon (IFX) stock involves risk, and past performance is not indicative of future results.

Featured Posts

-

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 09, 2025

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 09, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Screening

May 09, 2025 -

Vu Bao Hanh Tre O Tien Giang Loi Khai Cua Bao Mau Va Dien Bien Vu Viec

May 09, 2025

Vu Bao Hanh Tre O Tien Giang Loi Khai Cua Bao Mau Va Dien Bien Vu Viec

May 09, 2025 -

The Billionaire Successor To Warren Buffett A Canadian Perspective

May 09, 2025

The Billionaire Successor To Warren Buffett A Canadian Perspective

May 09, 2025 -

Palantir Stock Analyzing Q1 2024 Government And Commercial Growth

May 09, 2025

Palantir Stock Analyzing Q1 2024 Government And Commercial Growth

May 09, 2025