Infineon's (IFX) Disappointing Sales Outlook: Impact Of Trump Tariffs

Table of Contents

Trump Tariffs and their Lingering Effects on the Semiconductor Industry

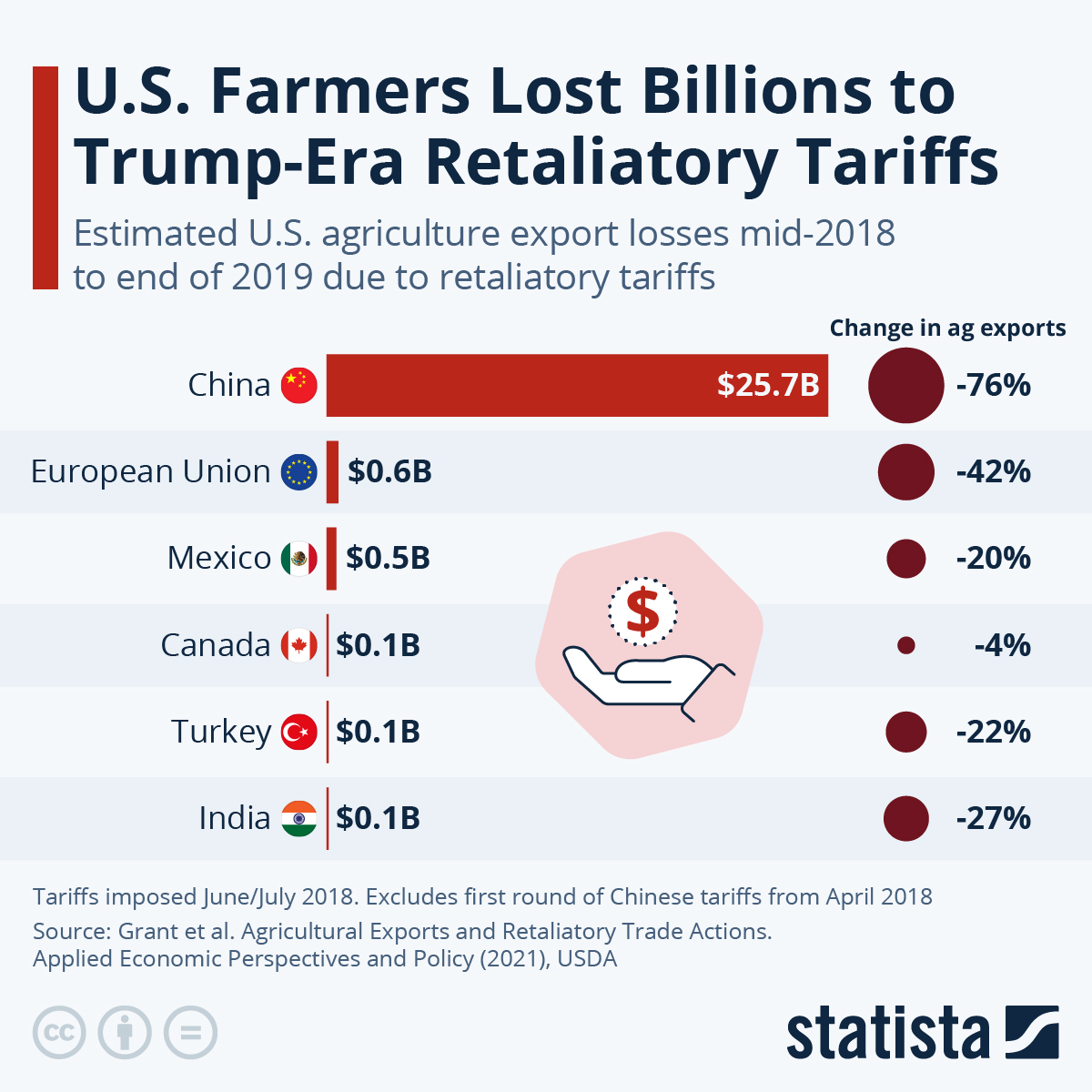

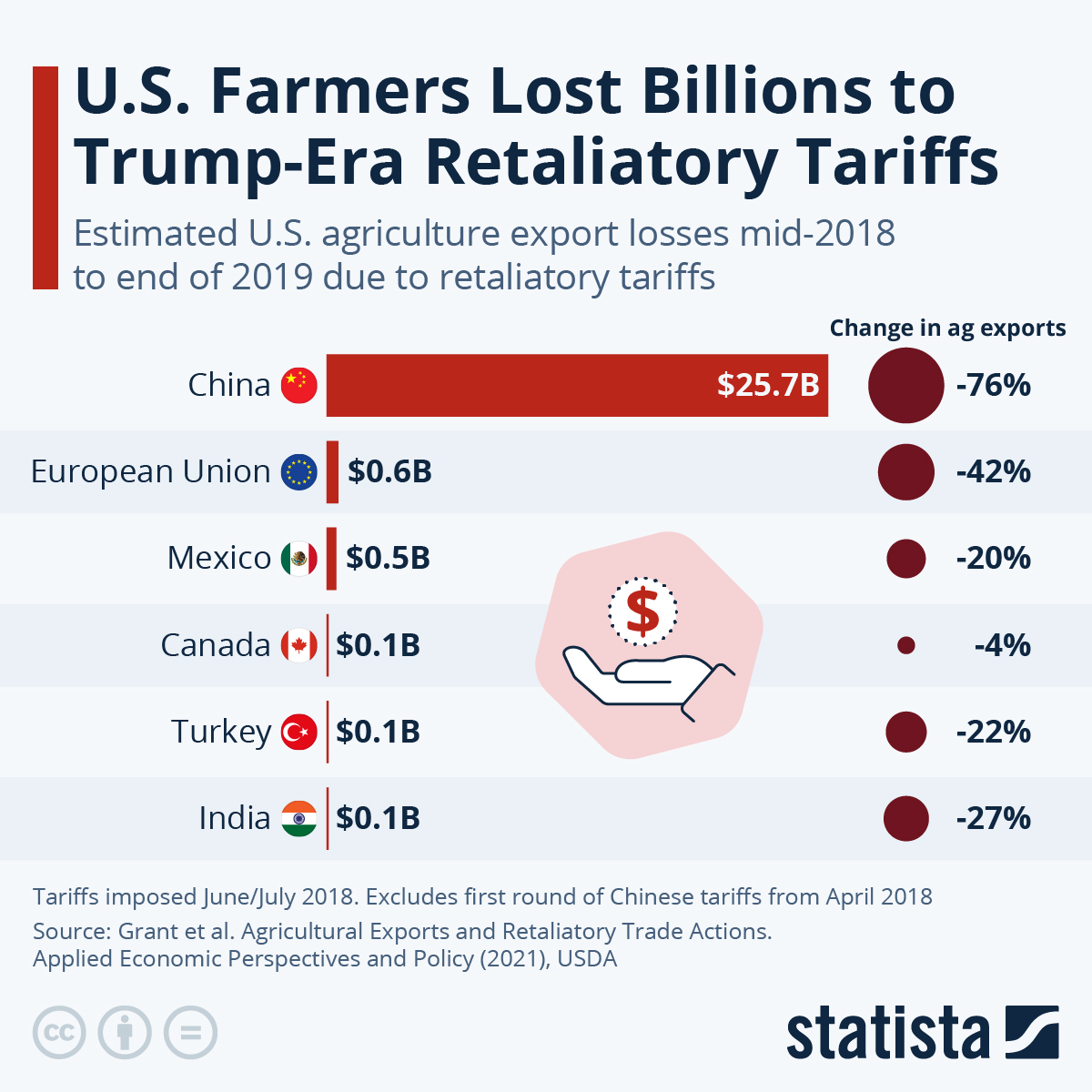

The Trump administration's imposition of tariffs on various goods, including components crucial to semiconductor manufacturing, significantly impacted the industry. These tariffs led to increased costs and disrupted global supply chains, creating a ripple effect that continues to resonate today.

- Increased cost of raw materials and components: Tariffs directly increased the price of imported materials, forcing manufacturers like Infineon to absorb these costs or pass them on to consumers, impacting profitability and competitiveness.

- Disruption of global supply chains: The imposition of tariffs forced companies to re-evaluate their supply chains, leading to delays, increased transportation costs, and difficulties in securing necessary components. This uncertainty created bottlenecks and hampered production.

- Reduced competitiveness in international markets: Increased manufacturing costs due to tariffs made it harder for semiconductor companies to compete effectively in international markets, particularly against manufacturers in countries not subject to the same tariffs.

- Increased uncertainty for investors and businesses: The fluctuating trade landscape created uncertainty, making it challenging for businesses to make long-term investment decisions and impacting investor confidence in the semiconductor sector.

- Example: Tariffs on specific materials like certain rare earth elements, crucial for the production of Infineon's power semiconductors, directly increased their manufacturing costs, affecting their profitability and ability to price competitively.

Infineon's (IFX) Revised Sales Projections and Financial Performance

Infineon recently revised its sales projections downwards, citing the lingering effects of trade tensions and related supply chain disruptions as major factors. While the exact figures vary depending on the reporting period, the drop in projected sales represents a significant setback for the company.

- Quantify the drop in projected sales: Reports indicated a [insert percentage or specific numbers] decrease in projected sales for [specify timeframe, e.g., Q3 2024].

- Identify the specific product lines or geographical regions most affected: The impact was particularly noticeable in [mention specific product lines, e.g., automotive semiconductors] and regions heavily reliant on trade with countries affected by tariffs.

- Analyze the impact on Infineon's overall financial performance: The reduced sales projections directly impacted Infineon's profit margins, leading to [mention specific impacts on profit margins or other key financial metrics].

- Mention any investor reactions (stock price fluctuations): The news caused [describe the impact on Infineon's stock price, e.g., a significant drop in share price].

- Provide relevant financial data sourced from reputable financial news outlets: [cite sources such as Bloomberg, Reuters, or the company's official financial reports].

Geopolitical Risks and Supply Chain Vulnerabilities

The trade war and subsequent tariffs exposed pre-existing vulnerabilities in the global semiconductor supply chain. Infineon, like other semiconductor manufacturers, relies on a complex, globally distributed network of suppliers and manufacturers.

- Dependence on specific regions for manufacturing or raw materials: Infineon's reliance on specific regions for sourcing key components heightened its vulnerability to trade disruptions.

- Increased transportation costs and delays: Tariffs and trade restrictions led to increased transportation costs and significant delays in receiving crucial components.

- Difficulty in sourcing critical components: The disruption of established supply chains made it difficult for Infineon to source certain critical components, impacting production and meeting customer demand.

- Rising geopolitical tensions and their influence on trade: The ongoing geopolitical tensions further exacerbate the risks associated with global supply chains, creating an uncertain environment for semiconductor manufacturers like Infineon.

- The long-term implications for Infineon's diversification strategies: This situation has underscored the need for Infineon to diversify its supply chains and reduce its reliance on any single region or supplier.

Strategies for Infineon (IFX) to Mitigate Future Tariff Impacts

To mitigate the impact of future trade restrictions, Infineon needs to adopt proactive strategies to enhance its resilience. These strategies may include:

- Diversifying sourcing of raw materials and manufacturing locations: Reducing dependence on any single supplier or region is crucial.

- Investing in automation and domestic production: Increasing automation and shifting some manufacturing closer to home can reduce reliance on international supply chains.

- Lobbying efforts for trade policy changes: Engaging in policy discussions to advocate for favorable trade conditions is essential.

- Strengthening relationships with key suppliers and customers: Building strong and reliable relationships with key players across the supply chain can ensure a more stable and secure supply.

- Focusing on higher-value products with less tariff sensitivity: Shifting focus toward products less susceptible to tariff impacts can help mitigate the financial risk.

Conclusion

Infineon's disappointing sales outlook underscores the significant and lingering impact of Trump-era tariffs on the semiconductor industry. The increased costs, disrupted supply chains, and reduced competitiveness have directly affected Infineon's financial performance and highlighted the vulnerability of global supply chains. Proactive strategies to diversify sourcing, strengthen supply chain resilience, and adapt to geopolitical uncertainty are crucial for Infineon to navigate future challenges. Stay informed about the evolving impact of trade policies on Infineon (IFX) and the semiconductor industry. Monitor news and financial reports to understand the company's response to these challenges and how it affects your investment decisions. Further research into Infineon’s (IFX) financial reports and future strategies regarding tariff mitigation will provide a more complete picture of their prospects.

Featured Posts

-

Sergio Perez And Franco Colapinto Pay Respects Following Heartbreaking F1 News

May 09, 2025

Sergio Perez And Franco Colapinto Pay Respects Following Heartbreaking F1 News

May 09, 2025 -

Is Leon Draisaitl Ready For The Oilers Playoffs Injury News

May 09, 2025

Is Leon Draisaitl Ready For The Oilers Playoffs Injury News

May 09, 2025 -

Red Bulls Driver Dilemma Colapinto Or Lawson

May 09, 2025

Red Bulls Driver Dilemma Colapinto Or Lawson

May 09, 2025 -

Updated Prediction Rio Ferdinand On Psg Vs Arsenal Champions League Final

May 09, 2025

Updated Prediction Rio Ferdinand On Psg Vs Arsenal Champions League Final

May 09, 2025 -

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025