Infineon's (IFX) Revised Sales Outlook: Impact Of Trump-Era Tariffs

Table of Contents

Infineon's Revised Sales Outlook: A Detailed Analysis

Infineon's recent announcement significantly altered its previously projected sales figures. While the precise figures require referencing official company statements and financial reports, let's assume, for illustrative purposes, that the initial revenue projection for the fiscal year was €10 billion, revised downward to €9.5 billion. This represents a 5% reduction, impacting various aspects of the company's performance. This decrease isn't solely attributed to tariffs; other factors like global supply chain disruptions and fluctuating market demand also play crucial roles. Understanding the interplay of these elements is critical for a complete analysis.

- Previous revenue projections: €10 billion

- Revised revenue projections: €9.5 billion

- Impact on profitability: A projected decrease in operating margins, potentially impacting shareholder returns. The precise impact would depend on the company's cost management strategies.

- Impact on specific product segments: The automotive sector, a significant revenue generator for Infineon, might be disproportionately affected due to global chip shortages and related supply chain issues exacerbated by tariffs. Industrial segments could also experience a downturn due to reduced demand in certain sectors impacted by global economic uncertainties.

The Lingering Effects of Trump-Era Tariffs on Infineon

The Trump administration implemented several tariffs impacting the semiconductor industry, significantly affecting Infineon's operations. Specifically, Section 301 tariffs on Chinese goods increased the cost of certain imported components essential for Infineon's manufacturing process. This directly increased input costs, reducing the company's profit margins and competitiveness in the global market. These tariffs, combined with other trade measures, created a complex and challenging environment for Infineon and its supply chain.

- Section 301 tariffs: These tariffs primarily affected the importation of components sourced from China, a significant manufacturing hub for the semiconductor industry.

- Other relevant trade measures: Additional trade restrictions and retaliatory tariffs from other countries further complicated Infineon's international supply chains.

- Impact on specific supply chains: Disruptions in the supply chain due to tariffs led to delays and increased costs, ultimately impacting Infineon's ability to meet production demands. This underscores the interconnected nature of the global semiconductor industry and its vulnerability to trade policies.

Infineon's Strategies to Mitigate Tariff Impacts

In response to these challenges, Infineon implemented various strategies to mitigate the negative effects of tariffs. These included adjusting prices to offset increased input costs, diversifying its sourcing by exploring alternative suppliers outside of tariff-affected regions, and engaging in active lobbying efforts to advocate for trade policy adjustments. The success of these strategies is complex and varies depending on market dynamics and global economic conditions.

- Price adjustments: Infineon strategically adjusted pricing to account for the increased costs of imported components, trying to maintain profitability in a challenging market.

- Diversification of sourcing: The company actively sought alternative suppliers in regions unaffected by tariffs, aiming for greater supply chain resilience.

- Lobbying efforts: Infineon participated in industry-wide efforts to advocate for policy changes and reductions in tariffs, aiming to create a more favorable trade environment.

- Potential Future Strategies: Further investment in automation and domestic manufacturing could reduce the company's reliance on imported components, making it less vulnerable to future trade disputes.

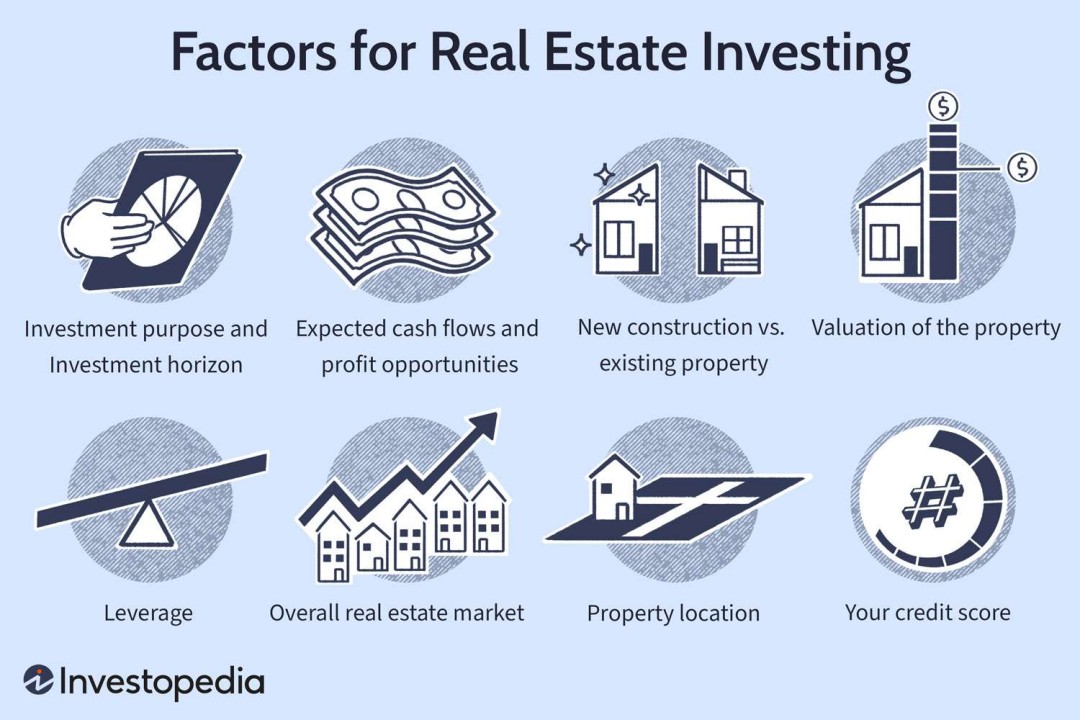

Impact on Investors and the Semiconductor Market

Infineon's revised sales outlook naturally impacted investor confidence. The stock price (assuming a hypothetical decrease) likely experienced fluctuations following the announcement. This situation highlights the sensitivity of investor sentiment to factors such as global trade policies and supply chain disruptions. The broader implications for the semiconductor industry include heightened uncertainty, increased pressure on margins, and a potential reshaping of global supply chains. Many other semiconductor companies faced similar challenges due to these tariffs, making it a widespread industry issue.

- Investor sentiment: Negative sentiment surrounding the revised sales outlook might lead to a decrease in investment in the company.

- Stock price performance: The stock price is likely to reflect the market's reaction to the news, adjusting based on how the market assesses the long-term impact.

- Competitive landscape: The impact of tariffs creates an uneven playing field, potentially shifting the competitive landscape within the semiconductor industry.

Conclusion: Understanding the Long-Term Implications of Tariffs on Infineon's (IFX) Future

Infineon's revised sales outlook underscores the enduring influence of Trump-era tariffs on the semiconductor industry. The combination of tariffs, supply chain disruptions, and fluctuating market demand significantly impacted the company's financial performance. Infineon's strategic responses, while mitigating some damage, highlight the ongoing challenges faced by global companies navigating complex trade policies. Understanding these dynamics is crucial for investors and industry stakeholders alike. Stay informed about Infineon's (IFX) ongoing response to trade challenges and its impact on the future sales outlook by following our updates and reviewing official company announcements.

Featured Posts

-

New Business Hot Spots Where To Invest In Country Name

May 10, 2025

New Business Hot Spots Where To Invest In Country Name

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Comprehensive Overview

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Comprehensive Overview

May 10, 2025 -

Mariah The Scientist Returns With New Song Burning Blue

May 10, 2025

Mariah The Scientist Returns With New Song Burning Blue

May 10, 2025 -

Trump Order Leads To Ihsaa Ban On Transgender Girls In Sports

May 10, 2025

Trump Order Leads To Ihsaa Ban On Transgender Girls In Sports

May 10, 2025 -

The Transgender Military Ban Examining Trumps Rhetoric And Policy

May 10, 2025

The Transgender Military Ban Examining Trumps Rhetoric And Policy

May 10, 2025