ING Group Publishes 2024 Financial Results: Form 20-F Analysis

Table of Contents

Key Financial Highlights from ING Group's 20-F Filing

The 2024 Form 20-F filing reveals significant developments in ING Group's financial standing. Analyzing the reported figures against previous years allows us to identify key trends and assess the overall financial health of the company. Let's examine some of the most important KPIs:

-

Revenue Growth: ING Group's revenue for 2024 [Insert actual figures here, e.g., showed a 5% increase compared to 2023, reaching €X billion]. A breakdown by segment (Wholesale Banking, Retail Banking, Investment Management) will reveal which areas contributed most significantly to this growth. [Insert segment-specific data and analysis here, e.g., Wholesale Banking experienced strong growth driven by increased trading activity, while Retail Banking saw more modest gains].

-

Net Income and Profit Margins: Net income for 2024 [Insert actual figures and percentage change here]. Profit margins [Insert actual figures and percentage change here, providing context and comparing to previous years] indicating [Interpret the results, e.g., improved profitability or a decrease and reasons why].

-

Earnings per Share (EPS) and Dividend Payouts: EPS for 2024 stood at [Insert actual figures here], representing a [Increase/decrease]% change from the previous year. This impacted dividend payouts, which were [Insert details on dividend payouts and policy here].

-

Return on Equity (ROE): ING Group's ROE for 2024 was [Insert actual figures here]. This signifies [Positive/negative implications, explanation and comparison to previous years and industry benchmarks].

-

Assets Under Management (AUM): AUM under ING's management reached [Insert actual figures here] in 2024, showing a [Percentage change]% change compared to 2023. This reflects [Explain the significance of the change in AUM based on market conditions and ING’s investment strategies].

Analysis of ING Group's Operational Performance in 2024

Beyond the headline financial figures, a deep dive into ING Group's operational performance provides a more nuanced picture of its 2024 activities. Several key aspects deserve careful consideration:

-

Credit Quality and Loan Portfolio: The quality of ING Group's loan portfolio is a critical factor. The level of Non-Performing Loans (NPLs) [Insert actual figures and percentage here] indicates [Assessment of the health of the loan portfolio, including any trends or concerns].

-

Capital Ratios and Adequacy: Maintaining adequate capital ratios is crucial for the stability of any bank. ING Group's capital ratios [Insert actual figures and comparison to regulatory requirements here] demonstrate [Assessment of capital adequacy and its implications for future lending and growth].

-

Risk Management Initiatives: The effectiveness of ING Group's risk management strategies is paramount. [Discuss specific risk management initiatives mentioned in the 20-F, analyzing their success and impact].

-

Regulatory Compliance: Adherence to banking regulations is non-negotiable. The 20-F filing should detail ING Group's compliance efforts. [Discuss any significant findings or regulatory actions].

Exploring the Future Outlook for ING Group Based on the 20-F Filing

The 20-F filing provides valuable insights into ING Group’s vision for the future. Analyzing this information allows us to assess the company's growth prospects and potential challenges.

-

Management's Guidance: ING Group's management provides guidance for future earnings and growth [Insert details from the 20-F filing about the company's outlook].

-

Strategic Initiatives: Key strategic initiatives, such as [List and describe key initiatives from the 20-F], are expected to have a significant impact on the company's future performance.

-

Competitive Landscape: The competitive landscape for ING Group includes [List key competitors]. The 20-F likely addresses the competitive challenges and opportunities [Explain the analysis of the competitive landscape and its implication for ING's future].

-

Potential Risks and Opportunities: The 20-F should outline potential risks and opportunities that could impact future performance. These might include [List potential risks and opportunities and discuss their potential impact].

Conclusion

Analyzing ING Group's 2024 financial results, as presented in the Form 20-F filing, reveals a mixed picture. While [mention positive aspects, e.g., revenue growth and strong capital ratios], the company also faces challenges such as [mention negative aspects, e.g., potential economic headwinds and competitive pressures]. Understanding these financial highlights, operational performance, and future outlook is crucial for investors and stakeholders alike. For a complete analysis of ING Group's 2024 Form 20-F, download the full filing and conduct your own in-depth analysis. Further research into comparative analyses with competitors within the Dutch Banking Sector and a deeper dive into specific segments of ING Group’s business would provide even greater clarity.

Featured Posts

-

Hamas Deception Witkoffs Account Of Being Duped

May 23, 2025

Hamas Deception Witkoffs Account Of Being Duped

May 23, 2025 -

Witkoffs Claim Duped By Hamas Emissary Reveals All

May 23, 2025

Witkoffs Claim Duped By Hamas Emissary Reveals All

May 23, 2025 -

Zimbabwe Seal Historic Test Victory Over Bangladesh Muzarabanis Stellar Performance

May 23, 2025

Zimbabwe Seal Historic Test Victory Over Bangladesh Muzarabanis Stellar Performance

May 23, 2025 -

Ten Hag To Leverkusen Manchester United Manager Update

May 23, 2025

Ten Hag To Leverkusen Manchester United Manager Update

May 23, 2025 -

Analyzing Manchester Uniteds Signing Of Noussair Mazraoui

May 23, 2025

Analyzing Manchester Uniteds Signing Of Noussair Mazraoui

May 23, 2025

Latest Posts

-

Trumps Private Message To Europe Putins Unreadiness For Wars End

May 23, 2025

Trumps Private Message To Europe Putins Unreadiness For Wars End

May 23, 2025 -

Trumps Air Traffic Plan Newark Airports Recent Issues Explained

May 23, 2025

Trumps Air Traffic Plan Newark Airports Recent Issues Explained

May 23, 2025 -

Newark Airport Chaos Trump Era Air Traffic Control Plan Blamed

May 23, 2025

Newark Airport Chaos Trump Era Air Traffic Control Plan Blamed

May 23, 2025 -

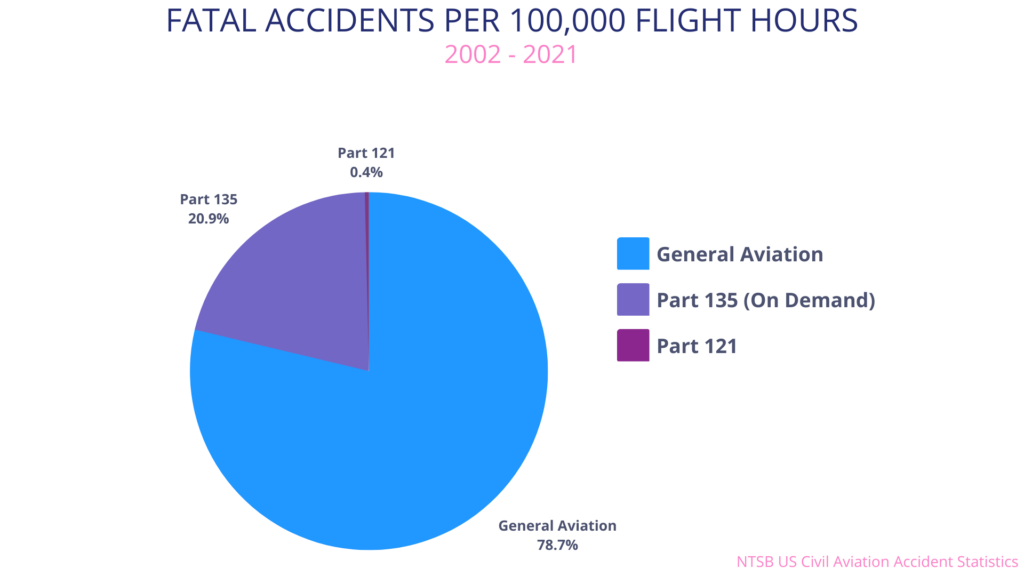

Airplane Safety Statistics Separating Fact From Fear

May 23, 2025

Airplane Safety Statistics Separating Fact From Fear

May 23, 2025 -

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 23, 2025

Close Calls And Crashes A Visual Analysis Of Airplane Safety Data

May 23, 2025