ING's 2024 Form 20-F: A Comprehensive Analysis Of Financial Performance

Table of Contents

Main Points:

2.1 Revenue Analysis: Examining ING's Key Income Streams in 2024

ING's revenue streams are diverse, spanning retail banking, wholesale banking, and investment management. Analyzing each segment reveals the drivers of its overall financial performance.

2.1.1 Retail Banking Performance: ING's retail banking segment, a core part of its business, relies heavily on deposits, lending, and associated fees.

- Net Interest Income: A key performance indicator (KPI) reflecting the difference between interest earned and interest paid, experienced [Insert Data from 20-F, e.g., a 5% increase].

- Loan Growth: [Insert Data from 20-F, e.g., Growth in mortgage lending] demonstrates strong performance in this area.

- Customer Acquisition Costs: [Insert Data and Analysis from 20-F, e.g., remained relatively stable, indicating efficient customer acquisition strategies].

Compared to 2023 and industry benchmarks, ING's retail banking performance shows [Insert Comparative Analysis and Interpretation].

2.1.2 Wholesale Banking Revenue: This segment encompasses corporate lending, investment banking, and trading activities. The performance here is highly sensitive to market conditions.

- Trading Revenue: Fluctuations in trading revenue are expected, and 2024 saw [Insert Data from 20-F and Analysis].

- Loan Book Composition: ING's loan book likely diversified across various sectors. [Insert details from 20-F regarding sectors and risk exposures].

- Market Share: ING's market share in key areas indicates its competitive position. [Insert Data and Analysis].

Changes in global economic conditions and interest rates had a significant impact on this segment. [Elaborate on these impacts based on the 20-F].

2.1.3 Investment Management Results: ING's investment management division manages significant assets. Its performance is critical to overall revenue.

- Assets Under Management (AUM): [Insert AUM data from 20-F, and discuss growth or decline].

- Investment Returns: [Analyze returns generated by the investment management arm, comparing them to market benchmarks like the S&P 500].

- Fee Income: [Insert data on fee income generated from investment management, relating it to AUM growth].

The performance of this segment is strongly influenced by market volatility and investor sentiment. [Insert analysis of how these factors impacted performance based on the 20-F].

2.2 Profitability and Efficiency: Assessing ING's Financial Health

Analyzing profitability and efficiency metrics reveals the overall health of ING's operations.

2.2.1 Net Income and Profit Margins: [Insert data from the 20-F on net income and profit margins for each segment]. Analyze the year-over-year changes and compare them to industry averages and competitors.

2.2.2 Cost Efficiency Ratios: A key metric is the cost-to-income ratio. [Insert data and analysis from 20-F on this ratio, demonstrating ING's efficiency]. [Mention any cost-cutting initiatives and their impact].

2.2.3 Return on Equity (ROE): ROE measures the return generated on shareholder equity. [Insert ROE data from 20-F and compare it to previous years and competitors]. A higher ROE signifies better profitability.

2.3 Risk Management and Capital Adequacy: Evaluating ING's Resilience

ING's financial stability is crucial. Analyzing its risk management and capital adequacy provides insight into its resilience.

2.3.1 Credit Risk Exposure: [Analyze data from 20-F on non-performing loans, loan loss provisions, and capital adequacy ratios (like CET1). Discuss ING's strategies for managing credit risk].

2.3.2 Regulatory Compliance: [Discuss ING's compliance with relevant regulations, mentioning any significant regulatory actions or changes in capital requirements].

2.3.3 Liquidity Position: [Analyze ING's liquidity coverage ratio (LCR) and other liquidity metrics to assess its ability to meet short-term obligations. Discuss its funding sources].

2.4 Future Outlook and Investment Implications: Analyzing ING's Prospects

Looking ahead, several factors will influence ING's performance.

2.4.1 Management Guidance: [Summarize ING's management guidance on future performance and growth from the 20-F].

2.4.2 Industry Trends: [Analyze relevant industry trends – e.g., interest rate changes, digital banking adoption, regulatory changes – and their potential impact on ING].

2.4.3 Investment Recommendations: [Based on the analysis, offer potential investment recommendations. Disclaimer: This is not financial advice. Conduct thorough research before making investment decisions. ]

3. Conclusion: Key Takeaways from ING's 2024 Form 20-F and Call to Action

This analysis of ING's 2024 Form 20-F reveals [Summarize key findings: strong areas, areas needing improvement]. Understanding ING's financial performance is vital for investors and stakeholders. To gain a complete understanding of ING's financial position and future prospects, download and review ING's 2024 Form 20-F. Analyze ING's 2024 20-F for a comprehensive view of its financial performance and to make informed decisions. [Insert link to ING's 2024 20-F filing].

Featured Posts

-

Honest Review A Young Playwrights Watercolor Inspired Script

May 22, 2025

Honest Review A Young Playwrights Watercolor Inspired Script

May 22, 2025 -

Peppa Pigs Expanding Family The Arrival Of A New Sibling

May 22, 2025

Peppa Pigs Expanding Family The Arrival Of A New Sibling

May 22, 2025 -

Service De Navette Gratuit Experimente Entre La Haye Fouassiere Et Haute Goulaine

May 22, 2025

Service De Navette Gratuit Experimente Entre La Haye Fouassiere Et Haute Goulaine

May 22, 2025 -

Vybz Kartel Opens Up Self Esteem Issues And Skin Bleaching

May 22, 2025

Vybz Kartel Opens Up Self Esteem Issues And Skin Bleaching

May 22, 2025 -

Directeur Hypotheken Abn Amro Florius And Moneyou Welkom Karin Polman

May 22, 2025

Directeur Hypotheken Abn Amro Florius And Moneyou Welkom Karin Polman

May 22, 2025

Latest Posts

-

Understanding The Thames Water Executive Bonus Structure

May 22, 2025

Understanding The Thames Water Executive Bonus Structure

May 22, 2025 -

Thames Water Public Outrage Over Executive Bonuses

May 22, 2025

Thames Water Public Outrage Over Executive Bonuses

May 22, 2025 -

Are Thames Water Executive Bonuses Excessive A Critical Analysis

May 22, 2025

Are Thames Water Executive Bonuses Excessive A Critical Analysis

May 22, 2025 -

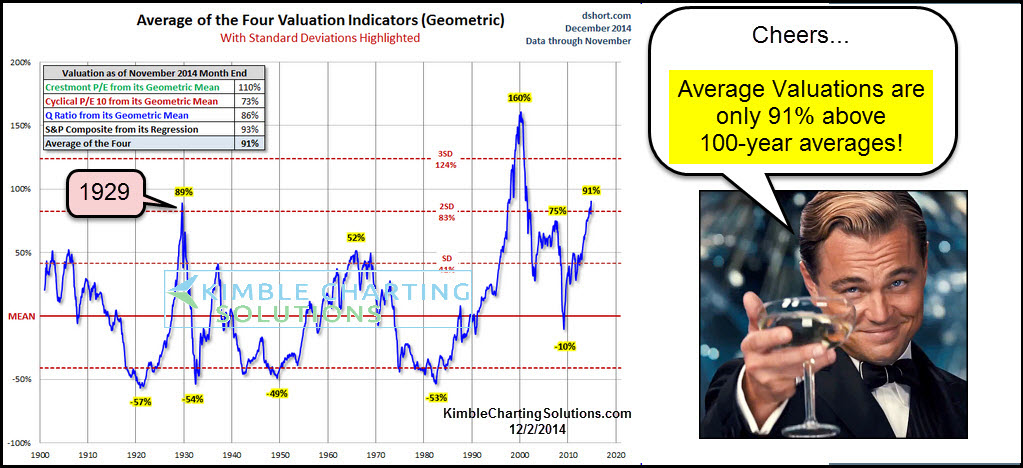

High Stock Market Valuations A Bof A Analysis And Why You Shouldnt Worry

May 22, 2025

High Stock Market Valuations A Bof A Analysis And Why You Shouldnt Worry

May 22, 2025 -

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025

The Thames Water Executive Bonus Debate Facts And Figures

May 22, 2025